Global tire manufacturer Goodyear (NYSE: GT) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 3.7% year on year to $4.65 billion. Its non-GAAP profit of $0.28 per share was 72% above analysts’ consensus estimates.

Is now the time to buy Goodyear? Find out by accessing our full research report, it’s free for active Edge members.

Goodyear (GT) Q3 CY2025 Highlights:

- Revenue: $4.65 billion vs analyst estimates of $4.68 billion (3.7% year-on-year decline, 0.7% miss)

- Adjusted EPS: $0.28 vs analyst estimates of $0.16 (72% beat)

- Adjusted EBITDA: $472 million vs analyst estimates of $439.6 million (10.2% margin, 7.4% beat)

- Operating Margin: 3.2%, down from 5.6% in the same quarter last year

- Free Cash Flow was -$181 million compared to -$351 million in the same quarter last year

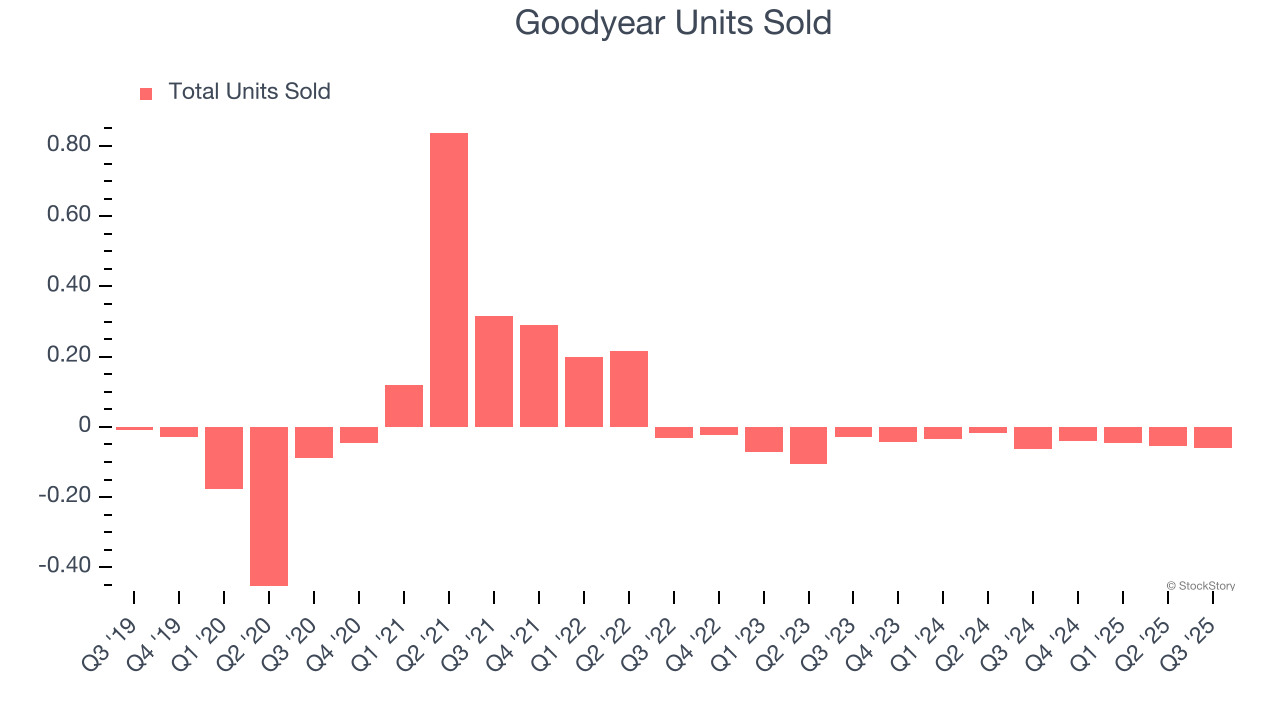

- Sales Volumes rose 5.2% year on year (-108% in the same quarter last year)

- Market Capitalization: $2.56 billion

"We delivered a meaningful increase in segment operating income relative to the second quarter in an industry environment that continued to be marked by global trade disruption," said Mark Stewart, chief executive officer and president.

Company Overview

With its iconic blimp floating above major sporting events since 1925, Goodyear (NYSE: GT) is one of the world's largest tire manufacturers, producing and selling tires for automobiles, trucks, aircraft, and other vehicles, along with related services.

Revenue Growth

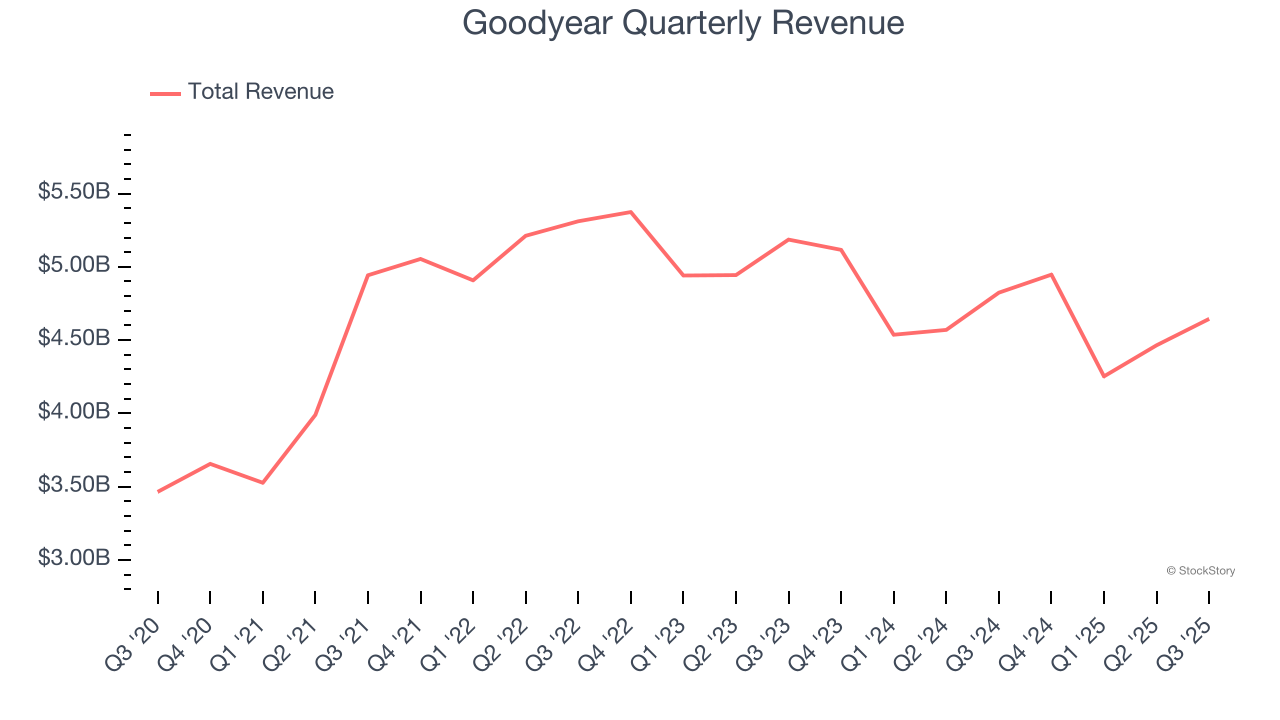

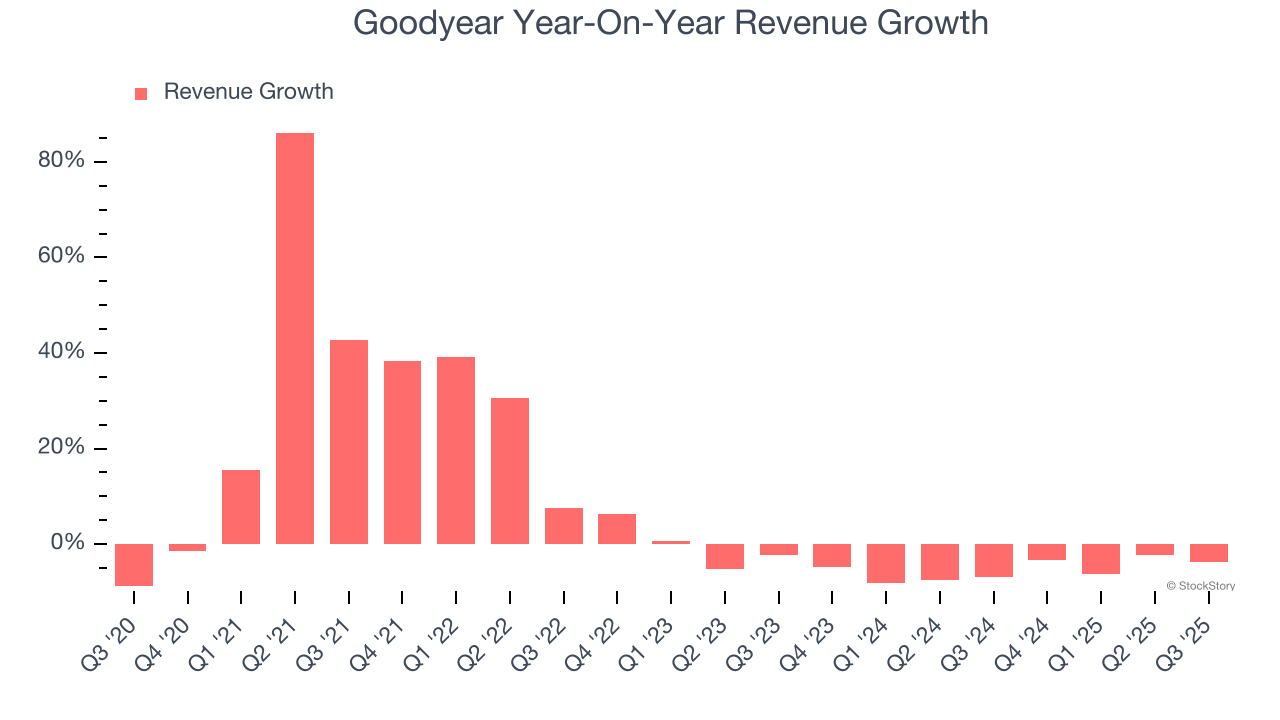

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Goodyear’s sales grew at a decent 8.1% compounded annual growth rate over the last five years. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Goodyear’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 5.4% over the last two years.

We can better understand the company’s revenue dynamics by analyzing its number of units sold, which reached -0.1 in the latest quarter. Over the last two years, Goodyear’s units sold averaged 38.9% year-on-year declines. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Goodyear missed Wall Street’s estimates and reported a rather uninspiring 3.7% year-on-year revenue decline, generating $4.65 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.5% over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below average for the sector.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

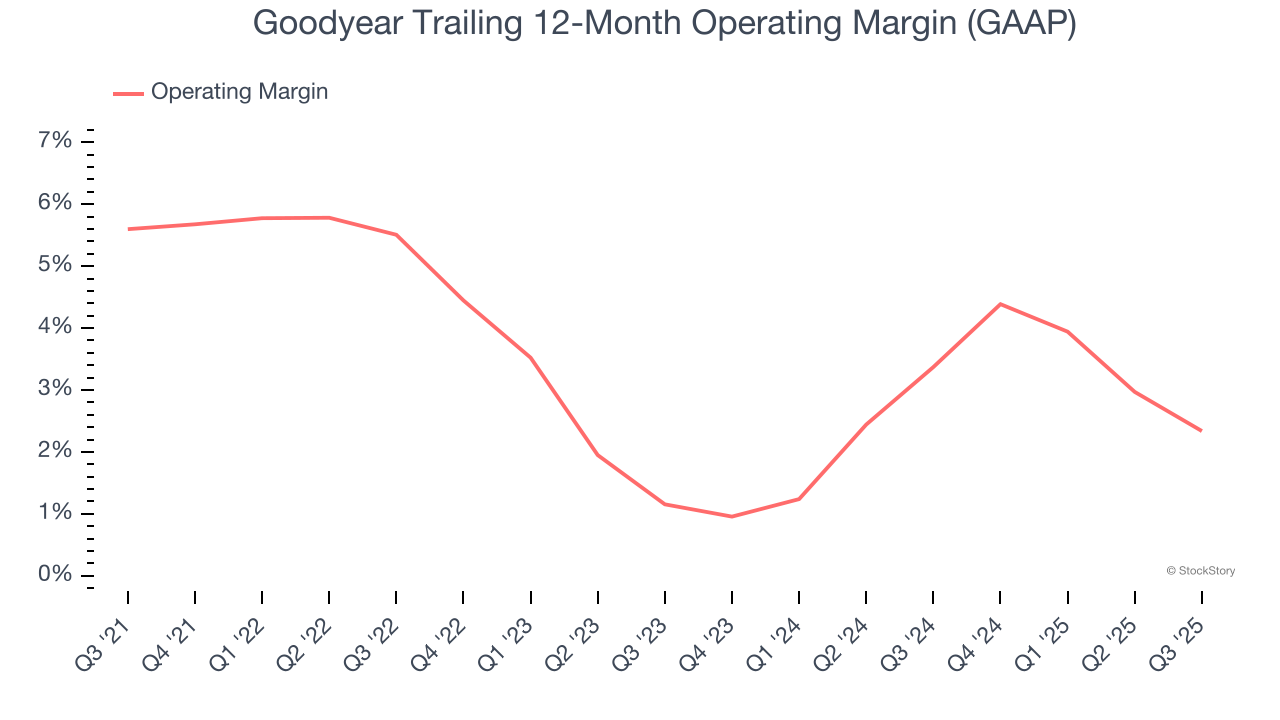

Goodyear was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.5% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Goodyear’s operating margin decreased by 3.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Goodyear’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Goodyear generated an operating margin profit margin of 3.2%, down 2.4 percentage points year on year. Since Goodyear’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

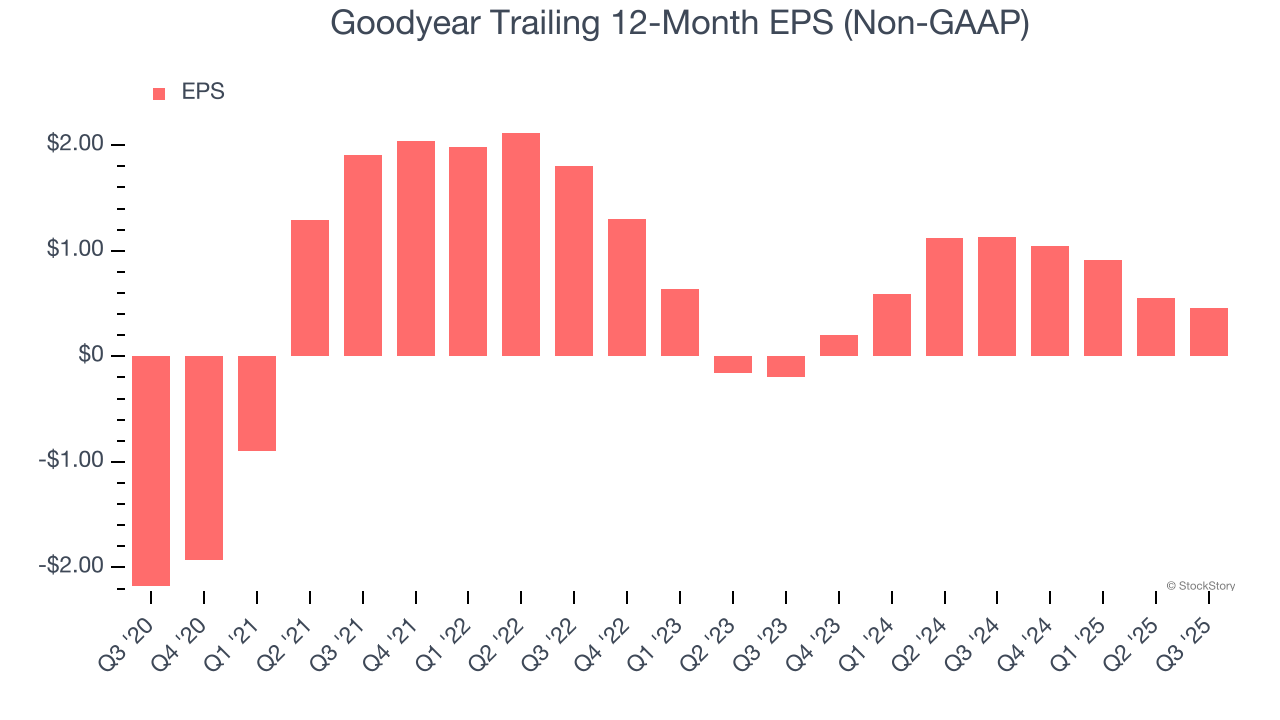

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Goodyear’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Goodyear, its two-year annual EPS growth of 107% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Goodyear reported adjusted EPS of $0.28, down from $0.37 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Goodyear’s full-year EPS of $0.46 to grow 162%.

Key Takeaways from Goodyear’s Q3 Results

It was good to see Goodyear beat analysts’ EPS expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its adjusted operating income missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The market seemed to be hoping for more, and the stock traded down 2% to $8.78 immediately after reporting.

So should you invest in Goodyear right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.