Over the last six months, Employers Holdings’s shares have sunk to $42.26, producing a disappointing 8.9% loss - a stark contrast to the S&P 500’s 34.7% gain. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Employers Holdings, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Do We Think Employers Holdings Will Underperform?

Even though the stock has become cheaper, we don't have much confidence in Employers Holdings. Here are three reasons why EIG doesn't excite us and a stock we'd rather own.

1. Net Premiums Earned Point to Soft Demand

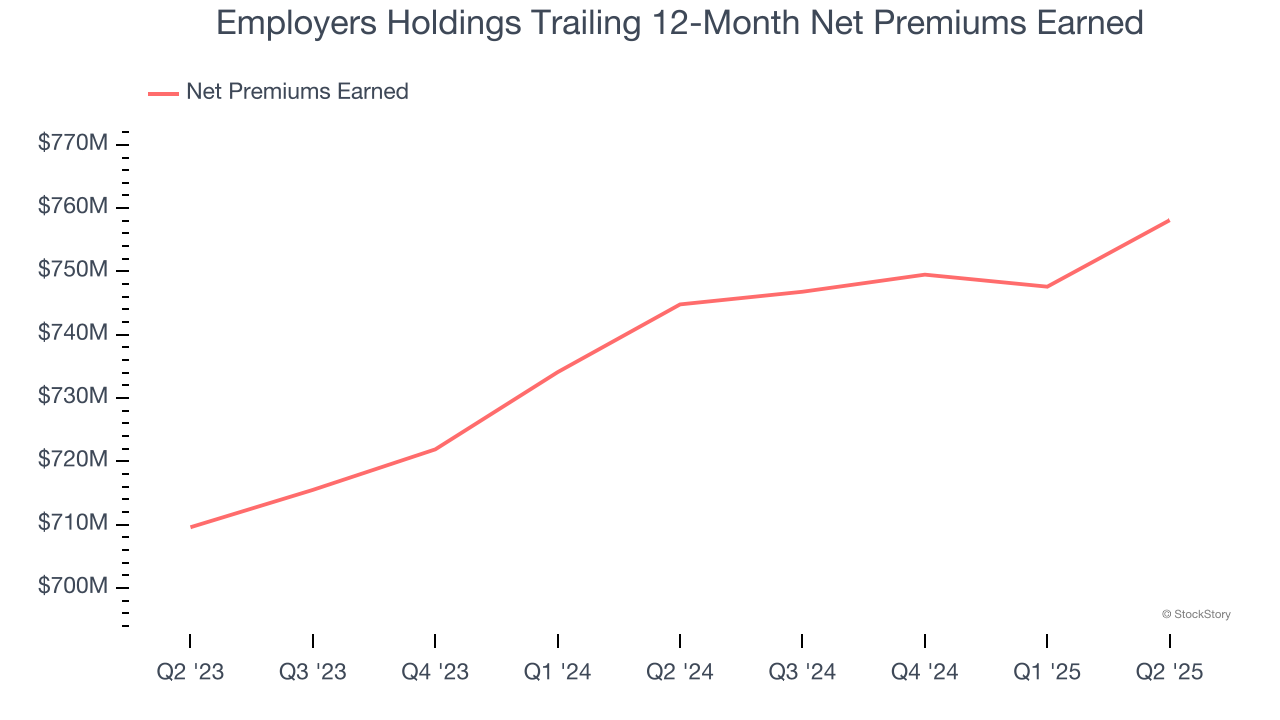

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore net of what’s ceded to reinsurers as a risk mitigation and transfer strategy.

Employers Holdings’s net premiums earned has grown at a 3.4% annualized rate over the last two years, worse than the broader insurance industry and in line with its total revenue.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Employers Holdings’s revenue to drop by 1.8%, a decrease from its 2.4% annualized growth for the past two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

3. EPS Barely Growing

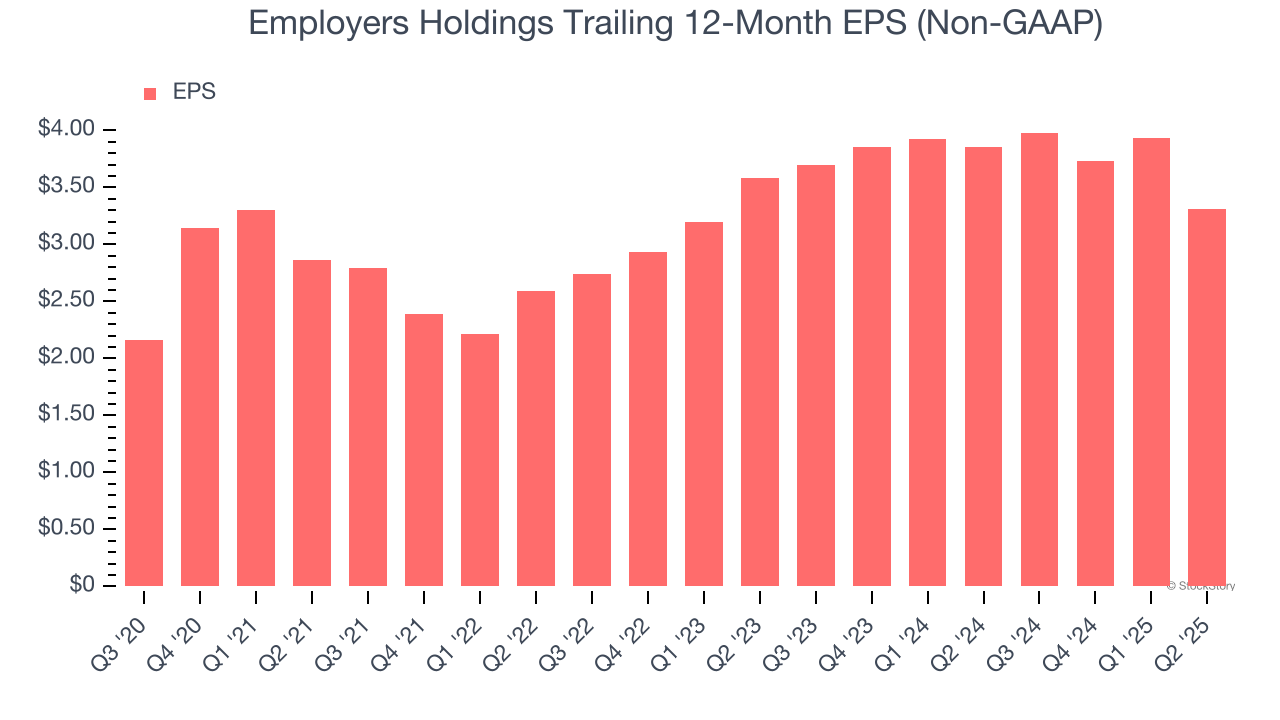

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Employers Holdings’s EPS grew at an unimpressive 8.3% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 5.8% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

Employers Holdings falls short of our quality standards. After the recent drawdown, the stock trades at 0.9× forward P/B (or $42.26 per share). This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment. Let us point you toward our favorite semiconductor picks and shovels play.

Stocks We Would Buy Instead of Employers Holdings

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.