Since February 2025, RenaissanceRe has been in a holding pattern, posting a small return of 2.6% while floating around $240.

Is now the time to buy RNR? Find out in our full research report, it’s free.

Why Is RenaissanceRe a Good Business?

Born in Bermuda after the devastating Hurricane Andrew created a crisis in the catastrophe insurance market, RenaissanceRe (NYSE: RNR) provides property, casualty, and specialty reinsurance and insurance solutions to customers worldwide, primarily through intermediaries.

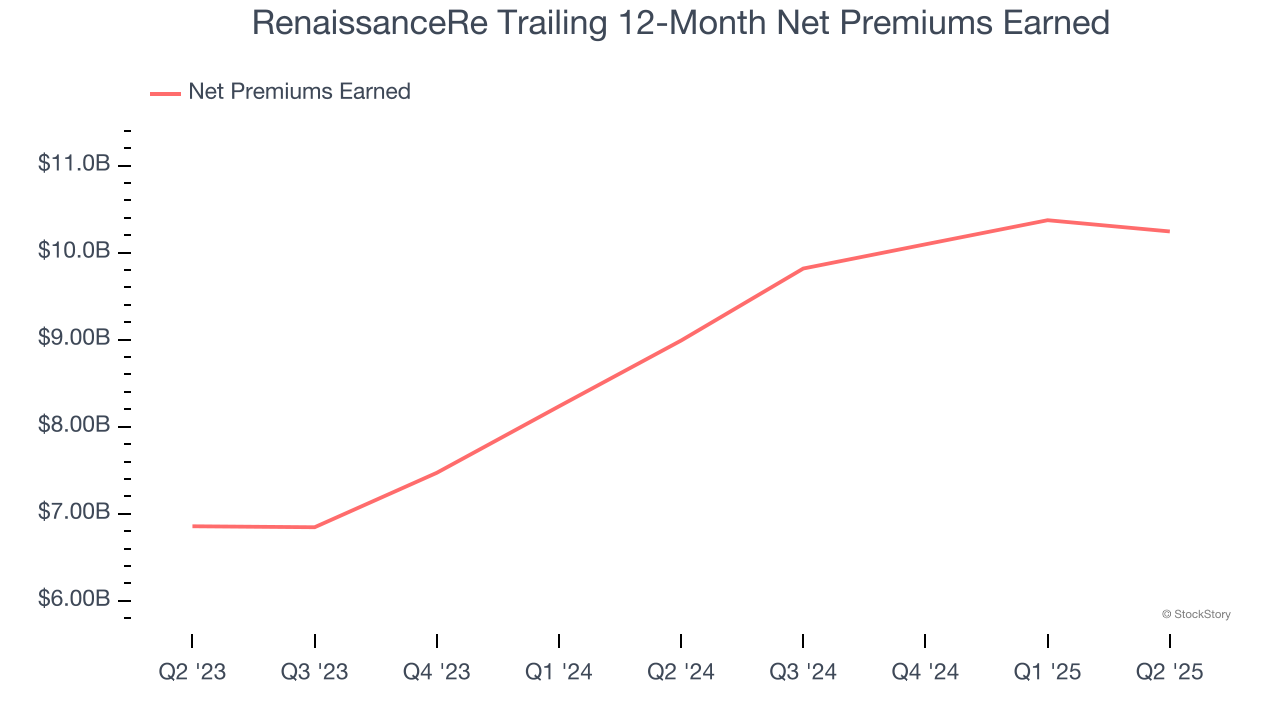

1. Net Premiums Earned Skyrockets, Fueling Growth Opportunities

Markets consistently prioritize net interest income over non-recurring fees, recognizing its superior quality compared to the more unpredictable revenue streams.

RenaissanceRe’s net premiums earned has grown at a 22.2% annualized rate over the last two years, much better than the broader insurance industry.

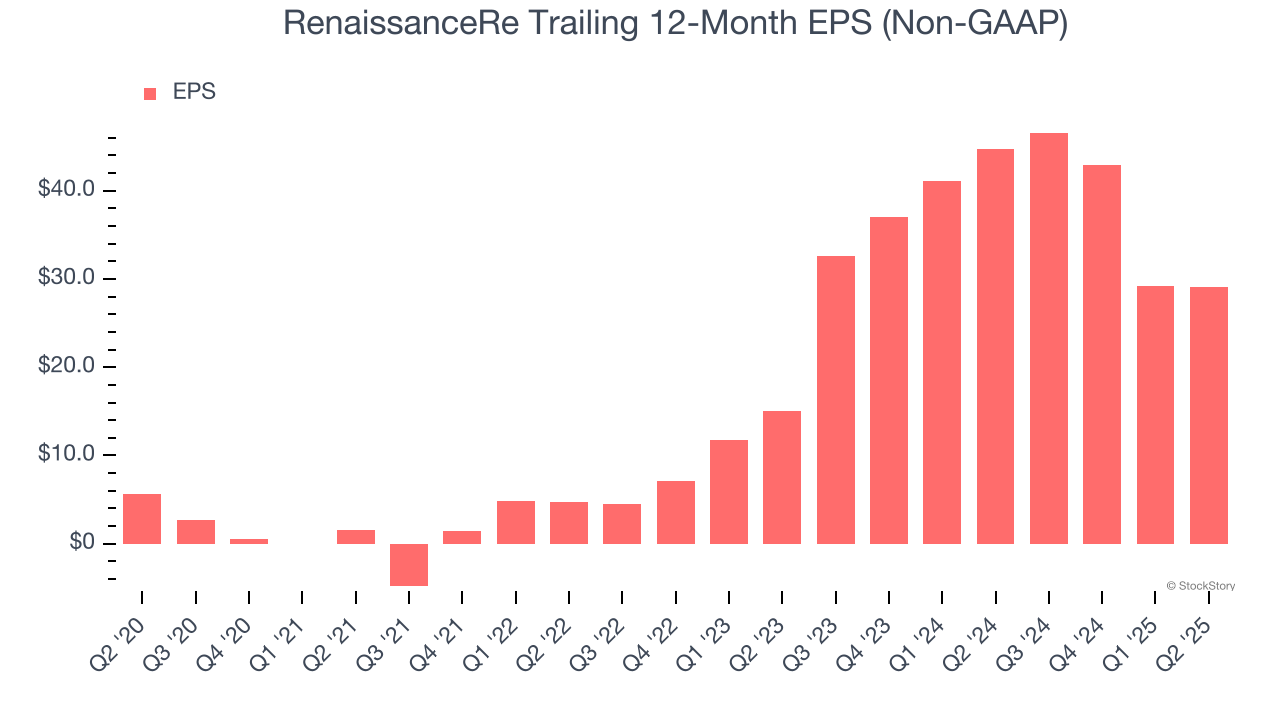

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

RenaissanceRe’s EPS grew at an astounding 38.9% compounded annual growth rate over the last five years, higher than its 23% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

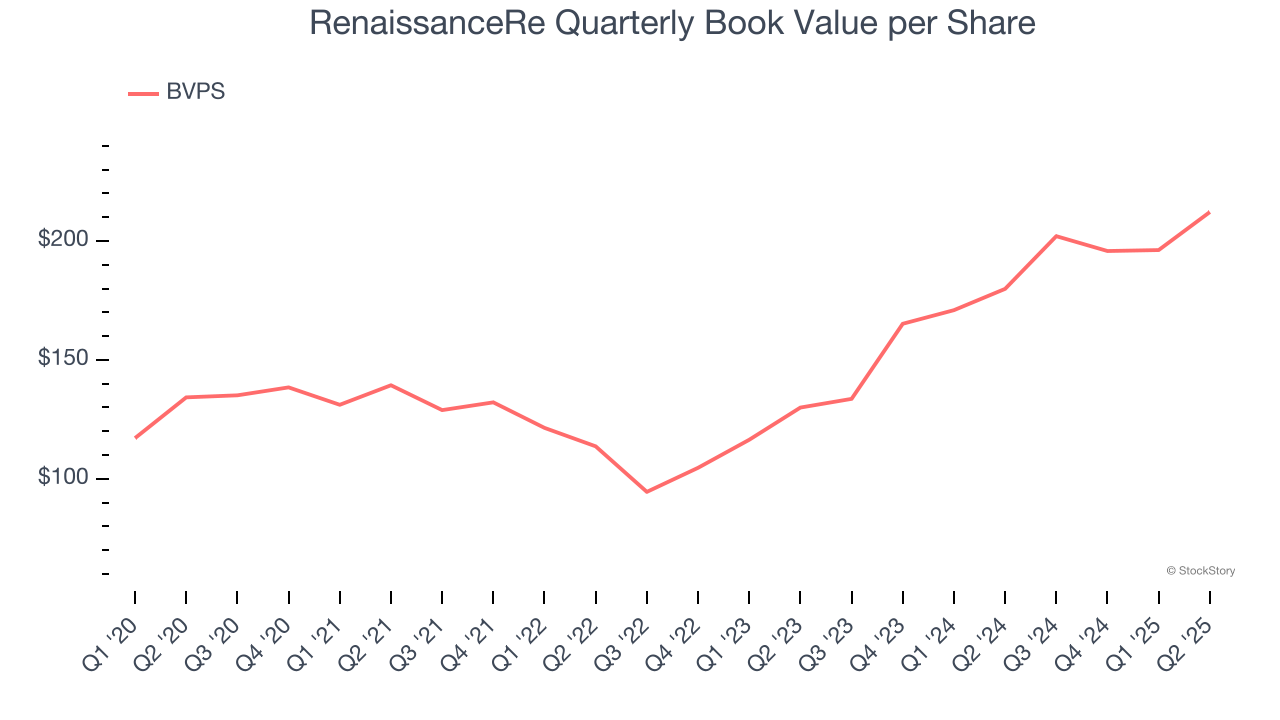

3. Growing BVPS Reflects Strong Asset Base

Book value per share (BVPS) serves as a key indicator of an insurer’s financial stability, reflecting a company’s ability to maintain adequate capital levels and meet its long-term obligations to policyholders.

RenaissanceRe’s BVPS increased by 9.6% annually over the last five years, and growth has recently accelerated as BVPS grew at an incredible 27.8% annual clip over the past two years (from $129.98 to $212.15 per share).

Final Judgment

These are just a few reasons why RenaissanceRe ranks highly on our list, but at $240 per share (or 1.1× forward P/B), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2024 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.