The past six months have been a windfall for e.l.f. Beauty’s shareholders. The company’s stock price has jumped 86.7%, hitting $138.26 per share. This performance may have investors wondering how to approach the situation.

Is now still a good time to buy ELF? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Is ELF a Good Business?

Short for "eyes, lips, face", e.l.f. Beauty (NYSE: ELF) is a developer of high-quality beauty products at accessible price points.

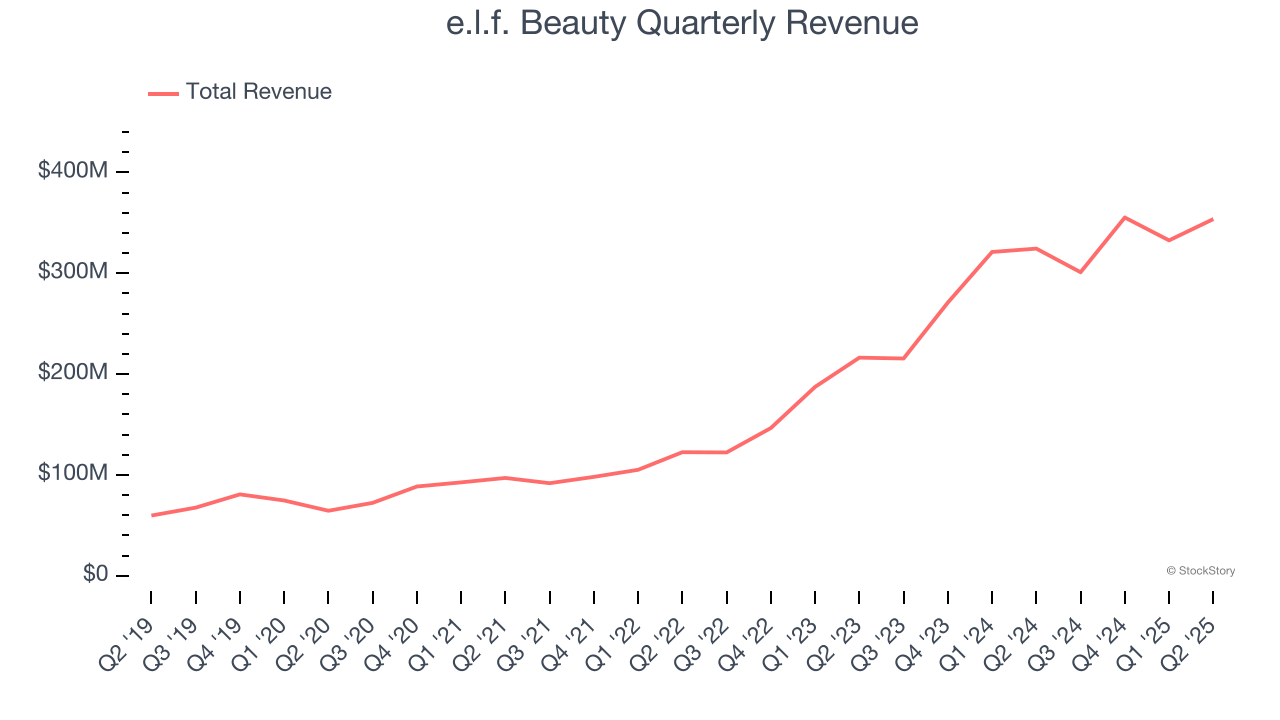

1. Skyrocketing Revenue Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, e.l.f. Beauty’s 47.6% annualized revenue growth over the last three years was incredible. Its growth surpassed the average consumer staples company and shows its offerings resonate with customers.

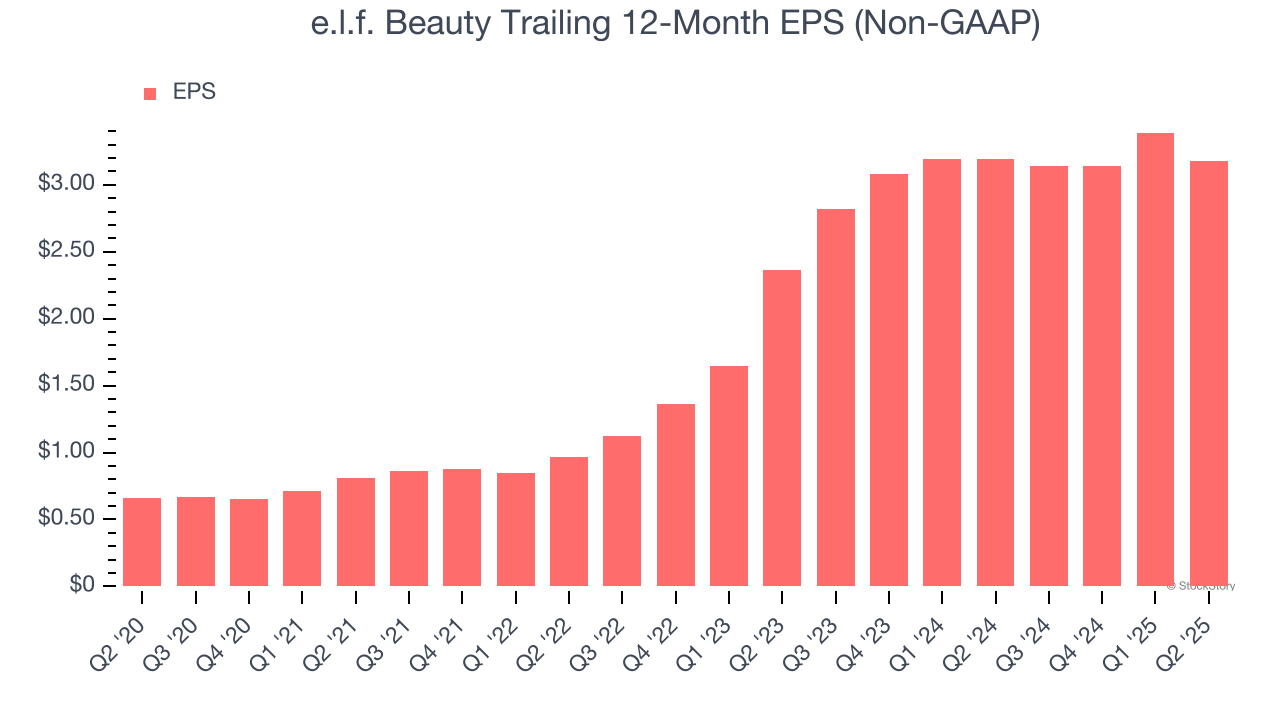

2. Outstanding Long-Term EPS Growth

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

e.l.f. Beauty’s astounding 48.6% annual EPS growth over the last three years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

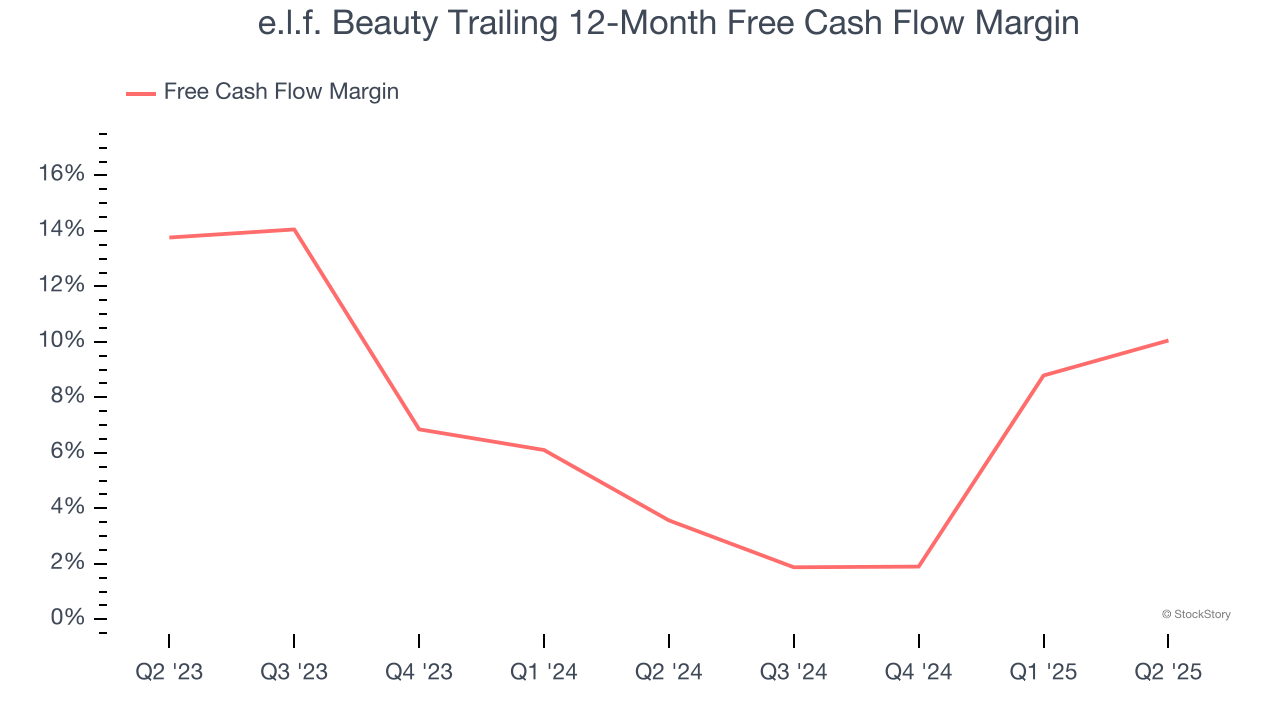

3. Increasing Free Cash Flow Margin Juices Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, e.l.f. Beauty’s margin expanded by 6.5 percentage points over the last year. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat. e.l.f. Beauty’s free cash flow margin for the trailing 12 months was 10.1%.

Final Judgment

These are just a few reasons why e.l.f. Beauty ranks highly on our list, and after the recent rally, the stock trades at 35.6× forward P/E (or $138.26 per share). Is now a good time to buy despite the apparent froth? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.