Biopharma manufacturing company Repligen Corporation (NASDAQ: RGEN) reported Q2 CY2025 results beating Wall Street’s revenue expectations, with sales up 14.8% year on year to $182.4 million. The company’s full-year revenue guidance of $725 million at the midpoint came in 2.1% above analysts’ estimates. Its non-GAAP profit of $0.37 per share was 5% below analysts’ consensus estimates.

Is now the time to buy Repligen? Find out by accessing our full research report, it’s free.

Repligen (RGEN) Q2 CY2025 Highlights:

- Revenue: $182.4 million vs analyst estimates of $175.1 million (14.8% year-on-year growth, 4.1% beat)

- Adjusted EPS: $0.37 vs analyst expectations of $0.39 (5% miss)

- Adjusted EBITDA: $32.18 million vs analyst estimates of $31.38 million (17.6% margin, 2.5% beat)

- The company lifted its revenue guidance for the full year to $725 million at the midpoint from $707.5 million, a 2.5% increase

- Management slightly raised its full-year Adjusted EPS guidance to $1.69 at the midpoint

- Operating Margin: 7.6%, up from 3.4% in the same quarter last year

- Organic Revenue rose 17% year on year (-2% in the same quarter last year)

- Market Capitalization: $6.72 billion

Olivier Loeillot, President and Chief Executive Officer of Repligen said, “We had another outstanding quarter in Q2 with 17% organic non-COVID growth. We are very pleased with the momentum we see across the portfolio. This included strength in both consumables and capital equipment, while biopharma demand continues to perform very well. Orders grew over 20%, which represented the eighth quarter in a row of orders exceeding non-COVID revenue and the fifth quarter of sequential order growth. We believe this is a testament to our differentiated strategy, which resulted in 15% organic non-COVID growth in the first half of 2025."

Company Overview

With over 13 strategic acquisitions since 2012 to build its comprehensive bioprocessing portfolio, Repligen (NASDAQ: RGEN) develops and manufactures specialized technologies that improve the efficiency and flexibility of biological drug manufacturing processes.

Revenue Growth

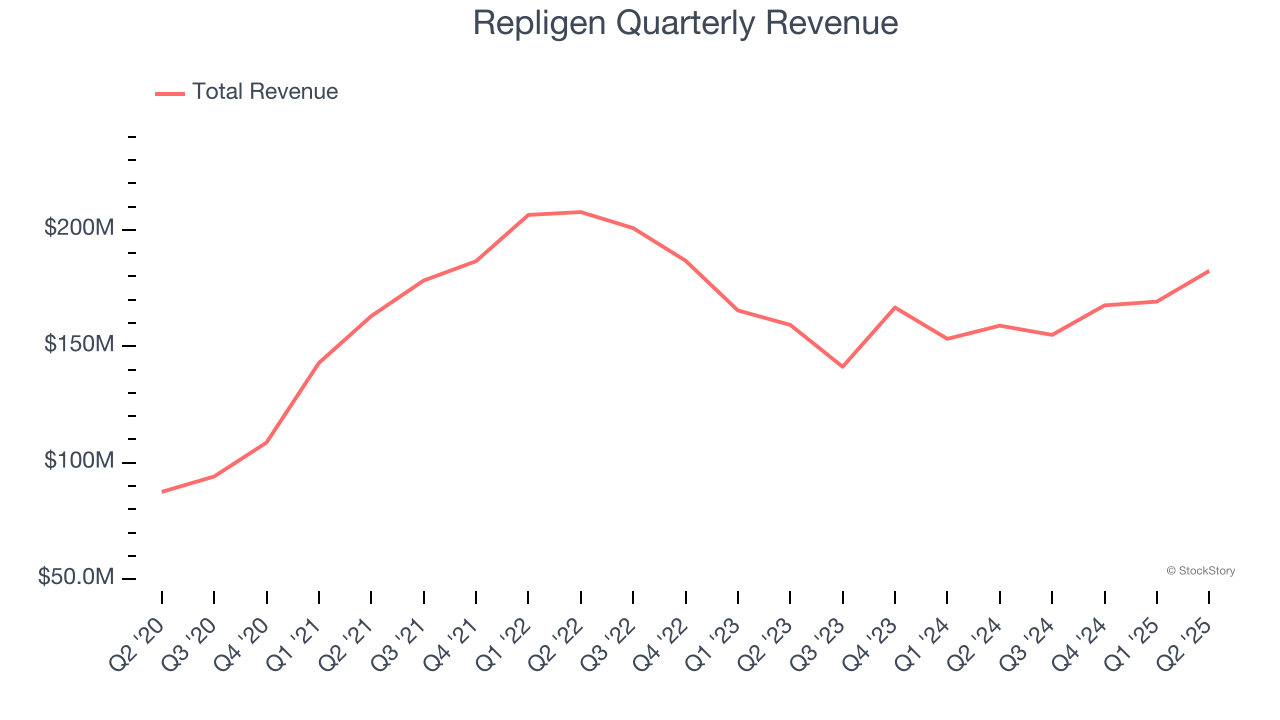

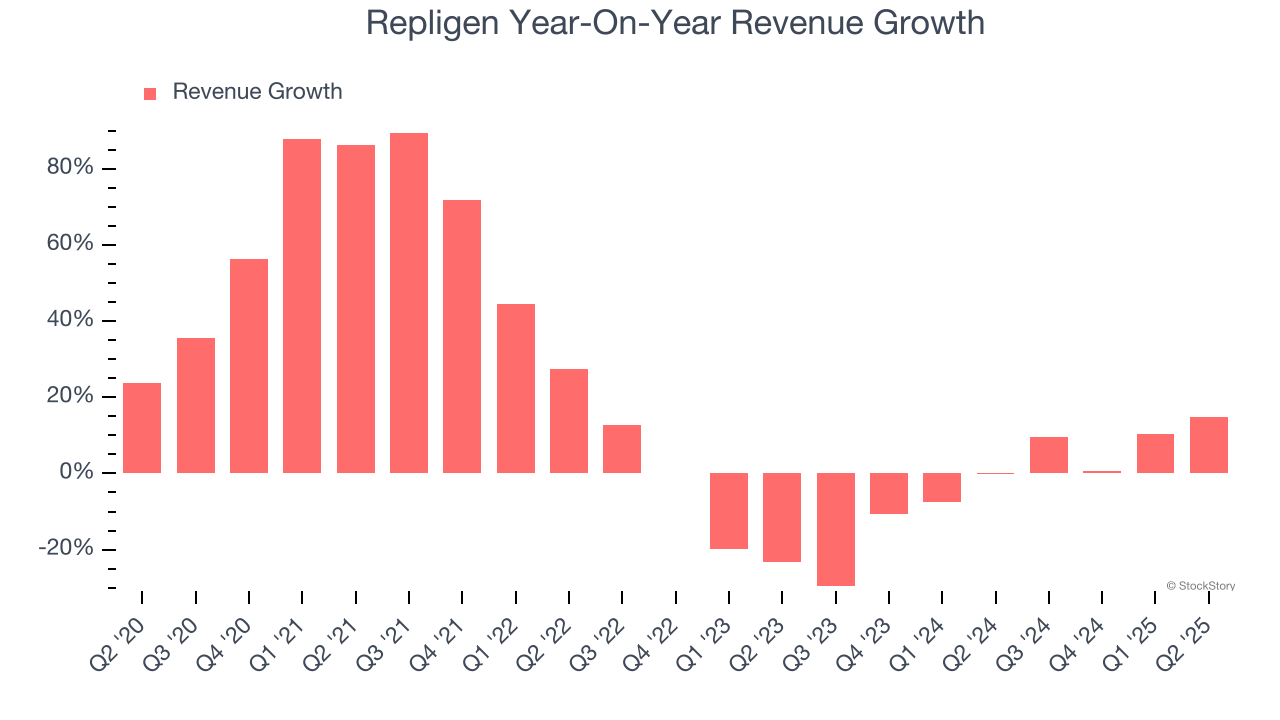

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Repligen’s 17.4% annualized revenue growth over the last five years was impressive. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Repligen’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 2.7% over the last two years.

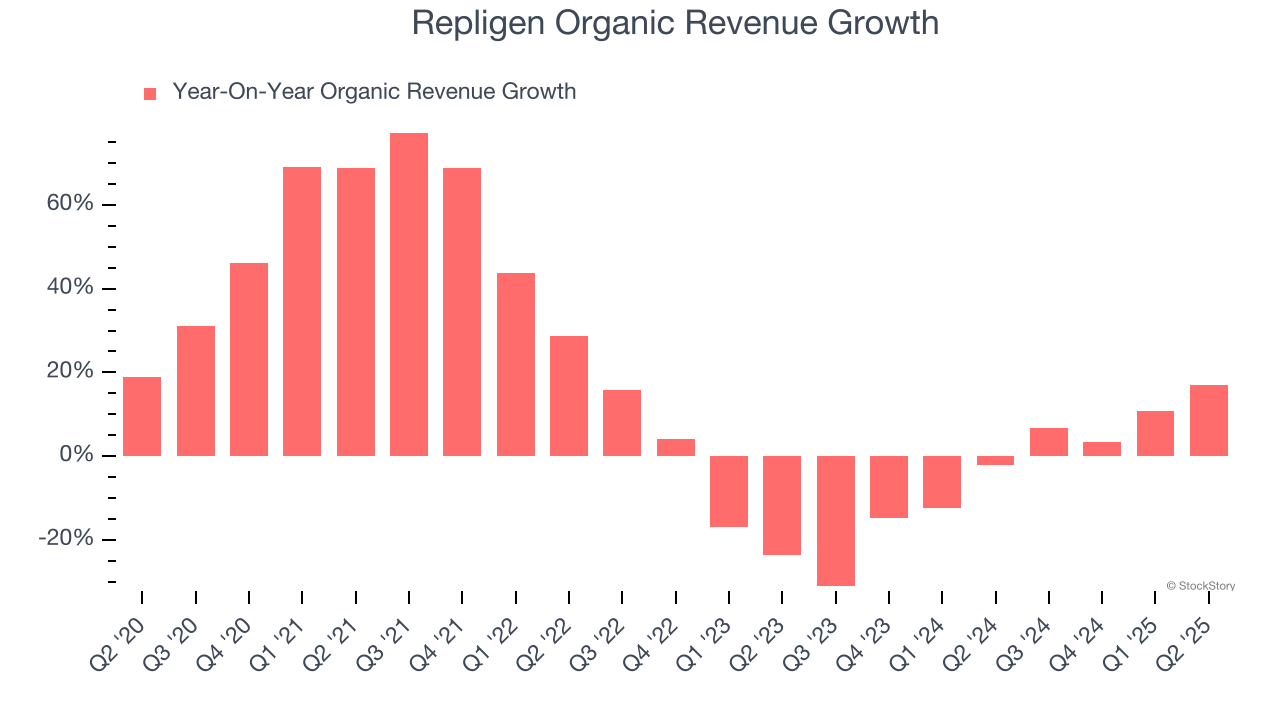

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Repligen’s organic revenue averaged 2.8% year-on-year declines. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Repligen reported year-on-year revenue growth of 14.8%, and its $182.4 million of revenue exceeded Wall Street’s estimates by 4.1%.

Looking ahead, sell-side analysts expect revenue to grow 13% over the next 12 months, an improvement versus the last two years. This projection is admirable and indicates its newer products and services will fuel better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Adjusted Operating Margin

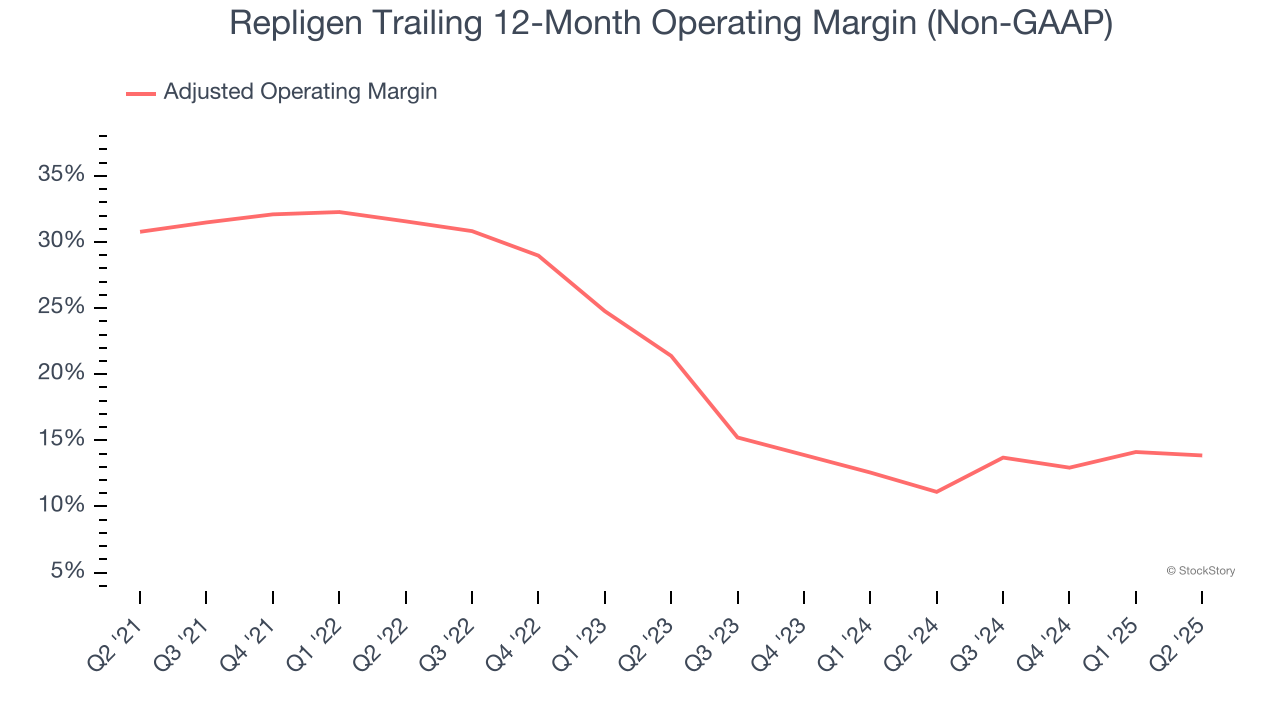

Repligen has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average adjusted operating margin of 21.8%.

Analyzing the trend in its profitability, Repligen’s adjusted operating margin decreased by 16.9 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 7.5 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Repligen generated an adjusted operating margin profit margin of 12%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

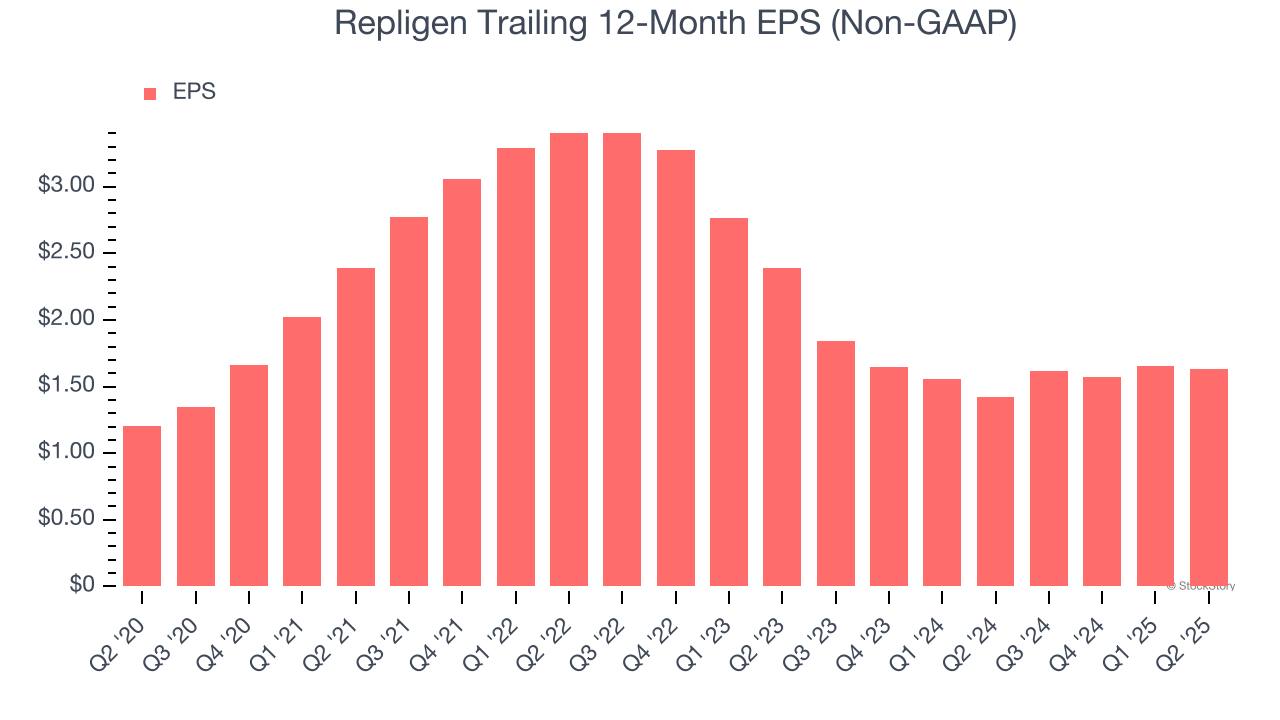

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Repligen’s EPS grew at a decent 6.3% compounded annual growth rate over the last five years. However, this performance was lower than its 17.4% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

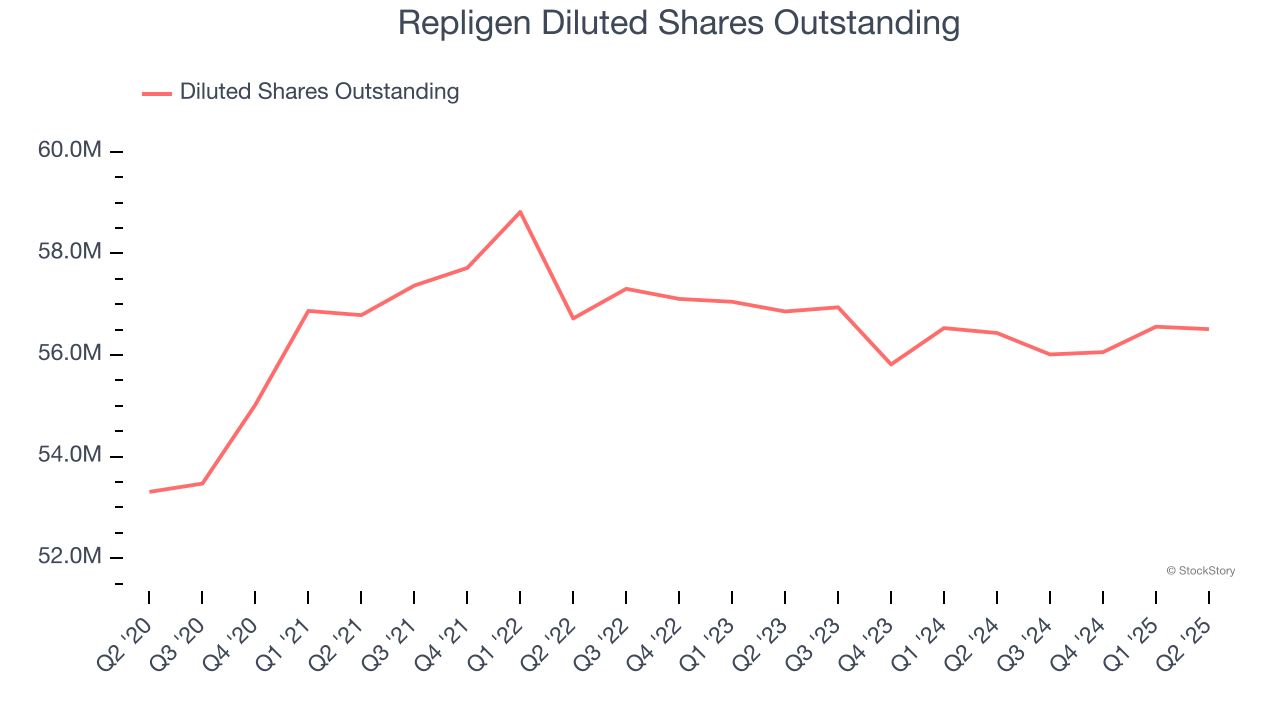

Diving into the nuances of Repligen’s earnings can give us a better understanding of its performance. As we mentioned earlier, Repligen’s adjusted operating margin was flat this quarter but declined by 16.9 percentage points over the last five years. Its share count also grew by 6%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q2, Repligen reported EPS at $0.37, down from $0.40 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Repligen’s full-year EPS of $1.63 to grow 16.5%.

Key Takeaways from Repligen’s Q2 Results

We were impressed by how significantly Repligen blew past analysts’ organic revenue expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its EPS missed. Looking ahead, the company slightly raised full-year revenue and EPS guidance. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 3.8% to $124.17 immediately after reporting.

Sure, Repligen had a solid quarter, but if we look at the bigger picture, is this stock a buy? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.