INVO Fertility (IVF) shares have soared roughly 215% in recent sessions even though there hasn’t been any fundamental development or major news release that supports such an aggressive move.

Even after this massive rally, IVF remains a microcap name with a valuation of $6.52 million only. So, it remains highly susceptible to price manipulation in 2026.

Note that INVO Fertility stock is now trading at more than 4x its price in early January.

Should You Chase the Rally in INVO Fertility Stock?

This sudden vertical move in IVF bears all the hallmarks of a meme story rally, likely fueled by retail speculation on social media platforms or a coordinated “short squeeze” attempt.

In such scenarios, a company’s share price often becomes entirely detached from the underlying business value.

Historically, these parabolic rallies in penny stocks like INVO Fertility end with a sharp correction as early speculators take profits.

This leaves “bag holders” who bought at the peak with massive losses within a matter of minutes. Investors are, therefore, cautioned against chasing the recent rally in IVF stock on Jan. 20.

IVF Shares Remain Super Risky to Own in 2026

From a fundamental standpoint, the bear case for INVO Fertility shares is substantial.

The company remains highly unprofitable, with a fragile cash status that has necessitated dilutive private placements and multiple reverse stock splits – the most recent one in late 2025.

Moreover, IVF’s history has been marked with turbulence and instability for the most part as well, including a brief merger with Naya Biosciences that was quickly unwound to refocus on fertility clinics.

With high cash burn and a reputation for shareholder dilution, the risk of a total wipeout remains high for anyone investing in INVO Fertility at the current inflated levels.

Note that the penny stock’s 14-day relative strength index (RSI) sits at about 75 currently, signaling overbought conditions that often trigger a sharp pullback.

Wall Street Isn’t Really Interested in INVO Fertility

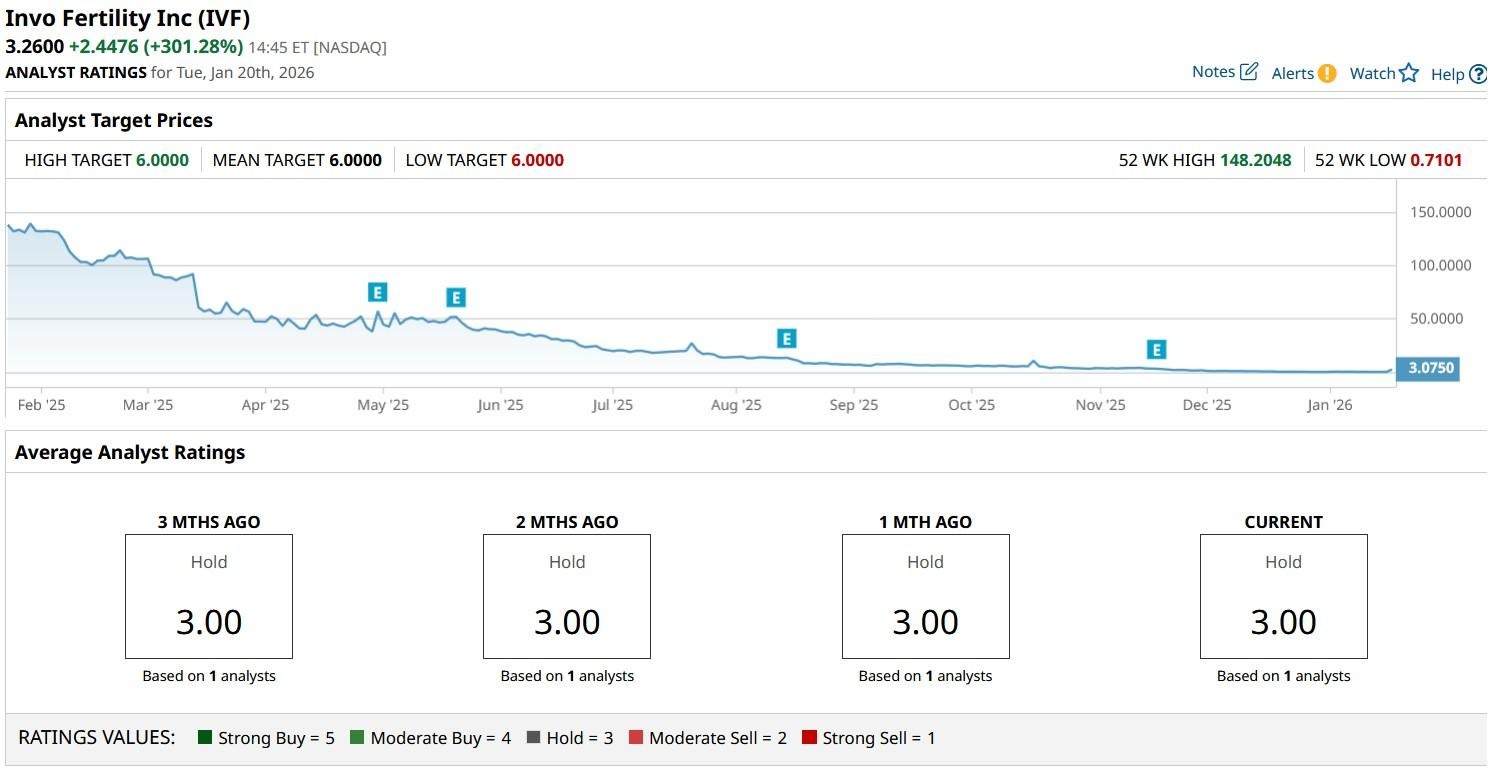

IVF shares remain a risky proposition for 2026 also because Wall Street analysts aren’t particularly interested in covering this healthcare services company.

INVO Fertility receives coverage from just one investment firm currently, and even that analyst rates it at “Hold” only.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart