What a time it’s been for Dillard's. In the past six months alone, the company’s stock price has increased by a massive 59.5%, reaching $700.23 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Dillard's, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Dillard's Not Exciting?

We’re happy investors have made money, but we're swiping left on Dillard's for now. Here are three reasons you should be careful with DDS and a stock we'd rather own.

1. Lack of New Stores, a Headwind for Revenue

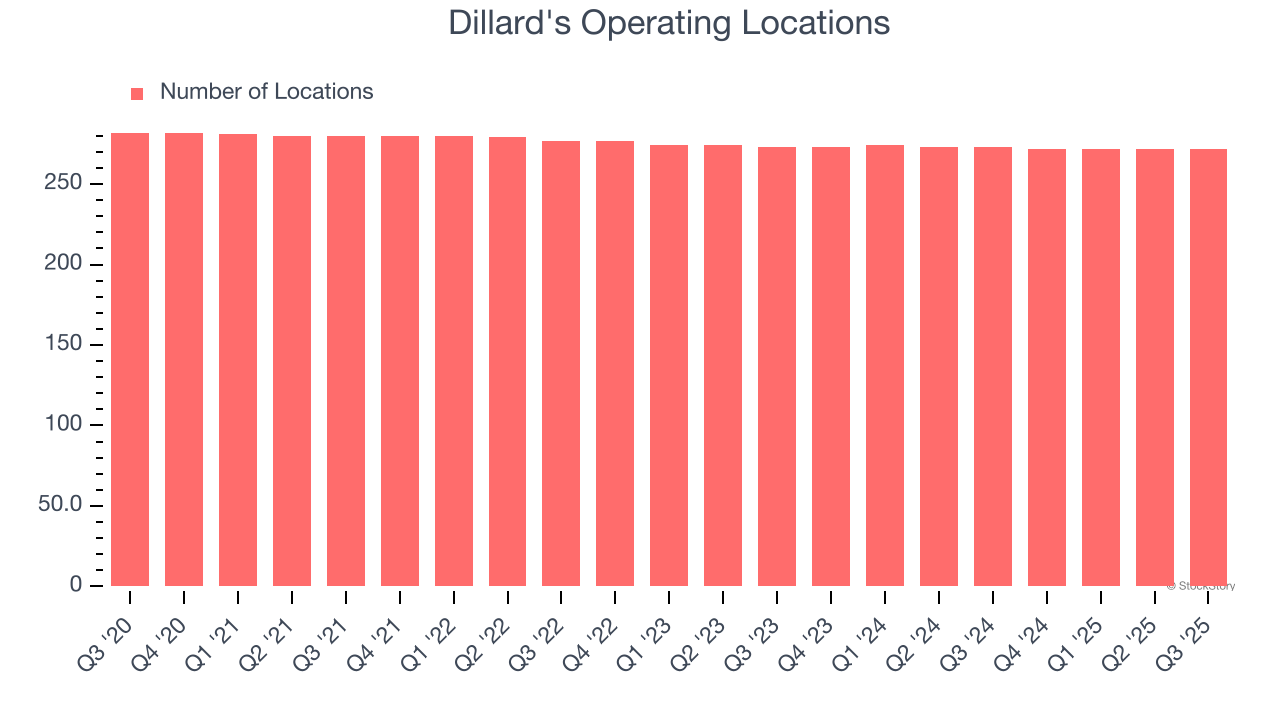

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

Dillard's operated 272 locations in the latest quarter, and over the last two years, has kept its store count flat while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

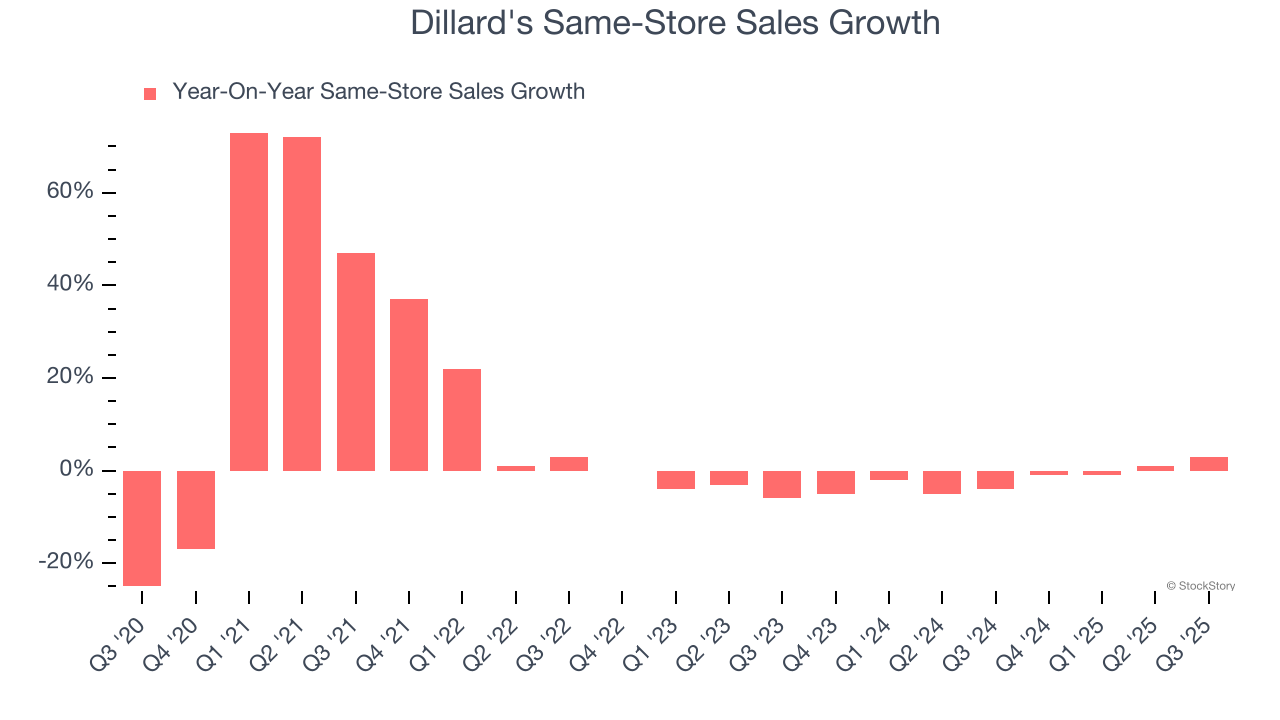

2. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales is an industry measure of whether revenue is growing at existing stores, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Dillard’s demand has been shrinking over the last two years as its same-store sales have averaged 1.8% annual declines.

3. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Dillard's, its EPS declined by 9.5% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

Dillard's isn’t a terrible business, but it isn’t one of our picks. Following the recent rally, the stock trades at 23.6× forward P/E (or $700.23 per share). At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment. We’d recommend looking at one of our top digital advertising picks.

Stocks We Would Buy Instead of Dillard's

Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.