Tariffs have been a centerpiece of U.S. President Donald Trump’s strategy, who has boasted of having used tariff threats to end multiple wars across the world. U.S. tariff collections have surged under Trump’s watch, helping to narrow the burgeoning budget deficit, although the numbers still appear ugly and are frankly unsustainable over the long term.

Ever since the president announced wide-ranging tariffs on “Liberation Day” last April, he has blown hot and cold over them. While the tariffs have been a hanging sword over the last year as Trump—who self-proclaimed himself as the “Tariff Man” during his first tenure—has frequently threatened to impose them on countries not agreeing to his demands, the heat has risen over the last few days.

Tariff Heat Might Rise Again

First, the president threatened the EU with tariffs if it opposed his demands to acquire Greenland. Then came the salvo of 100% tariffs on Canada if the country proceeded with the free trade deal with China. Now, he has increased the tariffs on South Korea to 25%, alleging that the country is “not living up” to the agreed terms. We might see Trump raise the pitch further as other countries sign trade deals among themselves—the India-EU trade deal, hailed as the “mother of all deals,” being the latest example.

While markets have somehow learned to live with the tariff tantrum, among others, on the belief that the president would eventually mellow down his threat—a phenomenon popularly known as Trump Always Chickens Out (TACO)—tariff threats do lead to occasional selloffs in markets.

Utility Companies Can Be a Good Play Amid the Current Environment

One way to play the story could be through precious metals (and by extension, the companies mining them) that are enjoying the rally of a lifetime. In my previous articles, I had listed Anglogold Ashanti (AU) and Angico-Eagles Mines (AEM) as two dividend stocks to buy amid the current macro environment. Here we’ll look at the investment case for American Electric Power (AEP), which looks like a good buy for conservative investors looking for a safe, high dividend-paying stock.

AEP Expects Its EPS To Grow at a CAGR of 9% Over Five Years

AEP is a regulated utility whose earnings are quite predictable and linear. It is among the largest electricity producers in the U.S. with a diverse generating capacity of 29,000 megawatts and boasts the largest transmission network, spanning 40,000 miles. The company is present in 11 states and serves 5.6 million customers.

While previously AEP forecast annual earnings growth of 6% and 8% between 2026 and 2030, it has raised the guidance to between 7% and 9%. For 2026, it guided for an earnings per share (EPS) between $6.15 and $6.45, which is around 8% higher than the 2025 guidance.

AEP is investing $72 billion over five years to add more capacity and expects the bulk of incremental growth, 80% to be precise, to come from data centers, including those set up by hyperscalers like Meta Platforms (META), Amazon (AMZN), and Alphabet (GOOG) (GOOGL). U.S. tech companies have ramped up their artificial intelligence (AI) capex despite concerns over overspending and have been scrambling to secure power supplies for their massive data centers.

Apart from the AI opportunity, AEP is also benefiting from industrial capex in the areas that it serves. Among others, it would supply power to Nucor’s (NUE) steel mill in West Virginia. Notably, AEP highlighted during the Q3 2025 earnings call that its estimates are “conservative,” while adding, “Our forecast is not a theoretical model. It's built on signed contracts.”

American Electric Power Has a Healthy Dividend Yield

Meanwhile, AEP is a dividend powerhouse that has paid dividends for over a century, and in October 2025, it increased its quarterly dividend by 2 cents to 95 cents. While the dividend growth might be relatively muted over the next few years as the company is spending aggressively on capex, the stock has a dividend yield of 3.2%, which looks quite healthy.

AEP Stock Forecast

AEP stock has delivered double-digit returns since I covered the stock in March 2025. I expect the stock to rise further this year, especially as more investors might seek solace in stable dividend stocks. The stock trades at a forward price-to-earnings (P/E) multiple of 18.5x, which is not too demanding, if not mouthwateringly cheap.

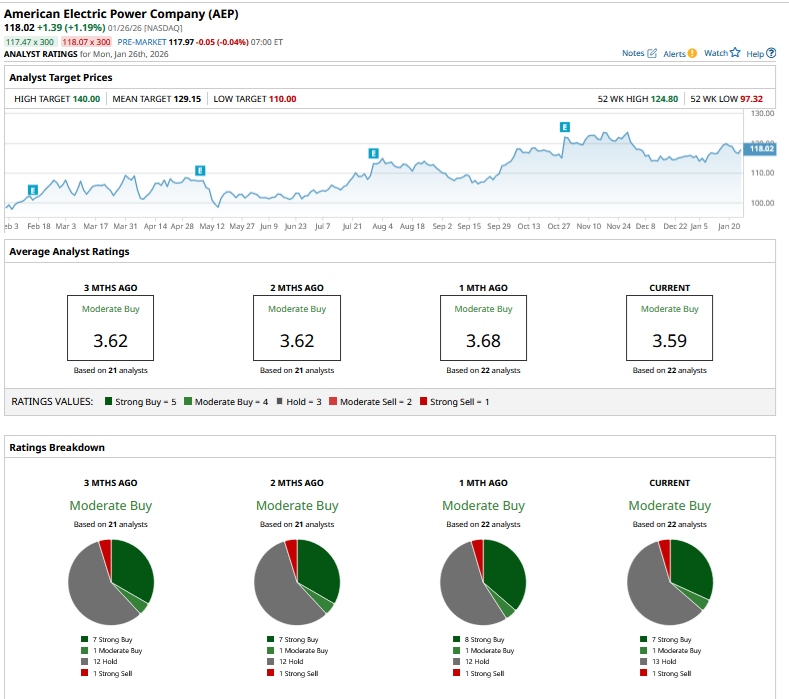

Sell-side analysts are not as bullish, though, and AES has a consensus rating of “Moderate Buy” from the 22 analysts polled by Barchart. The stock’s mean target price of $129.15 is just about 9.4% higher than the Jan. 26 closing price.

On the date of publication, Mohit Oberoi had a position in: AU , META , GOOG , AMZN . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart