Urban Outfitters’s 26.9% return over the past six months has outpaced the S&P 500 by 16.9%, and its stock price has climbed to $54.96 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Urban Outfitters, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.We’re happy investors have made money, but we don't have much confidence in Urban Outfitters. Here are three reasons why URBN doesn't excite us and a stock we'd rather own.

Why Is Urban Outfitters Not Exciting?

Founded as a purveyor of vintage items, Urban Outfitters (NASDAQ: URBN) now largely sells new apparel and accessories to teens and young adults seeking on-trend fashion.

1. Long-Term Revenue Growth Disappoints

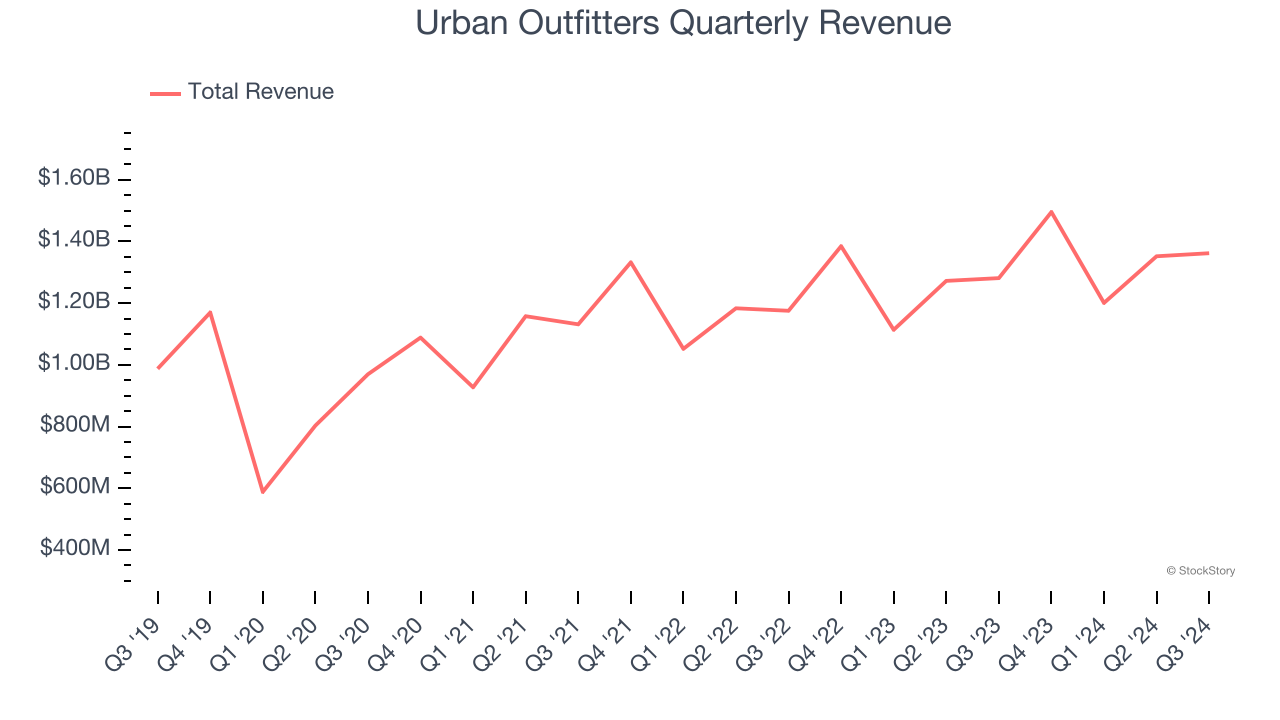

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last five years, Urban Outfitters grew its sales at a tepid 6.5% compounded annual growth rate. This was below our standard for the consumer retail sector.

2. Low Gross Margin Hinders Flexibility

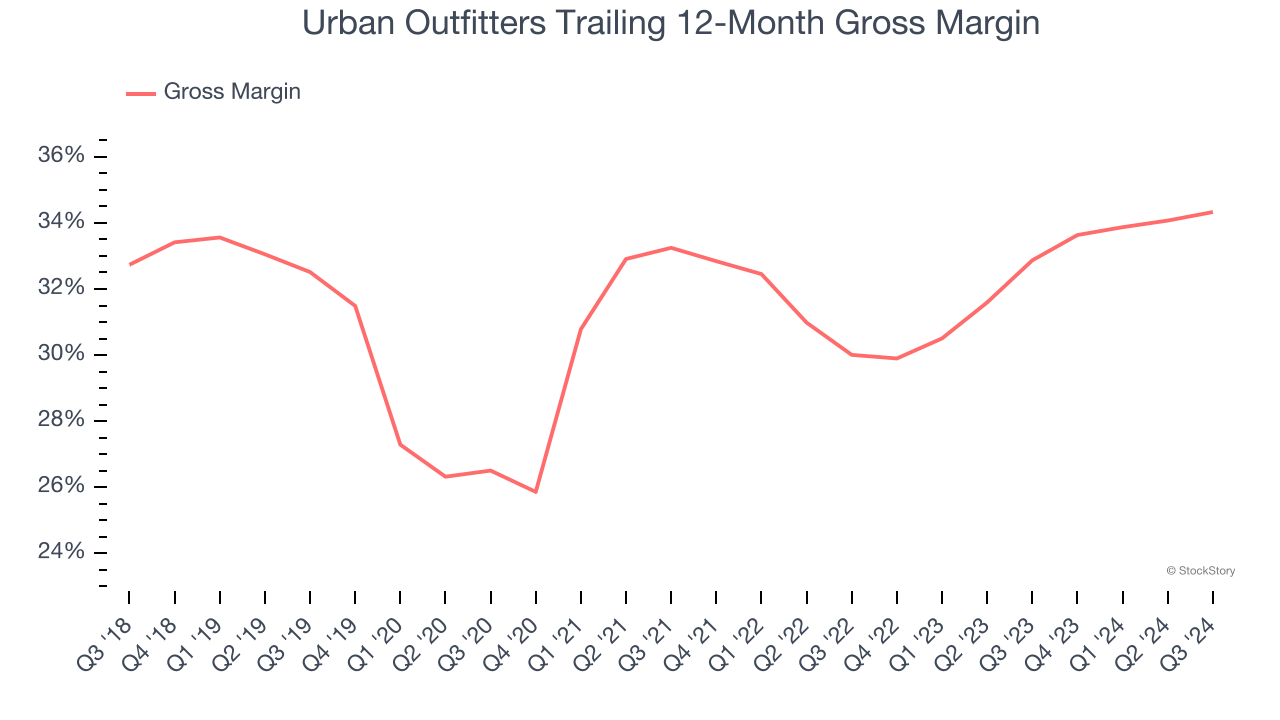

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

Urban Outfitters’s gross margin is slightly below the average retailer, giving it less room to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged a 33.6% gross margin over the last two years. That means Urban Outfitters paid its suppliers a lot of money ($66.37 for every $100 in revenue) to run its business.

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Urban Outfitters historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.4%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

Final Judgment

Urban Outfitters isn’t a terrible business, but it doesn’t pass our bar. With its shares topping the market in recent months, the stock trades at 14.1× forward price-to-earnings (or $54.96 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere. We’d recommend looking at FTAI Aviation, an aerospace company benefiting from Boeing and Airbus’s struggles.

Stocks We Like More Than Urban Outfitters

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.