Netflix (NFLX) shares are slipping on Wednesday after regulatory filings revealed Reed Hastings has unloaded more than 375,000 shares of Netflix stock.

On Dec. 1, the cofounder and current chairman of the mass media giant sold 375,470 NFLX shares. However, it appears that through a prearranged 10b5-1 trading plan, Hastings simply sold shares that converted on the same day as the transaction.

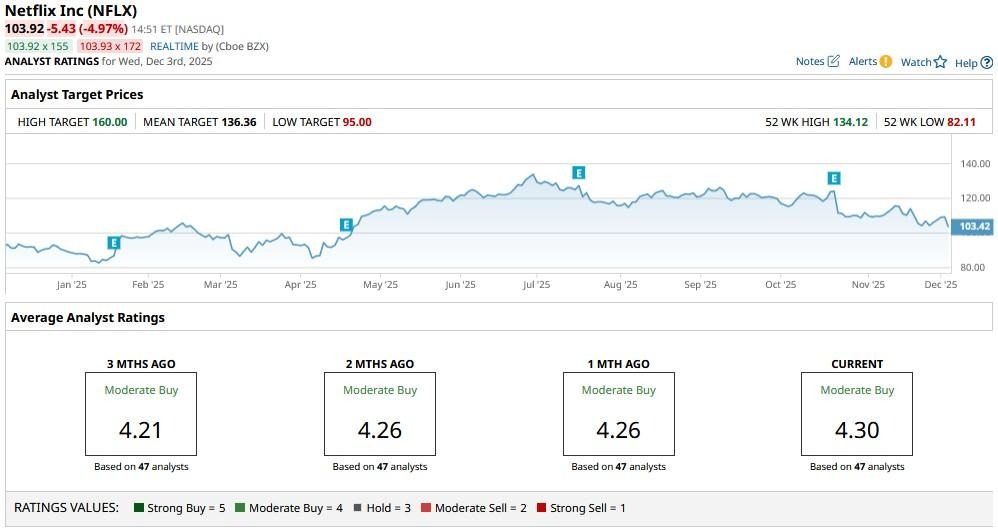

Netflix stock is currently down 22% versus its June high. The selloff this morning pushed it below its 20-day moving average (MA) at $109.47, signaling continued bearish momentum in the near term.

Why Hastings’ Stock Sale Isn’t Negative for Netflix

Hastings’ move, while alarming on the surface, isn’t particularly concerning for NFLX shares.

Why? Because the sale was through a prearranged 10b5-1 trading plan adopted in 2023. Plus, through the Hastings-Quillin Family Trust, he continues to control over 21 million shares of Netflix.

This indirect ownership underscores his ongoing commitment to the Nasdaq-listed firm.

In short, the transaction doesn’t reflect a loss of confidence, but routine portfolio management or personal liquidity planning.

NFLX Technicals Warrant Trimming Exposure

While Hastings’ filing may not warrant selling Netflix shares, technicals suggest otherwise.

The streaming giant is currently trading decisively below its major moving averages (50-day, 100-day, 200-day) – indicating the broader trend remains indisputably bearish.

Plus, NFLX has its 100-day relative strength index (RSI) at nearly 48 currently, reinforcing that the downward momentum is not near exhaustion yet.

According to Barchart, options pricing also suggests the mass media stock could tumble to roughly $91 or another 12% from current levels through late February.

Valuation wise, Netflix is currently trading at a forward price-to-earnings (P/E) ratio of about 43x, which even dwarfs the multiple on the best-of-breed AI stocks like Nvidia (NVDA).

Wall Street Remains Bullish on Netflix

Despite the aforementioned risks, however, Wall Street remain bullish on Netflix, believing its dominance in the streaming space will drive its share price higher in 2026.

The consensus rating on NFLX shares remains at “Moderate Buy” with the mean target of about $136 indicating potential upside of more than 30% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Netflix Stock Breaks Below 20-Day Moving Average Amid Selloff. Should You Buy the Dip?

- Heavy Volume in Home Depot Call Options - Investors are Bullish on HD Stock

- How to Use the Naked Put Options Strategy to Earn Income & Buy Stocks at a Discount

- Nvidia Just Lit a Fire Under Synopsys Stock But Its Chart Is Waving Red Flags. Here’s the Only Way I’d Trade SNPS Here.