Once a household name in smartphones, BlackBerry (BB) famously lost its grip on the booming mobile market to Apple’s (AAPL) iPhone and Android-powered rivals. After walking away from handset manufacturing altogether, the company reinvented itself as a software-driven player focused on Internet of Things (IoT) and cybersecurity solutions. Even as competition in the cybersecurity software space continues to heat up, BlackBerry stock has still managed a respectable run in 2025, albeit with some volatility, supported by solid financial performance that has helped keep investor confidence intact.

That optimism was reinforced in September, when BlackBerry delivered a strong fiscal 2026 second-quarter earnings report, highlighted by particularly robust results from its QNX segment, which quickly caught the market’s attention. Now, the company is preparing to report its third-quarter earnings on Dec. 18, and Wall Street is heading into the release expecting meaningful gains in the upcoming quarter. With that backdrop, here’s a closer look at what lies ahead for BlackBerry.

About BlackBerry Stock

Founded in 1984, BlackBerry built its legacy as a pioneer of secure mobile communication, once dominating the smartphone market with its iconic keyboard devices. Headquartered in Waterloo, Ontario, the company has since exited the handset business completely and reinvented itself as a software-first enterprise focused on mission-critical technologies. Today, BlackBerry supports enterprises and governments with intelligent software and services that keep the world running behind the scenes.

The company’s high-performance foundational software empowers top automakers and industrial leaders to build transformative applications, open up new revenue opportunities, and introduce innovative business models, while maintaining the highest standards of safety, security, and reliability. Its QNX operating system is a key revenue engine, embedded in millions of vehicles worldwide and increasingly central to next-generation automotive and industrial systems.

Alongside this, BlackBerry’s cybersecurity business delivers endpoint protection, secure communications, and threat intelligence to enterprises and governments, positioning the company as a behind-the-scenes enabler of safety, security, and connectivity in an increasingly digital world. The company is currently valued at a market capitalization of roughly $2.6 billion.

After surging an impressive 32.34% over the past year, BlackBerry’s rally has lost some steam more recently as investors weigh uncertainties around its ongoing shift toward cybersecurity and IoT, along with renewed debate over the company’s long-term direction. Even so, the stock has held up well in 2025, rising a solid 12.04% for the year, just a notch below the broader S&P 500 Index's ($SPX) 14.49% gain during the same stretch.

A Look Inside BlackBerry’s Q2 Performance

On Sept. 25, BlackBerry delivered a standout second-quarter earnings report that showcased clear operational progress and marked its second consecutive quarter of GAAP profitability. The results exceeded expectations across the board and sparked a strong market reaction, with the stock surging nearly 9% on the day of the announcement, followed by another 6.7% gain on Sept. 26.

For the quarter, BlackBerry reported revenue of $129.6 million, up 3% year-over-year (YOY), comfortably topping Wall Street’s $122 million forecast and landing above management’s own guidance. Strength was evident across BlackBerry’s key businesses, led by its QNX division, which focuses on embedded software for automotive and IoT applications. QNX generated $63.1 million in revenue, representing a robust 15% YOY increase and coming in ahead of guidance.

Also, the segment delivered an impressive 32% adjusted EBITDA margin, while its adjusted gross margin remained flat at a healthy 83%, highlighting the durability and profitability of the platform. The company’s Secure Communications segment, which includes UEM, SecuSUITE, and AtHoc, also posted solid results, generating $59.9 million in revenue during the quarter.

Importantly, Secure Communications' annual recurring revenue (ARR) continued to trend higher, rising both YOY and sequentially to $213 million, signaling improving momentum and revenue visibility. Profitability further strengthened BlackBerry’s investment case. The company posted GAAP earnings of $0.02 per share, a sharp reversal from a loss of $0.03 per share in the year-ago quarter.

On an adjusted basis, earnings came in at $0.04 per share, well ahead of Wall Street’s $0.01 estimate. Additionally, BlackBerry returned $20 million to shareholders through the repurchase of roughly five million common shares during the quarter, while total cash, cash equivalents, and short- and long-term investments declined $18.4 million sequentially to $363.5 million.

Dear BlackBerry Investors, Mark Your Calendars for Dec. 18

Looking ahead to the third quarter, BlackBerry’s management has laid out an upbeat outlook. The company expects revenue to come in between $132 million and $140 million, with the fast-growing QNX segment projected to deliver $66 million to $70 million in revenue. Meanwhile, Secure Communications revenue is forecast to land in the $60 million to $64 million range. On the bottom line, BlackBerry sees adjusted earnings of $0.02 to $0.04 per share, signaling continued progress on profitability.

With that backdrop, the former smartphone pioneer is set to report its third-quarter earnings after the market closes on Thursday, Dec. 18, and anticipation is clearly building. Options markets are pricing in a sizable move of 10.18% around the earnings release, reflecting heightened investor interest. Looking further out, analysts covering the stock expect third-quarter earnings of $0.03 per share, which would represent a striking 200% YOY improvement and underscore the momentum behind BlackBerry’s turnaround.

How Are Analysts Viewing BlackBerry Stock?

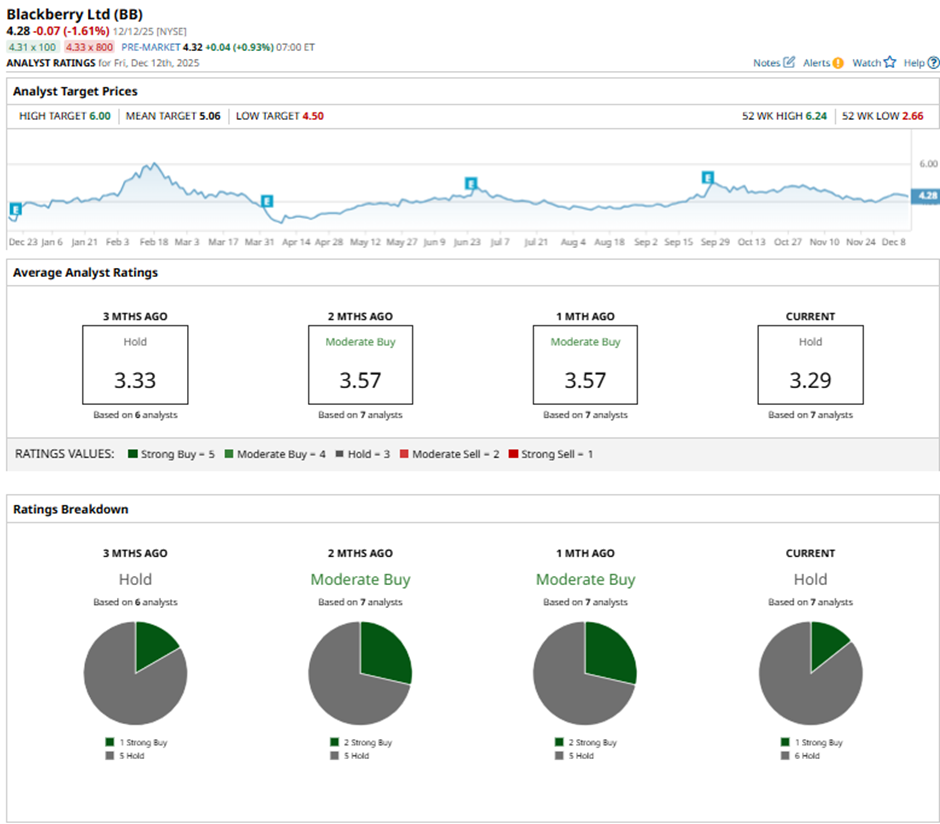

Despite the buzz around BlackBerry’s upcoming earnings, Wall Street’s overall tone remains somewhat cautious. The stock currently carries a consensus “Hold” rating, reflecting a wait-and-see stance among analysts. Of the seven analysts covering the name, just one is bullish enough to rate it a “Strong Buy,” while the other six are sitting on the sidelines with “Hold” recommendations.

Regardless, room for upside is still possible. The average price target of $5.06 points to a potential gain of 19.34% from current levels. At the same time, the most optimistic Street estimate pegs the stock at $6, implying upside of up to 41.51% if BlackBerry delivers on expectations.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Barchart Stock Screeners to Help You Find Better Call Option Trades

- ‘You Didn’t Want to Be in Jamestown’: Elon Musk Warns Mars Won’t Be A Billionaire Vacation Spot; It Will Be ‘Very Dangerous’ and ‘You Might Die’

- Why You Need to Watch FedEx Stock This Week

- Dear BlackBerry Stock Fans, Mark Your Calendars for December 18