Thunder Bay, Ontario--(Newsfile Corp. - January 20, 2026) - Thunder Gold Corp. (TSXV: TGOL) (FSE: Z25) (OTCQB: TGOLF) ("Thunder Gold" or the "Company") is pleased to announce the 2026 Phase One drill program at its 100%-owned, 2,500-hectare, Tower Mountain Gold Property, located 40 kilometres from the port city of Thunder Bay, Ontario. The fully funded, 5,000 metre drill program is scheduled to start February 1, 2026. This drill program shall focus on resource definition drilling to increase the geological confidence of the mineralization occurring adjacent to the western contact of the Tower Mountain Intrusive Complex ("TMIC").

The Company also advises that the previously announced Mineral Resource Estimate ("MRE"), currently in progress under the supervision of Micon International Limited ("Micon"), Toronto, ON., Canada, is anticipated to be completed by February 2026.

Wes Hanson, President and CEO, states, "Thunder Gold met or exceeded ALL our objectives in 2025. We demonstrated opportunity for future resource growth east of the TMIC at the P Target (26 holes averaging 0.592 g/t Au over 17.9 metres true width). We identified multiple soil geochemical anomalies within the current claim package offering future discovery potential. Metallurgical testing (16 representative samples) indicates gold recovery ranging from 68 to 95% (average of 85%). The Phase 2 and 3 drill programs significantly increased the mineralization footprint of the 3738 Target. More importantly, this resource definition drilling verified the predictive accuracy of our internal models, intersecting mineralization, where predicted by the model at the grades interpolated by the model.

"Our 2026 objectives are aimed at continuing our positive momentum. Release of the MRE in the coming weeks is the initial catalyst for 2026. We anticipate that the Micon model will offer multiple targets to both increase the overall mineral resource and to increase the geological confidence with the mineral resource estimated by Micon.

"Our 2026 drilling, commencing February 1, 2026, shall focus entirely on resource definition drilling within the Micon MRE model. Our focus will be directed towards increasing the geological confidence of as much of the resource as possible, but we will also seize opportunities to increase the total resource wherever possible.

"We plan to complete detailed metallurgical testing to increase gold recovery and establish a preferred process design for costing.

"Our primary objective for 2026 is to be positioned to initiate a combined MRE update and Scoping Study (formerly Preliminary Economic Assessment) by the fourth quarter of 2026. We believe Tower Mountain's best-in-class infrastructure advantage, low drilling cost per metre, and broad, predictable mineralization style offers opportunities for rapid, cost-effective exploration and future development. We look forward to continuing to define the investment opportunity at Tower Mountain in 2026."

2025 Review

Thirteen (13) holes (751.5 metres) were drilled at the P-Target in November 2024, identifying significant gold mineralization at surface within a plunging alteration envelope trending to the southeast at approximately 20 to 30 degrees.

A total of 32 holes (5,145.5 metres) of drilling were completed in 2025. The first half of the year focused on exploration drilling of the P and H Targets. In the second half of the year, the Company pivoted away from high risk-reward exploration to focus on resource definition drilling at the A, 3738 and Ellen Targets.

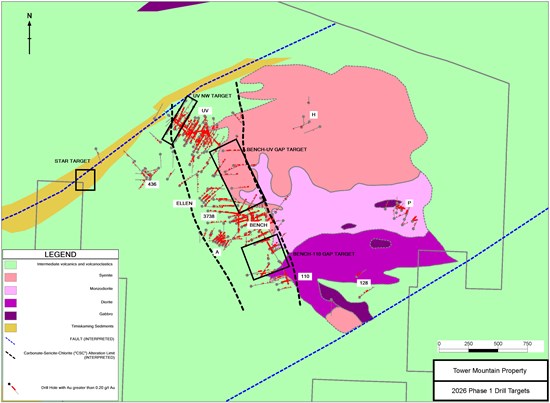

Table 1.0 summarizes the 2024 and 2025 exploration drill results for the P, H and A SW (southwest) Targets.

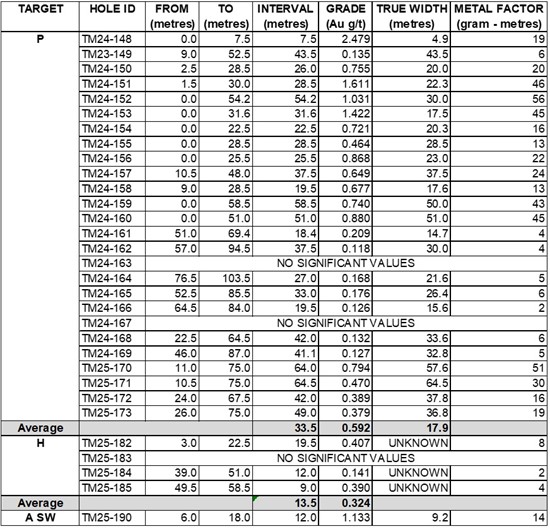

Table 2.0 summarizes the 2025 resource definition drill results for the A, 3738 and Ellen Targets.

Table 1.0 Summary of 2024 and 2025 Drill Results - Exploration Targets

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5364/280851_thunder%20gold%20table%201.jpg

Intervals reported at a cutoff grade of > 0.10 g/t Au, over a minimum true width of >4.5 metres. Maximum internal waste within a given interval is limited to 25% of the interval length. Where true width cannot be estimated due to insufficient information, a minimum interval length >7.5 metres is utilized.

P-Target

Twenty-six (26) holes (2,293.5 metres) tested the P-Target from November 2024 through May 2025.

The initial thirteen (13) holes (751.5 metres) completed in November 2024, averaged 0.848 g/t Au over an average true width of 28.2 metres. The drilling identified that the mineralization plunged to the southeast at approximately 20 to 30 degrees. The down-dip extent of the mineralization was not determined.

In Q1, 2025 the Company's 2025 Phase One drill program targeted the down-dip continuity of the P-Target and attempted to trace the down plunge continuity to the southeast. The initial holes tracing the down plunge continuity failed to intersect the projected keel of the plunging target which the Company subsequently determined (2025 Phase Two) had a shallower plunge than initial predicted. The down-dip drill holes (TM25-161 to 167) targeted the interpreted down-dip continuation of the mineralization initially intersected in 2024. Two of the seven holes failed to intersect any significant mineralization. The remaining five (5) holes intersected the targeted lithology but the intense alteration observed near surface was absent. As a result, gold grades ranging from 0.10 to 0.20 g/t were returned over similar true widths to that observed in the initial drilling.

The final two holes (TM25-168 and 169) intersected the same grade/ true widths as the down-dip drilling, suggesting that the projected plunge of the alteration was either flatter or steeper than interpreted. As a result, the Company terminated the Phase One program early with the intent on resuming drilling the P-Target during Phase Two when assay results could inform on drill targeting.

The Phase Two drill program (May-June 2025) included four (4) holes targeting a revised down-plunge projection of the P-Target mineralization. All four holes (TM25-170 to 173) intersected the targeted alteration averaging 0.529 g/t Au over a true width of 49.2 metres in a fence of holes drilled 100 metres to the southeast of the previous limit of the target. The fact that the true width is increasing to the southeast is intriguing, especially as the potential up-dip extent of the P-Target cannot be effectively drilled without helicopter support.

H-Target

A single hole, TM25-182 tested the H-Target, 1,000 metres to the northwest of the P-Target, during the 2025 Phase Two drill program. It intersected 0.407 g/t Au over 19.5 metres from the bottom of casing (3.0 metres).

Three (3) follow up holes (TM25-183-185) were completed during the Phase Three drill program. All three holes intersect low tenor gold mineralization, averaging 0.20 g/t Au over 9.0 metres. The drill results suggest that the mineralization at the H-Target is sub-horizontal.

Resource Definition Drilling

Resource definition drilling of the 3738 and A Targets initially occurred during Phase Two 2025. Results of the initial holes prompted the Company's decision to pivot away from Exploration drilling and focus the entirety of the Phase Three 2025 drilling towards resource definition drilling of the #3738, A, Ellen and Bench Targets along the western TMIC contact, in advance of the Micon 43-101 MRE.

Significant results of the resource definition drilling are presented in Table 2.0.

3738 Target

A total of ten (10) holes (2,892.5 metres) of resource definition drilling were completed at the 3738 Target during Phases Two and Three, 2025. The drilling returned an average mineralized intercept of 0.544 g/t Au over an average true width of 59.0 metres.

A Target

A total of four (4) holes (357 metres) were completed at the A-Target during Phase Two-2025. Three (3) of the four (4) holes intersected mineralization averaging 1.818 g/t Au over an average true width of 54.8 metres. The hole that missed (TM25-177) was drilled in the opposite direction from hole TM25-176 which collared in mineralization.

Table 2.0 Summary of 2025 Drill Results - Resource definition Targets

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5364/280851_thunder%20gold%20table%202.jpg

Intervals reported at a cutoff grade of > 0.10 g/t Au, over a minimum true width of >4.5 metres. Maximum internal waste within a given interval is limited to 25% of the interval length. Where true width cannot be estimated due to insufficient information, a minimum interval length >7.5 metres is utilized.

Phase One 2026 Program

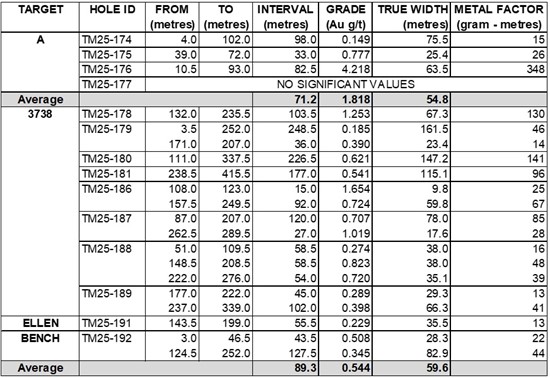

The planned drill program will consist almost exclusively of resource definition drill holes targeting gaps in the drill coverage between the UV target to the northwest and the 110 Target to the southeast, a strike length of 1,500 metres (Ref. Figure 1.0).

Phase One will start February 1, 2026. The Company currently estimates Phase One completion by June 30, 2026. Final assay results are estimated to be available by July 31, 2026. Phase Two drilling is currently scheduled to commence September 30, 2026. The Company advises that the timelines noted above are estimates and subject to change.

Figure 1.0 - 2026 Phase One Resource Definition Drill Program (5,000 metres)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5364/280851_7213a93dd4318958_003full.jpg

UV NW Target

Two (2) holes (600 metres) are planned to test the northwestern limit and depth extent of mineralization intersected in holes TM04-09 (1.88 g/t Au over 81.0 metres), TM04-24 (0.93 over 88.5 metres) and TM21-90 (0.58 over 40.5 metres). Modeling suggests possible sub-vertical continuity to this mineralization which occurs largely within intrusive rock.

Two (2) holes (400 metres) are planned to test depth extensions of mineralization intersected in holes TM03-11 (1.27 g/t Au over 40.5 metres) and TM04-15 (1.95 g/t Au over 33 metres). Modeling suggests sub-vertical depth extension to both targets and the drilling is planned to test the current interpolation limits.

UV-Bench Gap Target

Ten holes (10) holes (2,000 metres) are planned to test the Bench - UV gap, a sparsely drilled area between the two main mineralized areas. The proposed drill holes will infill between and below holes TM04-29 (0.62 g/t Au over 22.5 metres) and TM23-143 (0.47 g/t Au over 63.0 metres). Once again, drill holes will target the current model interpolation limits of the Micon MRE. The objective of this drilling is twofold, both to increase the total resource and to increase to geological confidence of the defined resource in the Micon MRE.

Bench-110 Gap Target

Six holes (1,700 metres) are planned for the Bench-110 Gap infilling between holes TM11-82 (0.63 g/t Au over 36 metres) and TM 22-126 (1.08 g/t Au over 21.0 metres). Drilling shall target the interpolation limits of the Micon MRE block model with the objective of increasing the resource footprint to the southeast.

STAR Target

Two (2) holes (300 metres) are planned to test a cluster of anomalous surface rock samples associated with a coincident soil geochemical anomaly at the Star Target, approximately 1.0 kilometre west of the UV Target. The STAR Target, like the UV Northwest Target, can only be accessed during the winter field season so the Company has decided to test this target as part of the Phase One drill program.

Phase Two Drill Program

The Company expects to have sufficient funds on the completion of Phase One 2026 to proceed immediately into a Phase Two 2026 drill program of between 1,500 to 2,000 metres of drilling.

Care and Control Procedures

Diamond drilling is conducted by qualified contractors independent of the Company. All drilling is completed using N-diameter (47.6 mm) tooling. The independent drill contractor maintains security of the core until it is delivered to the Company's logging facility. On receipt of the core, independent contractors receive the core, log it for physical and geotechnical information and photograph the core for reference. A contract geologist, under the supervision of the Company's qualified person ("QP") logs the core for geological information and marks the core for sampling employing a standard 1.5 metre sample length. The contract geologist enters the data into the Company's electronic database under the supervision of the Company QP. Contract core splitters cut the core in half using a rotary diamond saw. One half is placed into sequentially numbered plastic sample bags that are sealed. The remaining half is returned to the core box and stored sequentially in racks at the Company's logging facility. The bagged samples are delivered to an independent assaying facility for analysis.

Quality Assurance and Quality Control

The Company inserts Certified Reference Materials ("CRMs") into the sample stream to monitor laboratory performance. The CRMs consist of certified standards and blanks prepared and sold by CDN Resource Laboratories of Langley B.C. an independent laboratory serving the global market.

Typically, four (4) to six (6) standards are utilized. Each standard is certified at a gold grade ranging from 0.20 to 2.00 g/t Au, representative of the large tonnage, low-grade target being evaluated. Standards are inserted at a rate of one standard for every twenty (20) samples. Certified blanks are inserted into the sample stream at an identical one in twenty sample rate.

Blanks and Standard performance is monitored by the Company QP. Standards returning values outside the certified limits are investigated and if necessary, re-assay at the discretion of the Company QP.

In 2026, the Company shall begin blind duplicate analyses of 5% of the sample population at a secondary laboratory. Pulp rejects from the primary assay facility shall be pulled from the sample stream and shipped to a second independent laboratory for gold analysis.

Assaying

The Company's primary laboratory is Activation Laboratories Ltd. ("Actlabs") facility in Thunder Bay, Ontario.

The Company's secondary laboratory is AGAT Laboratories ("AGAT") also located in Thunder Bay.

Both Actlabs and AGAT are independent from the Company and fully accredited by the Standards Council of Canada ("SCC") as per SCC-15308 ISO/IEC 17025:2017.

Samples are received, dried, crushed, split and pulverized to produce a representative, 250-gram sample for analysis. The crushed reject is stored for return to the client. The 250-gram pulverized sample is split to obtain an approximate 30-gram sample for assay. The reject portion of the 250-gram pulverized sample is stored for return to the client.

The 30-gram sample aliquot is analyzed using Actlabs 1A2 procedure, lead collection fire assay fusion (FA) with an atomic absorption (AAS) finish. All assay results greater than 5.0 g/t Au are re-assayed using Actlabs 1A3-30 method which uses a gravimetric finish for higher accuracy. All assays greater than 30.0 g/t Au are re-assayed using Actlabs 1A4-1000 screen metallics method where a representative 1000-gram sample is split from the crushed reject fraction, pulverized to 95% passing 149 micron and sieved and analyzed by size fraction. Assays are performed on the entire +149 µm fraction and two splits of the -149 µm fraction. A final assay is calculated based on the weight of each size fraction. All the above is completed at Actlabs Thunder Bay facility.

Actlabs reports the results to the Company's QP and Logistics Manager. The QP is responsible for monitoring CRM results, flagging and investigating any failures and if necessary, requesting any re-assaying.

Qualified Person

Technical information in this news release has been reviewed and approved by Wes Hanson, P.Geo., President and CEO of Thunder Gold Corp., who is a Qualified Person under the definitions established by National Instrument 43-101.

About the Tower Mountain Gold Property

The 100%-owned Tower Mountain Gold Property is located adjacent to the Trans-Canada highway, approximately 40 km west of the international port city of Thunder Bay, Ontario. The 2,500-hectare property surrounds the largest, exposed, intrusive complex in the eastern Shebandowan Greenstone Belt where most known gold occurrences have been described as occurring either within, or proximal to, intrusive rocks. Gold at Tower Mountain is localized within extremely altered rocks surrounding the Tower Mountain Intrusive Complex, a multi-phase, long duration intrusive complex that control gold distribution on the Property. Historical drilling has established anomalous gold extending out from the intrusive contact for over 500 metres along a 1,500-metre strike length, to depths of over 500 metres from surface. The remaining 75% of the perimeter surrounding the intrusion shows identical geology, alteration, and geophysical response, offering a compelling exploration opportunity.

About Thunder Gold Corp.

Thunder Gold is advancing the Tower Mountain Project in Thunder Bay, Ontario - an emerging gold system with the scale, consistency, and quality to support a long-life, open-pit operation. Results from our disciplined drill programs have consistently reinforced confidence in the continuity and predictability of the discovery, while highlighting significant potential for expansion across multiple zones of the Tower Mountain Intrusive Complex. With industry-leading drilling costs, existing infrastructure and a skilled local workforce, Tower Mountain represents a rare combination of size, scalability, and cost-effective growth.

At Thunder Gold, our vision is clear: to unlock a discovery that has the potential to become a transformational gold project, delivering long-term value for shareholders while contributing to the future of Canada's mining industry. For more information about the Company, please visit: www.thundergoldcorp.com.

On behalf of the Board of Directors,

Wes Hanson, P.Geo., President and CEO

For further information, contact:

Wes Hanson, CEO

(647) 202-7686

whanson@thundergoldcorp.com

Kaitlin Taylor, Investor Relations

IR@thundergoldcorp.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities legislation (collectively, "forward-looking statements"). Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. All statements, other than statements of historical fact, are forward-looking statements and are based on predictions, expectations, beliefs, plans, projections, objectives and assumptions made as of the date of this news release, including without limitation; anticipated results of geophysical drilling programs, geological interpretations and potential mineral recovery. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to the gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty or reliance on forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise any forward-looking statements, other than as required by applicable law, to reflect new information, events or circumstances, or changes in management's estimates, projections or opinions. Actual events or results could differ materially from those anticipated in the forward-looking statements or from the Company's expectations or projections.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/280851