Ryanair (RYAAY) stock closed higher on Jan. 20 after Elon Musk, the billionaire chief executive of Tesla (TSLA), asked his social media followers if he should buy the discount airline.

His poll on X followed a public dispute with Ryanair’s head Michael O’Leary, who dismissed the idea of partnering with Starlink for in-flight WiFi.

Including today’s gains, Ryanair stock is up a remarkable 72% versus its 52-week low.

Does Musk’s Poll Matter for Ryanair Stock?

Ryanair’s refusal to install Starlink for in-flight WiFi citing cost concerns reinforces the company’s commitment to capital discipline.

While Musk’s social media poll amplified retail interest in RYAAY shares today, it doesn’t really mean anything for investors given the lack of credibility from a regulatory standpoint.

The European Union’s aviation regulations mandate that airlines operating within the bloc maintain at least 50% ownership and effective control by EU nationals.

It’s a requirement that would categorically block Musk – a U.S. citizen – from acquiring controlling interest in Ireland-based Ryanair Holdings Plc.

In short, the investment thesis for RYAAY remains rooted in the air carrier’s fundamentals rather than speculative chatter of a potential acquisition on social media.

Should You Buy RYAAY Shares Today?

While Ryanair shares had a blockbuster 2025, there’s reason for investors to consider trimming their exposure to the low-cost airline this year.

Why? Because its financials could make it increasingly difficult for the stock to push any higher.

RYAAY will report its Q3 earnings next week on Jan. 26. Consensus is for it to record $0.16 per share of earnings, down an alarming 45% from the same quarter last year.

Moreover, the airline is going for about 14x forward earnings, more than double the multiple on its peer Deutsche Lufthansa (DLAKY).

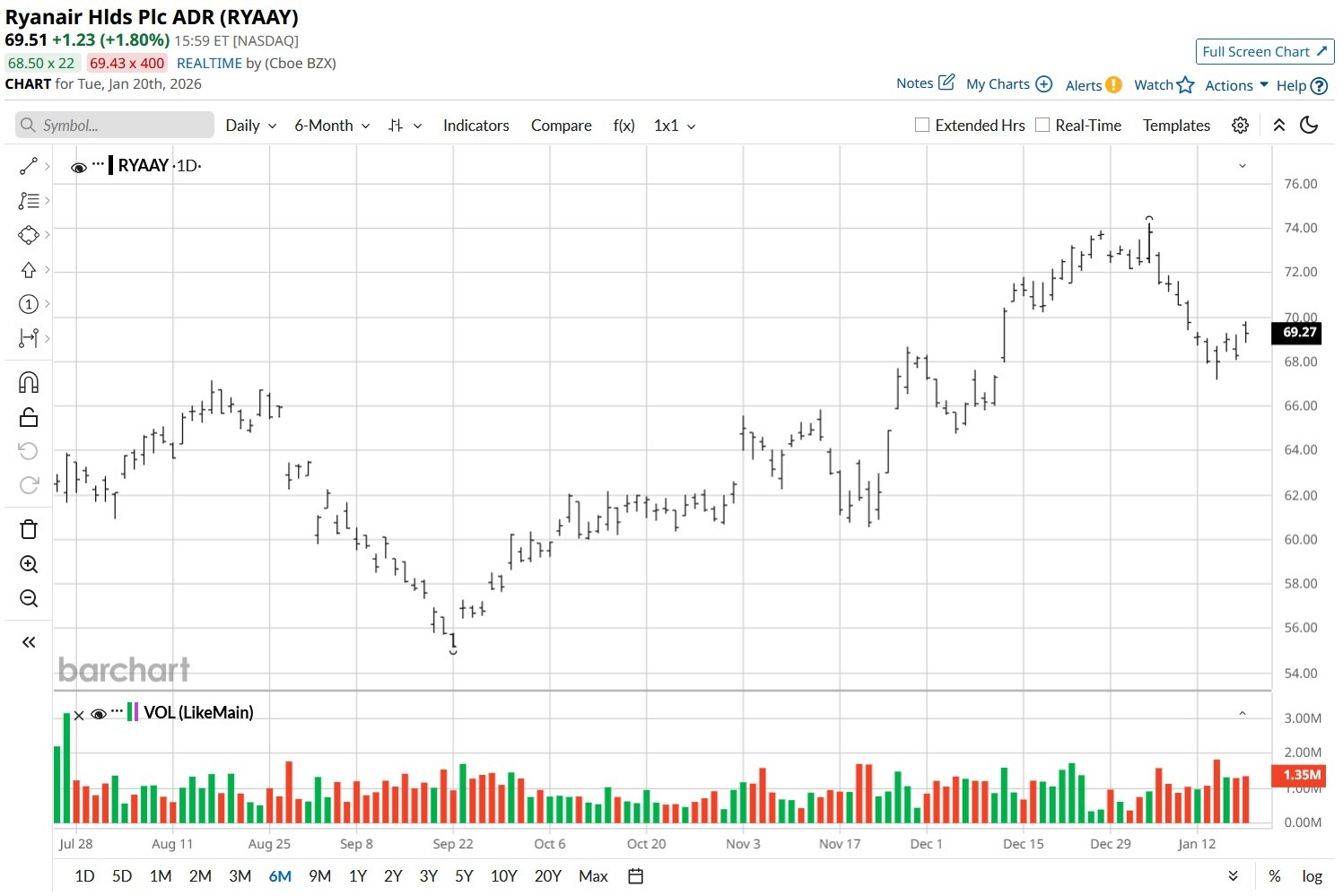

Note that Ryanair remains below its 20-day moving average (MA), indicating bears could remain in control in the near term.

How Wall Street Recommends Playing Ryanair

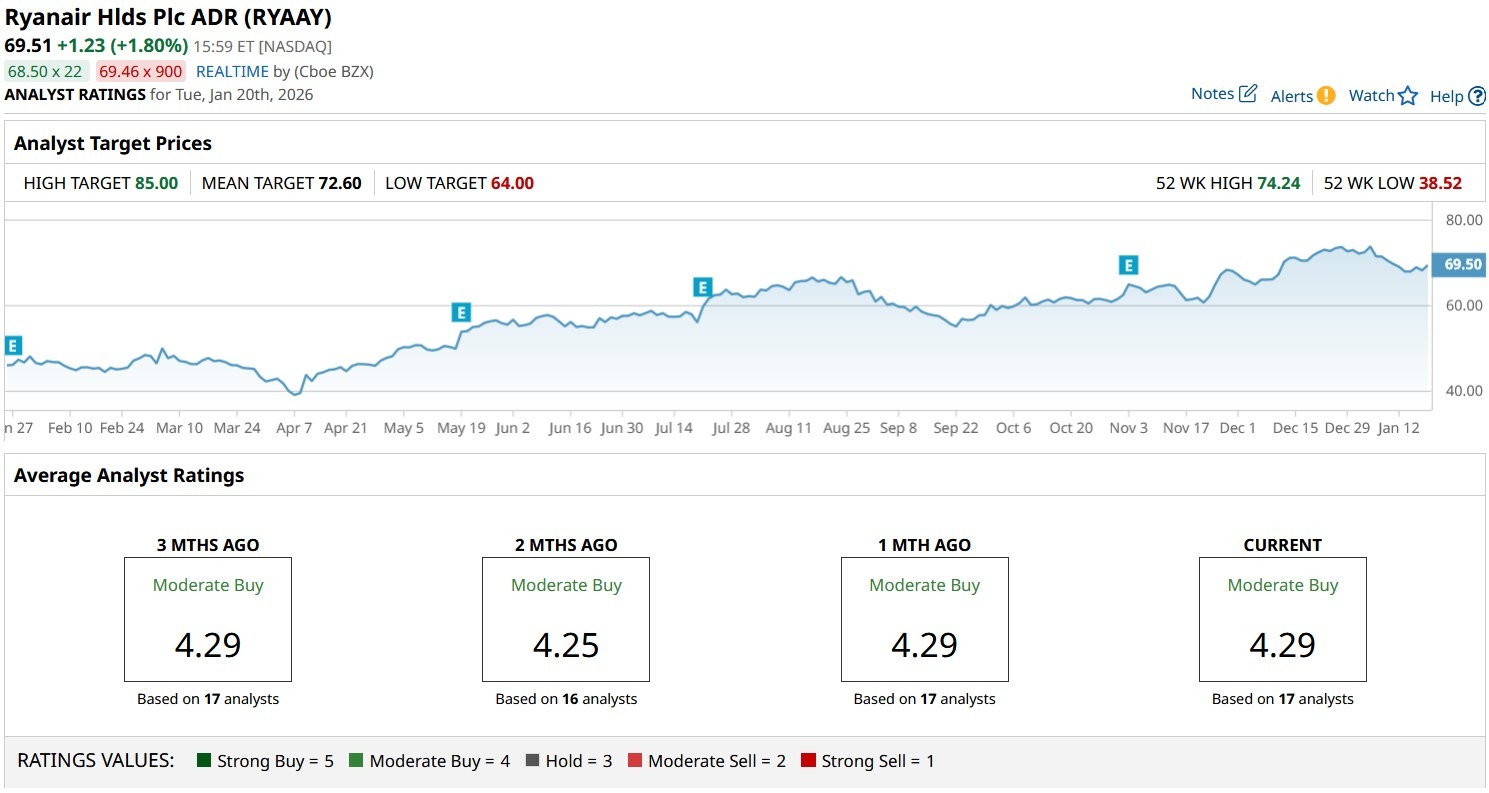

Despite expected weakness in Q3 financials, Wall Street analysts continue to recommend sticking with RYAAY stock.

The consensus rating on Ryanair sits at “Moderate Buy” with the mean target of about $73 signaling potential upside of more than 5% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy the Dip in 3M Stock Today?

- Is Ryanair Stock a Buy, Sell, or Hold as Elon Musk Proposes Buying the Discount Airline?

- This Little-Known Fertility Stock Is Up 215% in the Past 5 Days. Should You Chase the Mysterious Penny Stock Rally Here?

- Intel Stock Is Already Up 19% in 2026. Can Q4 Earnings Propel It Higher in 2026?