Looking back on sit-down dining stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including The Cheesecake Factory (NASDAQ: CAKE) and its peers.

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

The 12 sit-down dining stocks we track reported a mixed Q3. As a group, revenues missed analysts’ consensus estimates by 0.7%.

While some sit-down dining stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.4% since the latest earnings results.

The Cheesecake Factory (NASDAQ: CAKE)

Celebrated for its delicious (and free) brown bread, gigantic portions, and delectable desserts, Cheesecake Factory (NASDAQ: CAKE) is an iconic American restaurant chain that also owns and operates a portfolio of separate restaurant brands.

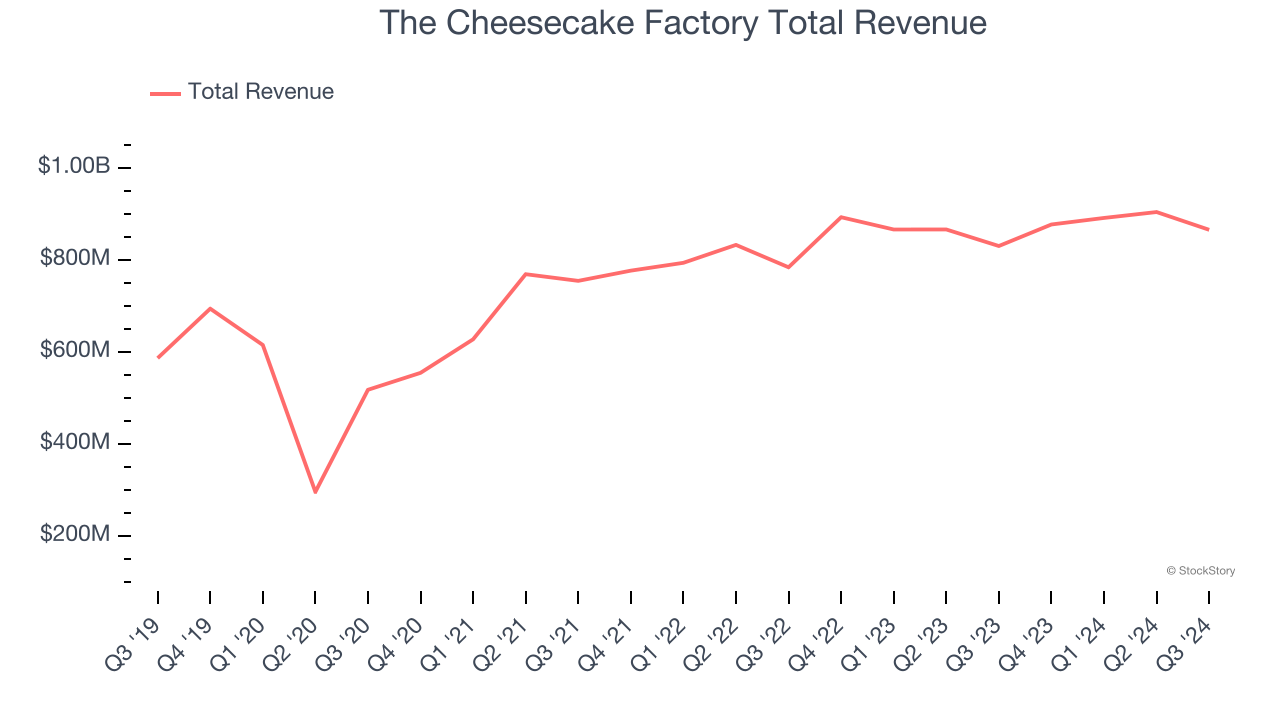

The Cheesecake Factory reported revenues of $865.5 million, up 4.2% year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ EPS estimates.

“The third quarter was our fourth consecutive quarter of year-over-year top- and bottom-line growth, reflecting our strong operational execution, the benefits of our scale, and the delicious, memorable experiences we offer across our restaurant concepts,” said David Overton, Chairman and Chief Executive Officer.

Interestingly, the stock is up 12.3% since reporting and currently trades at $48.12.

Is now the time to buy The Cheesecake Factory? Access our full analysis of the earnings results here, it’s free.

Best Q3: Brinker International (NYSE: EAT)

Founded by Norman Brinker in Dallas, Texas, Brinker International (NYSE: EAT) is a casual restaurant chain that operates under the Chili’s, Maggiano’s Little Italy, and It’s Just Wings banners.

Brinker International reported revenues of $1.14 billion, up 12.5% year on year, outperforming analysts’ expectations by 3.4%. The business had a stunning quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ same-store sales estimates.

Brinker International scored the biggest analyst estimates beat and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 38.3% since reporting. It currently trades at $134.45.

Is now the time to buy Brinker International? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Denny's (NASDAQ: DENN)

Open around the clock, Denny’s (NASDAQ: DENN) is a chain of diner restaurants serving breakfast and traditional American fare.

Denny's reported revenues of $111.8 million, down 2.1% year on year, falling short of analysts’ expectations by 3.2%. It was a softer quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

As expected, the stock is down 15.2% since the results and currently trades at $5.62.

Read our full analysis of Denny’s results here.

Bloomin' Brands (NASDAQ: BLMN)

Owner of the iconic Australian-themed Outback Steakhouse, Bloomin’ Brands (NASDAQ: BLMN) is a leading American restaurant company that owns and operates a portfolio of popular restaurant brands.

Bloomin' Brands reported revenues of $1.04 billion, down 3.8% year on year. This result lagged analysts' expectations by 0.8%. It was a softer quarter as it also logged full-year EPS guidance missing analysts’ expectations.

Bloomin' Brands had the slowest revenue growth among its peers. The stock is down 30.8% since reporting and currently trades at $11.61.

Read our full, actionable report on Bloomin' Brands here, it’s free.

Darden (NYSE: DRI)

Started in 1968 as the famous seafood joint, Red Lobster, Darden (NYSE: DRI) is a leading American restaurant company that owns and operates a portfolio of popular restaurant brands.

Darden reported revenues of $2.89 billion, up 6% year on year. This number topped analysts’ expectations by 0.7%. It was a strong quarter as it also logged a solid beat of analysts’ same-store sales estimates and full-year revenue guidance slightly topping analysts’ expectations.

The stock is up 15.3% since reporting and currently trades at $184.15.

Read our full, actionable report on Darden here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.