- IQST Delivers Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

- Litchfield Hills Research Issues Recommendation and Detailed Report on IQSTEL (IQST) with $18 Price Target.

- IQST Has Organic Growth, Acquisitions and High-Margin Product Expansion.

- New IQST Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

- $128.8 Million in Preliminary Revenue for First Half of 2025.

- June Revenue Hits $27.3 Million; Globetopper Acquisition Positions Company to Reach $400 Million Run Rate in Q3 – Ahead of Plan.

- Launch of IQ2Call, Delivering Vertical AI-Telecom Integration to Target the $750B Global Market.

- Equity Position Strengthened with $6.9 Million Debt Cut -- Almost $2 Per Share.

- Closing of GlobeTopper Acquisition on July 1st, Forecasting $34M Revenue and Positive EBITDA for H2 2025.

- Global Cybersecurity Market is Expected to Surpass $500 Billion by 2030, Fueled by Rapid Digital Transformation, Cloud Adoption and Escalating Cyber Threats.

- IQST Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

IQSTEL, Inc. (Nasdaq: IQST) offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Respected Investment Firm Litchfield Hills Research Issues Recommendation and Detailed Report on IQSTEL (IQST) with $18 Price Target

Litchfield Hills Research issued a July , 2025 buy recommendation on IQST with a very detailed, 19 page report titled: Unlocking Global Telecom Value Through Innovation, Relationships, and Acquisitions. This new report Initiates Litchfield Hills Research Coverage of IQST with a Buy Rating and $18 price target. A downloadable PDF with the full report can be accessed on the Litchfield Hills Research website via this direct link: https://hillsresearch.com/wp-content/uploads/2025/07/LHR-IQST-intitiation-report.pdf.

$128.8 Million in Preliminary Revenue for First Half of 2025

June Revenue Hits $27.3 Million; Globetopper Acquisition Positions Company to Reach $400 Million Run Rate in Q3 – Ahead of Plan

On July 17th IQST announced preliminary unaudited revenue of $128.8 million for the first half of 2025 (H1). June alone contributed $27.3 million, a significant increase from May's $23.7 million, highlighting the company's accelerating commercial momentum across its global telecom and tech operations.

Starting as of July 1st, IQST will begin consolidating revenue from its newly acquired subsidiary, Globetopper, expected to add $5 million to $6 million per month in additional revenue.

On this trajectory, IQST expects to reach a $400 million annualized revenue run rate during Q3 — several months ahead of the company's original year-end target. This milestone represents a critical leap forward in the company's strategic roadmap toward achieving its $1 billion revenue goal by 2027.

Historically, the second half of the year delivers even stronger results, and with Globetopper now part of the group IQST is on track to reach its $340 million revenue forecast for 2025.

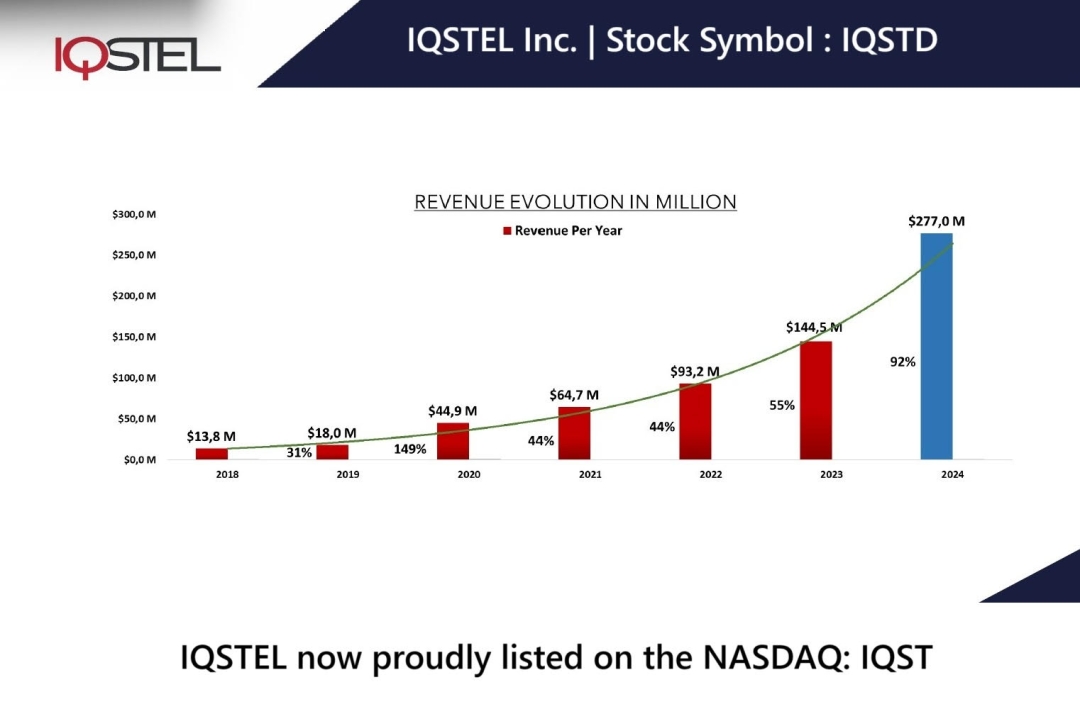

Leandro Iglesias, CEO of IQST said: "This is only the beginning. We grew from $13 million in revenue in 2018 to nearly $300 million last year. With the second half of 2025 set to elevate us even further, we are laying the foundation to become a $1 billion company by 2027."

Expanding Tech Portfolio with Launch of IQ2Call, Delivering Vertical AI-Telecom Integration to Target the $750B Global Market

On July 15th IQST announced the launch of IQ2Call, a next-generation, AI-powered call center service developed by its artificial intelligence subsidiary, Reality Border. Designed to eliminate wait times and provide intelligent, adaptive scalability, IQ2Call merges the IQST telecom infrastructure with advanced AI to create a revolutionary customer engagement platform.

IQST IQ2Call is currently being deployed with its first batch of customers in Spain and the United States, marking the start of its global rollout. The solution offers enterprise-grade performance with real-time analytics, zero wait times, and the ability to instantly scale operations from 1 to 100+ agents — all while maintaining full compliance and multilingual support.

The global call center services market was valued at approximately $496 billion in 2024, with projections to exceed $750 billion by 2030, driven by rising customer experience demands, multilingual support requirements, and the shift toward automation. IQ2Call is designed to meet this growing need with an AI-first architecture that solves the long-standing limitations of traditional call centers — including long wait times, staffing challenges, and inconsistent service quality. For more details visit: Visit www.IQ2Ca

Equity Position Strengthened with $6.9 Million Debt Cut -- Almost $2 Per Share

On July 9th IQST announced a significant reduction of $6.9 million in debt from its balance sheet. This debt reduction will have a direct and positive impact on IQST net stockholders' equity, which stood at $11.34 million as of Q1 2025. The reduction was achieved through a combination of debt conversions into common shares and Series D Preferred Shares. The conversion into Series D Preferred Shares reflects investor confidence in the IQST strategic plan to reach $1 billion in annual revenue by 2027.

In addition to improving the company's capital structure, this transaction provides $0.92 million in interest savings, directly enhancing IQST cash flow and operational flexibility. A simple and clear way to see the impact of this move is that it reduced company debt by approximately $2 per share. At the same time, IQST is actively working on improving its adjusted EBITDA while reinforcing its balance sheet.

The execution date of the debt reduction was July 3, 2025, and the financial impact will be reflected in the IQST Q3 2025 Form 10-Q filing.

IQST Confirms Closing of GlobeTopper Acquisition, Forecasting $34M Revenue and Positive EBITDA for H2 2025

IQST has announced that the previously disclosed acquisition of 51% of GlobeTopper (GlobeTopper.com) is now officially closed and effective as of July 1, 2025.

This milestone marks a major acceleration of the IQST global fintech expansion strategy and positions the company to further solidify its path toward $1 billion in annual revenue by 2027.

With the transaction now finalized, GlobeTopper is a consolidated subsidiary of IQST and will begin contributing to IQST financial results starting in July 2025.

GlobeTopper is forecasting:

$34 million in revenue and $0.26 million in EBITDA for the second half of 2025

Starting with $5 million in revenue for July

Scaling up to over $6 million in December 2025

This forecast reflects only GlobeTopper's standalone performance. It does not yet include any additional upside from cross-selling or synergies with the IQST extensive commercial platform, which serves over 600 telecom operators globally.

As disclosed in IQSTEL's 8-K filed on May 30, the Unit Purchase Agreement outlines GlobeTopper's forecast standalone of $85 million in revenue and $0.62 million in EBITDA for FY-2026, reinforcing the strength of the underlying business model.

Craig Span, CEO of GlobeTopper, will continue to lead the company, ensuring seamless integration into IQST fintech operations. GlobeTopper is working in close collaboration with GlobalMoneyOne.com to implement a strategic 3-year business roadmap.

Together, they will focus on expanding cross-border payments, digital wallets, mobile remittances, and prepaid services, particularly across high-value markets in Africa, Europe, and the Americas.

For more information on $IQST visit: www.IQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Media Contact

Company Name: IQSTEL Inc.

Contact Person: Leandro Jose Iglesias, President and CEO

Email: Send Email

Phone: +1 954-951-8191

Address:300 Aragon Avenue Suite 375

City: Coral Gables

State: Florida 33134

Country: United States

Website: www.iQSTEL.com