Mexican fast-food chain Chipotle (NYSE: CMG) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 4.9% year on year to $2.98 billion. Its non-GAAP profit of $0.25 per share was 4.9% above analysts’ consensus estimates.

Is now the time to buy Chipotle? Find out by accessing our full research report, it’s free.

Chipotle (CMG) Q4 CY2025 Highlights:

- Revenue: $2.98 billion vs analyst estimates of $2.97 billion (4.9% year-on-year growth, 0.6% beat)

- Adjusted EPS: $0.25 vs analyst estimates of $0.24 (4.9% beat)

- Adjusted EBITDA: $515.6 million vs analyst estimates of $504.4 million (17.3% margin, 2.2% beat)

- Operating Margin: 14.1%, in line with the same quarter last year

- Free Cash Flow Margin: 7.7%, down from 12.4% in the same quarter last year

- Same-Store Sales fell 2.5% year on year (5.4% in the same quarter last year)

- Market Capitalization: $50.92 billion

Company Overview

Born from a desire to offer quick meals with fresh, flavorful ingredients, Chipotle (NYSE: CMG) is a fast-food chain known for its healthy, Mexican-inspired cuisine and customizable dishes.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $11.93 billion in revenue over the past 12 months, Chipotle is one of the most widely recognized restaurant chains and benefits from customer loyalty, a luxury many don’t have. Its scale also gives it negotiating leverage with suppliers, enabling it to source its ingredients at a lower cost.

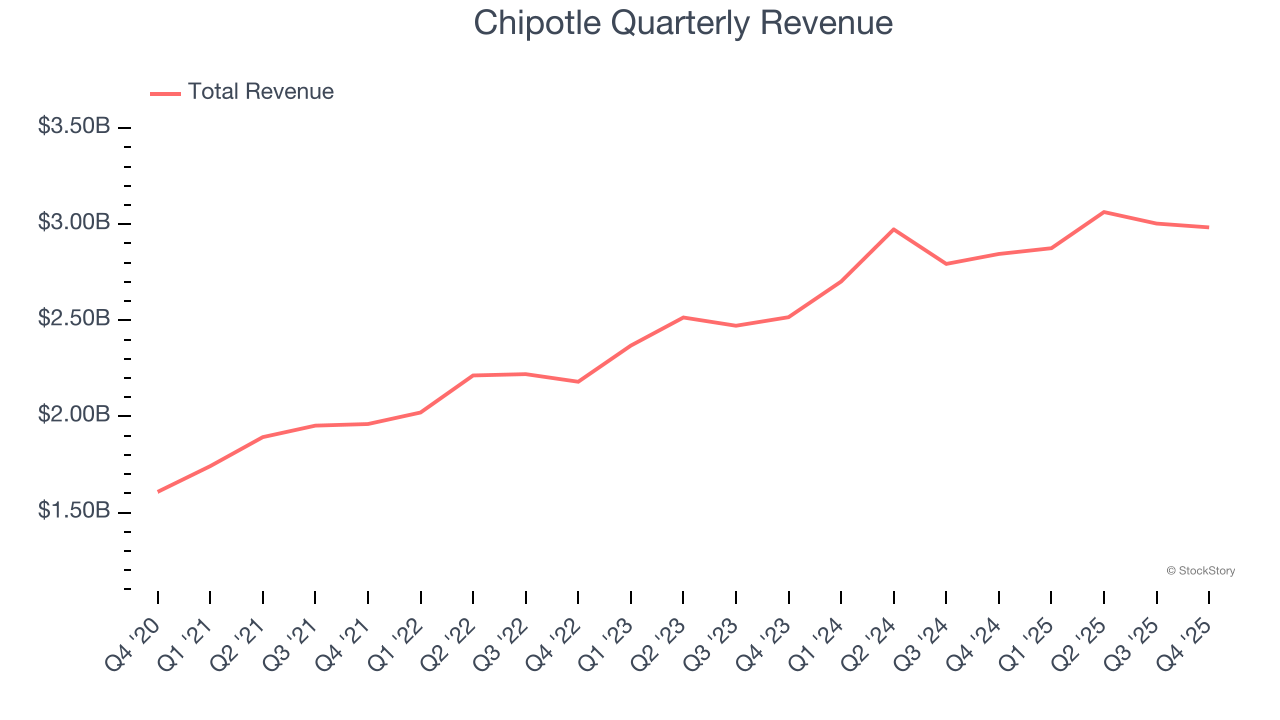

As you can see below, Chipotle’s sales grew at an impressive 13.5% compounded annual growth rate over the last six years as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Chipotle reported modest year-on-year revenue growth of 4.9% but beat Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 9.5% over the next 12 months, a deceleration versus the last six years. We still think its growth trajectory is satisfactory given its scale and suggests the market sees success for its menu offerings.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Restaurant Performance

Number of Restaurants

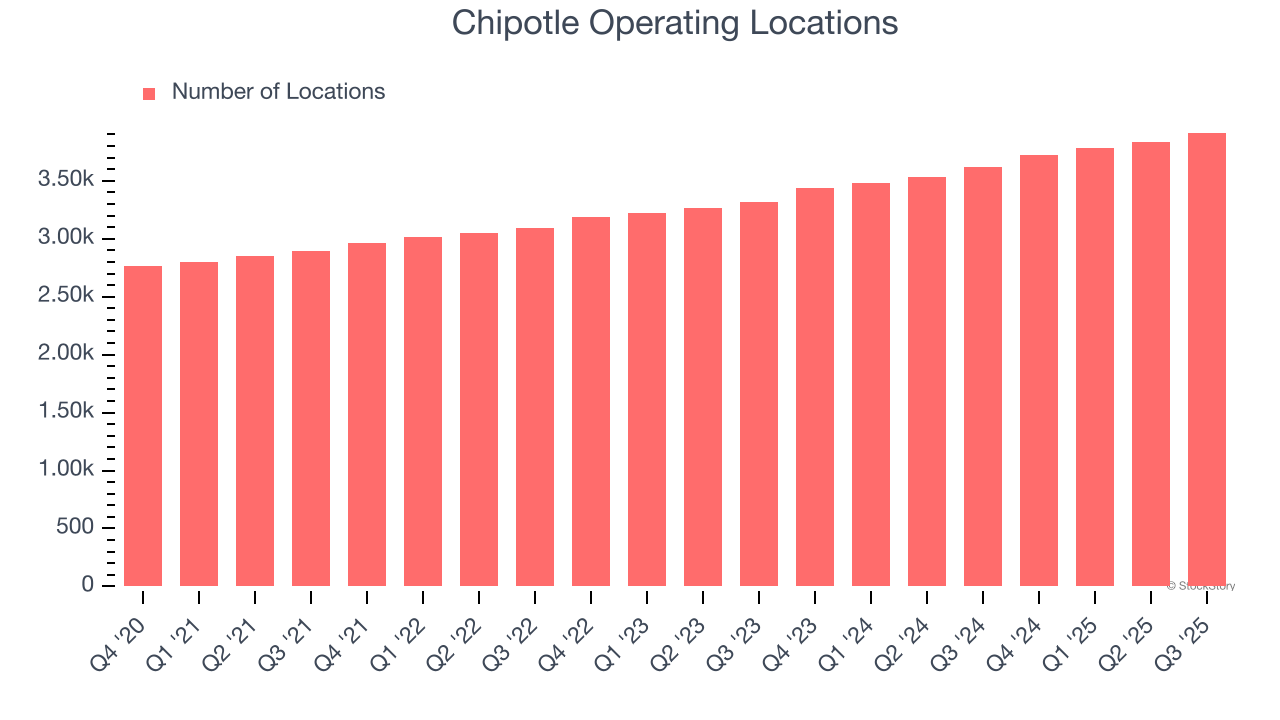

A restaurant chain’s total number of dining locations often determines how much revenue it can generate.

Over the last two years, Chipotle opened new restaurants at a rapid clip by averaging 8.4% annual growth, among the fastest in the restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Note that Chipotle reports its restaurant count intermittently, so some data points are missing in the chart below.

Same-Store Sales

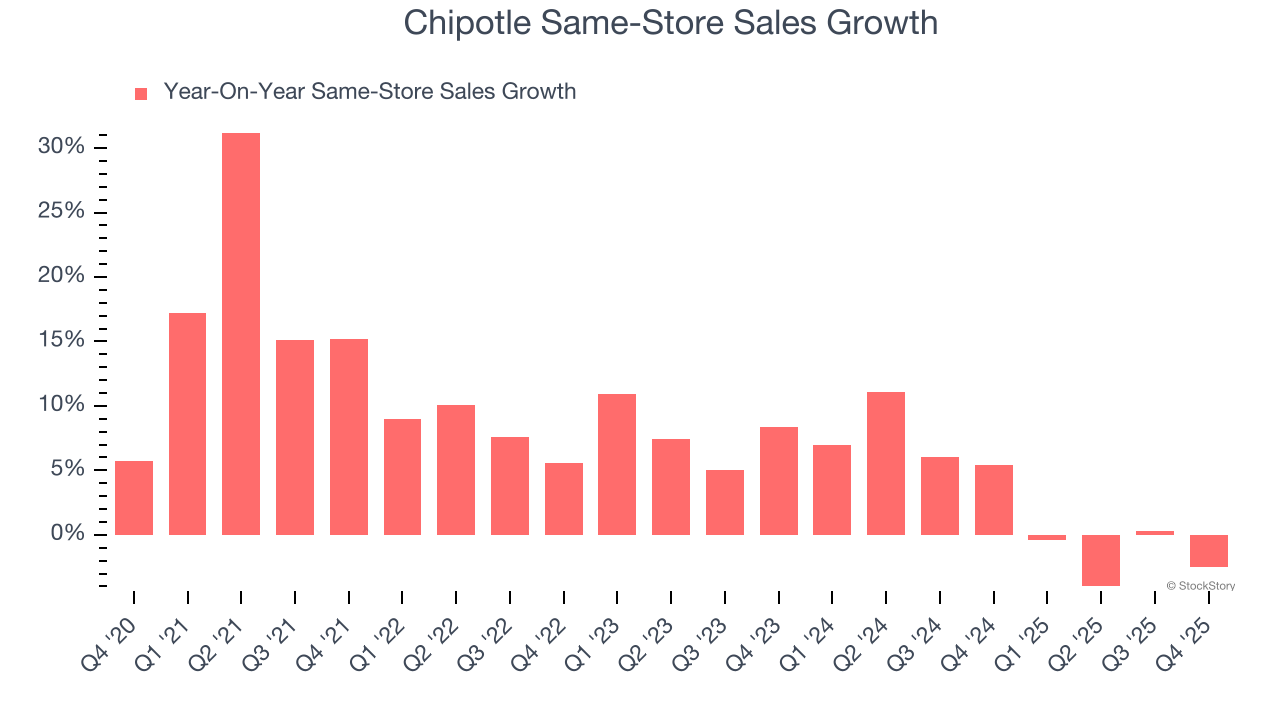

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

Chipotle’s demand has been healthy for a restaurant chain over the last two years. On average, the company has grown its same-store sales by a robust 2.9% per year. This performance suggests its rollout of new restaurants could be beneficial for shareholders. When a chain has demand, more locations should help it reach more customers and boost revenue growth.

In the latest quarter, Chipotle’s same-store sales fell by 2.5% year on year. This decline was a reversal from its historical levels. A one quarter hiccup shouldn’t deter you from investing in a business, and we’ll be monitoring the company to see how things progress.

Key Takeaways from Chipotle’s Q4 Results

While Chipotle met analysts’ same-store sales expectations this quarter, investors worried about a more than 3% decline in traffic to established stores (one part of same-store sales is traffic, and the other part is ticket or spend per customer). So while EPS managed to beat, the stock traded down 3.2% to $37.87 immediately following the results.

Is Chipotle an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).