Looking back on ground transportation stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including Saia (NASDAQ: SAIA) and its peers.

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

The 15 ground transportation stocks we track reported a slower Q4. As a group, revenues were in line with analysts’ consensus estimates.

While some ground transportation stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.4% since the latest earnings results.

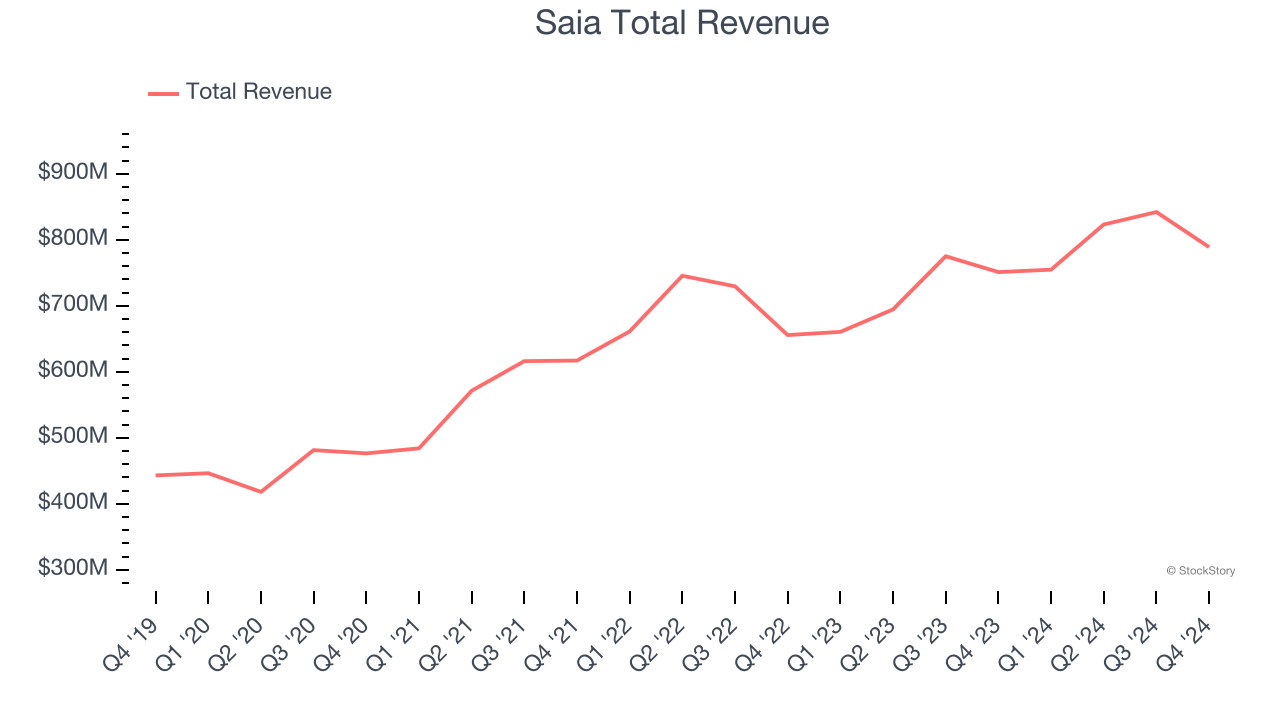

Saia (NASDAQ: SAIA)

Pivoting its business model after realizing there was more success in delivering produce than selling it, Saia (NASDAQ: SAIA) is a provider of freight transportation solutions.

Saia reported revenues of $789 million, up 5% year on year. This print exceeded analysts’ expectations by 1.5%. Overall, it was a strong quarter for the company with a solid beat of analysts’ sales volume estimates and a decent beat of analysts’ adjusted operating income estimates.

Saia President and CEO, Fritz Holzgrefe, commented on the year stating, “I am pleased with the progress we made this year, as we opened 21 new terminals and relocated 9 others, further enhancing our service offerings in both new and existing markets. We are proud to bring our 100th year in operation to a close with 214 terminals and our ability to provide direct service to all 48 contiguous states, positioning us as a leading national carrier. We remain focused on operational excellence and are pleased with customer acceptance thus far. We onboarded approximately 1,300 new team members during the year and closed 2024 with over 15,000 employees company-wide.”

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $476.10.

Is now the time to buy Saia? Access our full analysis of the earnings results here, it’s free.

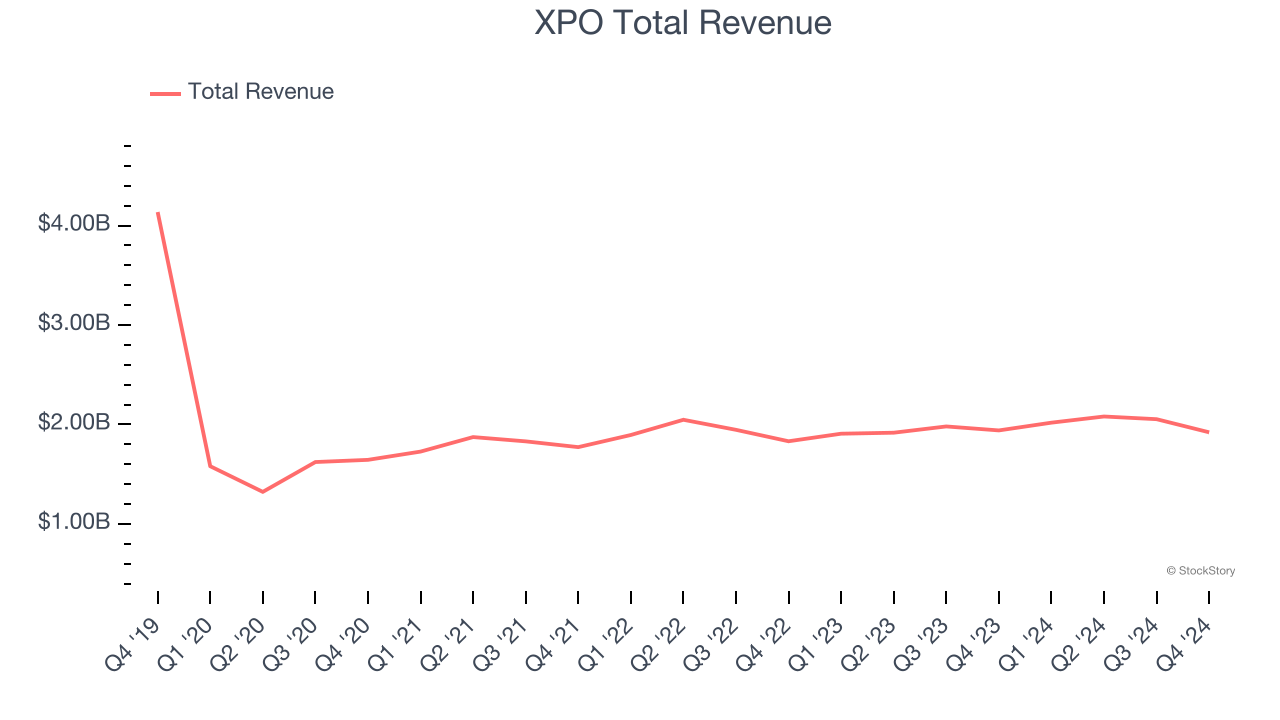

Best Q4: XPO (NYSE: XPO)

Owning a mobile game simulating freight operations for the Tour de France, XPO (NYSE: XPO) is a transportation company specializing in expedited shipping services.

XPO reported revenues of $1.92 billion, flat year on year, in line with analysts’ expectations. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 6.8% since reporting. It currently trades at $145.64.

Is now the time to buy XPO? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Werner (NASDAQ: WERN)

Conducting business in over a 100 countries, Werner (NASDAQ: WERN) offers full-truckload, less-than-truckload, and intermodal delivery services.

Werner reported revenues of $754.7 million, down 8.2% year on year, falling short of analysts’ expectations by 0.9%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Werner delivered the slowest revenue growth in the group. The stock is flat since the results and currently trades at $34.81.

Read our full analysis of Werner’s results here.

ArcBest (NASDAQ: ARCB)

Historically owning furniture, banking, and other subsidiaries, ArcBest (NASDAQ: ARCB) offers full-truckload, less-than-truckload, and intermodal deliveries of freight.

ArcBest reported revenues of $1 billion, down 8.1% year on year. This number met analysts’ expectations. Overall, it was a very strong quarter as it also put up a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is flat since reporting and currently trades at $93.87.

Read our full, actionable report on ArcBest here, it’s free.

RXO (NYSE: RXO)

With access to millions of trucks, RXO (NYSE: RXO) offers full-truckload, less-than-truckload, and last-mile deliveries.

RXO reported revenues of $1.67 billion, up 70.4% year on year. This result surpassed analysts’ expectations by 0.6%. More broadly, it was a mixed quarter as it also produced a solid beat of analysts’ adjusted operating income estimates but EBITDA guidance for next quarter missing analysts’ expectations significantly.

RXO pulled off the fastest revenue growth among its peers. The stock is down 17.1% since reporting and currently trades at $20.99.

Read our full, actionable report on RXO here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.