Hospitality company Hyatt Hotels (NYSE: H) missed Wall Street’s revenue expectations in Q4 CY2024, with sales falling 3.5% year on year to $1.6 billion. Its non-GAAP profit of $0.42 per share was 46.8% below analysts’ consensus estimates.

Is now the time to buy Hyatt Hotels? Find out by accessing our full research report, it’s free.

Hyatt Hotels (H) Q4 CY2024 Highlights:

- Revenue: $1.6 billion vs analyst estimates of $1.65 billion (3.5% year-on-year decline, 3.1% miss)

- Adjusted EPS: $0.42 vs analyst expectations of $0.79 (46.8% miss)

- Adjusted EBITDA: $255 million vs analyst estimates of $273 million (15.9% margin, 6.6% miss)

- EBITDA guidance for the upcoming financial year 2025 is $1.13 billion at the midpoint, below analyst estimates of $1.18 billion

- Operating Margin: 5%, up from 0.8% in the same quarter last year

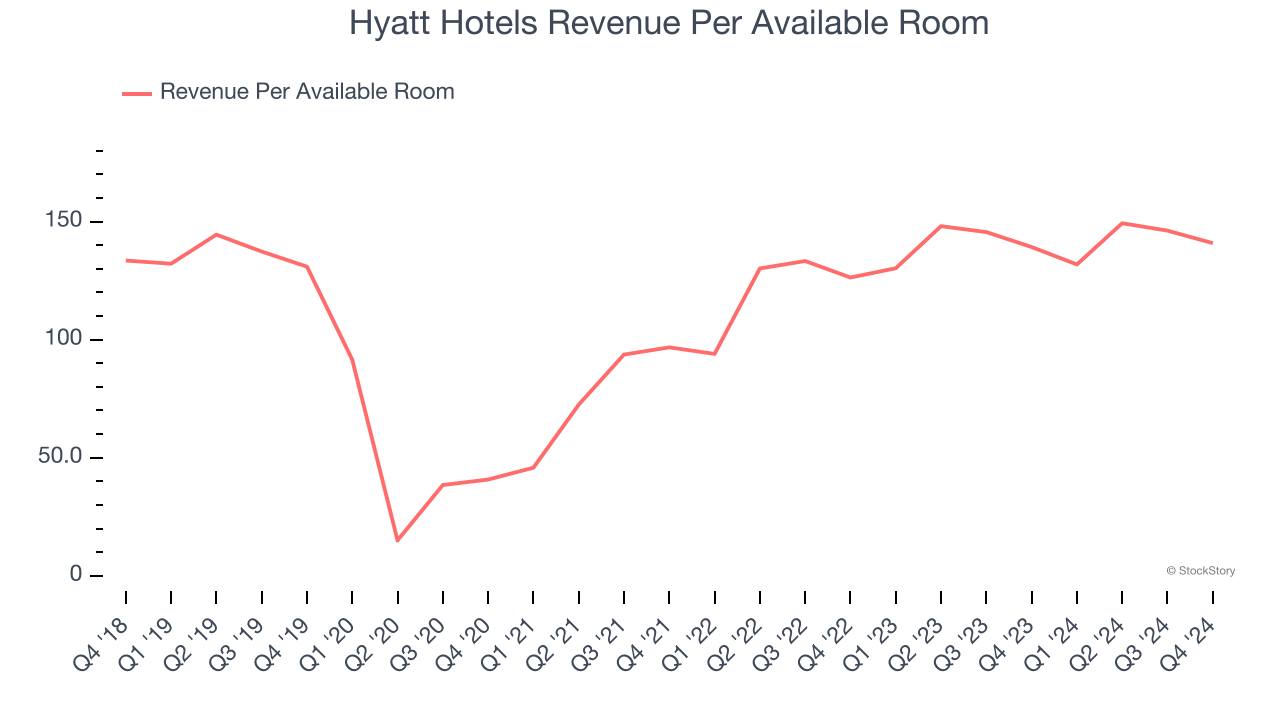

- RevPAR: $140.87 at quarter end, up 1.2% year on year

- Market Capitalization: $15.57 billion

Company Overview

Founded in 1957, Hyatt Hotels (NYSE: H) is a global hospitality company with a portfolio of 20 premier brands and over 950 properties across 65 countries.

Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sales Growth

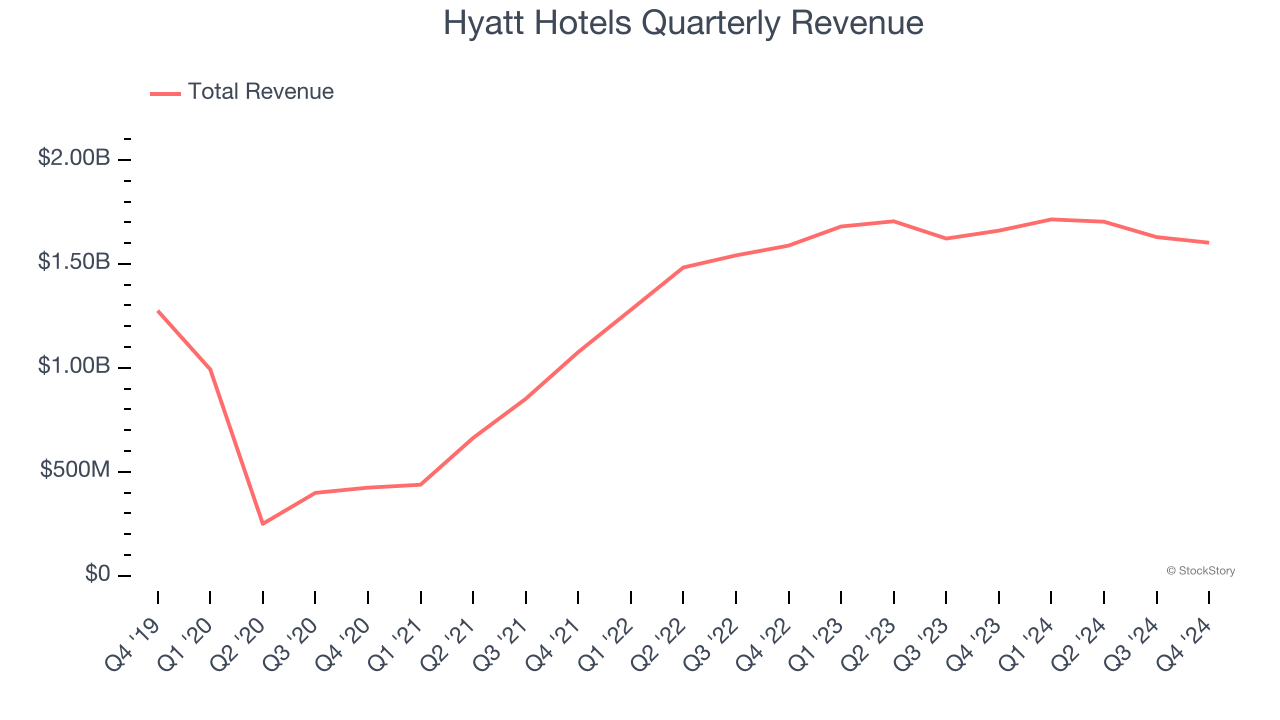

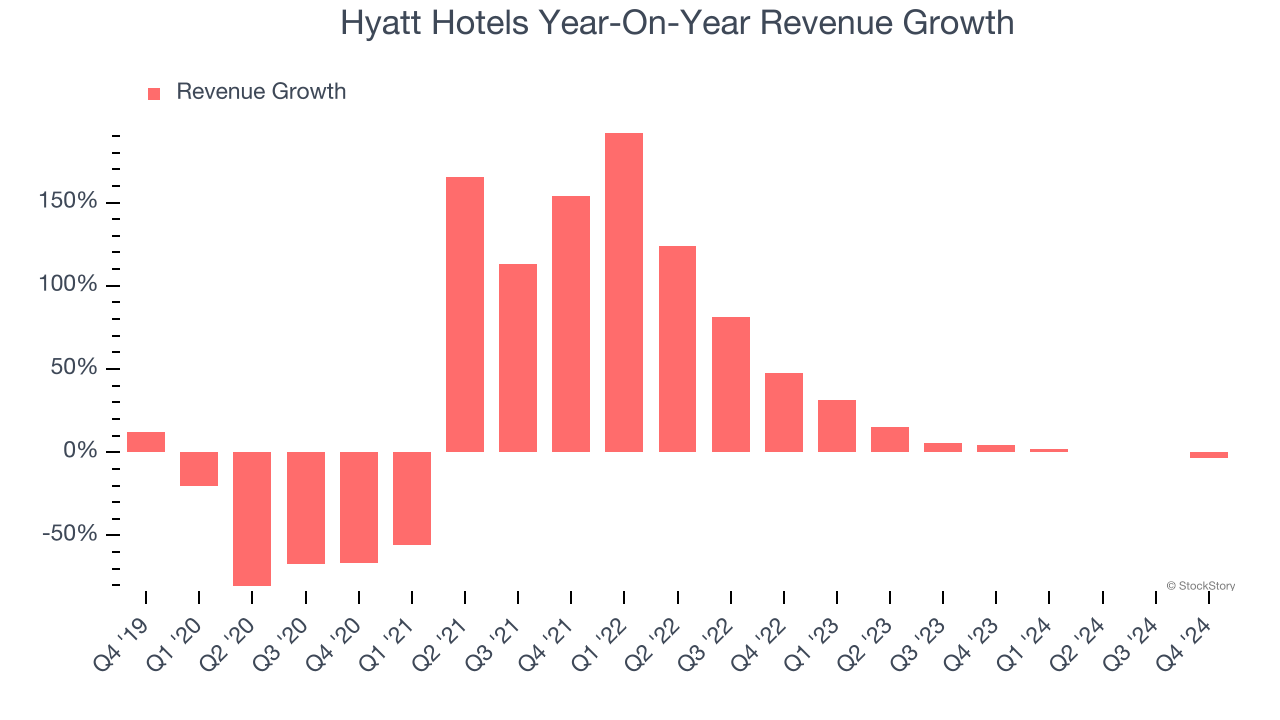

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Hyatt Hotels’s sales grew at a sluggish 5.8% compounded annual growth rate over the last five years. This was below our standard for the consumer discretionary sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Hyatt Hotels’s annualized revenue growth of 6.2% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

We can dig further into the company’s revenue dynamics by analyzing its revenue per available room, which clocked in at $140.87 this quarter and is a key metric accounting for daily rates and occupancy levels. Over the last two years, Hyatt Hotels’s revenue per room averaged 9.4% year-on-year growth. Because this number is better than its revenue growth, we can see its room bookings outperformed its sales from other areas like restaurants, bars, and amenities.

This quarter, Hyatt Hotels missed Wall Street’s estimates and reported a rather uninspiring 3.5% year-on-year revenue decline, generating $1.6 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 5.7% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its newer products and services will not accelerate its top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

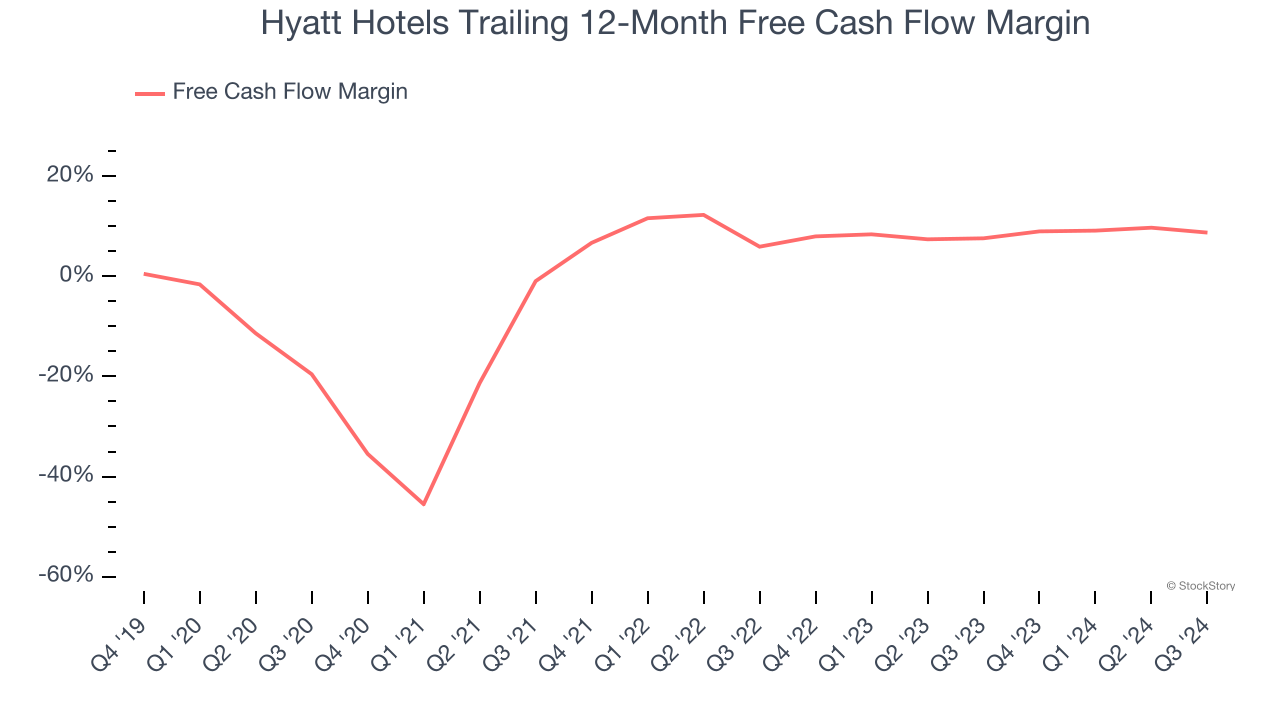

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Hyatt Hotels has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.5%, subpar for a consumer discretionary business.

Key Takeaways from Hyatt Hotels’s Q4 Results

We struggled to find many positives in these results as its EPS missed significantly. Its revenue, EBITDA, and full-year EBITDA guidance also fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 3.4% to $156.75 immediately after reporting.

Hyatt Hotels’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.