Fresh Del Monte Produce trades at $38.80 and has moved in lockstep with the market. Its shares have returned 8.9% over the last six months while the S&P 500 has gained 8.2%.

Is now the time to buy Fresh Del Monte Produce, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think Fresh Del Monte Produce Will Underperform?

We don't have much confidence in Fresh Del Monte Produce. Here are three reasons there are better opportunities than FDP and a stock we'd rather own.

1. Long-Term Revenue Growth Flatter Than a Pancake

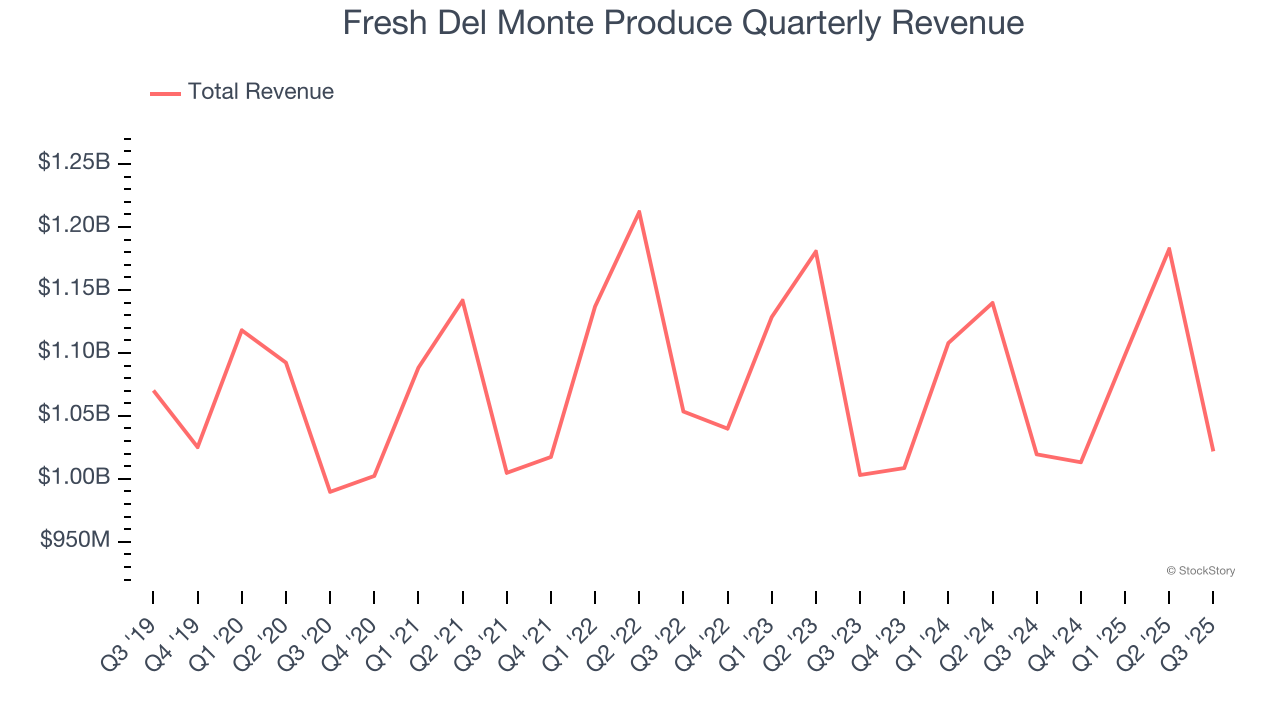

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Fresh Del Monte Produce struggled to consistently increase demand as its $4.32 billion of sales for the trailing 12 months was close to its revenue three years ago. This was below our standards and signals it’s a low quality business.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Fresh Del Monte Produce’s revenue to drop by 2.9%, a decrease from This projection is underwhelming and indicates its products will face some demand challenges.

3. Low Gross Margin Reveals Weak Structural Profitability

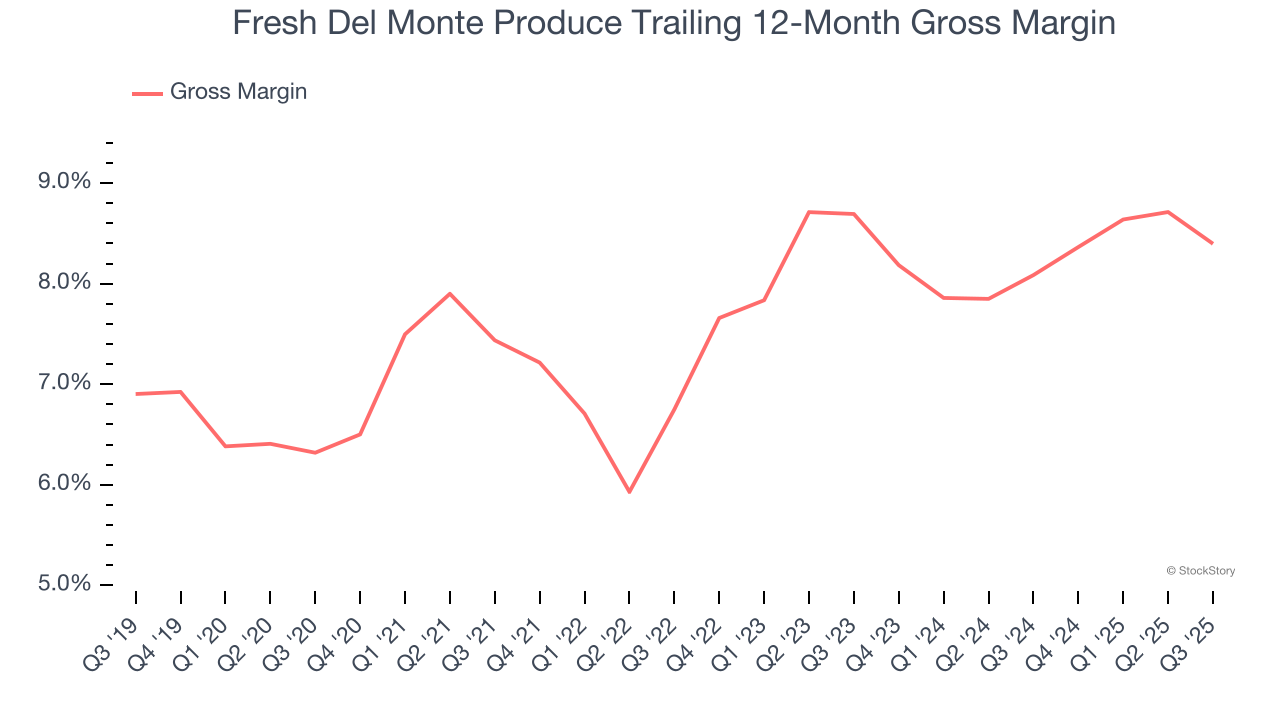

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products, has a stronger brand, and commands pricing power.

Fresh Del Monte Produce has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 8.2% gross margin over the last two years. That means Fresh Del Monte Produce paid its suppliers a lot of money ($91.76 for every $100 in revenue) to run its business.

Final Judgment

Fresh Del Monte Produce falls short of our quality standards. That said, the stock currently trades at 13.5× forward P/E (or $38.80 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are more exciting stocks to buy at the moment. We’d recommend looking at the Amazon and PayPal of Latin America.

High-Quality Stocks for All Market Conditions

Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.