Government services provider Maximus (NYSE: MMS) fell short of the market’s revenue expectations in Q4 CY2025, with sales falling 4.1% year on year to $1.35 billion. The company’s full-year revenue guidance of $5.28 billion at the midpoint came in 3.6% below analysts’ estimates. Its non-GAAP profit of $1.85 per share was 1.6% above analysts’ consensus estimates.

Is now the time to buy Maximus? Find out by accessing our full research report, it’s free.

Maximus (MMS) Q4 CY2025 Highlights:

- Revenue: $1.35 billion vs analyst estimates of $1.37 billion (4.1% year-on-year decline, 2.2% miss)

- Adjusted EPS: $1.85 vs analyst estimates of $1.82 (1.6% beat)

- Adjusted EBITDA: $170.4 million vs analyst estimates of $172.4 million (12.7% margin, 1.2% miss)

- The company dropped its revenue guidance for the full year to $5.28 billion at the midpoint from $5.33 billion, a 0.9% decrease

- Management raised its full-year Adjusted EPS guidance to $8.20 at the midpoint, a 1.2% increase

- EBITDA guidance for the full year is $738 million at the midpoint, in line with analyst expectations

- Operating Margin: 10.9%, up from 6.2% in the same quarter last year

- Free Cash Flow was -$250.7 million compared to -$103 million in the same quarter last year

- Market Capitalization: $5.11 billion

"Our first quarter results reflect resilient execution and a portfolio focused on essential government programs. With a strong pipeline, expanding opportunities related to the Working Families Tax Cut Act, and continued progress in technology-enabled service delivery, we remain focused on delivering high-quality services for our government partners and the communities they serve," said Bruce Caswell, President and Chief Executive Officer.

Company Overview

With nearly 50 years of experience translating public policy into operational programs that serve millions of citizens, Maximus (NYSE: MMS) provides operational services, clinical assessments, and technology solutions to government agencies in the U.S. and internationally.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $5.37 billion in revenue over the past 12 months, Maximus is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

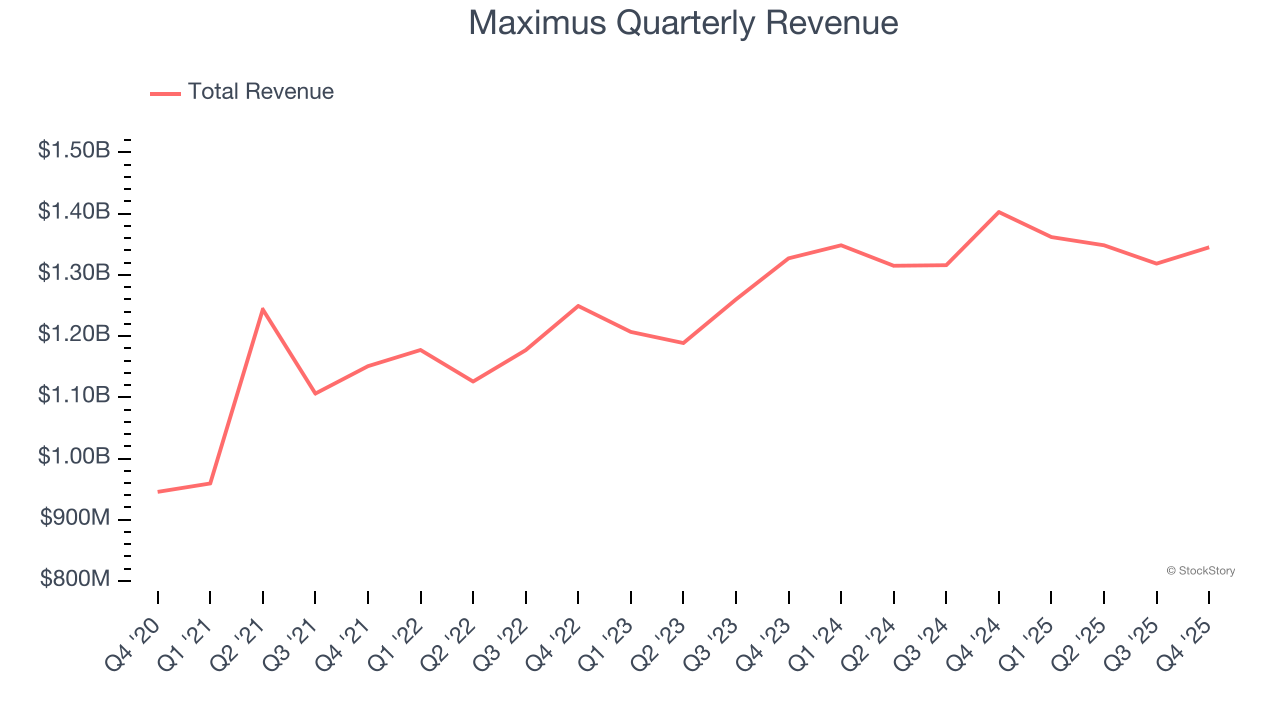

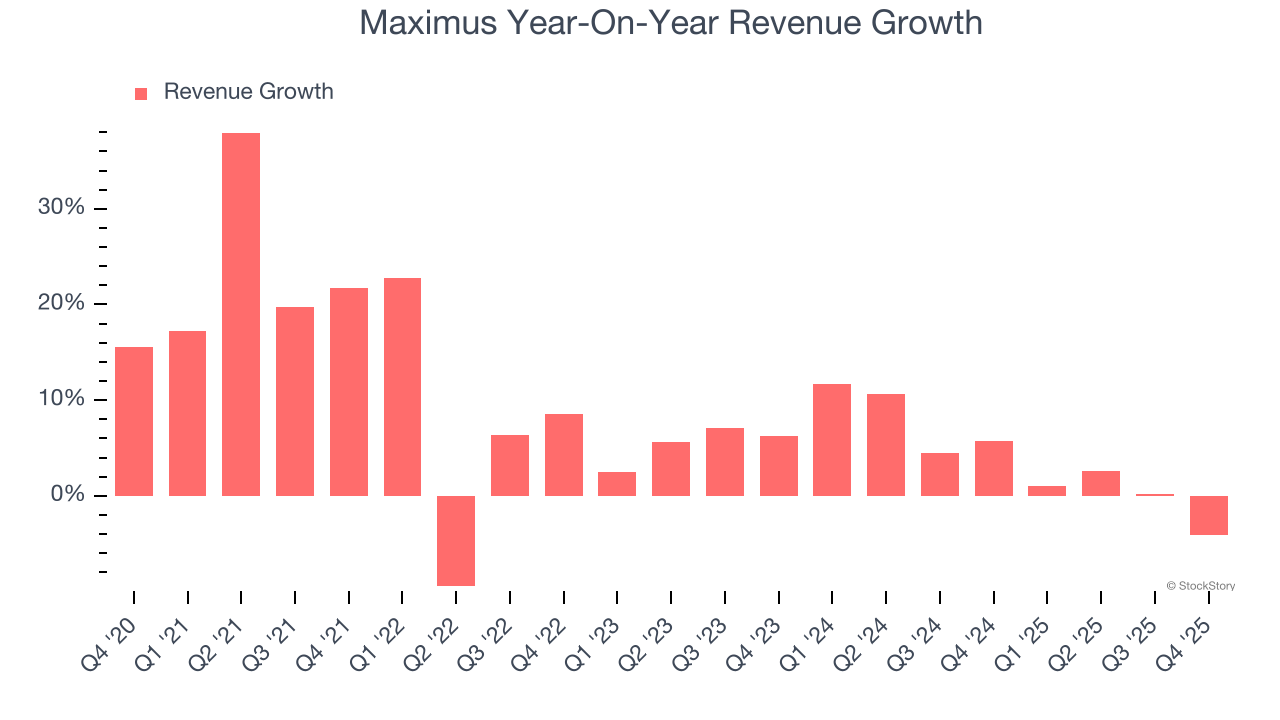

As you can see below, Maximus’s 8.4% annualized revenue growth over the last five years was solid. This is an encouraging starting point for our analysis because it shows Maximus’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Maximus’s recent performance shows its demand has slowed as its annualized revenue growth of 3.9% over the last two years was below its five-year trend.

This quarter, Maximus missed Wall Street’s estimates and reported a rather uninspiring 4.1% year-on-year revenue decline, generating $1.35 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.9% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its newer products and services will not accelerate its top-line performance yet. At least the company is tracking well in other measures of financial health.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

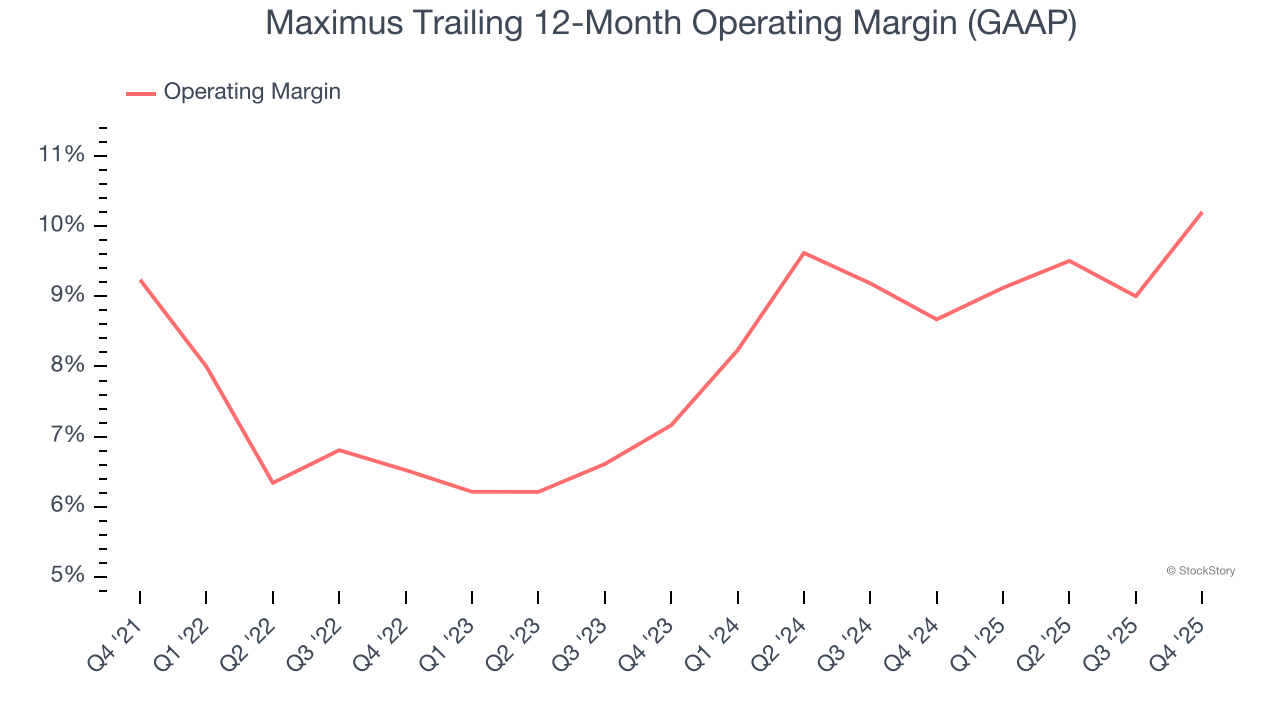

Maximus’s operating margin has been trending up over the last 12 months and averaged 8.4% over the last five years. Although its profitability is still mediocre, we can see its solid revenue growth is giving it operating leverage as it scales. This gives it a shot at higher long-term profits if it can keep expanding.

Looking at the trend in its profitability, Maximus’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Maximus generated an operating margin profit margin of 10.9%, up 4.7 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

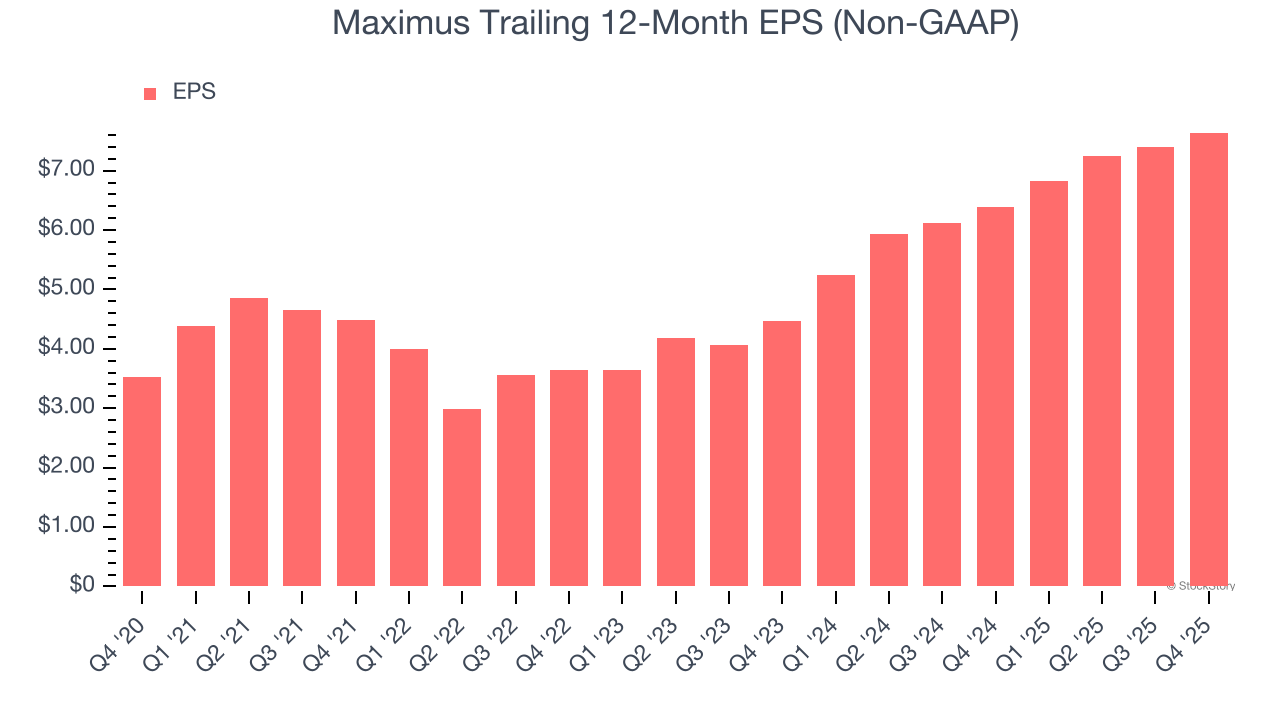

Maximus’s EPS grew at an astounding 16.8% compounded annual growth rate over the last five years, higher than its 8.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Maximus, its two-year annual EPS growth of 30.7% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Maximus reported adjusted EPS of $1.85, up from $1.61 in the same quarter last year. This print beat analysts’ estimates by 1.6%. Over the next 12 months, Wall Street expects Maximus’s full-year EPS of $7.64 to grow 12%.

Key Takeaways from Maximus’s Q4 Results

It was good to see Maximus beat analysts’ EPS expectations this quarter. On the other hand, its full-year revenue guidance missed and its revenue fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $93.69 immediately after reporting.

So should you invest in Maximus right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).