Over the last six months, Arcos Dorados’s shares have sunk to $7.01, producing a disappointing 10.6% loss - a stark contrast to the S&P 500’s 5% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Arcos Dorados, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Arcos Dorados Not Exciting?

Despite the more favorable entry price, we don't have much confidence in Arcos Dorados. Here are three reasons why there are better opportunities than ARCO and a stock we'd rather own.

1. Low Gross Margin Reveals Weak Structural Profitability

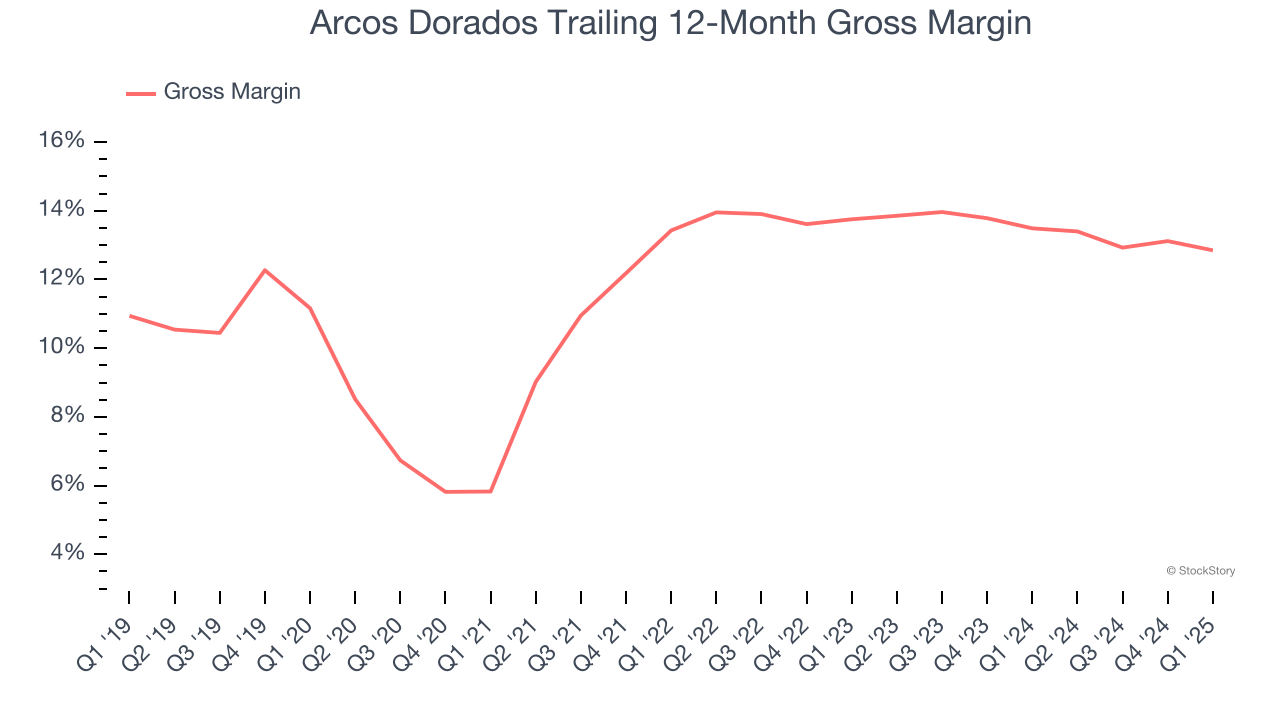

Gross profit margins are an important measure of a restaurant’s pricing power and differentiation, whether it be the dining experience or quality and taste of food.

Arcos Dorados has bad unit economics for a restaurant company, signaling it operates in a competitive market and has little room for error if demand unexpectedly falls. As you can see below, it averaged a 13.2% gross margin over the last two years. Said differently, Arcos Dorados had to pay a chunky $86.83 to its suppliers for every $100 in revenue.

2. Weak Operating Margin Could Cause Trouble

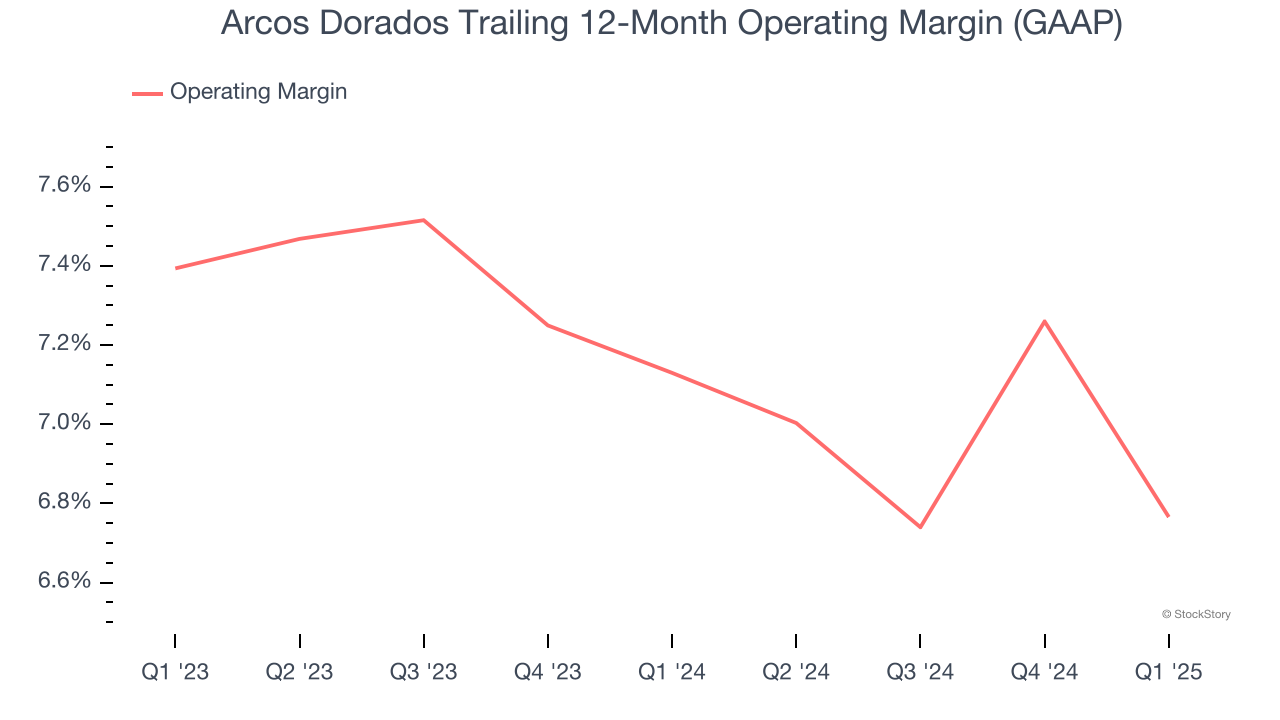

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Arcos Dorados’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 6.9% over the last two years. This profitability was mediocre for a restaurant business and caused by its suboptimal cost structureand low gross margin.

3. Breakeven Free Cash Flow Limits Reinvestment Potential

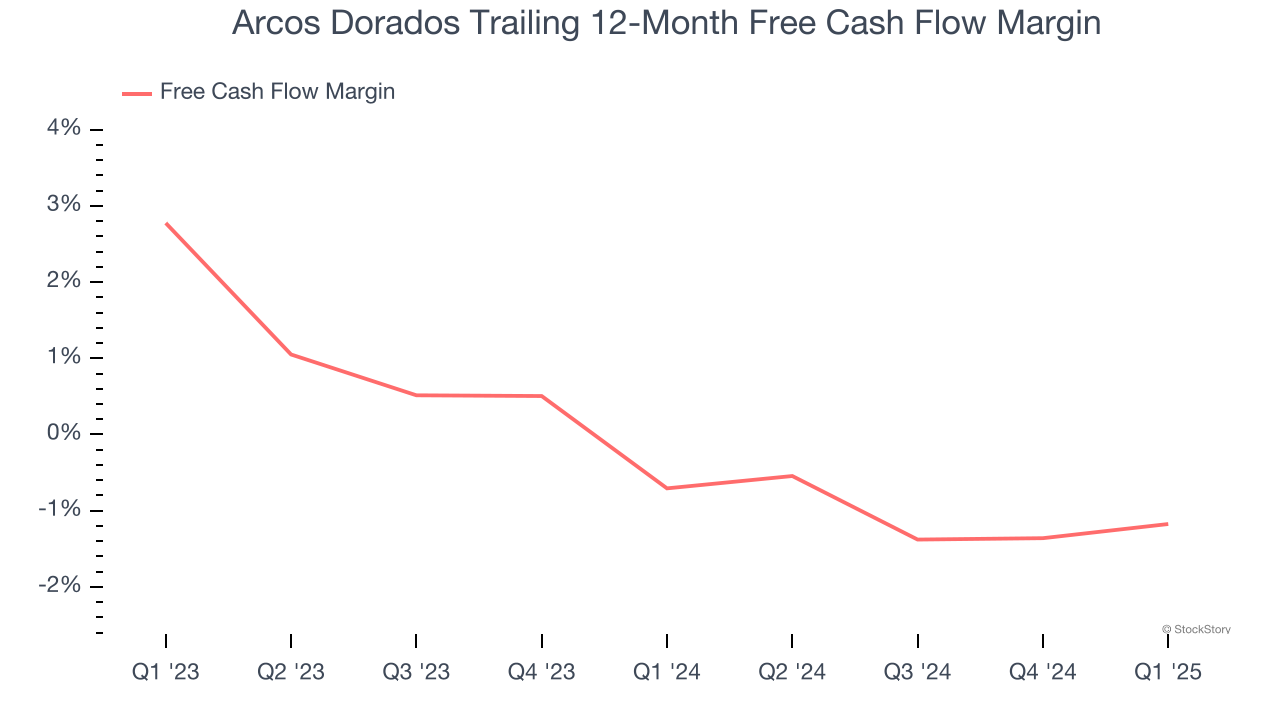

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Arcos Dorados broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Final Judgment

Arcos Dorados isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at $7.01 per share (or a forward price-to-sales ratio of 0.3×). The market typically values companies like Arcos Dorados based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere. We’d recommend looking at one of our top digital advertising picks.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2024 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.