State Street Corporation (STT), headquartered in Boston, Massachusetts, provides a range of financial products and services to institutional investors worldwide. Valued at $35.6 billion by market cap, the company’s products and services include custody, accounting, administration, daily pricing, international exchange services, cash management, financial asset management, securities lending, and investment advisory services. The financial giant is expected to announce its fiscal fourth-quarter earnings for 2025 in the near term.

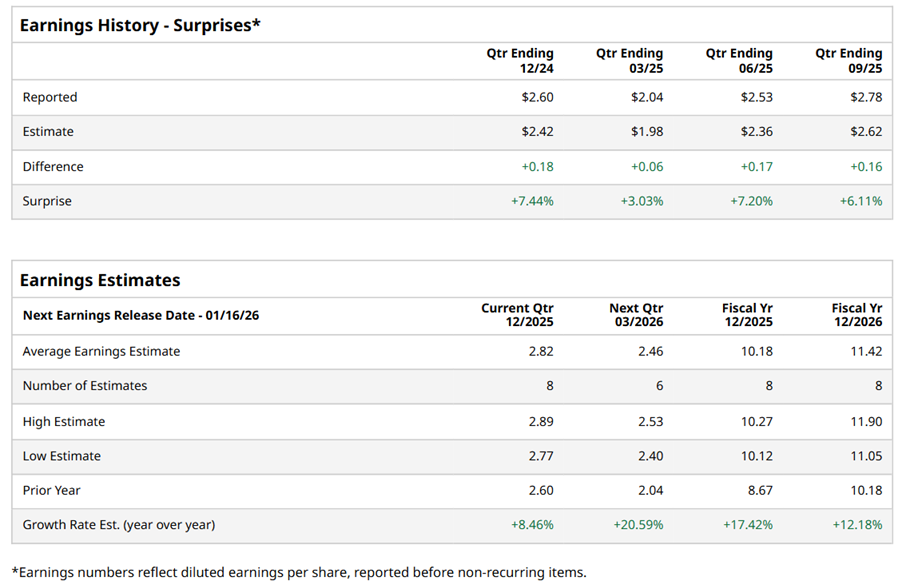

Ahead of the event, analysts expect STT to report a profit of $2.82 per share on a diluted basis, up 8.5% from $2.60 per share in the year-ago quarter. The company beat the consensus estimates in each of the last four quarters.

For the full year, analysts expect STT to report EPS of $10.18, up 17.4% from $8.67 in fiscal 2024. Its EPS is expected to rise 12.2% year over year to $11.42 in fiscal 2026.

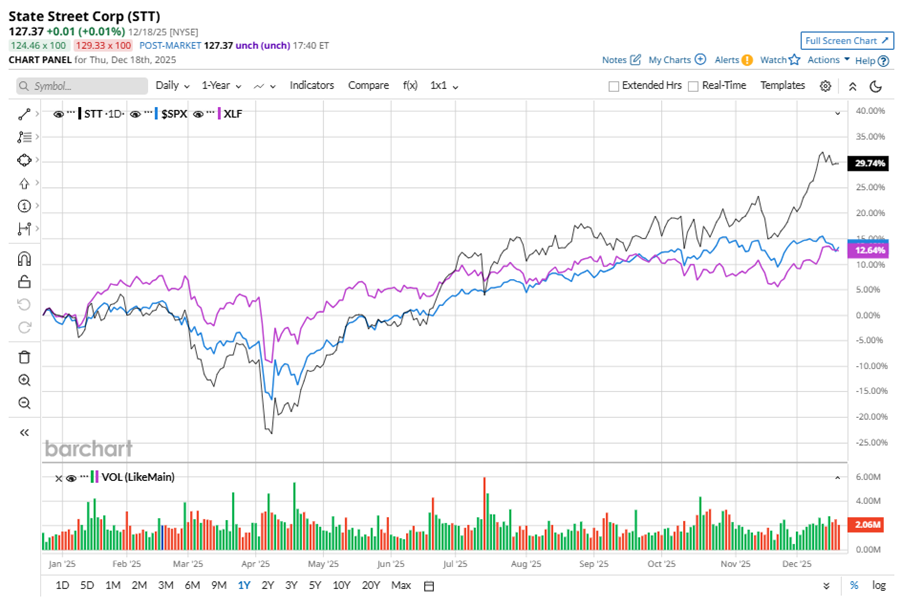

STT stock has outperformed the S&P 500 Index’s ($SPX) 15.4% gains over the past 52 weeks, with shares up 34.4% during this period. Similarly, it outperformed the Financial Select Sector SPDR Fund’s (XLF) 14.5% returns over the same time frame.

STT is outperforming due to broad-based growth in servicing and management fees, driven by new product launches, expanded client relationships, and technology investments. Its key highlights include record assets under custody and administration, strong client flows, and product innovation in digital assets and ETFs. The company's partnership with Apex Fintech Solutions and investments in AI and platform modernization are expected to drive future growth. Management is optimistic about momentum, citing disciplined execution and a constructive market environment.

On Oct. 17, STT shares closed down by 1.4% after reporting its Q3 results. Its revenue was $3.6 billion, surpassing analyst estimates by 2.3%. The company’s EPS of $2.78 beat analyst estimates by 5%.

Analysts’ consensus opinion on STT stock is moderately bullish, with a “Moderate Buy” rating overall. Out of 19 analysts covering the stock, 10 advise a “Strong Buy” rating, three suggest a “Moderate Buy,” five give a “Hold,” and one recommends a “Moderate Sell.” STT’s average analyst price target is $131.71, indicating a potential upside of 3.4% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Dividend Kings Delivering Generational Income & Market-Beating Returns

- Mizuho Says This 1 Agentic AI Company Is the Top Software Stock to Buy in 2026

- Broadcom Stock Just Raised Its Dividend by 10%. Should You Buy AVGO Stock Now?

- Weight Watchers Is Going All In on GLP-1 Drugs. Should You Buy WW Stock Here?