Netflix (NFLX) shares have been under notable pressure heading into its fourth-quarter earnings report on Jan. 20. Over the past three months, NFLX stock has fallen more than 26%, and it now sits roughly 33% below its 52-week high of $134.12. This decline has occurred despite the solid underlying business performance.

The streaming giant continues to benefit from strong content offerings, steady subscriber growth, and its expanding push into advertising, all of which have supported both revenue and earnings growth. Viewer engagement on the platform remains healthy, suggesting that the core business fundamentals are not deteriorating.

However, much of the weakness in NFLX stock stems from uncertainty surrounding Netflix’s recently announced bid to acquire Warner Bros. (WBD). The proposed deal has introduced several new risks that have weighed on investor sentiment. Regulatory scrutiny is a concern, as is the challenge of integrating a large and complex media business. In addition, the acquisition would likely add meaningful debt to Netflix’s balance sheet, and the possibility of equity dilution has further pressured the share price. As a result, Netflix has underperformed the S&P 500 Index ($SPX), even as its operating metrics remain relatively strong.

Looking ahead to earnings, a solid fourth-quarter report may not be enough to calm the market. The overhang from the Warner Bros. Discovery deal could continue to drive sharp moves in the stock, regardless of near-term financial results. Options markets are already signaling elevated expectations for volatility, with traders pricing in a post-earnings move of roughly 7.3% in either direction for contracts expiring Jan. 23. This is slightly higher than Netflix’s average earnings-related move of about 6.6% over the past four quarters. Investors should note that following the company’s last earnings release, the stock fell 10.1%.

Netflix Q4 Preview: Solid Content and Ad Strength to Power Q4

Netflix heads into the fourth quarter with significant tailwinds. The company continues to execute well, supported by a compelling content slate, a growing global membership base, and accelerating momentum in advertising.

Despite a challenging macroeconomic backdrop, Netflix has shown notable resilience by sustaining engagement across its platform. This strength is expected to carry into the fourth quarter as the company benefits from the return of several high-profile series and films. These popular titles tend to re-engage existing subscribers while also attracting new ones, supporting growth across Netflix’s global audience and driving overall viewing hours.

In addition, Netflix is expanding its reach through a greater emphasis on live programming. This strategic move allows the company to tap into audiences seeking real-time entertainment while also diversifying its content mix beyond traditional on-demand viewing. Over time, live content could enhance platform stickiness and open up new monetization opportunities.

Monetization remains another area of strength for the company. Recent price adjustments have been absorbed well by consumers, with minimal disruption to subscriber growth and retention. This pricing power provides Netflix with additional financial flexibility to reinvest in premium content and platform enhancements. At the same time, the company’s advertising business is delivering meaningful growth, benefiting from rising demand and improved execution within its ad-supported tier.

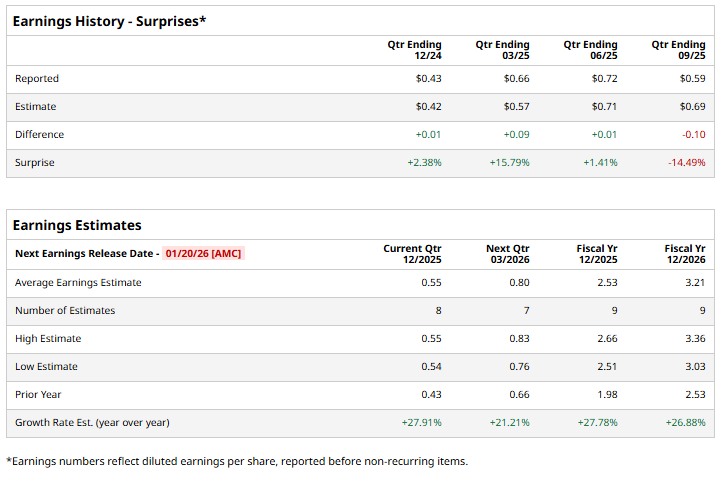

In short, expectations for the fourth quarter remain solid. Netflix projects revenue of approximately $11.96 billion, reflecting year-over-year (YoY) growth of 16.7%. Profitability is also expected to remain healthy. Over the past four quarters, the company has consistently exceeded Wall Street’s earnings expectations, supported by steady revenue expansion and improving margins.

Looking ahead to the upcoming results, analysts anticipate this momentum will continue. Earnings are projected at $0.55 per share, representing a 27.9% increase from the prior year and in line with management’s guidance. Overall, Netflix’s content strength, solid monetization strategy, and improving ad business position the company well for a strong finish to the year.

Is NFLX Stock a Buy?

Netflix’s long-term bull case rests on its expanding subscriber base and consistently strong engagement levels. Viewers are spending more time on the platform, supporting pricing power and helping Netflix defend its leadership position in an increasingly competitive market. Its ad-supported subscription tier is gaining traction and will likely drive its revenue and margins in the coming years.

That said, the stock is not without risk. Ongoing uncertainties related to the Warner Bros. Discovery deal have introduced volatility, and investors should be prepared for near-term fluctuations as these issues play out.

Analysts are cautiously optimistic and maintain a “Moderate Buy” rating on NFLX stock. The consensus view acknowledges the risks but shows the strength of Netflix’s fundamentals and its improving monetization strategy. For long-term investors, the recent weakness in the stock may represent an attractive entry point.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart