Washington Trust Bancorp has been treading water for the past six months, holding steady at $29.56. The stock also fell short of the S&P 500’s 11.3% gain during that period.

Is now the time to buy Washington Trust Bancorp, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think Washington Trust Bancorp Will Underperform?

We don't have much confidence in Washington Trust Bancorp. Here are three reasons you should be careful with WASH and a stock we'd rather own.

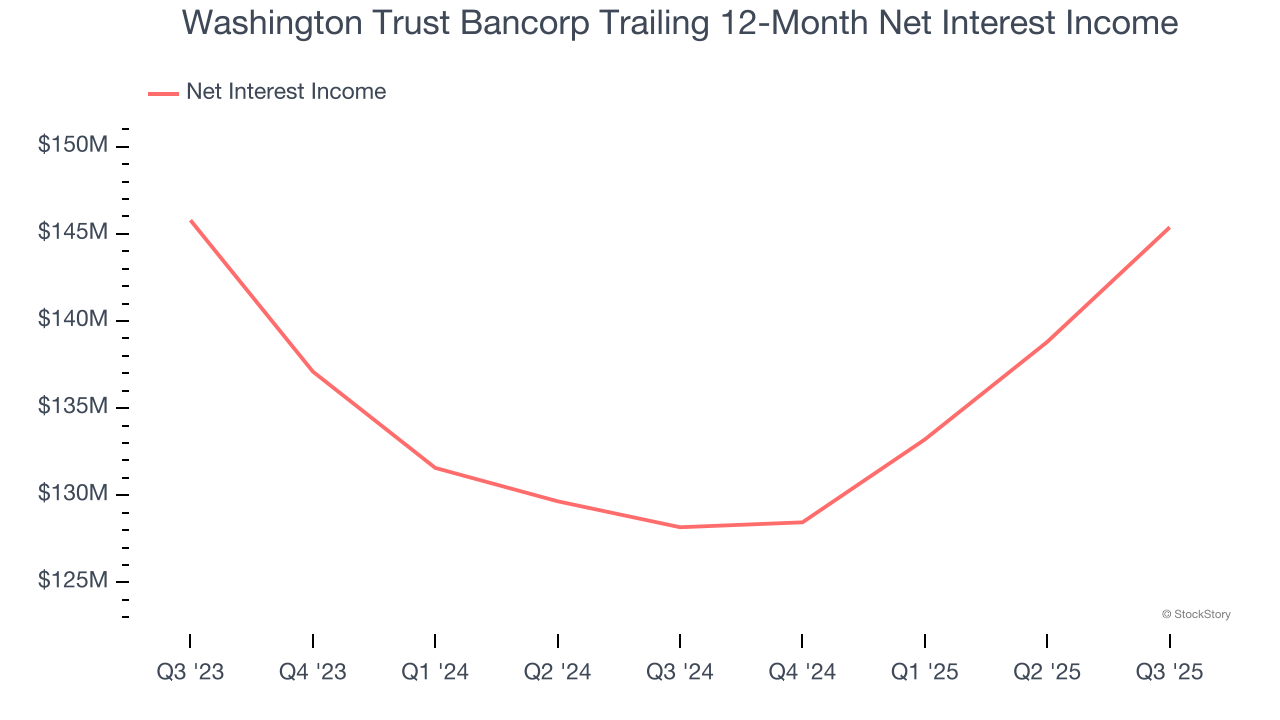

1. Net Interest Income Points to Soft Demand

Markets consistently prioritize net interest income over non-recurring fees, recognizing its superior quality compared to the more unpredictable revenue streams.

Washington Trust Bancorp’s net interest income has grown at a 2.7% annualized rate over the last five years, much worse than the broader banking industry.

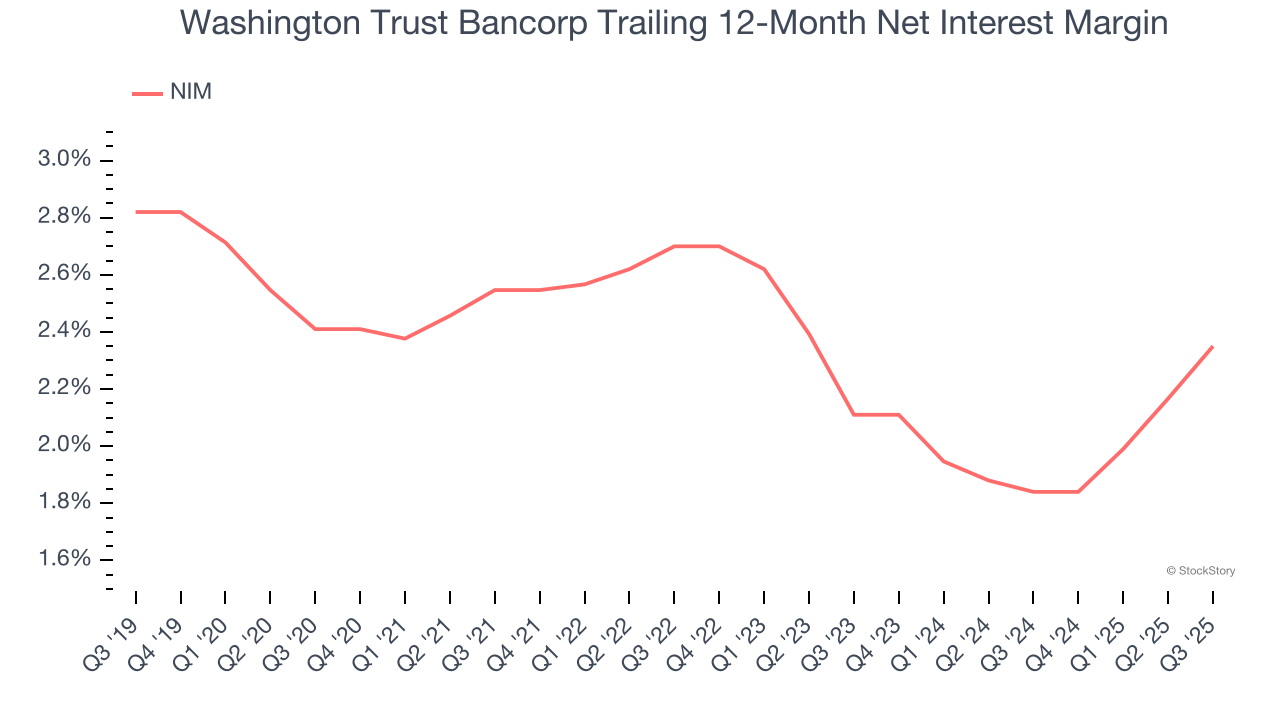

2. Low Net Interest Margin Reveals Weak Loan Book Profitability

The net interest margin (NIM) is a key profitability indicator that measures the difference between what a bank earns on its loans and what it pays on its deposits. This metric measures how efficiently one can generate income from its core lending activities.

Over the past two years, we can see that Washington Trust Bancorp’s net interest margin averaged a poor 2.1%, meaning it must compensate for lower profitability through increased loan originations.

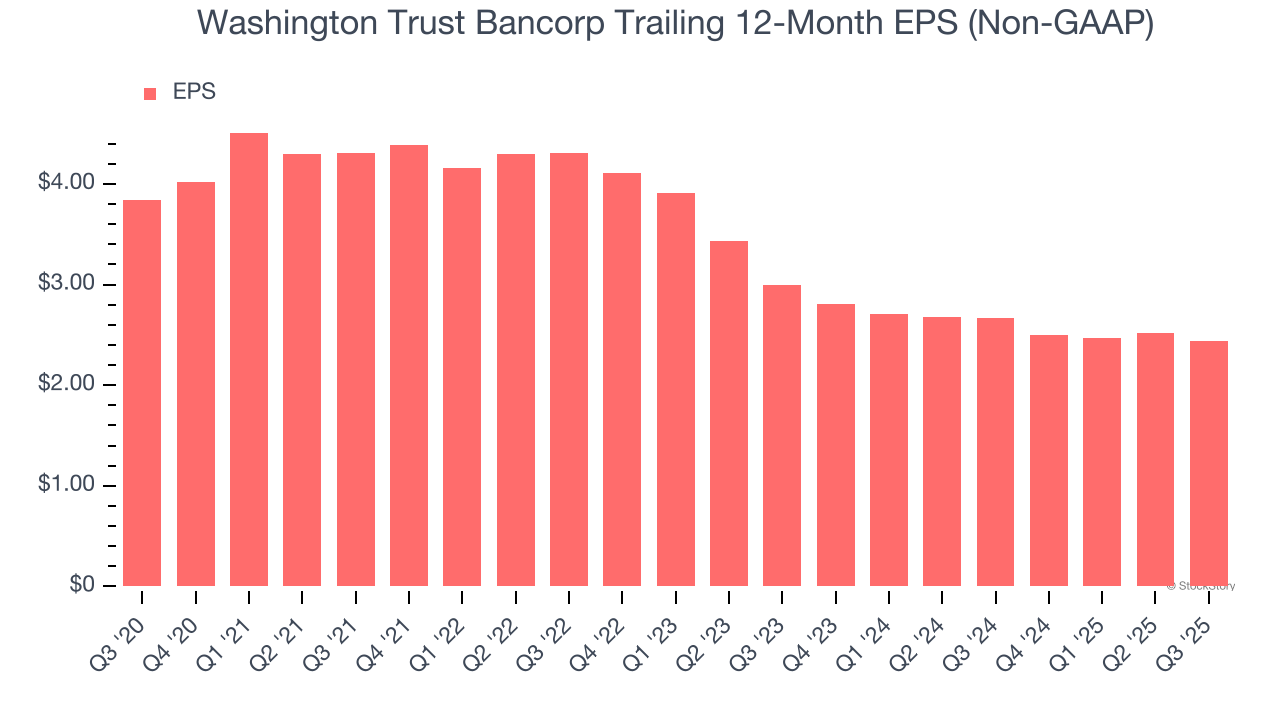

3. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Washington Trust Bancorp, its EPS declined by 8.7% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Final Judgment

We see the value of companies driving economic growth, but in the case of Washington Trust Bancorp, we’re out. With its shares trailing the market in recent months, the stock trades at 1× forward P/B (or $29.56 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find more timely opportunities elsewhere. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Washington Trust Bancorp

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.