Company’s record exploration investment continues to deliver significant results at key assets in Nevada

Coeur Mining, Inc. (“Coeur” or the “Company”) (NYSE: CDE) today provided an update on its 2021 exploration programs at its Rochester operation in northern Nevada and the Crown exploration project in southern Nevada. Collectively, Coeur has drilled just over one million feet (307,925 meters) from up to 27 active rigs at six different locations through the first ten months of 2021, reflecting a year-over-year increase of roughly 50%. The Company plans to invest an all-time record of approximately $70 million1 in exploration this year, nearly 48% more than last year’s record exploration investment.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211214005122/en/

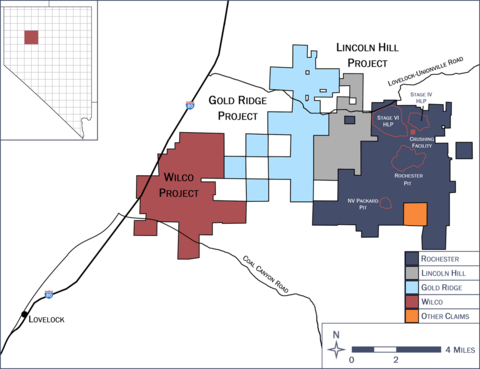

Rochester - Land Position (Graphic: Business Wire)

Key Highlights2,3

- Rochester delivers promising new expansion drill intercepts – Core and reverse circulation drilling commenced in the second quarter of 2021 with four rigs. A newly-restructured team is delivering excellent results and continuing to build an enhanced understanding of the Rochester geologic model with the goal of bringing forward higher-grade gold production over a potentially longer mine life to further enhance the economics of the ongoing expansion at Rochester. Key highlights include:

Nevada Packard (located roughly 2.0 miles (3.2 kilometers) southwest of the Rochester pit) – Expansion

- Hole ROCR21-1011 returned 15 feet (4.6 meters) of 0.218 ounces per ton (“oz/t”) (7.5 grams per tonne (“g/t”)) gold and 1.9 oz/t (65.9 g/t) silver

- Hole ROCR21-1042 returned 140 feet (42.7 meters) of 1.7 oz/t (56.9 g/t) silver

- Hole ROCR21-1044 returned 105 feet (32.0 meters) of 1.5 oz/t (51.4 g/t) silver

- Hole ROCR21-1045 returned 125 feet (38.1 meters) of 0.003 oz/t (0.1 g/t) gold and 3.6 oz/t (121.8 g/t) silver

South Rochester (located roughly 0.8 miles (1.3 kilometers) south of the Rochester pit) – Expansion

- Hole ROCR21-1027 returned 35 feet (10.7 meters) of 1.9 oz/t (64.9 g/t) silver

- Hole ROCR21-1038 returned 25 feet (7.6 meters) of 0.040 oz/t (1.4 g/t) gold and 0.1 oz/t (3.4 g/t) silver

- Hole ROCC21-1036 returned 165 feet (50.3 meters) of 0.003 oz/t (0.1 g/t) gold and 0.4 oz/t (13.7 g/t) silver

Lincoln Hill Resource (located roughly 3.0 miles (4.8 kilometers) west of the Rochester pit) – Expansion

- Hole LHR21-001 returned 285 feet (86.9 meters) of 0.003 oz/t (0.1 g/t) gold and 1.0 oz/t (33.4 g/t) silver

- Hole LHR21-002 returned 80 feet (24.4 meters) of 0.019 oz/t (0.7 g/t) gold and 0.4 oz/t (14.1 g/t) silver

- Drilling at the Crown Block project continues to demonstrate excellent growth potential in the heart of one of the most active exploration districts in Nevada – Drilling in early 2021 from up to four drill rigs focused on the new C-Horst discovery before transitioning to drilling greenfield and expansion targets in the second half of the year at Daisy, Secret Pass and SNA – all part of the original Crown Block resource package. Notable assay results include:

C-Horst – Greenfield

- Hole CH21-C009 returned 165 feet (50.3 meters) of 0.019 oz/t (0.7 g/t) gold and 57 feet (17.4 meters) of 0.013 oz/t (0.4 g/t) gold

- Hole CH21-082 returned 140 feet (42.7 meters) of 0.019 oz/t (0.7 g/t) gold

- Hole CH21-089 returned 115 feet (35.1 meters) of 0.031 oz/t (1.1 g/t) gold

Daisy – Expansion

- Hole D21-057 returned 35 feet (10.7 meters) of 0.103 oz/t (3.5 g/t) gold and 45 feet (13.7 meters) of 0.015 oz/t (0.5 g/t) gold starting at 265 feet (80.8 meters)

- Hole D21-061 returned 20 feet (6.1 meters) of 0.028 oz/t (1.0 g/t) gold

- Hole EM21-006 returned 60 feet (18.3 meters) of 0.072 oz/t (2.5 g/t) gold

Secret Pass – Expansion

- Hole SP21-032 returned 75 feet (22.9 meters) of 0.015 oz/t (0.5 g/t) gold and 70 feet (21.3 meters) of 0.044 oz/t (1.5 g/t) gold

- Hole SP21-049 returned 70 feet (21.3 meters) of 0.048 oz/t (1.7 g/t) gold

“The recent reorganization of our Nevada-based exploration team has led to the development of a clear and aggressive blueprint to further unlock exploration potential at both our Rochester operation and in Southern Nevada, supported by strong new drill results,” said Hans J. Rasmussen, Coeur’s Senior Vice President of Exploration. “Mapping, sampling and geophysical surveys are driving a focused drilling program over a much larger footprint than Coeur has previously undertaken at Rochester. Recent drill results also highlight promising upside potential in the land package acquired in 2018 now referred to as West Rochester. This area has strong potential as a source of future higher-grade gold resources and to provide Coeur more optionality for processing material from the larger Rochester district.

“At the Crown Block project area near Beatty, Nevada, the new team has maintained three active reverse circulation rigs for most of the year and added two core rigs in late November to accelerate metallurgy and engineering studies. Initially, drilling was focused within the small five-acre permitted footprint at C-Horst before shifting focus to expansion drilling within a 300-acre Plan of Operation covering the Daisy, Secret Pass and SNA targets, which returned promising results. Our organic, cutting-edge exploration program continues to focus on unlocking tremendous potential at Crown and to position Coeur as a key participant within this emerging and very active gold district.”

For a complete table of all drill results, please refer to the following link: https://www.coeur.com/_resources/pdfs/2021-12-14-Exploration-Update-Appendix-Final.pdf. Please see the “Cautionary Statements” section for additional information regarding drill results.

Rochester

Coeur has drilled a total of approximately 91,100 feet (27,800 meters) in 74 holes from up to four drill rigs mainly focused in the Rochester and Nevada (“NV”) Packard areas through the first ten months of 2021, compared to roughly 46,100 feet (14,050 meters) during the same period in 2020.

The focus of Rochester’s exploration program in 2021 has been on resource growth near the Rochester pit as well as expansion at NV Packard located approximately two miles southwest of the main Rochester pit. More recently, the focus shifted to the land package of Lincoln Hill, Independence Hill and Gold Ridge (collectively referred to as “West Rochester) which was acquired in late 2018 from Alio Gold for $18 million. The land package is located immediately west of the expanded infrastructure currently under construction as part of the POA11 expansion project. One core rig and one reverse circulation rig recently began drilling at Lincoln Hill and Gold Ridge, respectively.

West Rochester is geologically different from the Rochester Mine as it is endowed with higher-grade gold. Lincoln Hill’s current resource contains approximately four times the gold grade compared to the Rochester Mine reserves. Lincoln Hill and Independence Hill mineralization is hosted in the Triassic Rochester Formation, similar to the Rochester Mine while Gold Ridge is hosted in the Prida Formation limestone and andesite flows that overlies the Rochester Formation.

Key highlights from the 2021 exploration program include:

Rochester (East, South and North)

- Drilling in the area was affected by drill rig availability in the first half of 2021

- Up to four active rigs (two reverse circulation and two core)

- South Rochester drilling successfully encountered southern extensions of known mineralized faults as highlighted in holes ROCR21-1027, ROCR21-1038 and ROCR21-1036

NV Packard

- Infill drilling was completed late in the summer and focused on validating and upgrading the resource model

- Expansion targets were tested west and east as well as along the Packard access road with excellent results noted in the highlights above

- A new geologic interpretation has led to the discovery of significant silver mineralization as highlighted in holes ROCR21-1042 and ROCR21-1045 above, confirming excellent upside potential along and to the northeast of the Packard pit

- Due to winter conditions, follow-up drilling in this part of Packard will be delayed until Q2 2022

Most recently, at West Rochester, a regional surface exploration program was launched consisting of geochemistry, geophysics and geologic mapping. The results of this program have assisted in focusing on new targets for drilling in 2022. For the remainder of 2021, Coeur plans to transition its focus to West Rochester, specifically the Gold Ridge zone and lower portions of the Lincoln Hill zone. There are six approved drill pads on the upper portion of Lincoln Hill and 16 approved pads at Gold Ridge, which is at lower elevation and less susceptible to snow-related delays.

The Company expects to receive approval for a 250-acre drilling Plan of Operations in the West Rochester target areas in early 2022 that will open up new areas for drilling in the Gold Ridge, Lincoln Hill and Independence Hill zones. Gold Ridge has not been drilled since 2015 but has significant upside potential based on new structural geology and stratigraphic interpretations that corroborate new geophysical data over the zone. Similarly, Independence Hill has multiple geochemical anomalies from soil samples that have not been drill-tested. The geochemical results correlate well to gold-silver mineralization alteration collected from outcrop samples. A significant portion of the sample soil geochemistry program was designated to test for trends of these outcropping gold-mineralized zones.

Crown Block

The 2021 Crown exploration program started the year with three reverse circulation rigs and one diamond core rig focused on resource growth from the four known mineralized zones (Daisy, Secret Pass, SNA and C-Horst). Building on the highlights from the first half of the year published by Coeur in June 2021, the Company has continued on pace and currently has two reverse circulation rigs focused on resource expansion and two diamond core rigs focused on infill. Through the first ten months of 2021, Coeur drilled approximately 167,700 feet (51,125 meters) in 202 holes at Crown compared to roughly 74,500 feet (22,700 meters) in 63 holes during the same period in 2020.

The target mineralization style at Crown continues to be disseminated oxide gold hosted in both Cambrian sedimentary and Tertiary felsic volcanic rocks. Each known mineralized resource at Crown has shown a component of oxide mineralization in shallow portions of the drill holes. At Secret Pass, mineralization is near-surface oxide with deeper sulfidic mineralization in proximity to the east-west trending Fluorspar Canyon Fault and continues for roughly 10 miles to the west through the historic Bullfrog Mine. The fault is considered to be one of the most important controls of gold mineralization in the district.

At C-Horst, the Company has discovered that deeper mineralization becomes more oxidized by a phenomenon termed “hypogene” oxidation, which may support the potential for improved leach characteristics at depth over the entire mineralized section. After drilling in the first half of 2021 targeting depths of less than 1,200 feet, Coeur plans to begin testing for feeder structures in deeper portions beneath C-Horst for the remainder of the year. The Company believes the deeper feeder structures have the potential to lead to higher gold grades.

At Daisy, drilling has focused on resource expansion around zones that were drilled in 2018 and 2019 where gold is hosted in the Cambrian Carrara and overlaying Bonanza King Formations. The area is severely faulted by thrusts and high angle normal faults while undergoing widespread dissolution, a process that locally produced gold bearing breccias. The complicated structural environment creates an opportunity for more discoveries with additional drilling and re-interpretation. As shown on the graphic with holes EM21-006 and D21-057, gold grades can also be higher along specific faults or fault intersections, which can also lead to significant upside results in the expansion drill holes.

In October, approximately 3,600 feet (1,100 meters) and eight drill holes were completed at the Mary-Goldspar prospect located about two miles north of the Sterling Mine with assays still pending. The prospect is a historic fluorite producer with associated gold and felsic intrusive dikes. The association of fluorite, felsic dikes and gold is well-documented in the entire Bare Mountains area from the Sterling and Daisy mines. The association of fluorite with the felsic dikes is also well-documented from Sterling to SNA, so it is believed the tertiary gold mineralization event has a direct association with the felsic magmatism and is localized along north-south faults.

Two diamond core rigs were mobilized to site in late November to accelerate metallurgy and engineering studies for all four resource zones at Crown. These rigs will be directed to infill drill the resource shapes as well as to drill deeper beneath each zone, specifically at C-Horst, to test for higher grade mineralization feeder structures.

In late 2021 and into 2022, Coeur plans to (i) receive its amended 300-acre Plan of Operations to focus on C-Horst expansion and greenfield targets between SNA and C-Horst, (ii) continue expansion drilling around the Daisy and Secret Pass resources and (iii) continue with the two new diamond core rigs added in early December to focus on metallurgy and engineering studies on all four Crown resources.

Ongoing industry-wide supply and labor disruptions have impacted drill rig availability and resulted in longer-than-normal assay laboratory turnaround times. Coeur has elected to defer completion of study work and an initial economic assessment for the Crown Block until these conditions improve.

About Coeur

Coeur Mining, Inc. is a U.S.-based, well-diversified, growing precious metals producer with five wholly-owned operations: the Palmarejo gold-silver complex in Mexico, the Rochester silver-gold mine in Nevada, the Kensington gold mine in Alaska, the Wharf gold mine in South Dakota, and the Silvertip silver-zinc-lead mine in British Columbia. In addition, the Company has interests in several precious metals exploration projects throughout North America.

Cautionary Statements

This news release contains forward-looking statements within the meaning of securities legislation in the United States and Canada, including statements regarding exploration efforts and plans, timing of receipt of permits, exploration expenditures, drill results, investments, resource delineation, expansion, upgrade or conversion. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause Coeur’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, the risk that anticipated additions or upgrades to reserves and resources are not attained, the risk that planned drilling programs may be curtailed or canceled due to budget constraints or other reasons, the risks and hazards inherent in the mining business (including risks inherent in developing large-scale mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), changes in the market prices of gold, silver, zinc and lead and a sustained lower price environment, the uncertainties inherent in Coeur’s production, exploratory and developmental activities, including risks relating to permitting and regulatory delays (including the impact of government shutdowns), ground conditions, grade variability, any future labor disputes or work stoppages, the uncertainties inherent in the estimation of mineral reserves, the potential effects of the COVID-19 pandemic, including impacts to the availability of our workforce, continued access to financing sources, government orders that may require temporary suspension of operations at one or more of our sites and effects on our suppliers or the refiners and smelters to whom the Company markets its production, changes that could result from Coeur’s future acquisition of new mining properties or businesses, the loss of any third-party smelter to which Coeur markets its production, the effects of environmental and other governmental regulations, the risks inherent in the ownership or operation of or investment in mining properties or businesses in foreign countries, Coeur’s ability to raise additional financing necessary to conduct its business, make payments or refinance its debt, as well as other uncertainties and risk factors set out in filings made from time to time with the United States Securities and Exchange Commission, and the Canadian securities regulators, including, without limitation, Coeur’s most recent reports on Form 10-K and Form 10-Q. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. Coeur disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, Coeur undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Coeur, its financial or operating results or its securities.

Christopher Pascoe, Coeur’s Director, Technical Services and a qualified person under Canadian National Instrument 43-101, approved the scientific and technical information concerning Coeur’s mineral projects in this news release. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and resources, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, socio-political, marketing or other relevant factors, Canadian investors should refer to the Technical Reports for each of Coeur’s properties as filed on SEDAR at www.sedar.com.

Notes

The potential quantity and grade for the deposits described herein are conceptual in nature. There is insufficient exploratory work to define a mineral resource and it is uncertain if further exploration will result in the applicable target being delineated as a mineral resource.

- Reflects midpoint of guidance as published by Coeur on October 28, 2021 of $65-$75 million.

-

For a complete table of all drill results included in this release, please refer to the following link:

https://www.coeur.com/_resources/pdfs/2021-12-14-Exploration-Update-Appendix-Final.pdf - Rounding of grades, to significant figures, may result in apparent differences.

Conversion Table

1 short ton |

= |

0.907185 metric tons |

||

1 troy ounce |

= |

31.10348 grams |

View source version on businesswire.com: https://www.businesswire.com/news/home/20211214005122/en/

Contacts

Coeur Mining, Inc.

104 S. Michigan Avenue, Suite 900

Chicago, Illinois 60603

Attention: Jeff Wilhoit, Director, Investor Relations

Phone: (312) 489-5800

www.coeur.com