Continues to look to me to like the increased government deficit from the rate hikes, at the macro level, continues to support output and employment and is not triggering a recession as feared? Still a very high number- well above pre-Covid levels: Back to pre-Covid trend line: A slight decline for the month but still […] The post Job openings, hires, Manufacturers orders, real estate lending appeared first on Mosler Economics / Modern Monetary Theory .

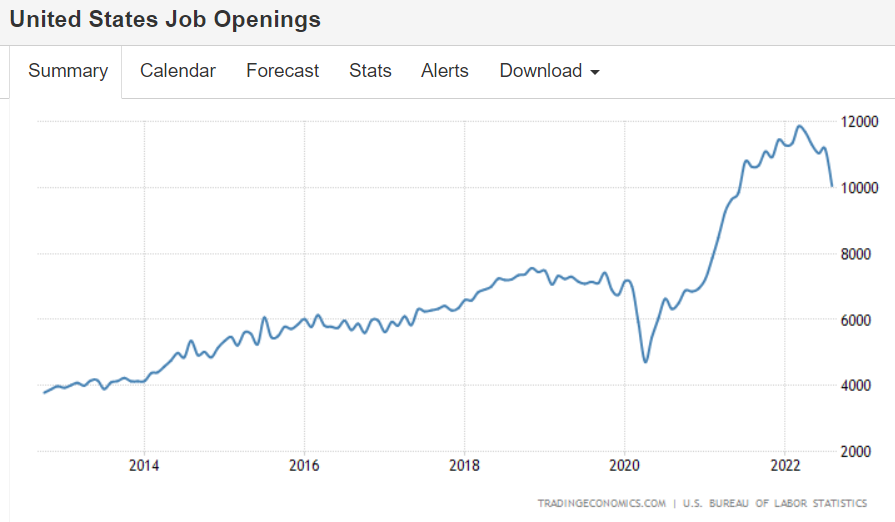

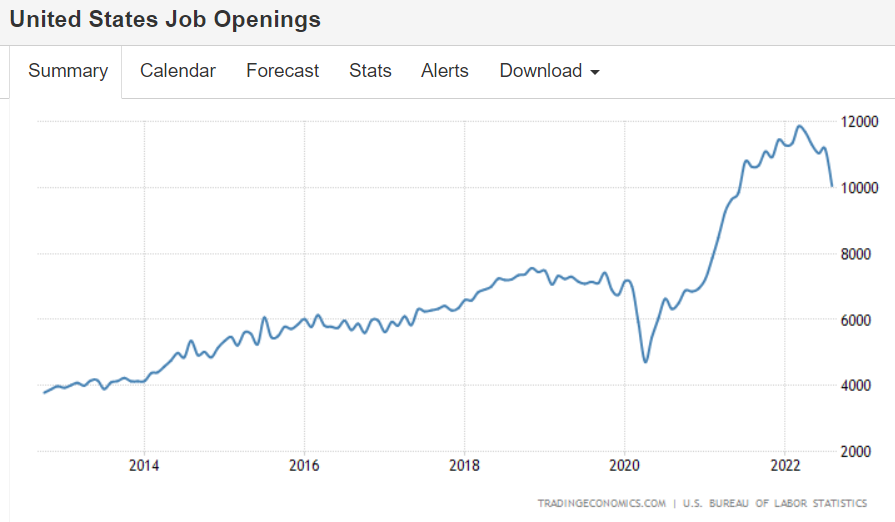

Continues to look to me to like the increased government deficit from the rate hikes, at the macro level, continues to support output and employment and is not triggering a recession as feared?Still a very high number- well above pre-Covid levels:

Continues to look to me to like the increased government deficit from the rate hikes, at the macro level, continues to support output and employment and is not triggering a recession as feared?Still a very high number- well above pre-Covid levels:

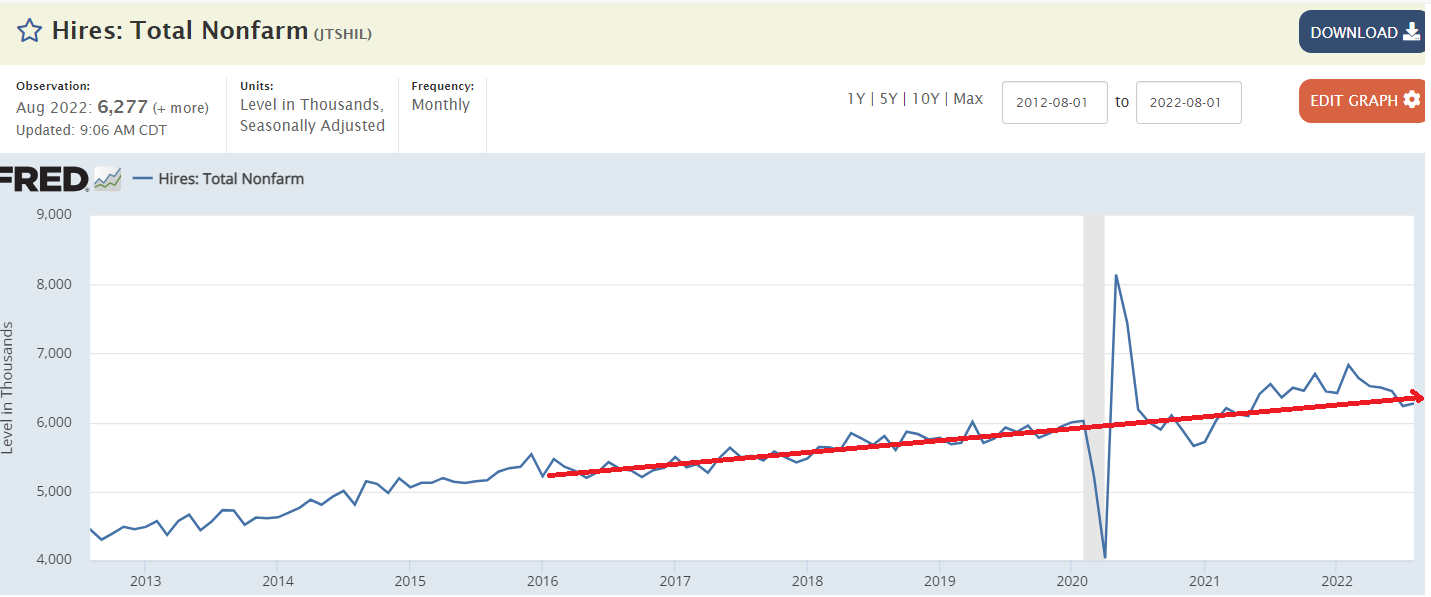

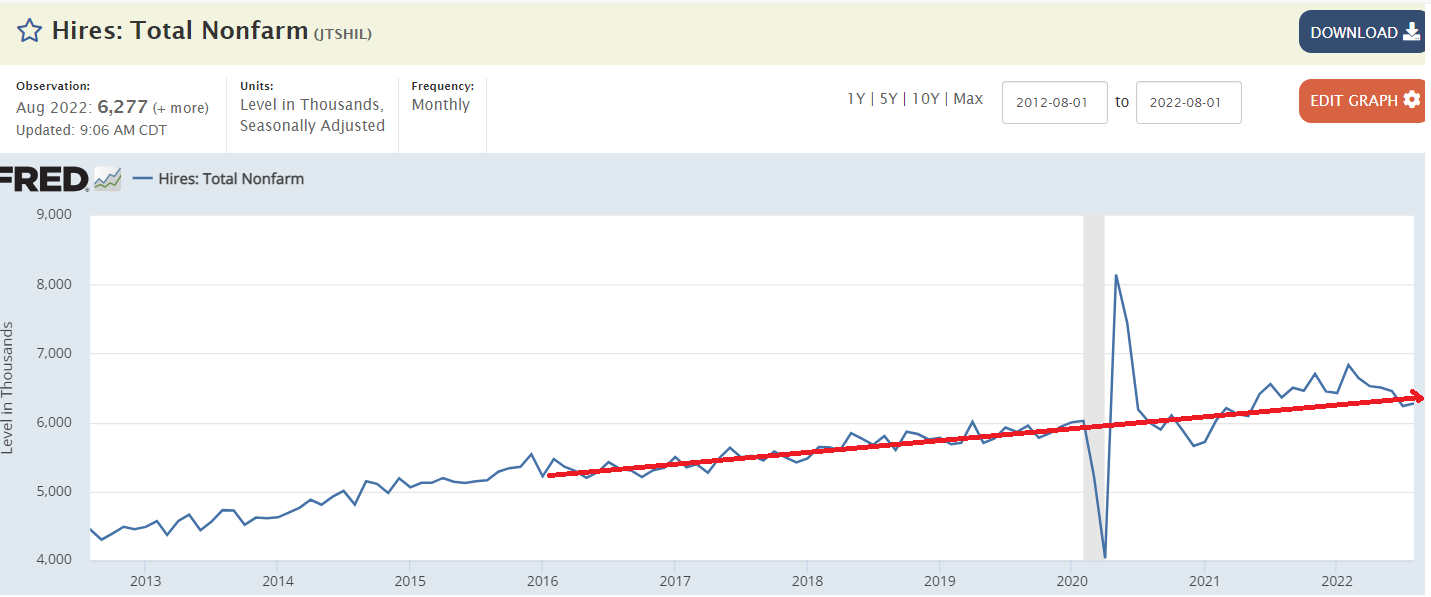

Back to pre-Covid trend line:

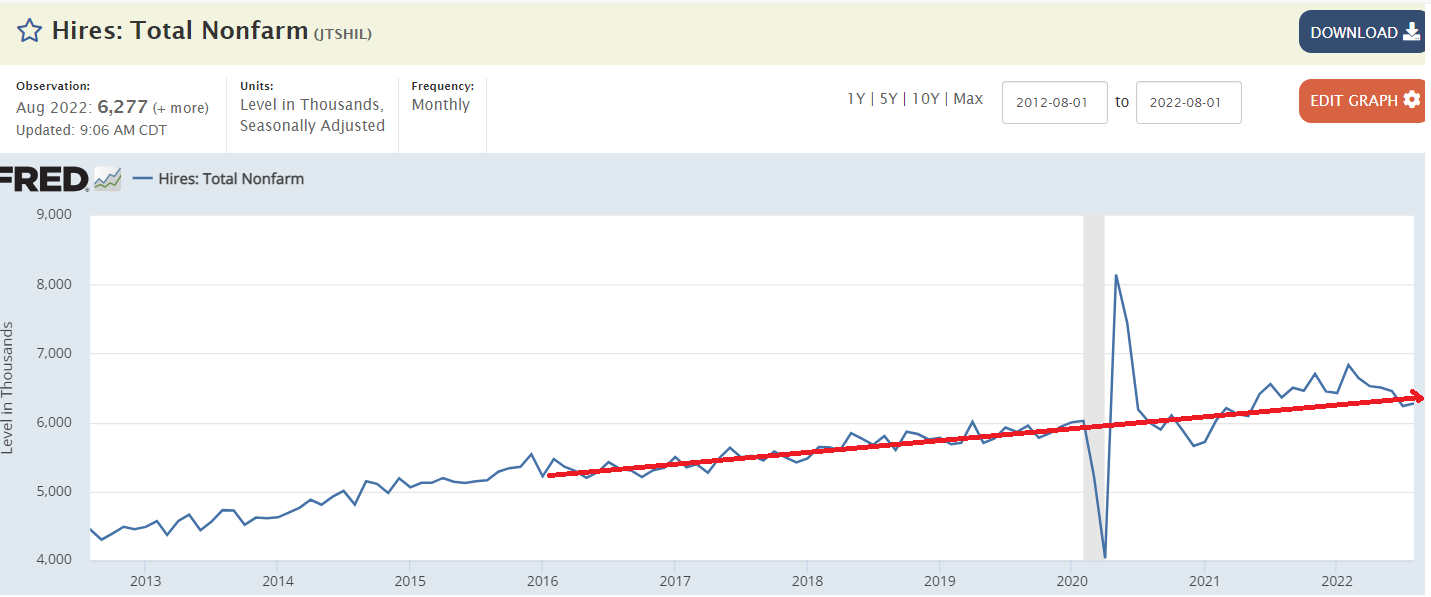

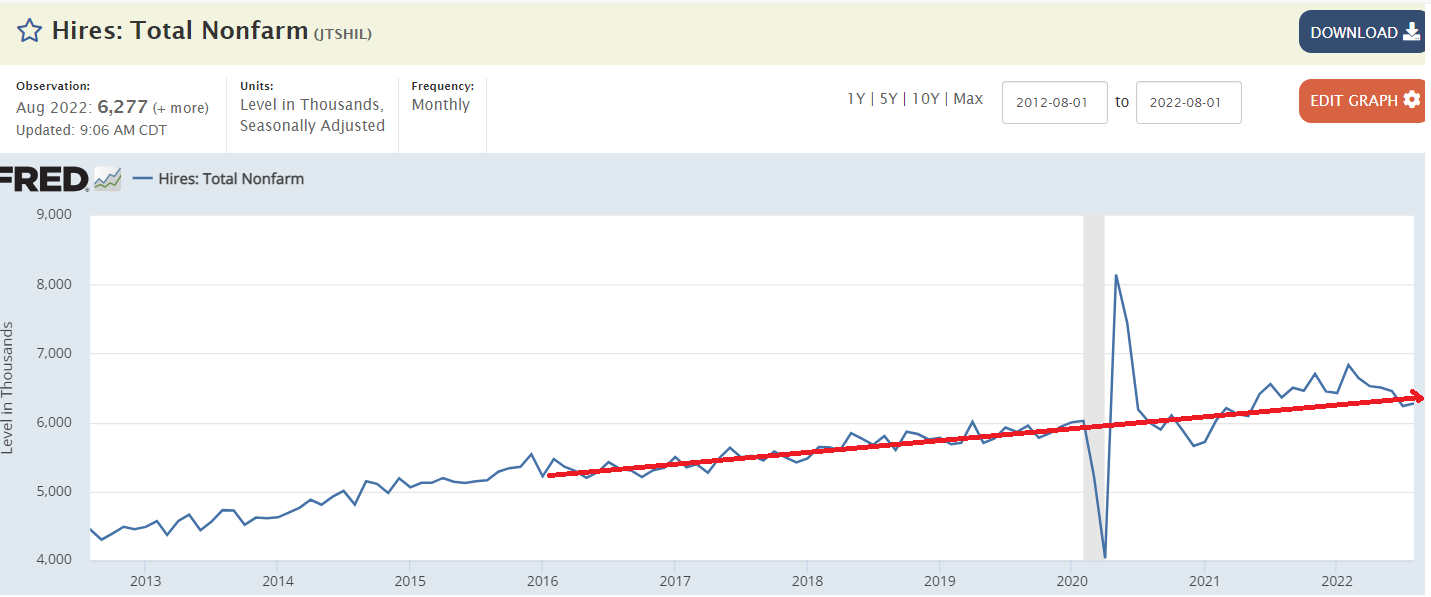

A slight decline for the month but still trending higher. No sign of recession here:

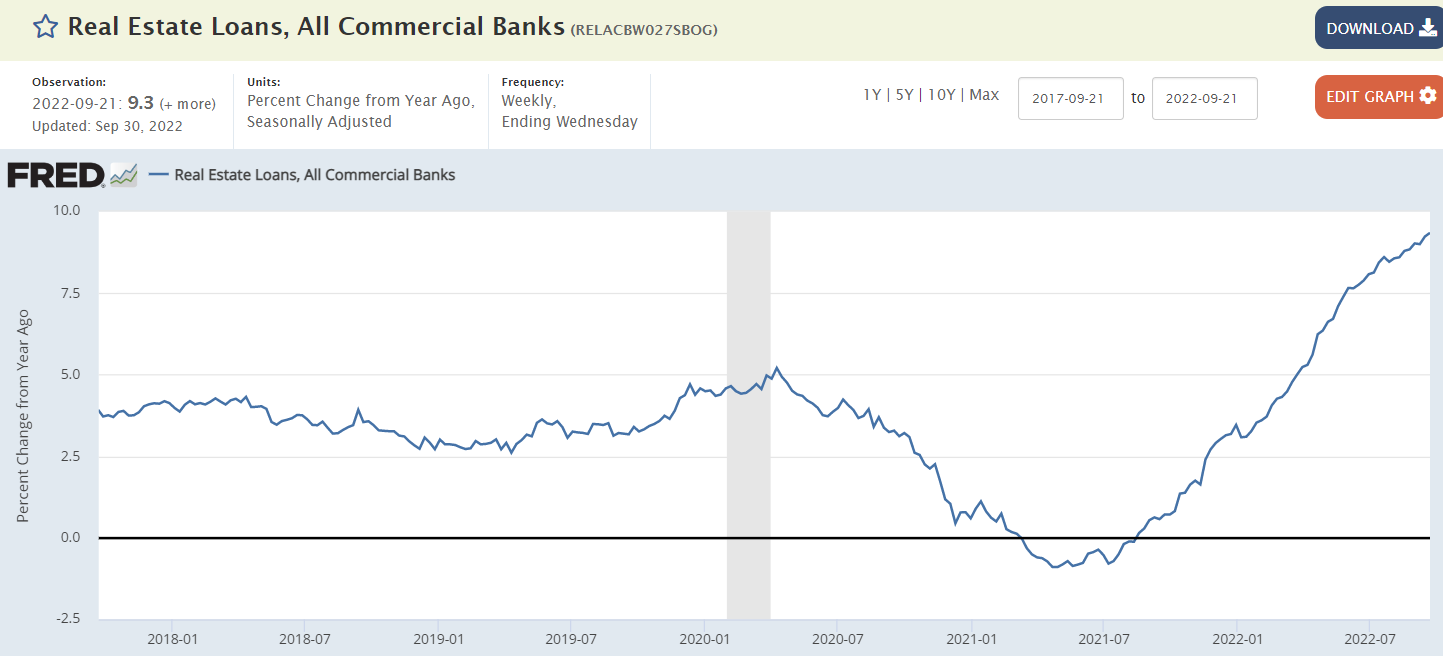

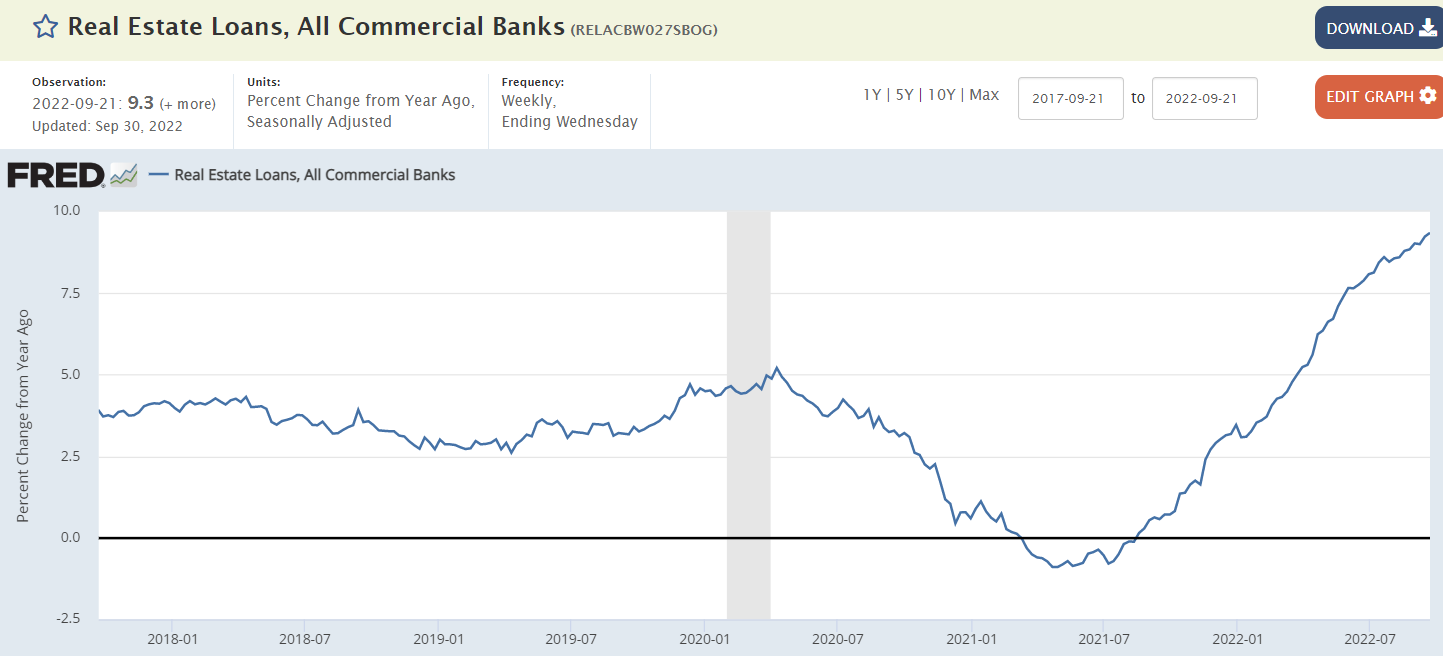

The rate of growth of bank real estate lending continues to increase since the rate hikes were initiated:

Share

The post Job openings, hires, Manufacturers orders, real estate lending appeared first on Mosler Economics / Modern Monetary Theory.

Continues to look to me to like the increased government deficit from the rate hikes, at the macro level, continues to support output and employment and is not triggering a recession as feared?Still a very high number- well above pre-Covid levels:

Continues to look to me to like the increased government deficit from the rate hikes, at the macro level, continues to support output and employment and is not triggering a recession as feared?Still a very high number- well above pre-Covid levels: