Sushi restaurant chain Kura Sushi (NASDAQ: KRUS) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 20.4% year on year to $79.45 million. On the other hand, the company’s full-year revenue guidance of $332 million at the midpoint came in 1.9% below analysts’ estimates. Its non-GAAP profit of $0.20 per share was 63.4% above analysts’ consensus estimates.

Is now the time to buy Kura Sushi? Find out by accessing our full research report, it’s free for active Edge members.

Kura Sushi (KRUS) Q3 CY2025 Highlights:

- Revenue: $79.45 million vs analyst estimates of $78.95 million (20.4% year-on-year growth, 0.6% beat)

- Adjusted EPS: $0.20 vs analyst estimates of $0.12 (63.4% beat)

- Adjusted EBITDA: $7.41 million vs analyst estimates of $7.36 million (9.3% margin, 0.6% beat)

- Operating Margin: 1.8%, up from -8.8% in the same quarter last year

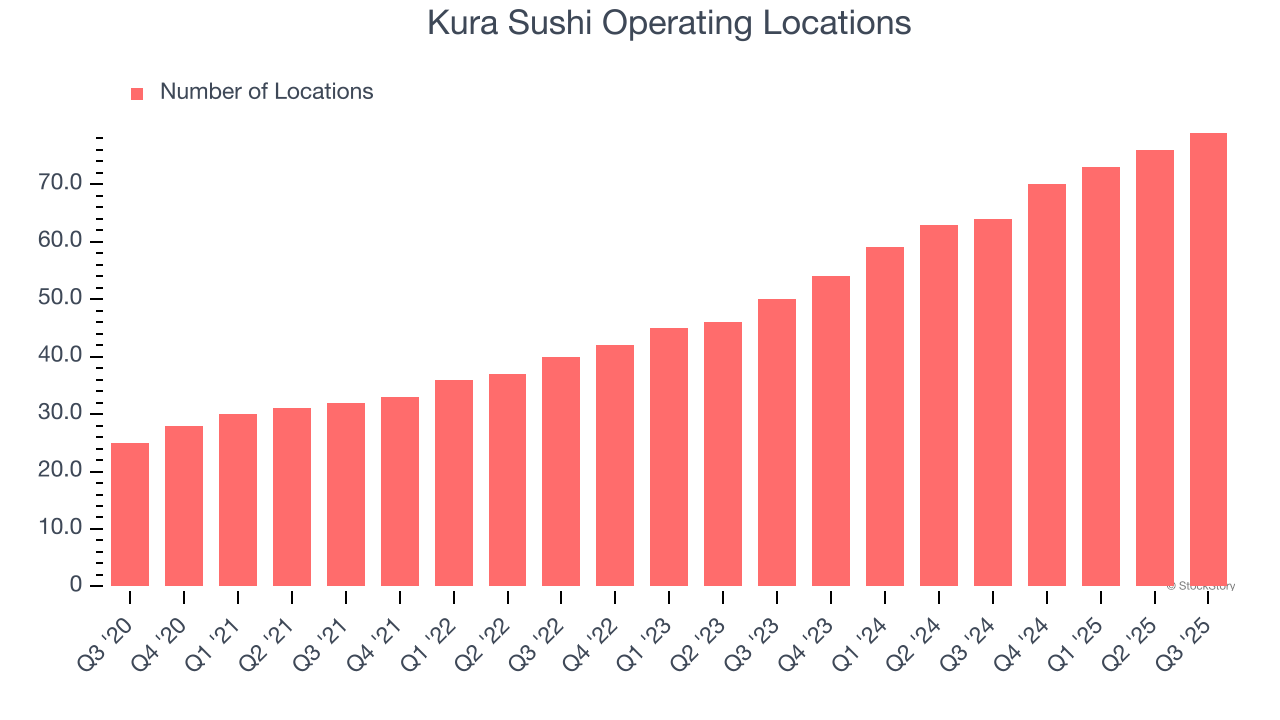

- Locations: 79 at quarter end, up from 64 in the same quarter last year

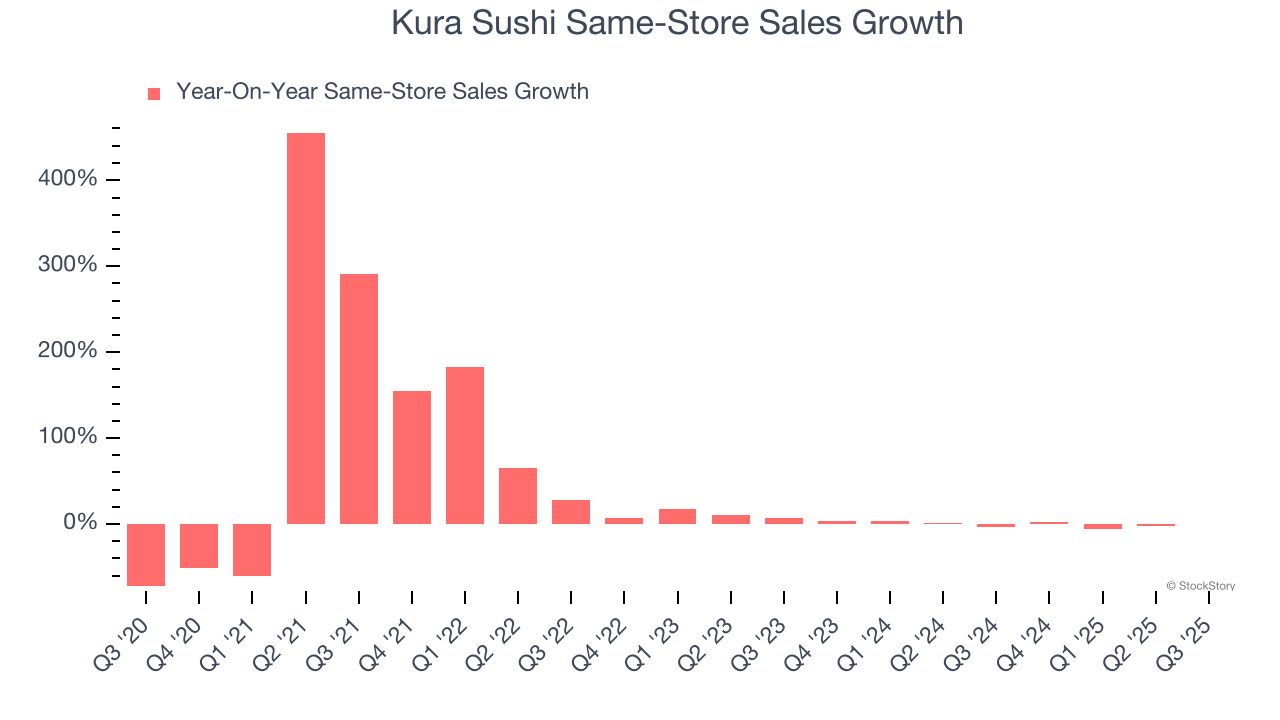

- Same-Store Sales were flat year on year (-3.1% in the same quarter last year)

- Market Capitalization: $711.5 million

Hajime Uba, President and Chief Executive Officer of Kura Sushi, stated, “I’m incredibly proud of what our team achieved during fiscal 2025 as we delivered a strong class of restaurant openings, adding a record of 15 new locations. We also successfully managed our corporate G&A expenses, resulting in an annual adjusted EBITDA growth of over 30%. These accomplishments are particularly noteworthy given the volatile consumer environment and tariff pressures we navigated throughout the year, which have negatively impacted our top-line results and restaurant-level margins. Nevertheless, our team remains resilient and we continue to believe that our focus on execution has positioned us well for continued growth in fiscal 2026.”

Company Overview

Known for its conveyor belt that transports dishes to diners, Kura Sushi (NASDAQ: KRUS) is a chain of sushi restaurants serving traditional Japanese fare with a touch of modernity and technology.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $282.8 million in revenue over the past 12 months, Kura Sushi is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can grow faster because it has more white space to build new restaurants.

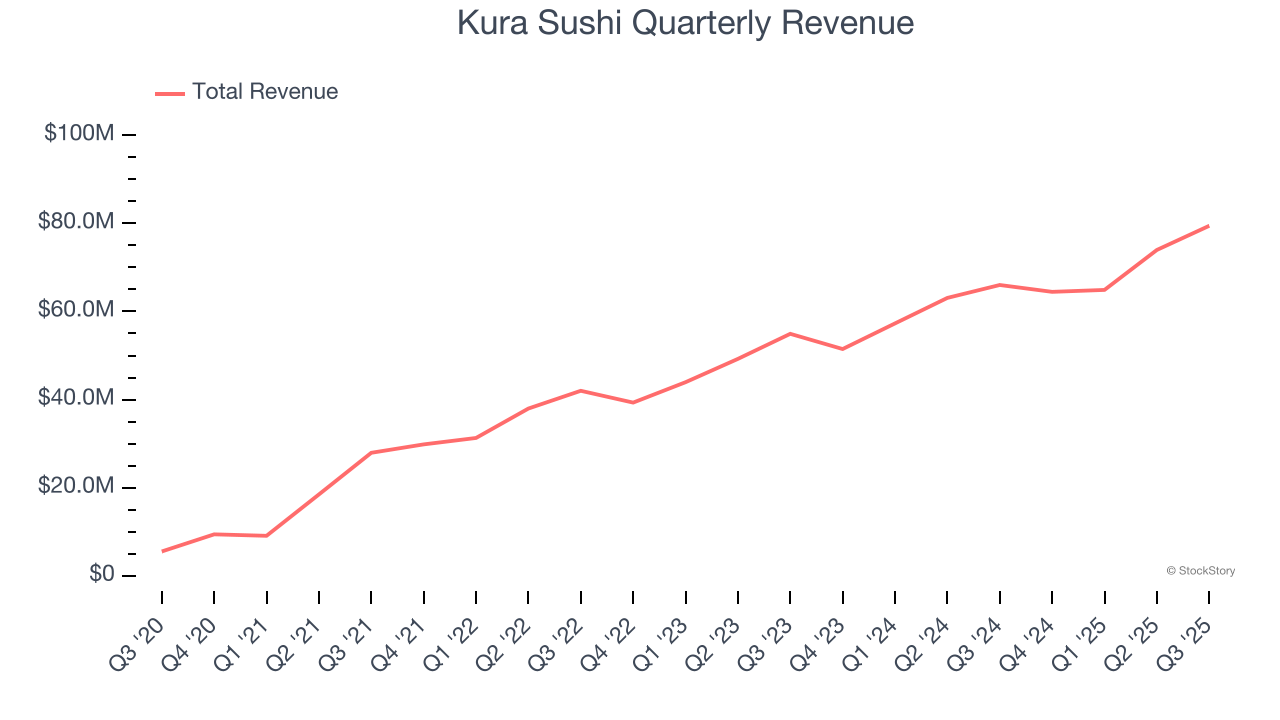

As you can see below, Kura Sushi grew its sales at an incredible 28% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new restaurants and expanded its reach.

This quarter, Kura Sushi reported robust year-on-year revenue growth of 20.4%, and its $79.45 million of revenue topped Wall Street estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 19.1% over the next 12 months, a deceleration versus the last six years. Despite the slowdown, this projection is noteworthy and indicates the market is baking in success for its menu offerings.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Restaurant Performance

Number of Restaurants

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Kura Sushi operated 79 locations in the latest quarter. It has opened new restaurants at a rapid clip over the last two years, averaging 27.8% annual growth, much faster than the broader restaurant sector. This gives it a chance to scale into a mid-sized business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing restaurants and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Kura Sushi’s demand within its existing dining locations has barely increased over the last two years as its same-store sales were flat. Kura Sushi should consider improving its foot traffic and efficiency before expanding its restaurant base.

In the latest quarter, Kura Sushi’s year on year same-store sales were flat. This performance was more or less in line with its historical levels.

Key Takeaways from Kura Sushi’s Q3 Results

It was good to see Kura Sushi beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed and its same-store sales fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $54.73 immediately after reporting.

Big picture, is Kura Sushi a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.