Stifel, Commonwealth Rank Highest in Satisfaction in Respective Segments

U.S. wealth management firms have an advisor engagement problem. With markets struggling, compliance and administrative responsibilities growing and the advisor population aging, many advisors are planning their own exit strategies. According to the J.D. Power 2023 U.S. Financial Advisor Satisfaction Study,SM released today, nearly one-third (28%) of financial advisors say they do not have enough time to spend with clients and 20% say they are five years or less away from retirement.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230705301734/en/

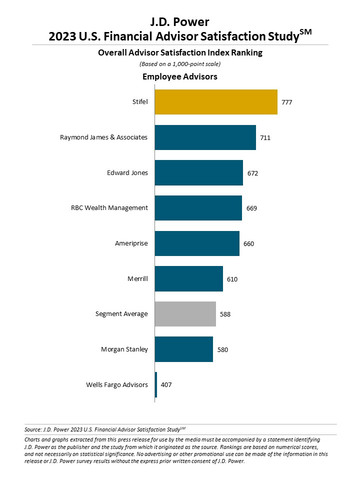

J.D. Power 2023 U.S. Financial Advisor Satisfaction Study (Graphic: Business Wire)

“In difficult market conditions like the ones we’ve been experiencing for the past several years, great investment advisors set themselves apart by proactively addressing their clients’ needs, delivering comprehensive guidance and communicating clearly and frequently about the issues that matter most to their clients,” said Craig Martin, executive managing director and head of wealth and lending intelligence at J.D. Power. “Right now, many advisors are struggling to find the time to deliver the level of hands-on service they know is critical to growing their business. They’re spending more time on administrative and compliance-oriented tasks and, in many cases, they are starting to question whether their firm is committed to providing them with the support and resources they need to succeed.”

Following are some key findings of the 2023 study:

- Not enough time to spend with clients: Nearly one-third (28%) of advisors say they do not have enough time to spend with clients. Advisors falling into this category spend an average of 41% more time each month than their peers on non-value-added tasks, such as compliance and administrative duties. Net Promoter Scores® (NPS)1, a measure of advisor advocacy, among those who say they do not have enough time to spend with clients are 27 points lower (on a -100 to 100 scale) among employee advisors and 30 points lower among independent advisors when compared with advisors who say they do have enough time to spend with clients.

- One eye on the exit: With the average age of U.S. financial advisors being 56 years old, 20% of advisors indicate that they are five years or less away from retirement. In addition, 30% of employee advisors and 28% of independent advisors say they “probably will” be working for their current firm in the next one to two years as opposed to saying they “definitely will.” This suggests that even if advisors are not contemplating leaving the industry or their firm, many may become apathetic about their situation. Among these two groups, overall satisfaction and NPS scores are significantly lower than among advisors who say they are strongly committed to their firms, meaning they could be perceived as hampering efforts to attract and retain talent.

- Female advisors lean in: Among employee advisors, overall satisfaction and NPS scores are significantly higher among female advisors than among their male counterparts. The overall satisfaction score among female employee advisors is 637 (on a 1,000-point scale) and the average NPS is 59. These compare with an average overall satisfaction score of 578 and an average NPS of 36 for male employee advisors. Among independent advisors there is not a material difference in overall satisfaction and NPS scores between genders.

- Strong leadership, support and professional development matter: Among employee advisors who are most likely to stay with their firm for the long term, the top reasons given for staying are a strong culture and company leadership. Other key factors influencing advisor retention and advocacy include professional development support and training and technology.

Study Rankings

Among employee advisors, Stifel ranks highest in overall satisfaction with a score of 777. Raymond James & Associates (711) ranks second and Edward Jones (672) ranks third.

Among independent advisors, Commonwealth ranks highest in overall satisfaction with a score of 798. Raymond James Financial Services (697) ranks second, while Ameriprise (664) and Cambridge (664) rank third in a tie.

The U.S. Financial Advisor Satisfaction Study was redesigned for 2023. It measures satisfaction among both employee advisors (those who are employed by an investment services firm) and independent advisors (those who are affiliated with a broker-dealer but operate independently) based on six key factors (in alphabetical order): compensation; firm leadership and culture; operational support; products and marketing; professional development; and technology.

The study is based on responses from 4,183 employee and independent financial advisors and was fielded from December 2022 through April 2023.

For more information about the U.S. Financial Advisor Satisfaction Study, visit https://www.jdpower.com/business/resource/us-financial-advisor-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2023067.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 Net Promoter System®, Net Promoter Score®, NPS®, and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230705301734/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com