Over the last six months, Dynatrace’s shares have sunk to $42.65, producing a disappointing 18.8% loss - a stark contrast to the S&P 500’s 11.1% gain. This may have investors wondering how to approach the situation.

Following the drawdown, is now an opportune time to buy DT? Find out in our full research report, it’s free.

Why Does DT Stock Spark Debate?

With its platform processing over 30 trillion pieces of IT performance data daily, Dynatrace (NYSE: DT) provides an AI-powered platform that helps organizations monitor, secure, and optimize their applications and IT infrastructure across cloud environments.

Two Things to Like:

1. Long-Term Revenue Growth Shows Strong Momentum

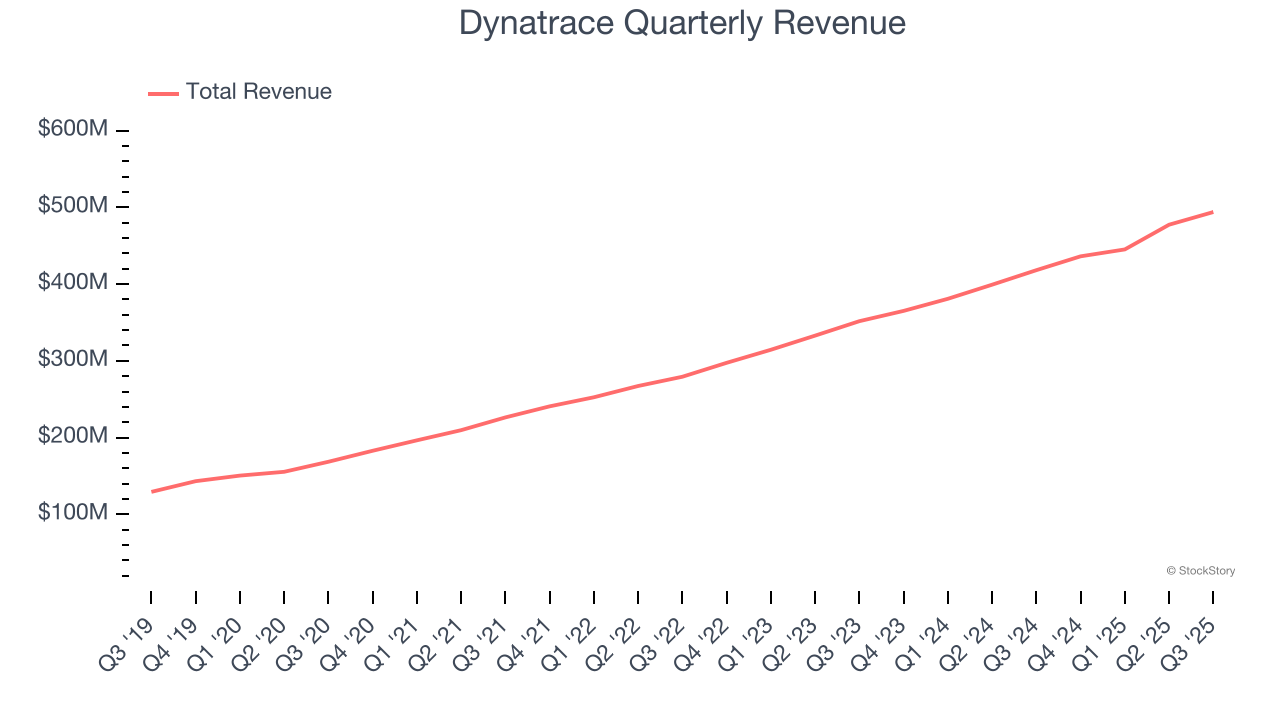

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Dynatrace grew its sales at a solid 24.6% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers.

2. Elite Gross Margin Powers Best-In-Class Business Model

Software is eating the world. It’s one of our favorite business models because once you develop the product, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

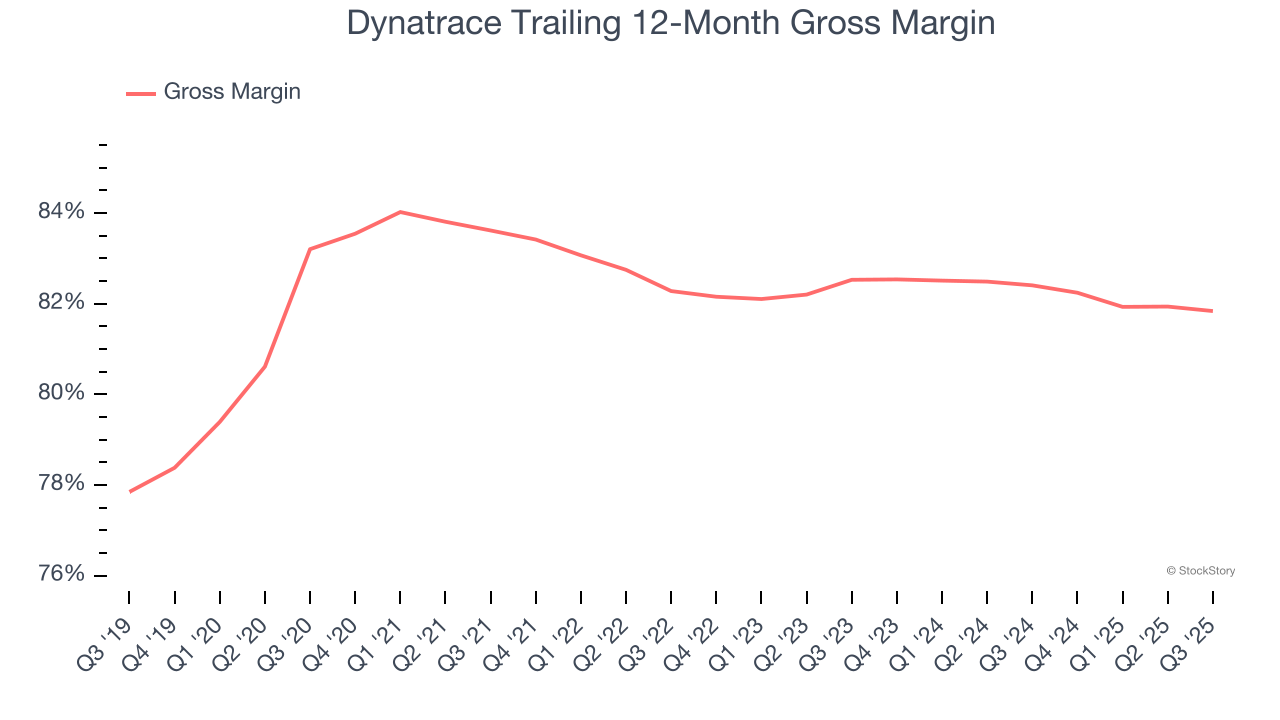

Dynatrace’s robust unit economics are better than the broader software industry, an output of its asset-lite business model and pricing power. They also enable the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an excellent 81.8% gross margin over the last year. Said differently, roughly $81.84 was left to spend on selling, marketing, and R&D for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Dynatrace has seen gross margins decline by 0.7 percentage points over the last 2 year, which is slightly worse than average for software.

One Reason to be Careful:

Operating Margin Rising, Profits Up

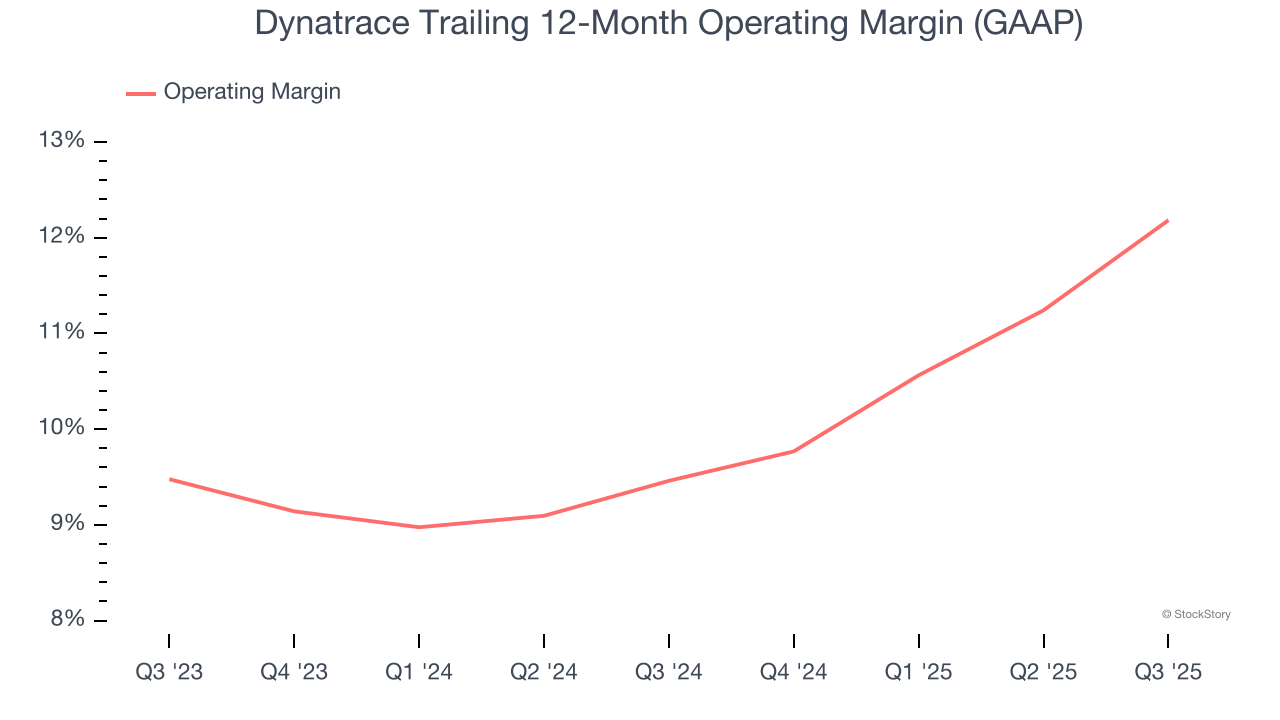

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Analyzing the trend in its profitability, Dynatrace’s operating margin rose by 2.7 percentage points over the last two years, as its sales growth gave it operating leverage. Its operating margin for the trailing 12 months was 12.2%.

Final Judgment

Dynatrace’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 6× forward price-to-sales (or $42.65 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.