It’s been nearly two years since Apple (AAPL) lost its top status in China, as tech companies like Huawei launched their 5G smartphones and took the No. 1 spot in the Chinese market. But today is a good day for Apple, as the maker of the iPhone is once again China’s market leader on the back of a 28% year-over-year gain in shipments in the fourth quarter.

According to Counterpoint Research, Apple saw strong sales in the fourth quarter from its iPhone 17 series. The only new product that didn’t see strong sales was the iPhone Air, which endured a delayed launch in China and only had a low single-digit share.

"The late launch and trade-offs between thinness and the feature set resulted in a slow start for the iPhone Air,” analyst Ivan Lam said. “But it’s a significant product, not only as an exploration into ultra-thin design, but also when considering the longer-term structural implications for the domestic market for eSIM smartphones."

Huawei, which first eclipsed Apple in the first quarter of 2024, dropped to fourth place in the quarter as its shipments fell 13.7%. Overall, Apple had a 21.8% share of the Chinese market in the fourth quarter, with Oppo moving up to second place with a 15.8% share. Vivo had 15.7% of the market, followed by Huawei’s 14.6% share.

Now, the trick will be for Apple to maintain the performance. Huawei still won the crown for the full year, capturing 16.9% of the Chinese market, while Apple had 16.7%. But notably, Apple saw growth of 7.5% in China from a year ago, while Huawei only grew 1.7%.

Does Apple’s recovery in China change the investment thesis for Apple stock?

About Apple Stock

Headquartered in Cupertino, California, Apple is a dominant tech company that revolutionized mobile phones by unveiling the iPhone. Apple’s flagship product was groundbreaking because it provided phone services, texting, music, and internet access through a touchscreen interface that also linked to Apple’s App Store.

Apple still gets the majority of its revenue from the iPhone, but it also has many other popular products, including its Mac computers, iPad tablets, wearable devices such as the Apple Watch, and the massively profitable Services segment that includes the App Store, iCloud, Apple Pay, and Apple TV.

Apple is the third-largest company in the world by market capitalization, worth $3.6 trillion. The company’s stock is up 8% in the last 12 months, which badly underperforms the S&P 500 Index's ($SPX) gain of 14%, and most of its peers in the “Magnificent 7” grouping of tech stocks that dominate the market.

Part of Apple’s weakness compared to its peers stems from tariff concerns, as the company’s products are primarily assembled in China. However, Apple is making efforts to bring some production to the U.S. For example, in August 2025, Apple announced that it would manufacture all iPhone and Apple Watch cover glass in Kentucky as part of a partnership with Corning.

The stock is trading at a forward price-to-earnings (P/E) ratio of 30.1x, which is nearly exactly the five-year P/E mean.

Apple Beats on Earnings

As shown in the chart above, Apple’s earnings report for the fiscal fourth quarter of 2025 (ending Sept. 27, 2025), showed revenue of $102.46 billion, up 7.9% from a year ago. Net income of $27.46 billion was up from $14.73 billion from a year ago, helping Apple post earnings per share of $1.85 — soundly better than analysts’ expectations of $1.73.

For the full year, Apple reported revenue of $416.16 billion and income of $112.01 billion, giving it $7.49 earnings per share (EPS), versus EPS of $6.11 in 2024.

One reason why Apple is so profitable is its fast-growing Services segment, which is much more lucrative than its products because the it is lighter on product design and physical development. For the full year, Apple generated $307 billion in revenue from its products at a 36.7% profit margin, but the Services segment generated $109.16 billion in revenue with a profit margin of 75.4%.

Apple is scheduled to report its Q1 2026 results after the closing bell on Jan. 29.

What Do Analysts Expect for AAPL Stock?

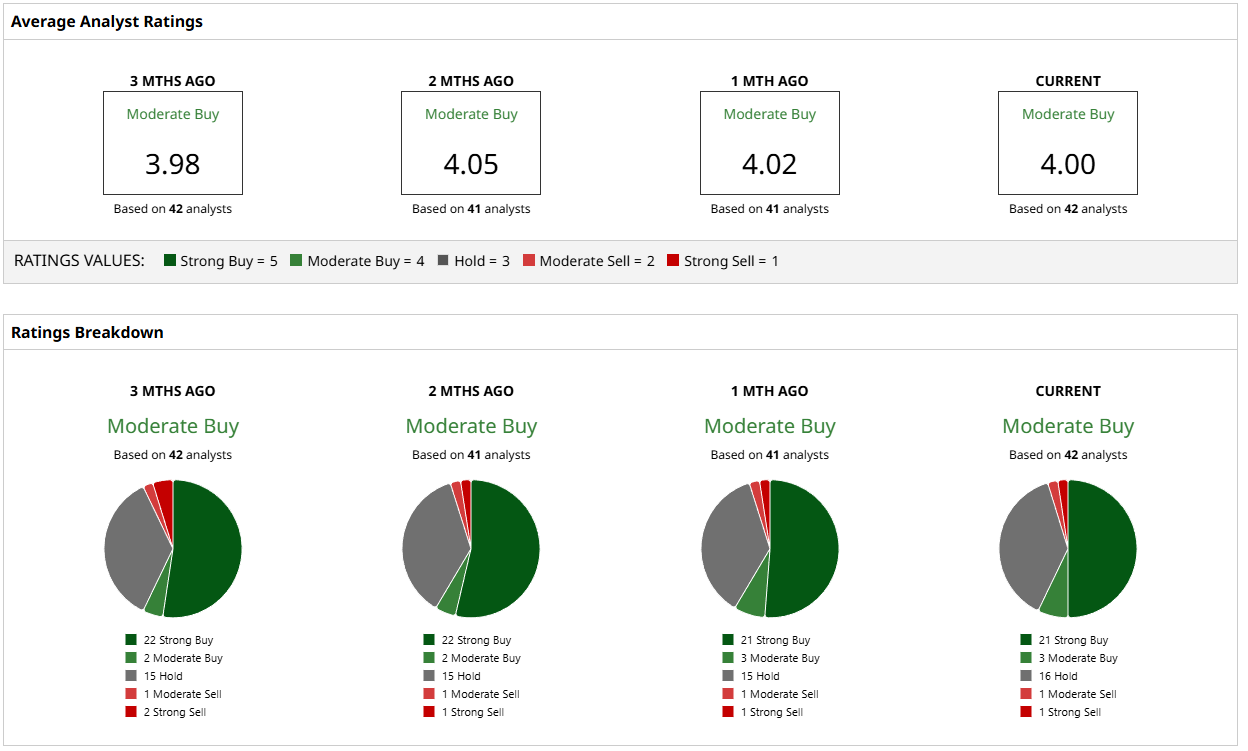

With earnings just around the corner, the consensus estimate for Apple is to deliver EPS of $2.65, which would be a 10.4% jump from a year ago. Forty-two analysts who follow Apple have a consensus “Moderate Buy” rating on the stock, with only two suggesting that investors sell. Sixteen analysts have “Hold” ratings, and 24 suggest buying.

The mean price target of $289 suggests a 17% gain in Apple stock is possible, while the most bullish target of $350 hints at a 42% increase. On the other hand, one analyst’s target of $230 suggests that Apple may be due for a drop.

Apple’s stronger sales in China is a bellwether for what appears to be a solid earnings report. Investors should be looking at the company’s sales numbers when they are released on Jan. 29 and pay attention to news Apple shares on its continued rollout of Apple Intelligence and incorporating generative AI into its product lines.

In all, I’m expecting Apple to have a solid year as it flies under the radar compared to the other Magnificent 7 stocks.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart