Medical device company Penumbra (NYSE: PEN) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 10.8% year on year to $315.5 million. On the other hand, the company’s full-year revenue guidance of $1.35 billion at the midpoint came in 0.8% below analysts’ estimates. Its non-GAAP profit of $0.97 per share was 8.5% above analysts’ consensus estimates.

Is now the time to buy Penumbra? Find out by accessing our full research report, it’s free.

Penumbra (PEN) Q4 CY2024 Highlights:

- Revenue: $315.5 million vs analyst estimates of $311.7 million (10.8% year-on-year growth, 1.2% beat)

- Adjusted EPS: $0.97 vs analyst estimates of $0.89 (8.5% beat)

- Adjusted EBITDA: $63.68 million vs analyst estimates of $52.26 million (20.2% margin, 21.9% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.35 billion at the midpoint, missing analyst estimates by 0.8% and implying 13% growth (vs 13% in FY2024)

- Operating Margin: 13.6%, up from 12.3% in the same quarter last year

- Constant Currency Revenue rose 13% year on year (27.9% in the same quarter last year)

- Market Capitalization: $10.25 billion

Company Overview

Founded in 2004, Penumbra (NYSE: PEN) designs and manufactures medical devices, focusing on the treatment of neurological and vascular diseases.

Medical Devices & Supplies - Cardiology, Neurology, Vascular

The medical devices and supplies industry, particularly in the fields of cardiology, neurology, and vascular care, benefits from a business model that balances innovation with relatively predictable revenue streams. These companies focus on developing life-saving devices such as stents, pacemakers, neurostimulation implants, and vascular access tools, which address critical and often chronic conditions. The recurring need for these devices, coupled with growing global demand for advanced treatments, provides stability and opportunities for long-term growth. However, the industry faces hurdles such as high research and development costs, rigorous regulatory approval processes, and reliance on reimbursement from healthcare systems, which can exert downward pressure on pricing. Looking ahead, the industry is positioned to benefit from tailwinds such as aging populations (which tend to have higher rates of disease) and technological advancements like minimally invasive procedures and connected devices that improve patient monitoring and outcomes. Innovations in robotic-assisted surgery and AI-driven diagnostics are also expected to accelerate adoption and expand treatment capabilities. However, potential headwinds include pricing pressures stemming from value-based care models and continued complexity changing from navigating regulatory frameworks that may prioritize further lowering healthcare costs.

Sales Growth

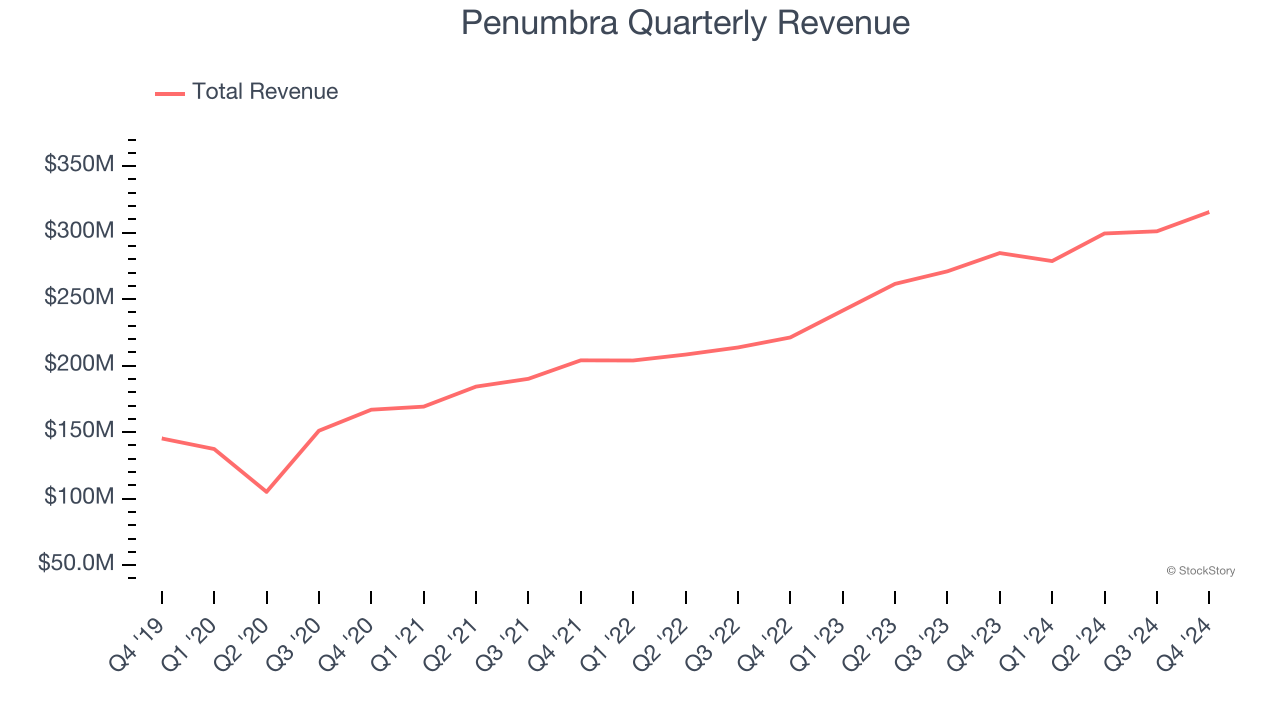

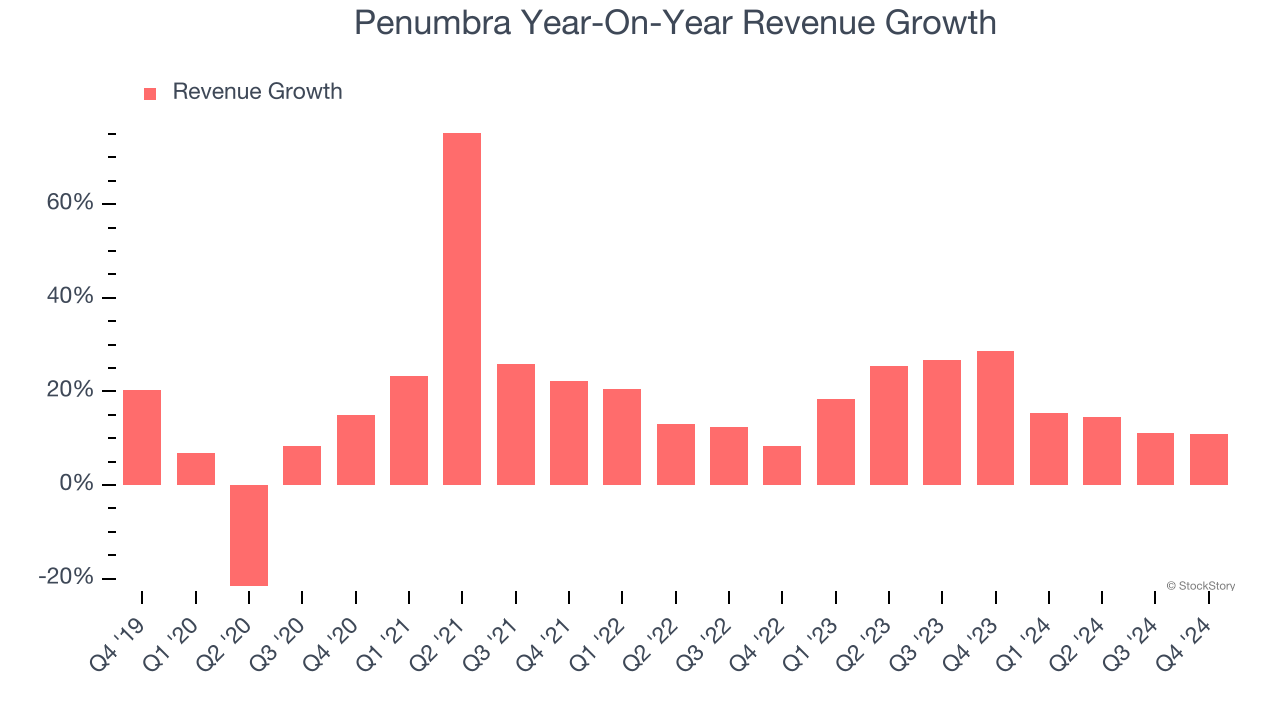

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Luckily, Penumbra’s sales grew at an impressive 16.9% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Penumbra’s annualized revenue growth of 18.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

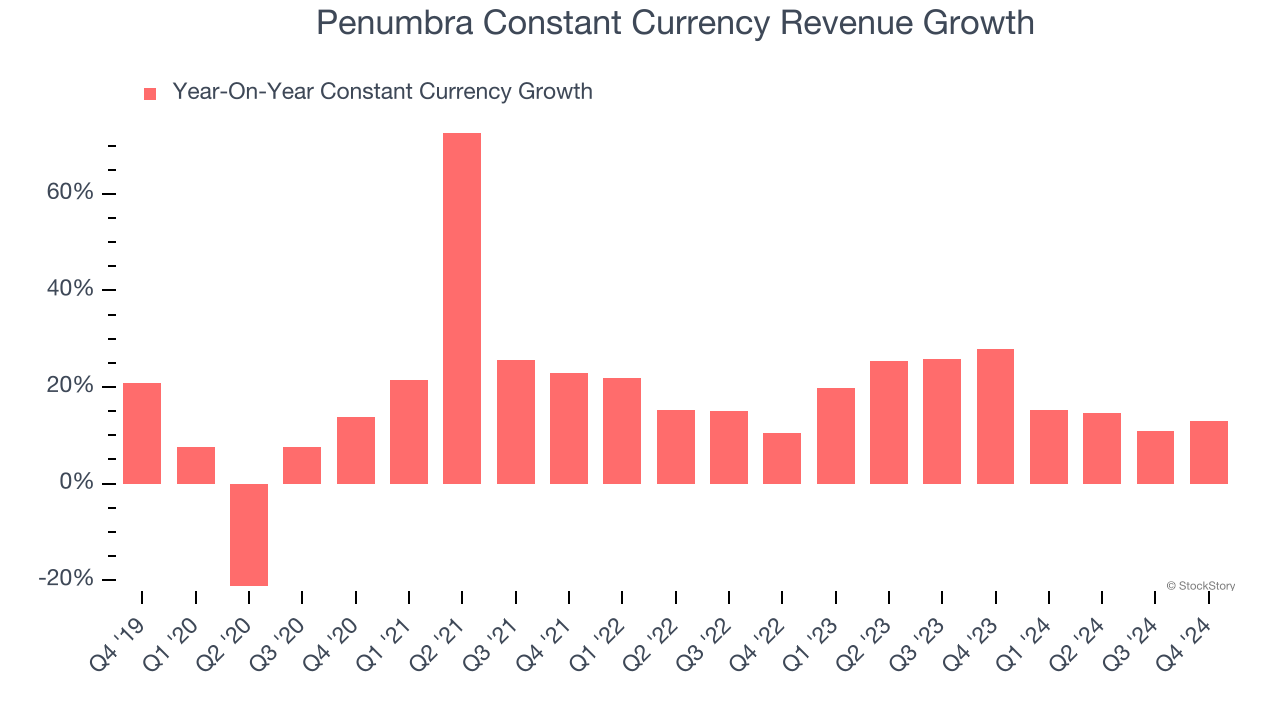

Penumbra also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales averaged 19.1% year-on-year growth. Because this number aligns with its normal revenue growth, we can see Penumbra’s foreign exchange rates have been steady.

This quarter, Penumbra reported year-on-year revenue growth of 10.8%, and its $315.5 million of revenue exceeded Wall Street’s estimates by 1.2%.

Looking ahead, sell-side analysts expect revenue to grow 14% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is noteworthy and implies the market sees success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

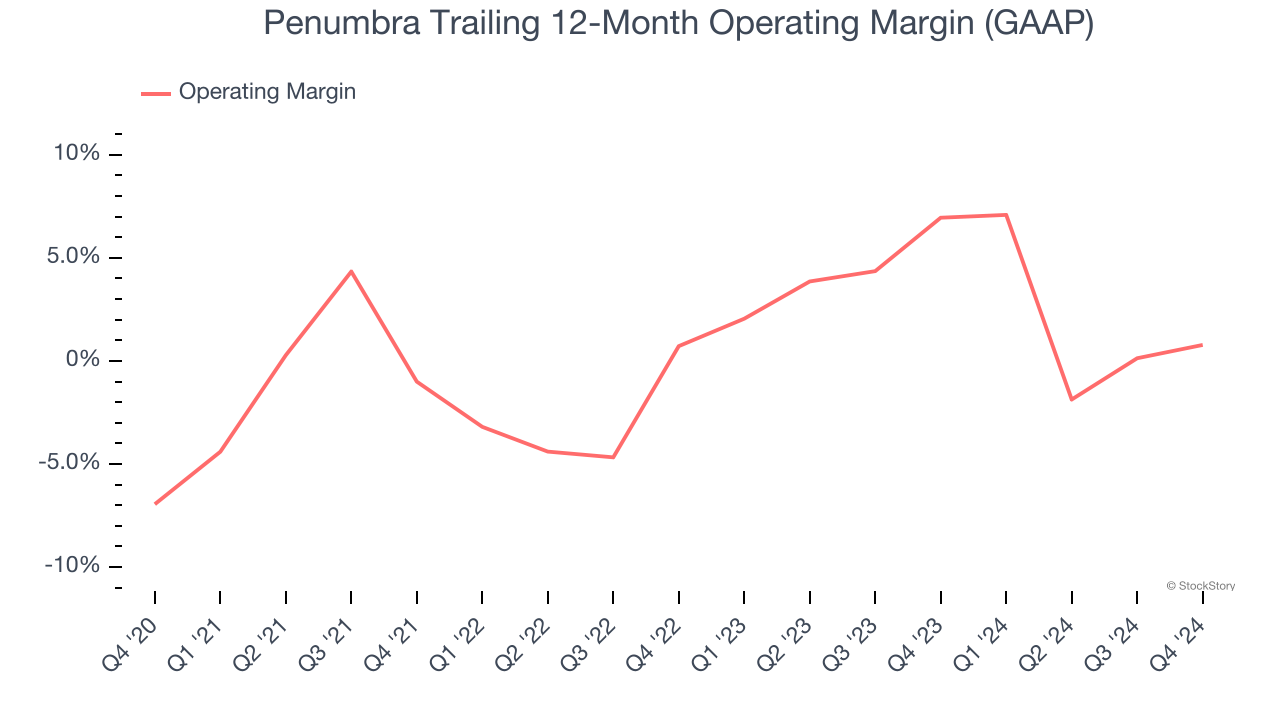

Penumbra was roughly breakeven when averaging the last five years of quarterly operating profits, lousy for a healthcare business.

On the plus side, Penumbra’s operating margin rose by 7.7 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its past improvements as the company’s margin was relatively unchanged on two-year basis.

In Q4, Penumbra generated an operating profit margin of 13.6%, up 1.3 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

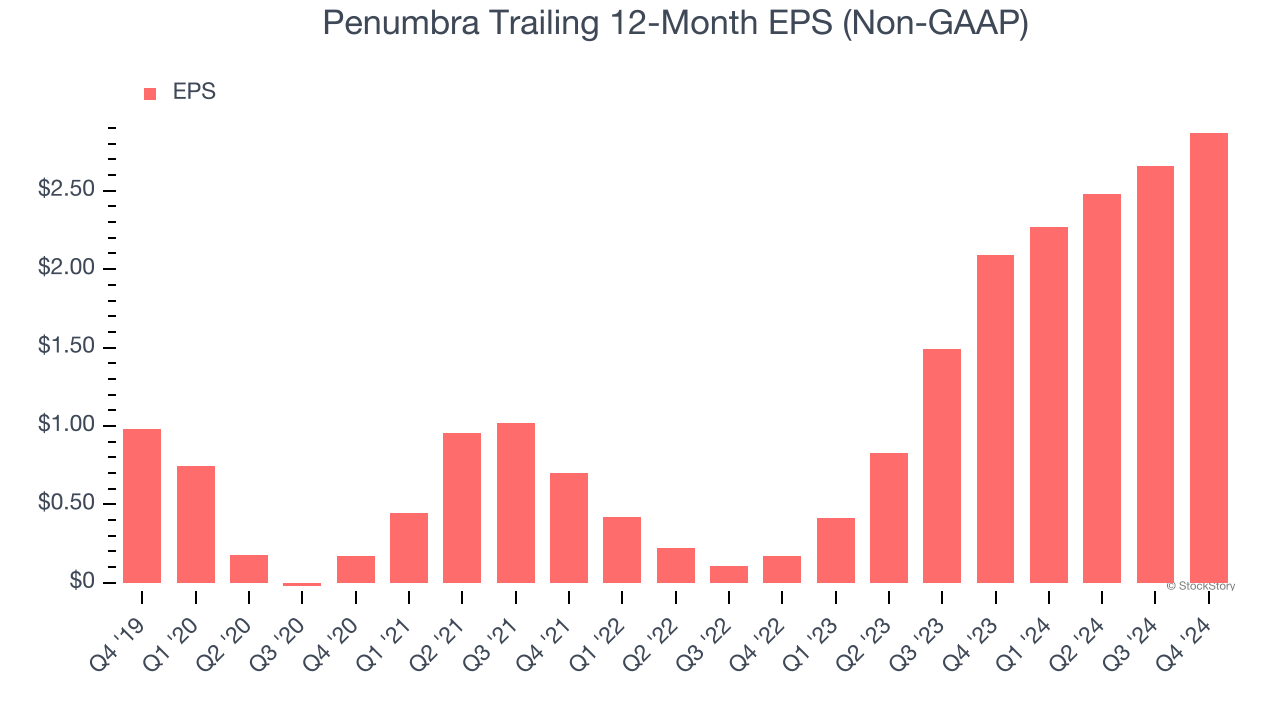

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Penumbra’s EPS grew at an astounding 23.9% compounded annual growth rate over the last five years, higher than its 16.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Penumbra’s earnings can give us a better understanding of its performance. As we mentioned earlier, Penumbra’s operating margin expanded by 7.7 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Penumbra reported EPS at $0.97, up from $0.76 in the same quarter last year. This print beat analysts’ estimates by 8.5%. Over the next 12 months, Wall Street expects Penumbra’s full-year EPS of $2.87 to grow 33.2%.

Key Takeaways from Penumbra’s Q4 Results

We were impressed by how significantly Penumbra blew past analysts’ constant currency revenue expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance slightly missed. Overall, this quarter had some key positives. The stock traded up 3.1% to $279 immediately after reporting.

Big picture, is Penumbra a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.