Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at Boot Barn (NYSE: BOOT) and its peers.

Footwear sales–like their apparel counterparts–are driven by seasons, trends, and innovation more so than absolute need and similarly face the bigger-picture secular trend of e-commerce penetration. Footwear plays a part in societal belonging, personal expression, and occasion, and retailers selling shoes recognize this. Therefore, they aim to balance selection, competitive prices, and the latest trends to attract consumers. Unlike their apparel counterparts, footwear retailers most sell popular third-party brands (as opposed to their own exclusive brands), which could mean less exclusivity of product but more nimbleness to pivot to what’s hot.

The 4 footwear retailer stocks we track reported a slower Q4. As a group, revenues missed analysts’ consensus estimates by 1.7% while next quarter’s revenue guidance was 0.5% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 24.4% since the latest earnings results.

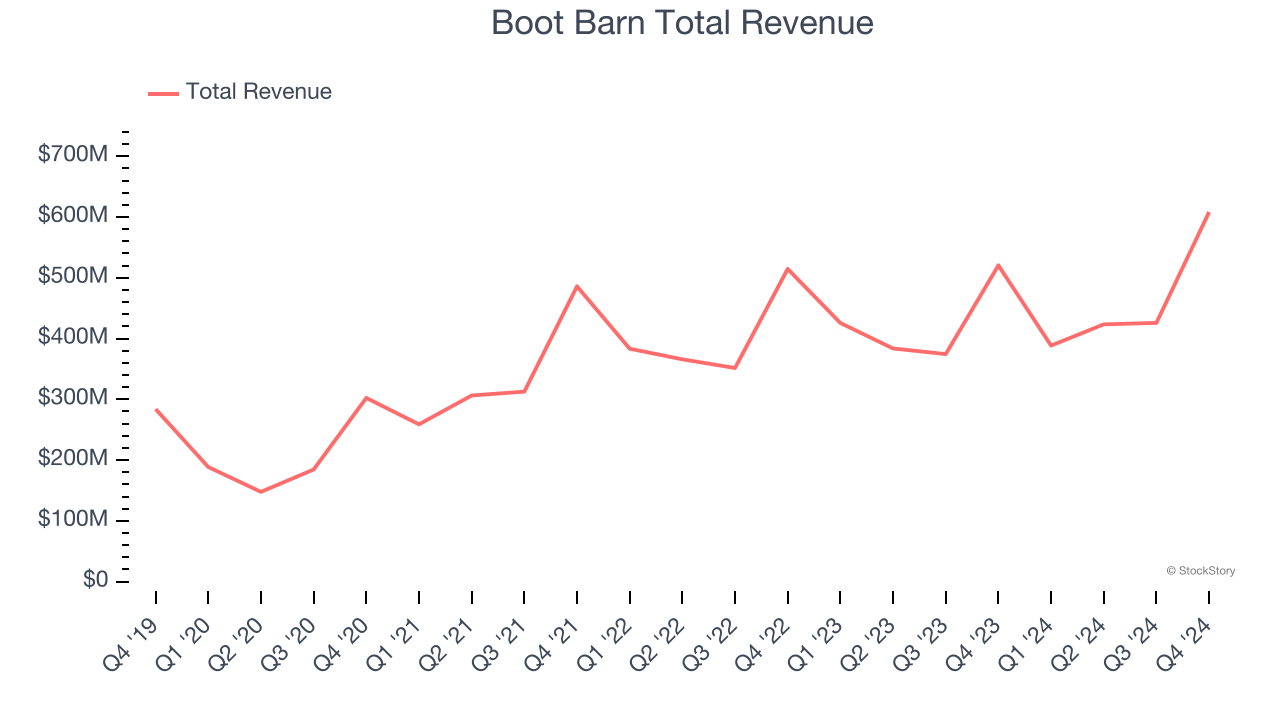

Boot Barn (NYSE: BOOT)

With a strong store presence in Texas, California, Florida, and Oklahoma, Boot Barn (NYSE: BOOT) is a western-inspired apparel and footwear retailer.

Boot Barn reported revenues of $608.2 million, up 16.9% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a decent beat of analysts’ EBITDA estimates but EPS guidance for next quarter missing analysts’ expectations.

John Hazen, Interim Chief Executive Officer, commented, “I want to thank the entire Boot Barn team for their excellent execution and dedication during a busy holiday season, which resulted in strong third quarter results and earnings per diluted share above the high-end of our guidance range. The strength we saw in the business was once again driven by broad-based growth across all major merchandise categories, channels and geographies, resulting in a consolidated same store sales increase of 8.6%. We also grew total sales 16.9% compared to the prior-year period, driven in part by the 13 new stores we opened in the third quarter and the 39 new stores we have opened year-to-date through our third fiscal quarter. In addition to strong sales, we continued to maintain our full-price selling model, resulting in merchandise margin expansion of 130 basis points. As we enter our fourth fiscal quarter, we feel very good about the overall tone of the business and the future growth potential of the brand.”

Boot Barn pulled off the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise of the whole group. Still, the market seems discontent with the results. The stock is down 28.2% since reporting and currently trades at $117.64.

Read our full report on Boot Barn here, it’s free.

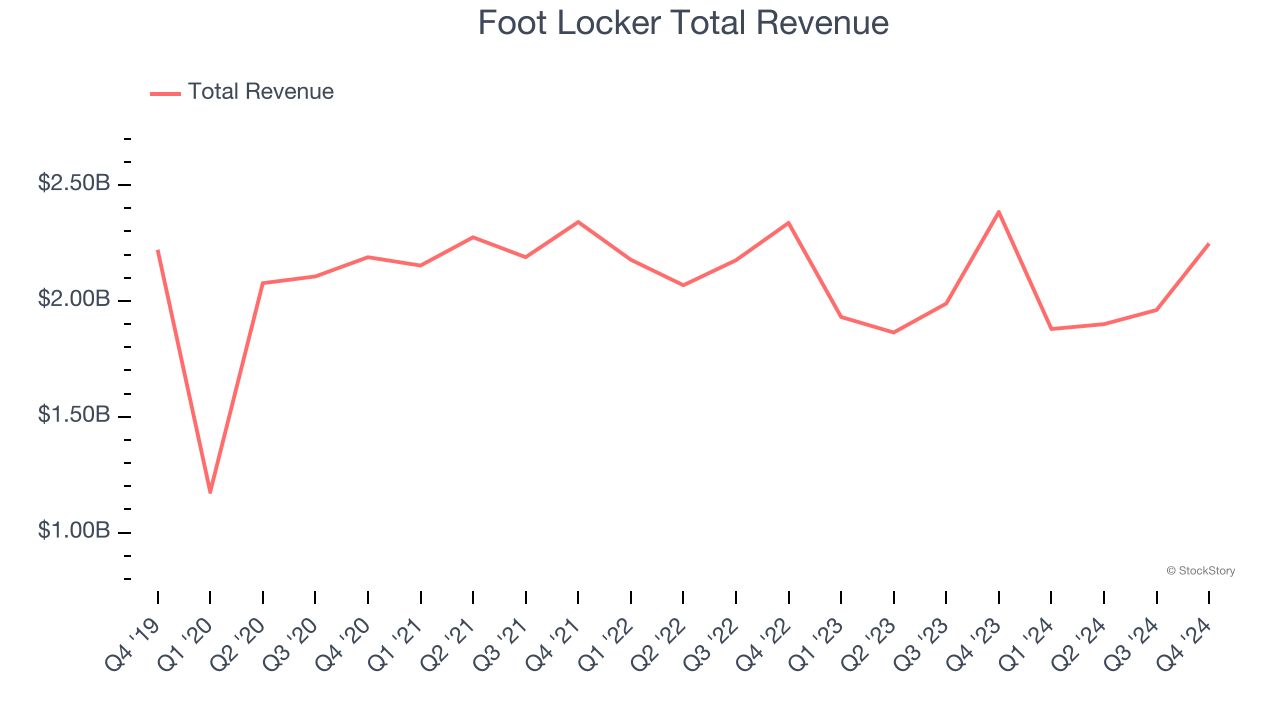

Best Q4: Foot Locker (NYSE: FL)

Known for store associates whose uniforms resemble those of referees, Foot Locker (NYSE: FL) is a specialty retailer that sells athletic footwear, clothing, and accessories.

Foot Locker reported revenues of $2.25 billion, down 5.7% year on year, falling short of analysts’ expectations by 3.2%. The business performed better than its peers, but it was unfortunately a mixed quarter with a solid beat of analysts’ EBITDA estimates but full-year EPS guidance missing analysts’ expectations.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 28.2% since reporting. It currently trades at $12.48.

Is now the time to buy Foot Locker? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: Designer Brands (NYSE: DBI)

Founded in 1969 as a shoe importer and distributor, Designer Brands (NYSE: DBI) is an American discount retailer focused on footwear and accessories.

Designer Brands reported revenues of $713.6 million, down 5.4% year on year, falling short of analysts’ expectations by 0.8%. It was a disappointing quarter as it posted full-year EPS guidance missing analysts’ expectations.

As expected, the stock is down 13% since the results and currently trades at $3.30.

Read our full analysis of Designer Brands’s results here.

Shoe Carnival (NASDAQ: SCVL)

Known for its playful atmosphere that features carnival elements, Shoe Carnival (NASDAQ: SCVL) is a retailer that sells footwear from mainstream brands for the entire family.

Shoe Carnival reported revenues of $262.9 million, down 6.1% year on year. This print missed analysts’ expectations by 2.7%. Overall, it was a softer quarter as it also produced full-year EPS guidance missing analysts’ expectations.

Shoe Carnival had the slowest revenue growth and weakest full-year guidance update among its peers. The stock is down 23.6% since reporting and currently trades at $17.30.

Read our full, actionable report on Shoe Carnival here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.