Over the past six months, GoodRx’s shares (currently trading at $4.10) have posted a disappointing 16.7% loss while the S&P 500 was flat. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy GoodRx, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think GoodRx Will Underperform?

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than GDRX and a stock we'd rather own.

1. Lackluster Revenue Growth

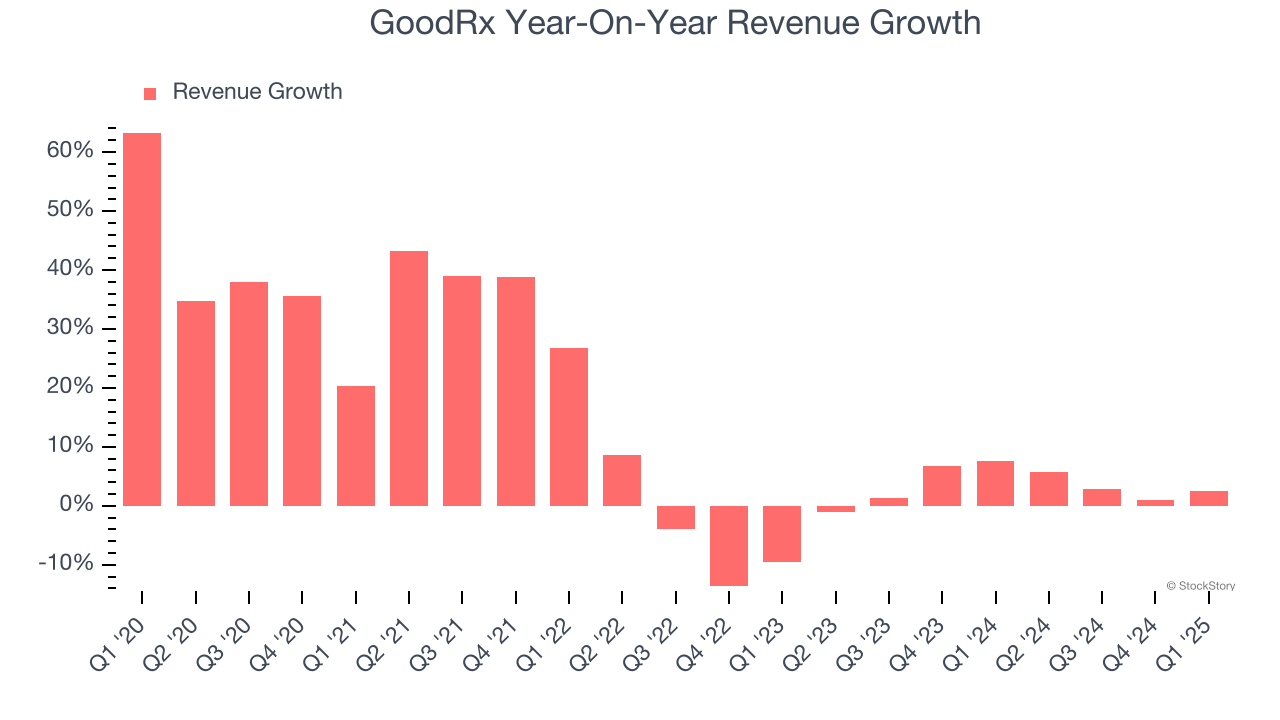

Long-term growth is the most important, but within healthcare, a stretched historical view may miss new innovations or demand cycles. GoodRx’s recent performance shows its demand has slowed as its annualized revenue growth of 3.3% over the last two years was below its five-year trend.

2. Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $797.4 million in revenue over the past 12 months, GoodRx is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

3. Previous Growth Initiatives Have Lost Money

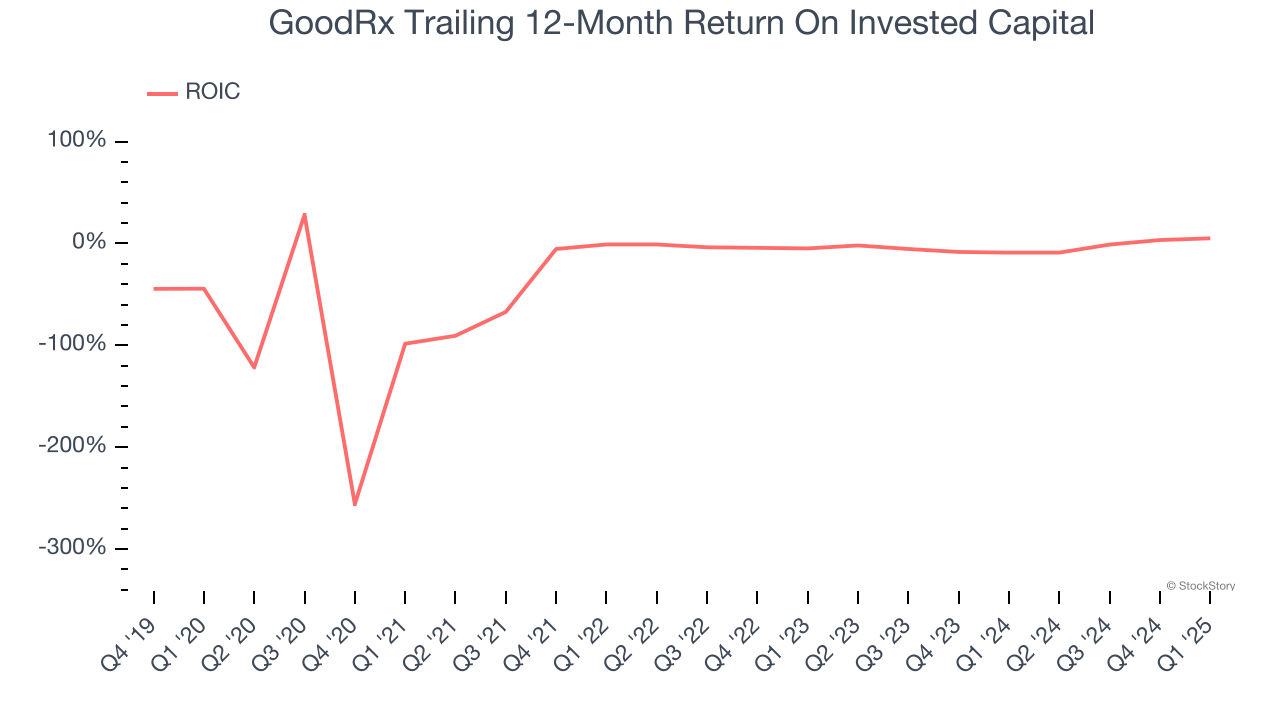

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

GoodRx’s five-year average ROIC was negative 21.6%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

Final Judgment

We see the value of companies helping consumers, but in the case of GoodRx, we’re out. Following the recent decline, the stock trades at 9.7× forward P/E (or $4.10 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment. Let us point you toward the Amazon and PayPal of Latin America.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.