When you're bullish on a stock and expect it to move higher, your initial impulse may be to play the stock options and buy a long call contract. There's nothing wrong with that if you believe a rapid price spike will happen in a relatively short period of time. Remember that Theta (time decay) works against you. If you decide to take a call option several months out, that can help buffer the Theta a bit, but you will be paying a hefty premium.

Instead, you can consider a cheaper strategy that will provide upside and protect your downside. The downside is the problem with directional options trades since you can lose the full cost of the call option. If you're willing to cap some upside to protect the downside, then a debit spread is worth considering.

What is a Call Debit Spread?

A call debit spread is also referred to as a bull call debit spread, debit spread or a long call spread. It is a multi-leg options strategy comprised of one long call and one short call option at a higher strike price in the same stock and the same expiration. It's a strategy used when you're bullish on the underlying stock. It's a debit trade because you pay for the trade rather than receive a premium payment like in a credit spread.

Debit spreads usually comprise an in-the-money (ITM) long call and an out-of-the-money (OTM) short call. However, you can have an OTM long call and even more OTM short call. The short call should have a higher strike price than the long call, which helps to finance part of the long call. The remaining cost is the price you pay for the trade. Debit spreads are ideal when implied volatility is low (IV) as it starts to rise.

Example of a Call Debit Spread

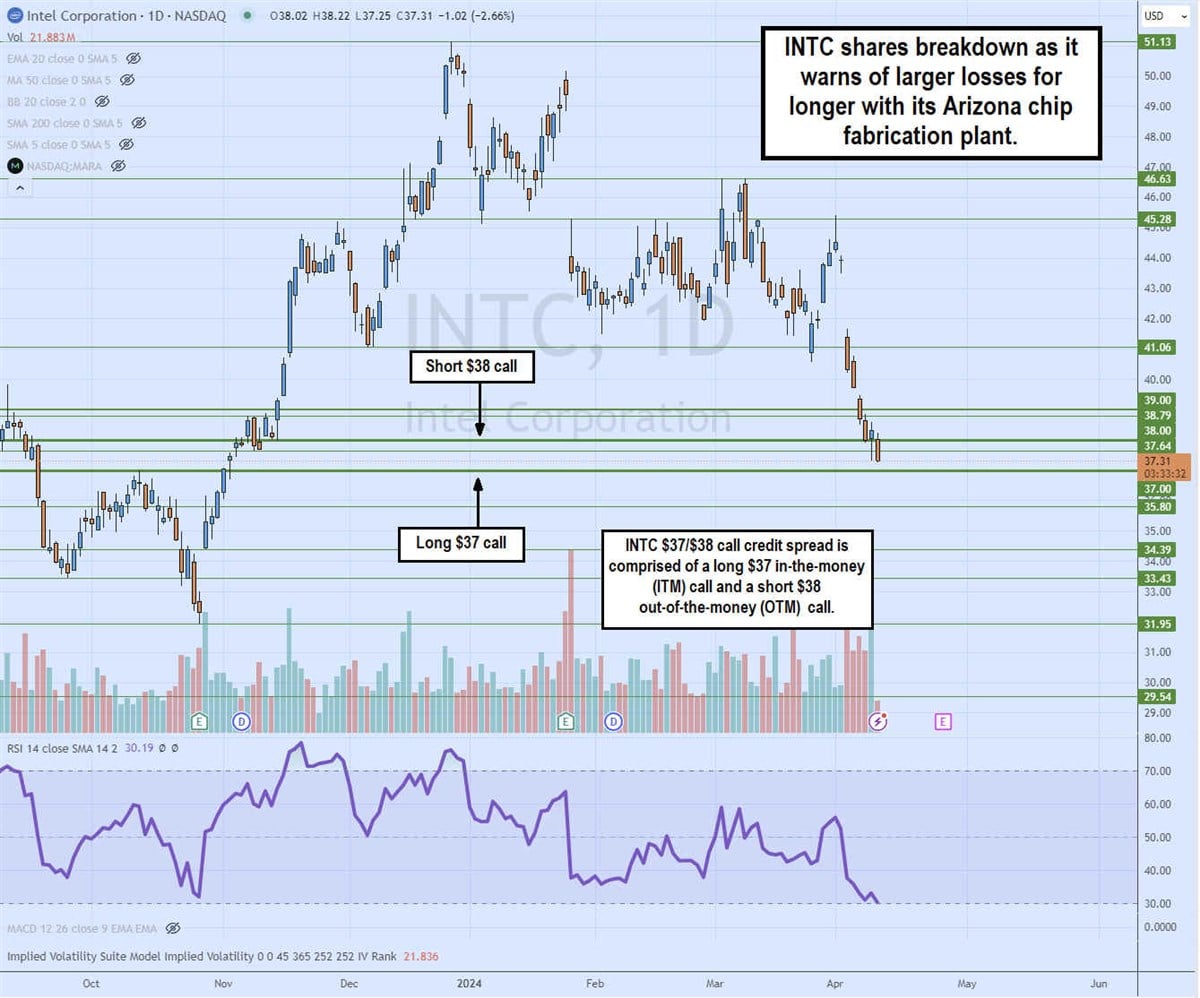

Let's use computer and technology sector giant Intel Co. (NASDAQ: INTC) as an example. Further concerns over the extended loss for their domestic semiconductor fabrication plants hit the stock pretty hard. Intel is working on its AI chips to face off against the incumbent leader NVIDIA Co. (NASDAQ: NVDA).

Putting on the Trade

INTC stock is currently trading at $37.30, but let’s take bullish stance and assume INTC will rally back up through $38 by the May 3, 2024 expiration date.

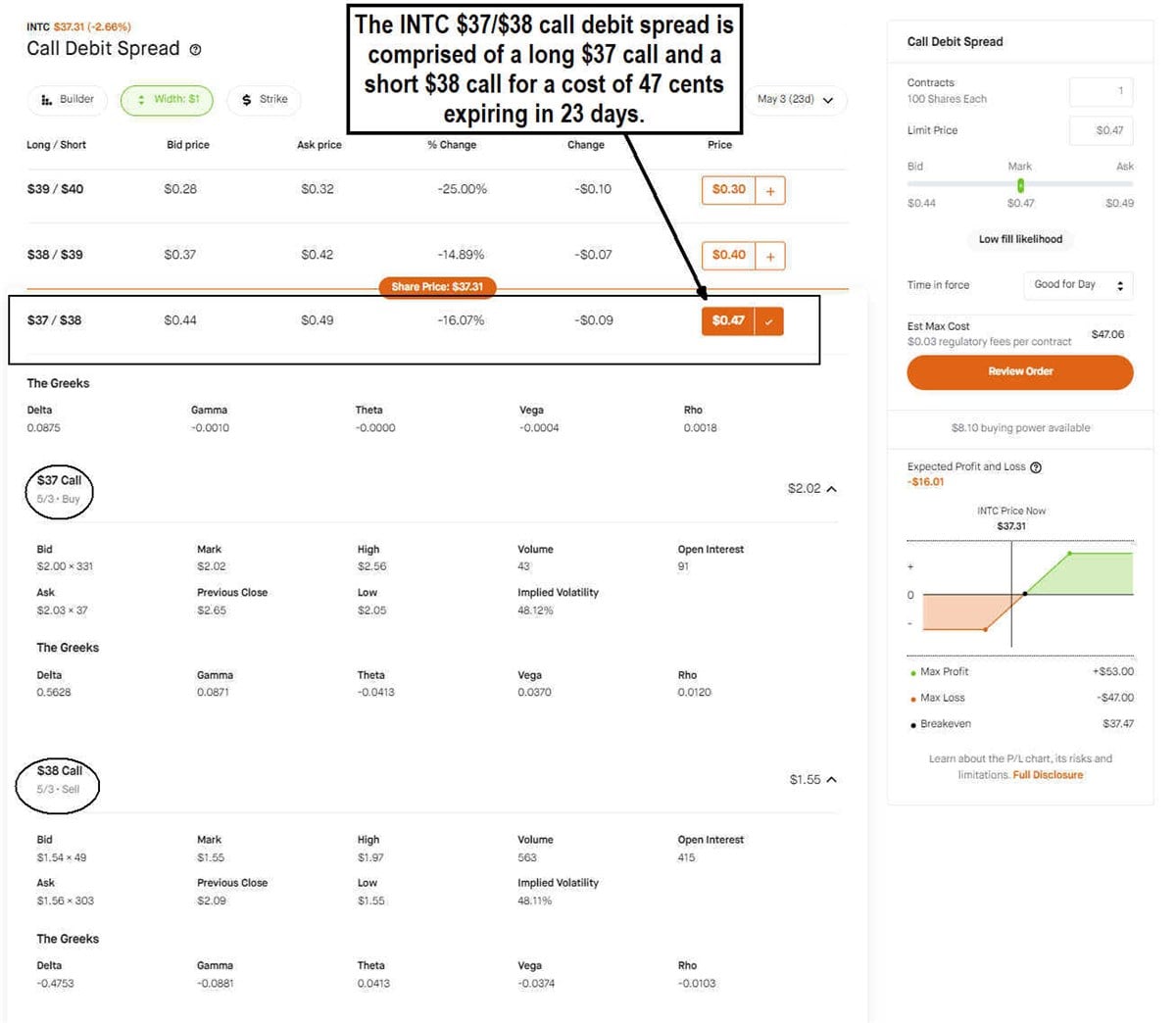

To put on the trade, we select the INTC $37/$38 call debit spread for 39 cents. This means we buy the $38 call at $2.02 and sell/short the $37 call at $1.55, leaving a debt of 47 cents.

The Potential Outcome

There are three potential outcomes for the trade based on where INTC stock closes on expiration.

- The breakeven price on the trade is $37.47 for INTC.

- The maximum loss is the $47 debit paid to put on the trade, which triggers a breakdown under $37. Both the $37 and $38 calls would expire worthless.

- The maximum gain is $53 based on the spread between the strikes of $1 minus the cost of the trade of 47 cents for a profit of $53. This is based on the $1 spread price difference minus the debit paid for the trade.

Remember that you're not obligated to wait until expiration to close the trade; you can close the trade out early to take your profits or losses.

The Pros and Cons of Debit Spreads

Trading call debit spreads can both safeguard and limit your investment outcomes. Let's take a closer look at the advantages and disadvantages associated with employing this strategy.

Trading call debit spreads can benefit your investment portfolio by:

- Financing part of your long call option. Selling the higher strike call provides you with a credit that can be applied to the long call at the lower strike. While the lower call usually tends to be ITM, you can make it OTM for a larger upside.

- Quantifying and minimizing your downside risk. You can't lose what you don't put into the pot. The total loss on your trade is potentially 100%, but it's still much less money than if you just took the long call.

- Enabling additional trades. The money you would have used to play only the long call will be less after selling the short call. That extra money saved can be used for an extra trade. In the INTC $37/38 call debit spread example, the $37 long call option trade would have cost $2.02 or $202. By selling the $38 call for $1.56, you end up paying $47 instead of $202. In essence, the long call debit spread on INTC $37/$38 saved you $156. That extra money saved could be used for other trades.

Some of the drawbacks of trading call debit spreads are that:

- The maximum profit potential is capped. Your upside and maximum profit are capped. By shorting the higher strike price call, you're capping your upside in exchange for helping finance the trade, making out-of-pocket costs cheaper.

- Maximum loss can increase with a higher short call price. The more OTM the short call is, the less credit you would receive, making the options trade more expensive. However, the maximum profit can increase since the spread would widen.

- The maximum loss is still 100% of the investment. If the stock falls under the lower strike price, then both options expire worthless, resulting in a 100% loss on the investment.

When You Feel the Itch

Call debit spreads can be considered whenever you are feeling bullish on a stock and are thinking of taking long-call options. It's just one extra trade that's added by selling the higher strike call. You can always close the position before the expiration date or even roll forward the trade.

If you want to collect premiums upfront, be on the lookout for our next article where we'll cover call credit spreads.