Stellantis (STLA) shares crashed more than 25% this morning after the automaker warned a “major EV reset” will trigger a massive €22.2 billion ($26.5 billion) impairment charge.

Also on Friday, the car company suspended its full-year dividend to “preserve” its balance sheet, adding it overestimated the timeline for the global transition to electric vehicles (EVs).

Versus its year-to-date high, Stellantis stock is now down more than 35%.

Should You Buy the Dip in Stellantis Stock?

STLA stock remains unattractive despite the “valuation haircut” because the €22.2 billion charge actually exceeds its entire market cap.

Simply put, the market is valuing Stellantis at less than the projected cost of its EV mistakes. This doesn’t just reflect disappointment, it signals a fundamental loss of confidence in the company.

Moreover, a mass exodus of income-focused investors now that the automaker has suspended its 2026 dividend could sustain the downward momentum in the weeks ahead.

At the time of writing, Stellantis is trading decisively below its key moving averages (MAs), which reinforces that bears are firmly in control across multiple timeframes.

STLA Shares Are the Auto Sector’s Weakling

Investors are cautioned against buying Stellantis shares also because the company’s price hikes have alienated its core middle-class buyer.

Plus, its Detroit rivals, Ford (F) and General Motors (GM), have significantly stolen market share as STLA continued to grapple with quality issues in recent years.

Meanwhile, inventory bloat remains an overhang as well. Stellantis currently has an excessive 90-day supply, nearly double what is generally considered healthy for the industry.

This means its profit margins are unlikely to improve anytime soon, especially since it’s a laggard in hybrid vehicles compared to Japanese automakers like Toyota (TM) or Honda (HMC).

What’s the Consensus Rating on Stellantis?

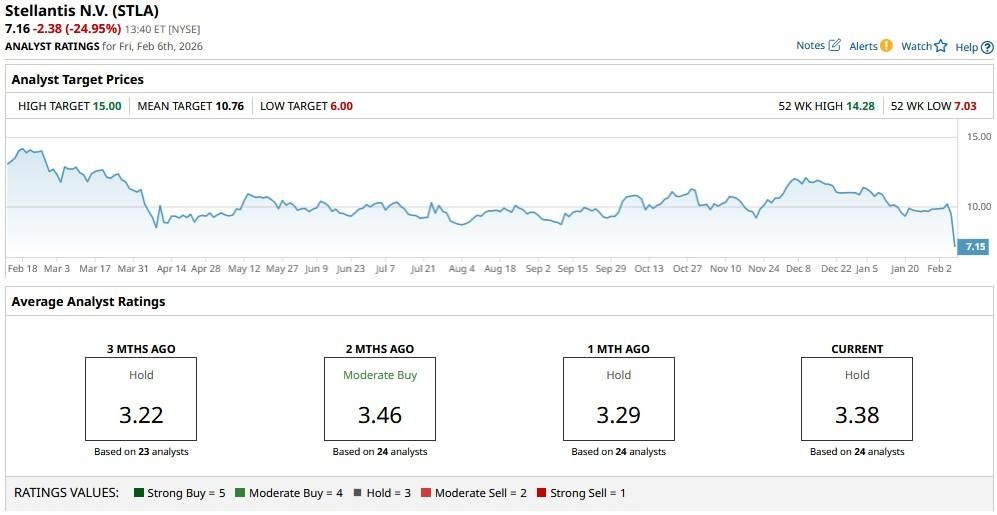

Wall Street analysts rated STLA shares at “Hold” only even before the company’s dire warning on Feb. 6. So, it’s reasonable to assume that some of them will downwardly revise estimates to bake in the impairment charge in the days ahead.

At the time of writing, the lowest price objective on Stellantis NV sits at $6, signaling potential downside of another 17% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart