While the S&P 500 is up 16.4% since March 2025, BankUnited (currently trading at $37.91 per share) has lagged behind, posting a return of 10.4%. This might have investors contemplating their next move.

Is now the time to buy BankUnited, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Do We Think BankUnited Will Underperform?

We're swiping left on BankUnited for now. Here are three reasons we avoid BKU and a stock we'd rather own.

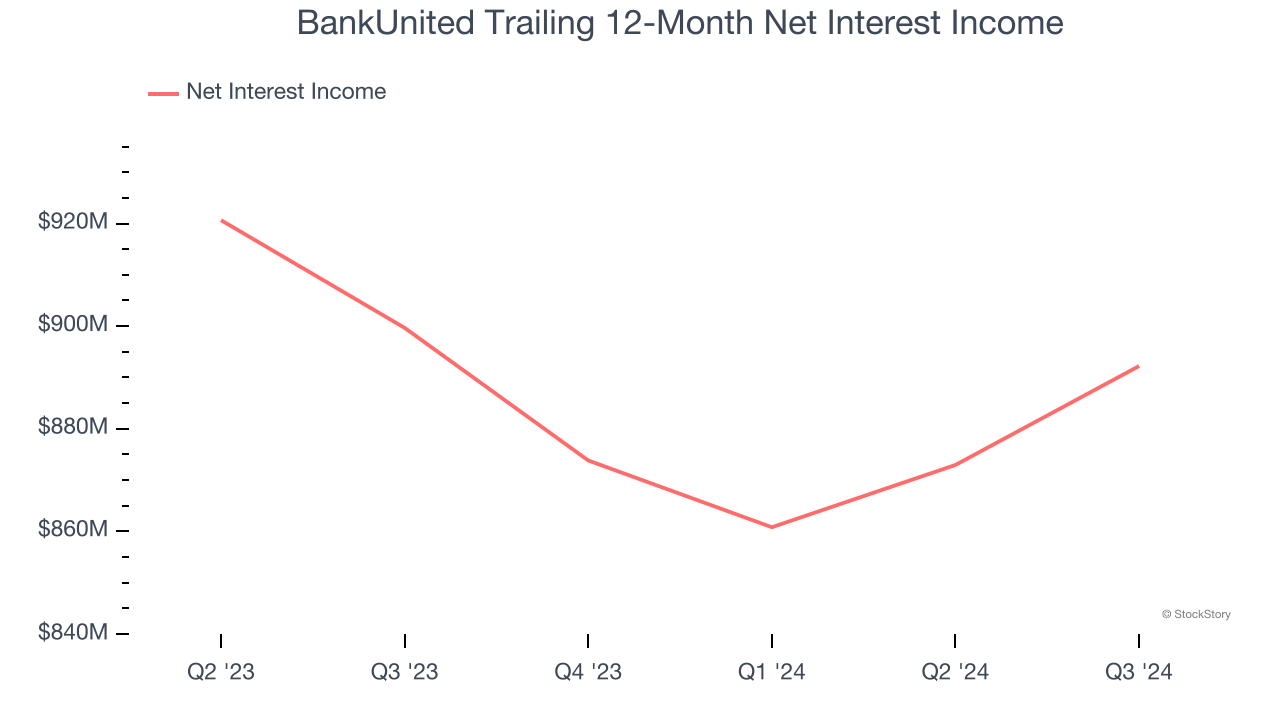

1. Net Interest Income Points to Soft Demand

Markets consistently prioritize net interest income over non-recurring fees, recognizing its superior quality compared to the more unpredictable revenue streams.

BankUnited’s net interest income has grown at a 5.3% annualized rate over the last five years, worse than the broader banking industry. Its growth was driven by an increase in its net interest margin, which represents how much a bank earns in relation to its outstanding loans, as its loan book shrank throughout that period.

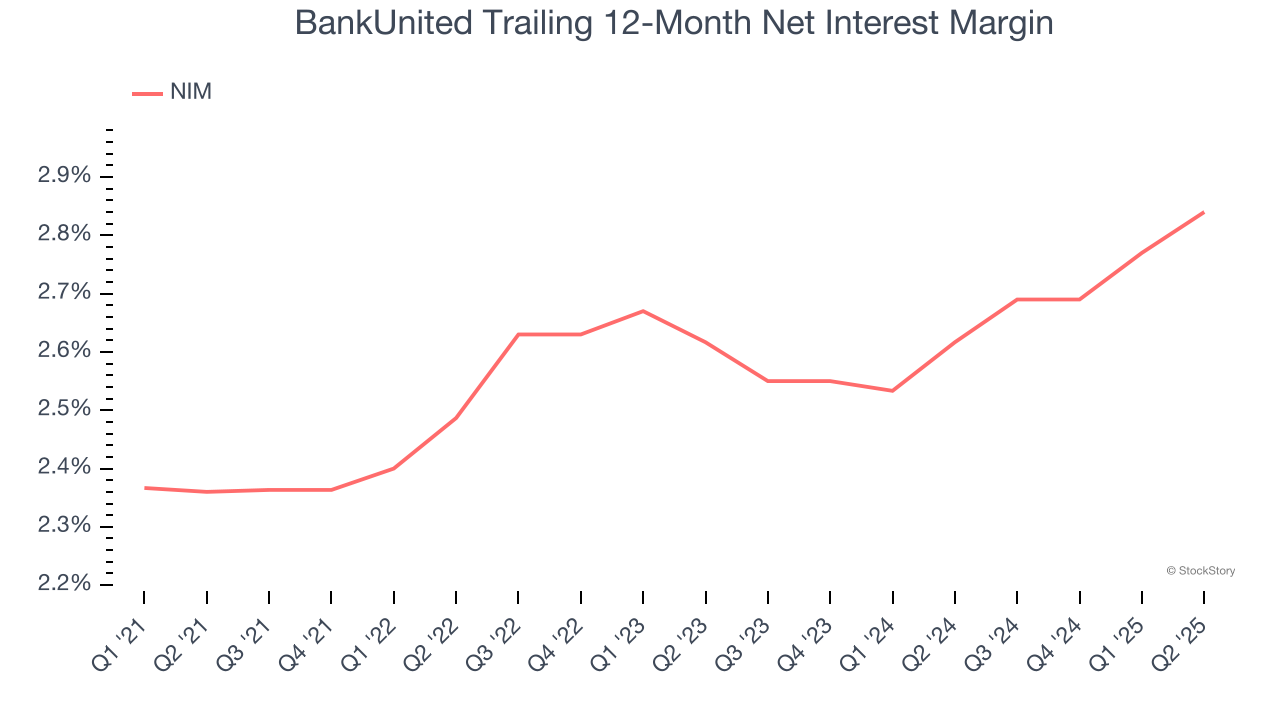

2. Low Net Interest Margin Reveals Weak Loan Book Profitability

Net interest margin (NIM) represents the unit economics of a bank by measuring the profitability of its interest-bearing assets relative to its interest-bearing liabilities. It's a fundamental metric that investors use to assess lending premiums and returns.

Over the past two years, we can see that BankUnited’s net interest margin averaged a weak 2.7%, indicating the company has weak loan book economics.

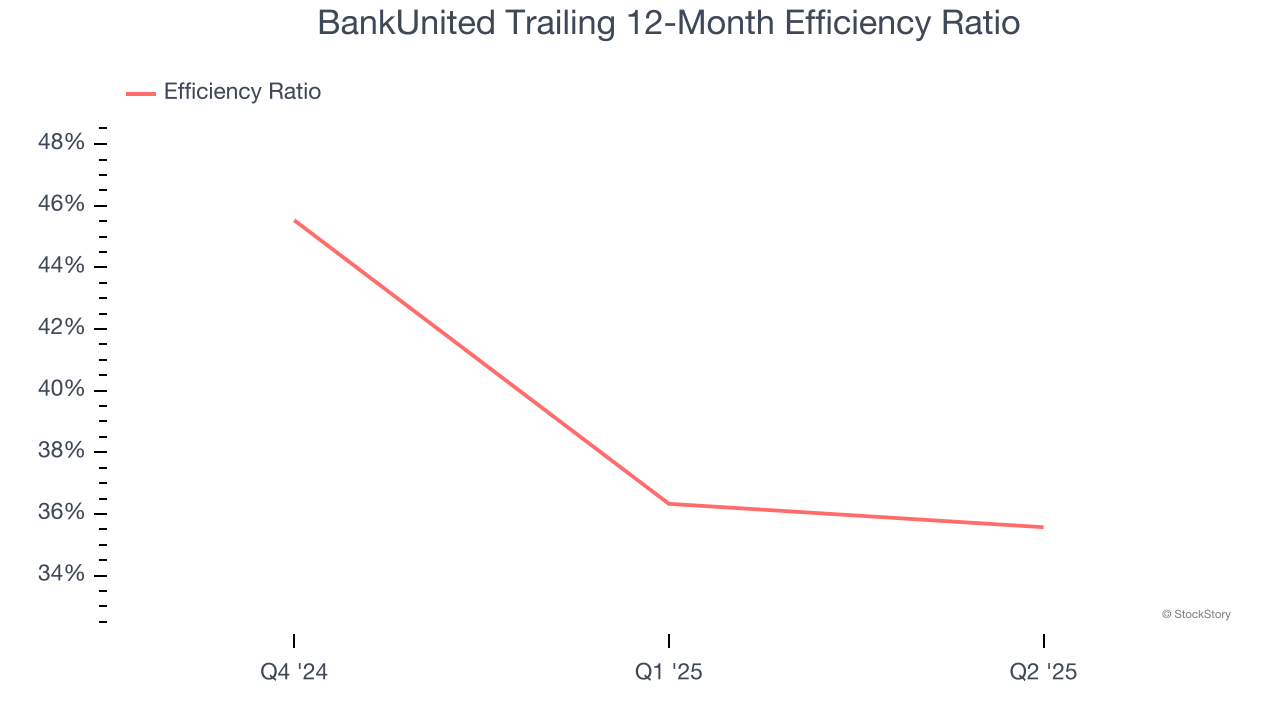

3. Efficiency Ratio Expected to Falter

The underlying profitability of top-line growth determines the actual bottom-line impact. Banking institutions measure this dynamic using the efficiency ratio, which is calculated by dividing non-interest expenses like personnel, facilities, technology, and marketing by total revenue.

Investors focus on efficiency ratio changes rather than absolute levels, understanding that expense structures vary by revenue mix. Counterintuitively, lower efficiency ratios indicate better performance since they represent lower costs relative to revenue.

For the next 12 months, Wall Street expects BankUnited to become less profitable as it anticipates an efficiency ratio of 61.4% compared to 35.6% over the past year.

Final Judgment

BankUnited doesn’t pass our quality test. With its shares underperforming the market lately, the stock trades at 0.9× forward P/B (or $37.91 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. Let us point you toward one of our all-time favorite software stocks.

Stocks We Like More Than BankUnited

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.