AutoZone has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 16.1% to $4,285 per share while the index has gained 16%.

Is AZO a buy right now? Find out in our full research report, it’s free.

Why Are We Positive On AZO?

Aiming to be a one-stop shop for the DIY customer, AutoZone (NYSE: AZO) is an auto parts and accessories retailer that sells everything from car batteries to windshield wiper fluid to brake pads.

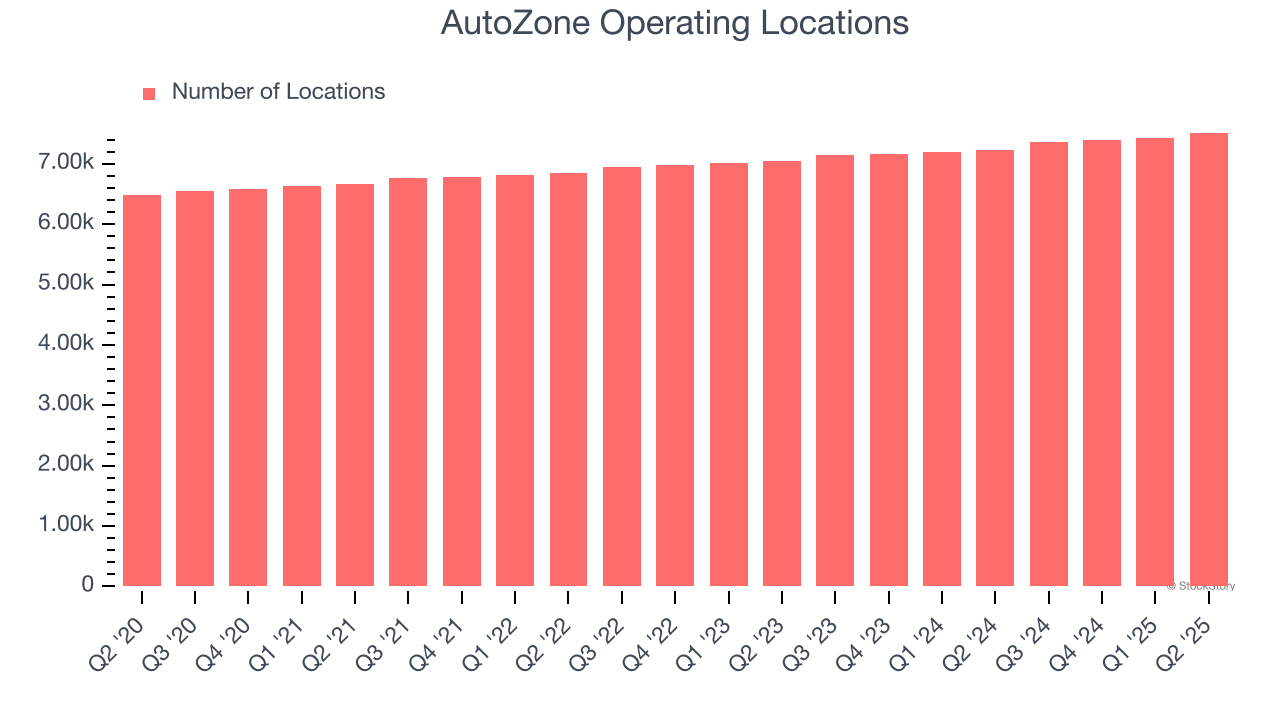

1. New Stores Popping Up Gradually, Supports Growth

A retailer’s store count often determines how much revenue it can generate.

AutoZone operated 7,516 locations in the latest quarter. It has opened new stores quickly over the last two years, averaging 3% annual growth, faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

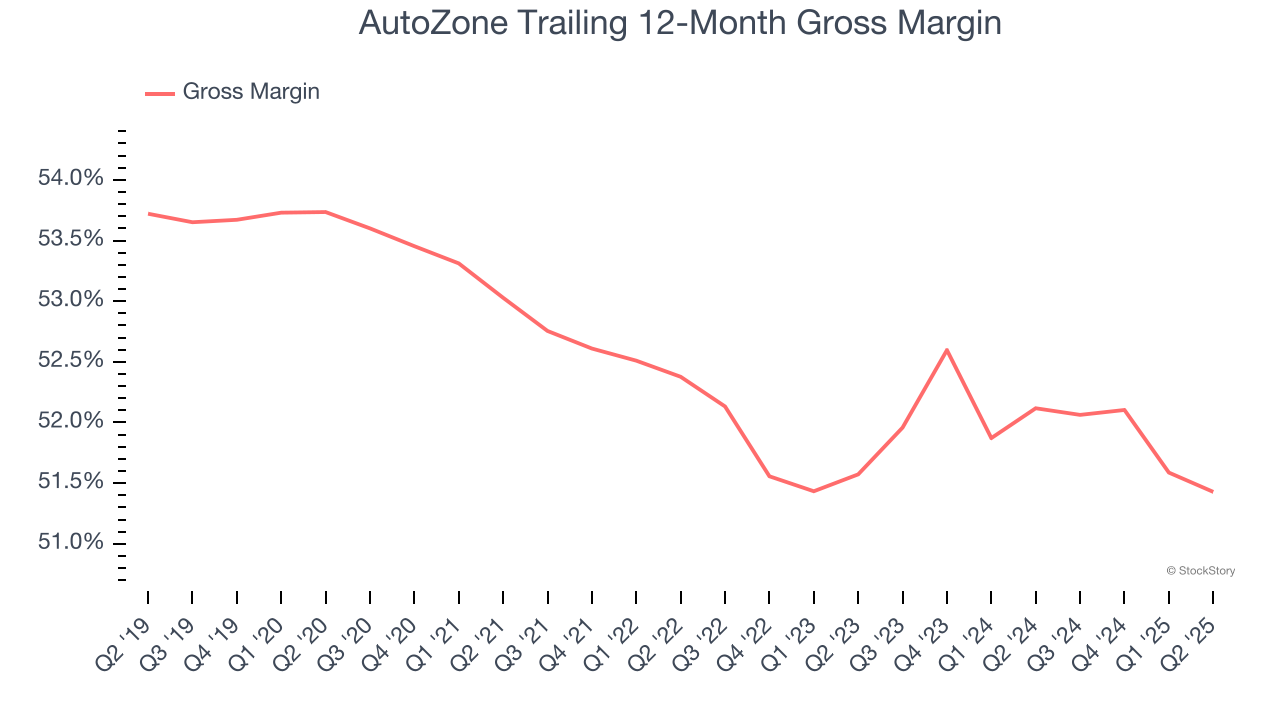

2. Elite Gross Margin Powers Best-In-Class Business Model

Gross profit margins are an important measure of a retailer’s pricing power, product differentiation, and negotiating leverage.

AutoZone has best-in-class unit economics for a retailer, enabling it to invest in areas such as marketing and talent. As you can see below, it averaged an elite 51.8% gross margin over the last two years. That means AutoZone only paid its suppliers $48.24 for every $100 in revenue.

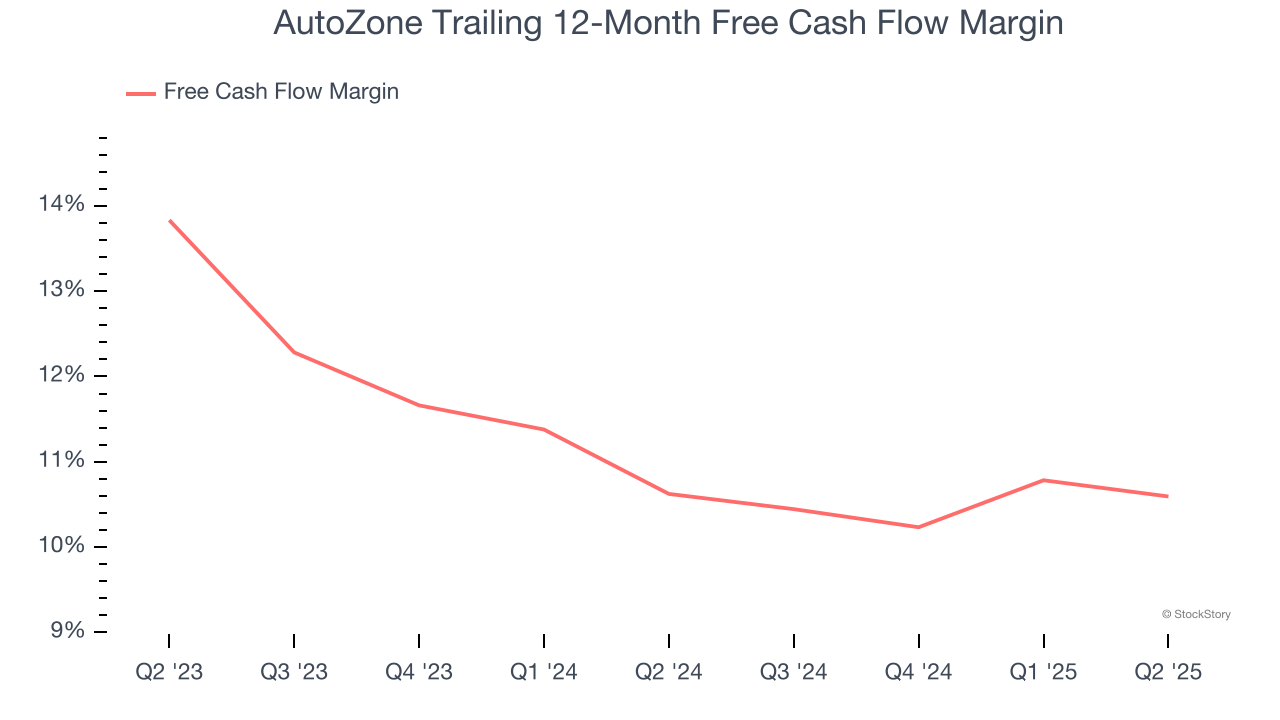

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

AutoZone has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer retail sector, averaging 10.6% over the last two years.

Final Judgment

These are just a few reasons AutoZone is a rock-solid business worth owning, but at $4,285 per share (or 25.9× forward P/E), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.