At present, one of the demanding technologies in the banking sector is cheque scanners. The cheque scanner enables remote deposit capture benefits with reduced time of transaction recording, cost of transportation, and less dependence on courier services. The banks, specifically in the US, are adopting the cheque scanner technology to improve the customer banking experience. For instance, according to the Federal Reserve, around 84% of the US customers visit the bank counter at least once a year. Hence, to provide enhanced service, banks are adopting automated systems. The Panini, one of the prominent market players in the US is serving the advanced banking technologies for multiple banks, such as U.S. Bank, KeyBank, and American National Bank.

Get Sample PDF Copy at https://www.theinsightpartners.com/sample/TIPRE00019004

The countries such as the UK and France are promoting remote deposit capture services. For instance, in October 2017, all-banks in the UK started to offer an image clearing system (ICS) for check deposit applications. The solution introduced in the country is enabling customers to exchange cheque images and data instead of visiting the bank with a physical paper document. The UK banks are processing the check with the image alone; there is no requirement for bank check documents. Such legislative changes from the country to enhance banking service is creating a substantial growth opportunity for market players in the UK.

Technological advancements have led to a highly competitive market in the region as population is getting attracted toward digital technologies. With the high adoption of automation technologies in operations, smart devices with remote connectivity are enhancing the service experience for bank customers. Significant innovations in retail banking through digital technologies improve customer personal banking experience, while commercial banking is pressurized to catch up. Increasing demand for innovation at banks for a faster and smooth transaction drives the market growth in North America. The bank counter in North American countries is being transformed to automated desks for improved and fast service applications.

Strategic Insights

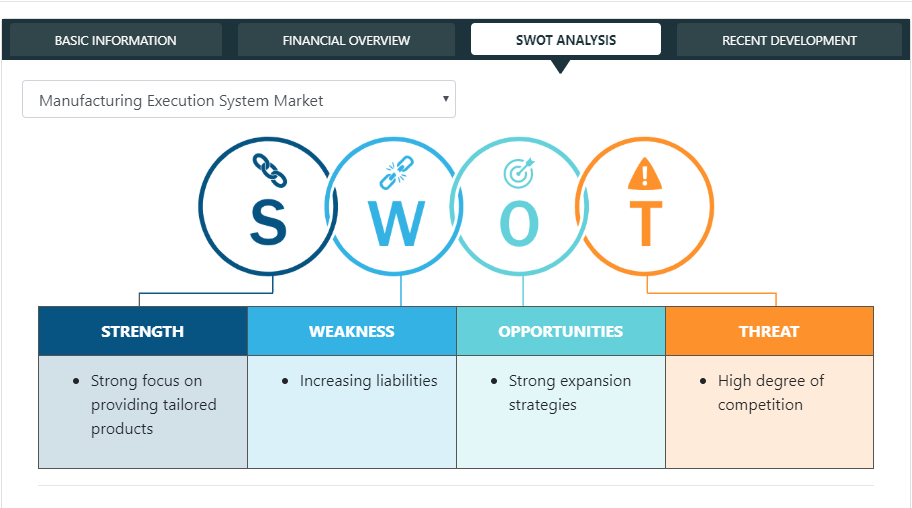

The market players focus on new product innovations and developments by integrating advanced technologies and features in their products to compete with the competitors.

• In 2020, Kodak formed alliance with Southern Lithoplate Inc. (SLP). In this alliance, Southern Lithoplate became a key supplier of Kodak solutions. This arrangement leverages Southern Lithoplate’s strong customer relationships and expertise within the newspaper sector and Kodak’s world-class products and technology.

• In 2019, Digital Check declared Micro Adaptive Cheque and Full-Page Document Scanner in Brazil. The SmartSource Micro Adaptive cheque and document scanner launched to the Brazilian market, at the CIAB FEBRABAN conference.

• In 2019, Panini announced its partnership with the Alogent Corp. With this partnership, the company’s focus on developing the first operating system agnostic, all-in-one check capture solution used to meet the branch capture requirement of financial institutions and small businesses and merchants.

Buy Complete Report at https://www.theinsightpartners.com/buy/TIPRE00019004

Media Contact

Company Name: The Insight Partners

Contact Person: Sameer Joshi

Email: Send Email

Phone: +1-646-491-9876

City: Pune

State: Maharashtra

Country: India

Website: https://www.theinsightpartners.com/reports/cheque-scanner-market