Wrapping up Q2 earnings, we look at the numbers and key takeaways for the construction and maintenance services stocks, including APi (NYSE: APG) and its peers.

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

The 13 construction and maintenance services stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 3.5% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 8.5% on average since the latest earnings results.

APi (NYSE: APG)

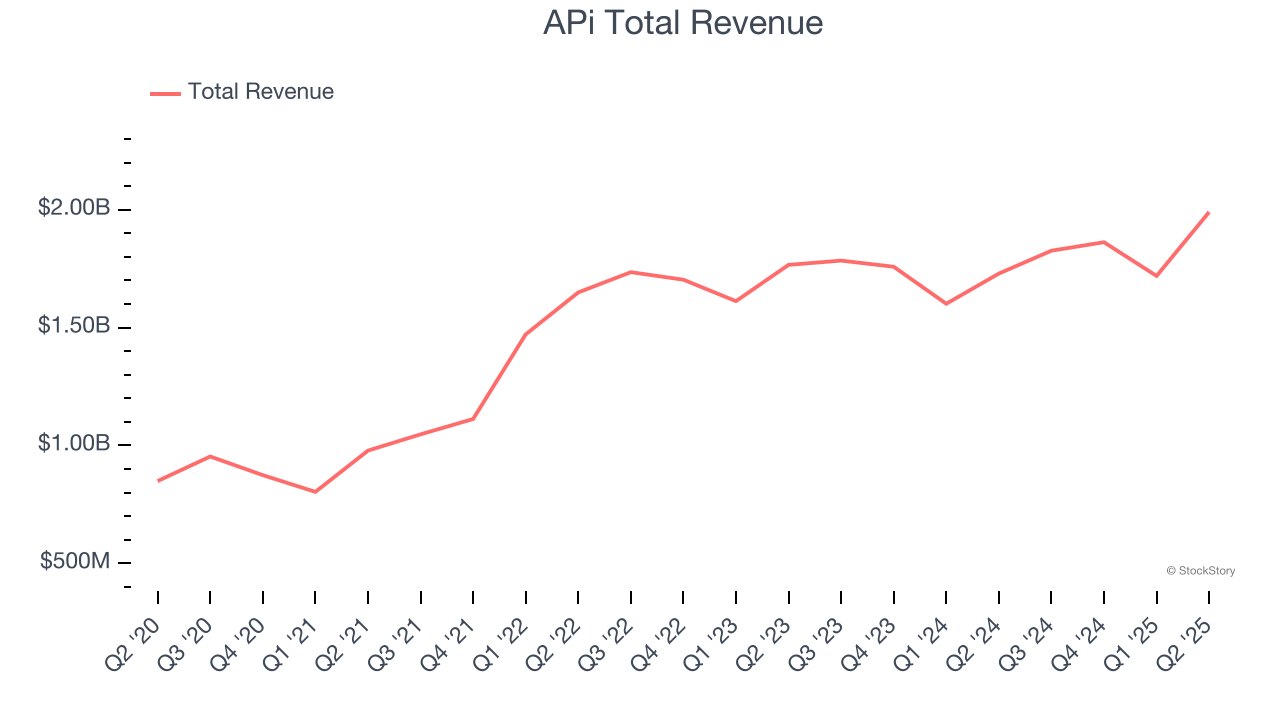

Started in 1926 as an insulation contractor, APi (NYSE: APG) provides life safety solutions and specialty services for buildings and infrastructure.

APi reported revenues of $1.99 billion, up 15.1% year on year. This print exceeded analysts’ expectations by 5.1%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ organic revenue estimates and full-year revenue guidance exceeding analysts’ expectations.

Interestingly, the stock is up 2.4% since reporting and currently trades at $35.26.

Is now the time to buy APi? Access our full analysis of the earnings results here, it’s free.

Best Q2: Primoris (NYSE: PRIM)

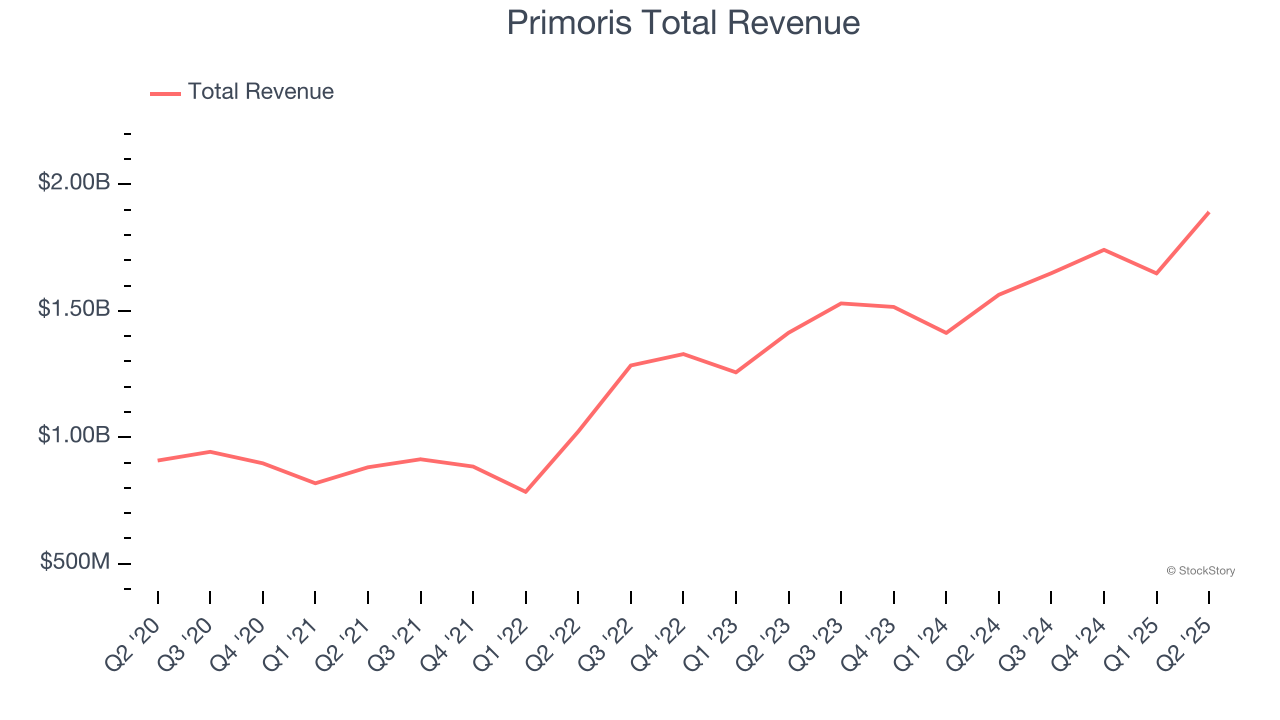

Listed on the NASDAQ in 2008, Primoris (NYSE: PRIM) builds, maintains, and upgrades infrastructure in the utility, energy, and civil construction industries.

Primoris reported revenues of $1.89 billion, up 20.9% year on year, outperforming analysts’ expectations by 12.1%. The business had an incredible quarter with a beat of analysts’ EPS and EBITDA estimates.

Primoris scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 34.5% since reporting. It currently trades at $125.30.

Is now the time to buy Primoris? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Matrix Service (NASDAQ: MTRX)

Founded in Oklahoma, Matrix Service (NASDAQ: MTRX) provides engineering, fabrication, construction, and maintenance services primarily to the energy and industrial markets.

Matrix Service reported revenues of $216.4 million, up 14.2% year on year, falling short of analysts’ expectations by 6.8%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Matrix Service delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 7% since the results and currently trades at $13.25.

Read our full analysis of Matrix Service’s results here.

Great Lakes Dredge & Dock (NASDAQ: GLDD)

Founded as Lydon & Drews dredging company, Great Lakes Dredge & Dock (NASDAQ: GLDD) provides dredging services, land reclamation, and coastal protection projects in the United States and internationally.

Great Lakes Dredge & Dock reported revenues of $193.8 million, up 13.9% year on year. This print topped analysts’ expectations by 9%. It was an incredible quarter as it also produced a beat of analysts’ EPS and EBITDA estimates.

The stock is up 17.1% since reporting and currently trades at $12.42.

Read our full, actionable report on Great Lakes Dredge & Dock here, it’s free.

Granite Construction (NYSE: GVA)

Having played a role in the construction of the Hoover Dam, Granite Construction (NYSE: GVA) is a provider of infrastructure solutions for roads, bridges, and other projects.

Granite Construction reported revenues of $1.13 billion, up 4% year on year. This result lagged analysts' expectations by 3%. Zooming out, it was actually a strong quarter as it recorded full-year revenue guidance exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

The stock is up 17.1% since reporting and currently trades at $109.37.

Read our full, actionable report on Granite Construction here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.