Reports construction pipeline in excess of $800 million

Completed vertical integration to support margin expansion through in-house production of modular units

Current and planned manufacturing facilities expected to support up to $150 million in annualized revenue

Projecting positive cash flow within SG Echo in 2023

Anticipates Q2 spin-out of Safe and Green Development Corporation and listing on NASDAQ

Company to host conference call today, March 29th, at 4:30 PM Eastern Time (details below)

Safe & Green Holdings Corp. (NASDAQ: SGBX) (“Safe & Green Holdings” or the “Company”), a leading developer, designer, and fabricator of modular structures, reported results for the three months and full year periods ended December 31, 2022.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230329005414/en/

(Graphic: Business Wire)

Recent Highlights:

- Announced agreement with The Peoples Health Care to deliver four fully mobile medical modules, consisting of one testing module, one CLIA lab facility module and two primary care modules, to provide innovative point-of-care medicine and diagnostic testing to Teamsters 848; initiating a partnership with The People’s Health Care to offer primary care, imaging, clinical lab, and pharmacy services to 10,000 Teamsters 848 members and their families

- Commenced auction process for Lago Vista property, which was acquired for approximately $3.5 million; expected to generate significantly higher value upon its sale

- Received a third-party fairness opinion of Safe and Green Development Corporation (SG DevCo) at an estimated fair market value of approximately $74.3 million

- Announced agreement to acquire roughly 25 acres in Denison, Texas for development of approximately 500 multi-family housing units in the Dallas greater metropolitan area

- Received an as-built appraisal for the Waldron renovation of $5.2 million, which is anticipated to open in late Q2 2023; the Company believes the newly appraised value provides access to additional low-cost debt funding

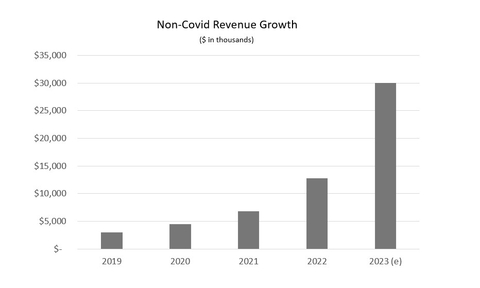

“2022 was a transformative year for the Company resulting in a nearly five-fold increase in construction services revenue for the fourth quarter of 2022 compared to the same period last year,” stated Paul Galvin, Safe & Green’s Chairman and Chief Executive Officer. “In 2017, the Company’s primary focus was on designing, fabricating, and delivering cutting-edge and sustainable structures made from highly-engineered cargo shipping containers. In response to the COVID-pandemic, we successfully pivoted our business model to supply modular labs. This was the right decision at the time, contributing significant revenue and validating our business model. With the pandemic now waning, we have returned to our roots and have successfully evolved into a vertically integrated developer and manufacturer of modular structures. Moreover, we are focused on four key verticals, including a nimble medical sector, each of which we believe will drive long-term revenue growth and profitability.”

“Importantly, we have barely scratched the surface of this multi-billion-dollar industry, as illustrated by our growing sales pipeline, which is now in excess of $800 million,” Galvin continued. “In addition to our proprietary technologies and processes, we believe the vertical integration of our business, through in-house manufacturing, filling our factories with our own work, provides us with a distinct competitive advantage in terms of pricing and speed-to-market, and is expected to drive significant margin expansion.”

“We are making progress within each of our four key verticals. First, within our manufacturing segment, SG Echo, we are witnessing strong demand across a wide range of customers, as well as our own internal development projects. Through the acquisition and subsequent investment into our Durant, Oklahoma manufacturing headquarters, along with our planned Waldron manufacturing facility, expected to open in Q2 2023, as well as our planned St. Marys manufacturing facility, we expect to have capacity to support over $150 million in annualized revenue. In order to leverage this capacity, we entered into an inter-company agreement to manufacture 800 residential units for our real estate development segment, Safe and Green Development Corporation (SG DevCo), related to the Magnolia Gardens residential project. This one project alone is expected to generate $130 million in additional manufacturing revenue. Additionally, since April 2022, we received a series of purchase orders totaling approximately $11.5 million from a leading provider of infrastructure solutions, adding to our growing backlog. Given the fixed-cost nature of this business, we expect to achieve gross margins in excess of 15% and generate significant operating profits as we increase the throughput and utilization of the facilities. In fact, we expect our manufacturing segment to generate positive cash flow in 2023, which we believe would be an important inflection point within a relatively short timeframe.”

“Within our medical segment, Safe & Green Medical, we are building a long-term and sustainable business model based on the growing demand for local, point-of-care medical services, especially within underserved communities. As the COVID-19 pandemic wanes, we intend to create a national footprint of various clinics and labs, designed to fit local needs. The point-of-care diagnostics market alone is projected to grow from $36 billion in 2022 to over $51 billion by 2029. We believe we can generate $5.0 million in annual gross revenue from each distinct medical site, not including the value of assets and data collection. As evidence of our early success, we recently announced that The Peoples Health Care, working in conjunction with Teamsters Local 848, have agreed to initially deploy four of our medical modules in order to offer their employees a variety of localized and comprehensive healthcare, lab and pharmacy services. The current plan includes repurposing the former lab at LAX Airport for an initial Teamsters unit. Agreements such as these illustrate our unique position within the market, through our ability to provide state-of-the-art, nimble medical centers that support an array of services from wellness exams to diagnostic lab testing. With over 1.2 million Teamsters members across the U.S., as well as their families and retirees, we look forward to expanding on this relationship, as well as announcing similar partnerships in the near future.”

“We are also making rapid progress within SG DevCo, which we expect to soon become its own independent, publicly traded company given the success and growth to date. At our Waldron site, which is currently under lease by SG Echo, we expect to complete the purchase of this facility by SG DevCo in April 2023. At our Cumberland and St. Marys sites alone, SG DevCo plans to build and own over 3,500 units. We recently obtained a certificate of occupancy for the Monticello project, located in the Catskills region, and look forward to commencing phase two of the project. In total, SG DevCo has a project pipeline in excess of 4,000 units to be developed. Aside from the intrinsic asset value creation, this initiative should contribute significant cash flow to our SG Echo manufacturing operations. In addition, we are making progress with the planned sale of the Lago Vista site, which we anticipate will close in the second quarter of 2023 and would further strengthen our balance sheet. This site was acquired for approximately $3.5 million, which we expect to sell for significantly more than the purchase price. We are also pleased to report progress on the planned spin-out and independent listing of SG DevCo, which we believe will unlock significant value for existing shareholders. Existing shareholders are expected to receive 30% of the spin-out, while Safe and Green Holdings will retain the balance of the ownership. As a result, we do not currently anticipate a need for near-term equity financing. Based on an independent third-party appraisal, the current asset value of SG DevCo is estimated at approximately $74 million, which is approximately 7 times the current market cap of Safe and Green Holdings alone. The planned spin out of SG DevCo does not include the Company’s Denison property, which will remain within Safe & Green Holdings. The current plan is to design and create an active senior living community with roughly 500 units and various amenities. The total development is expected to be approximately $115 million with projected profits of approximately $40 million over 5 years. Of the $115 million in development costs, approximately $80 million will feed directly to SG Echo for manufacturing, with an anticipated $15 million in margin to our manufacturing campus.”

“Lastly, we continue to advance activities within our environmental segment. Earlier this year we entered into a 10-year exclusive distribution agreement with Sanitec Industries LLC, to deploy the Sanitec Microwave Healthcare Waste Disinfection System™ in the State of New York using our mobile and modular units for the onsite destruction of biomedical waste. We are excited about this technology and the new vertical we are entering, as it addresses a significantly underserved market, where we believe we can provide a low-cost, compliant and distributed solution for major healthcare systems that will reduce transportation and landfill costs in an environmentally friendly and sustainable manner. We are in the process of building a national sales and service footprint for Sanitec. In addition, this segment is a perfect add on at our manufacturing locations, and will service all of the Safe & Green Medical sites as well.”

Mr. Galvin concluded, “Overall, we are more excited than ever about the outlook for the business. We believe we have built a highly scalable and profitable business model. Heading into 2023 we have substantially reduced our SG&A as a percentage of revenue. As a result, we expect to generate positive cash flow within our manufacturing segment. We believe we are in the right place, at the right time, with an exemplary management team that has the track records to execute on our vision.”

Financial Results for the Three Months Ended December 31, 2022

Revenue for the fourth quarter of 2022 was $4.1 million, compared to $8.5 million for the fourth quarter of 2021, reflecting the discontinuation of COVID-19 testing facilities, offset by increased construction services revenue. The construction services segment generated $4.2 million in revenue, a 476% increase, compared to the same period last year.

Total gross profit for the fourth quarter of 2022 was $0.3 million compared to $0.2 million in the fourth quarter of 2021, reflecting the decline in medical revenue, offset by increased revenue and improved gross margin within the construction services segment.

Operating expenses for the fourth quarter of 2022 were $4.0 million, compared to $2.4 million for the 2021 fourth quarter. This increase was primarily attributable to increased payroll-related expenses, as well as increased general and administrative expenses, that the Company incurred to support its anticipated growth. Operating expenses for the fourth quarter of 2022 included approximately $1.1 million of non-cash expenses, including $145 thousand of depreciation and amortization, as well as $924 thousand of stock-based compensation expense. This compares to approximately $1.0 million of non-cash expenses, including $156 thousand of depreciation and amortization, as well as $869 thousand of stock-based compensation expense for the same period last year. The fourth quarter of 2022 also included approximately $2.4 million of expenses allocated to SG DevCo that were not incurred for the same period last year. The Company expects its operating expense as a percentage of revenue will significantly decline in future quarters.

The net loss attributable to common shareholders was approximately $3.3 million, or $(0.24) per share in the fourth quarter of 2022, compared to a net loss of $3.4 million, or $(0.32) per share, in the fourth quarter of 2021.

Financial Results for the Twelve Months Ended December 31, 2022

Total revenue for the twelve months ended December 31, 2022, was $24.4 million, compared to $38.3 million for the twelve months ended December 31, 2021, reflecting a decrease in medical revenue due to the discontinuation of COVID-19 testing facilities, offset by a 94.8% increase in construction services revenue.

Gross profit for 2022 was $3.3 million compared to $2.3 million for 2021, reflecting the decline in medical revenue, offset by increased revenue and improved gross margin within the construction services segment.

Operating expenses for 2022 were $10.6 million, compared to $8.3 million for 2021, due to increased payroll-related expenses, as well as increased general and administrative expenses, which reflects the Company’s investments to support its anticipated growth. Operating expenses for 2022 included approximately $3.4 million of non-cash expenses, including $615 thousand of depreciation and amortization, as well as $2.8 million of stock-based compensation expense. This compares to approximately $2.3 million of non-cash expenses, including $605 thousand of depreciation and amortization, as well as $1.6 million of stock-based compensation expense for the same period last year. The Company expects its operating expense as a percentage of revenue will significantly decline in future quarters.

The net loss attributable to common shareholders was approximately $7.9 million, or $(0.59) per share in 2022, compared to a net loss of $10.8 million, or $(1.16) per share for 2021.

The Company’s Adjusted EBITDA for the year ended December 31, 2022 was approximately ($4.0) million as compared to approximately ($8.0) million for 2021. Both EBITDA and Adjusted EBITDA are not measures of performance calculated in accordance with Accounting Principles Generally Accepted in the United States of America (“GAAP”), and should not be considered in isolation of, or as a substitute for, earnings as an indicator of operating performance or cash flows from operating activities as a measure of liquidity. The Company believes the presentation of EBITDA and Adjusted EBITDA is relevant and useful by enhancing the readers’ ability to understand the Company’s operating performance. The Company’s management utilizes EBITDA and Adjusted EBITDA as a means to measure performance. The Company’s measurements of EBITDA and Adjusted EBITDA may not be comparable to similar titled measures reported by other companies. The table below reconciles EBITDA and Adjusted EBITDA, both non-GAAP measures, to GAAP numbers for net loss attributable to common stockholders of Safe & Green Holdings Corp.

| Three Months Ended | Year Ended | |||||||||||||||

| 12/31/2022 | 12/31/2021 | 12/31/2022 | 12/31/2021 | |||||||||||||

| Net loss attributable to common stockholders of Safe & Green Holdings Corp. | $ |

(3,732,928 |

) |

$ |

(3,426,633 |

) |

$ |

(8,319,048 |

) |

$ |

(10,832,674 |

) |

||||

| Addback interest expense |

|

161,506 |

|

|

269 |

|

|

336,239 |

|

|

1,254 |

|

||||

| Addback interest income |

|

(40,303 |

) |

|

(16,026 |

) |

|

(73,821 |

) |

|

(57,266 |

) |

||||

| Addback depreciation and amortization |

|

144,766 |

|

|

155,903 |

|

|

615,191 |

|

|

605,405 |

|

||||

| EBITDA (non-GAAP) | $ |

(3,466,959 |

) |

$ |

(3,286,487 |

) |

$ |

(7,441,439 |

) |

$ |

(10,283,281 |

) |

||||

| Addback loss on asset disposal |

|

25,024 |

|

|

9,899 |

|

|

25,024 |

|

|

44,081 |

|

||||

| Addback litigation expense |

|

197,765 |

|

|

15,866 |

|

|

664,724 |

|

|

570,934 |

|

||||

| Addback stock-based compensation expense |

|

923,987 |

|

|

868,734 |

|

|

2,798,844 |

|

|

1,647,391 |

|

||||

| Adjusted EBITDA (non-GAAP) | $ |

(2,320,183 |

) |

$ |

(2,391,988 |

) |

$ |

(3,952,847 |

) |

$ |

(8,020,875 |

) |

||||

At December 31, 2022, and December 31, 2021, the Company had a cash balance and short-term investments of $583 thousand and $13.0 million, respectively. As of December 31, 2022, stockholders’ equity was $14.9 million compared to $21.7 million as of December 31, 2021. The company believes it has sufficient cash and borrowing capacity to support near-term operations. In addition, the Company is in the process of selling its Lago Vista site, which should provide additional liquidity to support ongoing operations.

The Company’s complete financial results will be available in the Company’s Form 10-K, which will be filed with the Securities and Exchange Commission and will be available on the Company’s website.

Conference Call

Safe & Green Holdings will hold its conference call today, March 29th, at 4:30 PM Eastern Time.

Dial-in information:

- Toll-free dial-in number (U.S.): +1 888-506-0062

- International dial-in number: +1 973-528-0011

- Access code: 500795

Live and replay webcast links:

- Direct link: https://www.webcaster4.com/Webcast/Page/2935/47687

- IR website: https://ir.safeandgreenholdings.com/news-events/ir-calendar

- Twitter: @SGHcorp.

Telephone replay (available through April 12, 2023):

- Toll-free dial-in number (U.S.): +1 877-481-4010

- International dial-in number: +1 919-882-2331

- Access code 47687

About Safe & Green Holdings Corp.

Safe & Green Holdings Corp., a leading modular solutions company, operates under core capabilities which include the development, design, and fabrication of modular structures, meeting the demand for safe and green solutions across various industries. The firm supports third-party and in-house developers, architects, builders, and owners in achieving faster execution, greener construction, and buildings of higher value. Safe and Green Development Corporation is a leading real estate development company. Formed in 2021, the company focuses on the development of sites using purpose-built, prefabricated modules built from both wood & steel, sourced from one of Safe & Green Holdings factories and operated by SG Echo. For more information, visit www.safeandgreenholdings.com and follow us at @SGHcorp on Twitter.

Safe Harbor Statement

Certain statements in this press release constitute "forward-looking statements" within the meaning of the federal securities laws. Words such as "may," "might," "will," "should," "believe," "expect," "anticipate," "estimate," "continue," "predict," "forecast," "project," "plan," "intend" or similar expressions, or statements regarding intent, belief, or current expectations, are forward-looking statements. These forward-looking statements are based upon current estimates and assumptions and include statements regarding current and planned manufacturing facilities supporting up to $150 million in annualized revenue, generating positive cash flow in 2023 within the manufacturing segment, spinning out Safe and Green Development Corporation and listing on NASDAQ in Q2, generating a significantly higher value than $3.5 million upon sale of the Lago Vista property, the newly appraised value of the Waldron property providing access to additional low-cost debt funding, the Company’s four key verticals driving long-term revenue growth and profitability, the vertical integration of the Company’s business providing it with a distinct competitive advantage in terms of pricing and speed-to-market and driving significant margin expansion, the Waldron manufacturing facility opening in Q2 2023, the Magnolia Gardens residential project generating $130 million in additional manufacturing revenue, achieving gross margins in excess of 15% and generating significant operating profits as the Company increases the throughput and utilization of its facilities, building a long-term and sustainable business model based on the growing demand for local, point-of-care medical services, creating a national footprint of various clinics and labs designed to fit local needs, the point-of-care diagnostics market growing from $36 billion in 2022 to over $51 billion by 2029, generating $5.0 million in annual gross revenue from each distinct medical site not including the value of assets and data collection, repurposing the former lab at LAX Airport for an initial Teamsters unit, expanding on the Company’s relationship with the Teamsters and announcing similar partnerships in the near future, SG DevCo becoming its own independent, publicly traded company, completing the purchase of Waldron site in April 2023, building and owning over 3,500 units at the Cumberland and St. Marys sites, commencing phase two of the Monticello project, SG DevCo’s project pipeline contributing significant cash flow to SG Echo’s manufacturing operations, selling the Lago Vista site in the second quarter of 2023, the planned spin-out and independent listing of SG DevCo unlocking significant value for existing shareholders, not needing a near-term equity financing, the current asset value of SG DevCo being approximately $74 million, designing and creating an active senior living community on the Denison property with roughly 500 units and various amenities at a total development cost of approximately $115 million with projected profits of approximately $40 million over 5 years, feeding approximately $80 million of the $115 million in development costs directly to SG Echo for manufacturing, with an anticipated $15 million in margin, the destruction of biomedical waste market being significantly underserved, providing a low-cost, compliant and distributed solution for major healthcare systems that will reduce transportation and landfill costs in an environmentally friendly and sustainable manner, building a national sales and service footprint for Sanitec, having built a highly scalable and profitable business model, generating positive cash flow within the manufacturing segment and being in the right place, at the right time with an exemplary management team that has the track records to execute on the Company’s vision. While SG Blocks believes these forward-looking statements are reasonable, undue reliance should not be placed on any such forward-looking statements, which are based on information available to us on the date of this release. These forward-looking statements are subject to various risks and uncertainties, many of which are difficult to predict that could cause actual results to differ materially from current expectations and assumptions from those set forth or implied by any forward-looking statements. Important factors that could cause actual results to differ materially from current expectations include, among others, the Company’s ability to establish the manufacturing capacity to support up to $150 million in annualized revenue, the Company’s ability to generate positive cash flow in 2023 within the manufacturing segment, the Company’s ability to spin-off SG DevCo as its own independent, publicly traded company, the Company’s ability to sell the Lago Vista property, the Company’s ability to secure low-cost debt funding for the Waldron property, the Company’s ability to leverage the vertical integration of its business to provide it with a distinct competitive advantage in terms of pricing and speed-to-market and drive significant margin expansion, the Company’s ability to open the Waldron manufacturing facility in Q2 2023, the Company’s ability to establish the capacity to support over $150 million in annualized revenue, the Company’s ability to generate $130 million in additional manufacturing revenue from the Magnolia Gardens residential project, the Company’s ability to achieve gross margins in excess of 15% and generate significant operating profits as it increases the throughput and utilization of its facilities, the Company’s ability to build a long-term and sustainable business model based on the growing demand for local, point-of-care medical services, the Company’s ability to create a national footprint of various clinics and labs designed to fit local needs, the Company’s ability to generate $5.0 million in annual gross revenue from each distinct medical site not including the value of assets and data collection, the Company’s ability to repurpose the former lab at LAX Airport for an initial Teamsters unit, the Company’s ability to expand its relationship with the Teamsters and announce similar partnerships in the future, the Company’s ability to unlock significant value for existing shareholders with the spin-off SG DevCo, the Company’s ability to complete the purchase of Waldron site in April 2023, SG DevCo’s ability to build over 3,500 units at the Cumberland and St. Marys sites, the Company’s ability to commence phase two of the Monticello project as planned, the Company’s ability to develop an active senior living community on the Denison property with roughly 500 units and various amenities at a total development cost of approximately $115 million with projected profits of approximately $40 million over 5 years, the Company’s ability to use SG DevCo’s project pipeline to contribute cash flow to SG Echo’s manufacturing operations with $15 million in margin, the Company’s ability to establish a national sales and service footprint for Sanitec, the Company’s ability to expand within various verticals as planned, the Company’s ability to position itself for future profitability, the Company’s ability to maintain compliance with the NASDAQ listing requirements, and the other factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 and its subsequent filings with the SEC, including subsequent periodic reports on Forms 10-Q and 8-K. The information in this release is provided only as of the date of this release, and we undertake no obligation to update any forward-looking statements contained in this release on account of new information, future events, or otherwise, except as required by law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230329005414/en/

Contacts

Investor Relations:

Crescendo Communications, LLC

(212) 671-1020

sgbx@crescendo-ir.com