What a brutal six months it’s been for Rumble. The stock has dropped 27.2% and now trades at $6.54, rattling many shareholders. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Following the pullback, is now the time to buy RUM? Find out in our full research report, it’s free for active Edge members.

Why Does RUM Stock Spark Debate?

Founded in 2013 as a champion for content creator rights and free expression, Rumble (NASDAQ: RUM) is a video sharing platform that positions itself as a free speech alternative to mainstream platforms, offering creators more favorable revenue-sharing opportunities.

Two Positive Attributes:

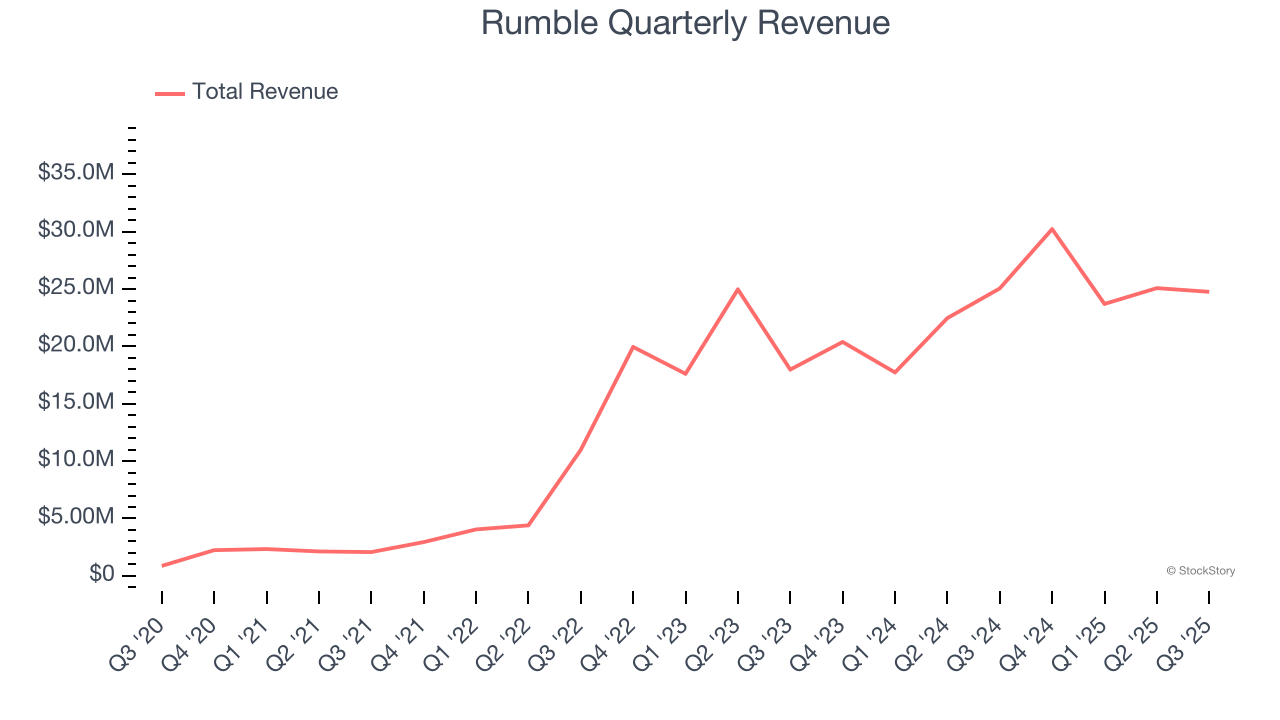

1. Skyrocketing Revenue Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Rumble’s 85.5% annualized revenue growth over the last four years was incredible. Its growth surpassed the average business services company and shows its offerings resonate with customers.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect Rumble’s revenue to rise by 202%, an improvement versus its 85.5% annualized growth for the past four years. This projection is eye-popping and suggests its newer products and services will spur better top-line performance.

One Reason to be Careful:

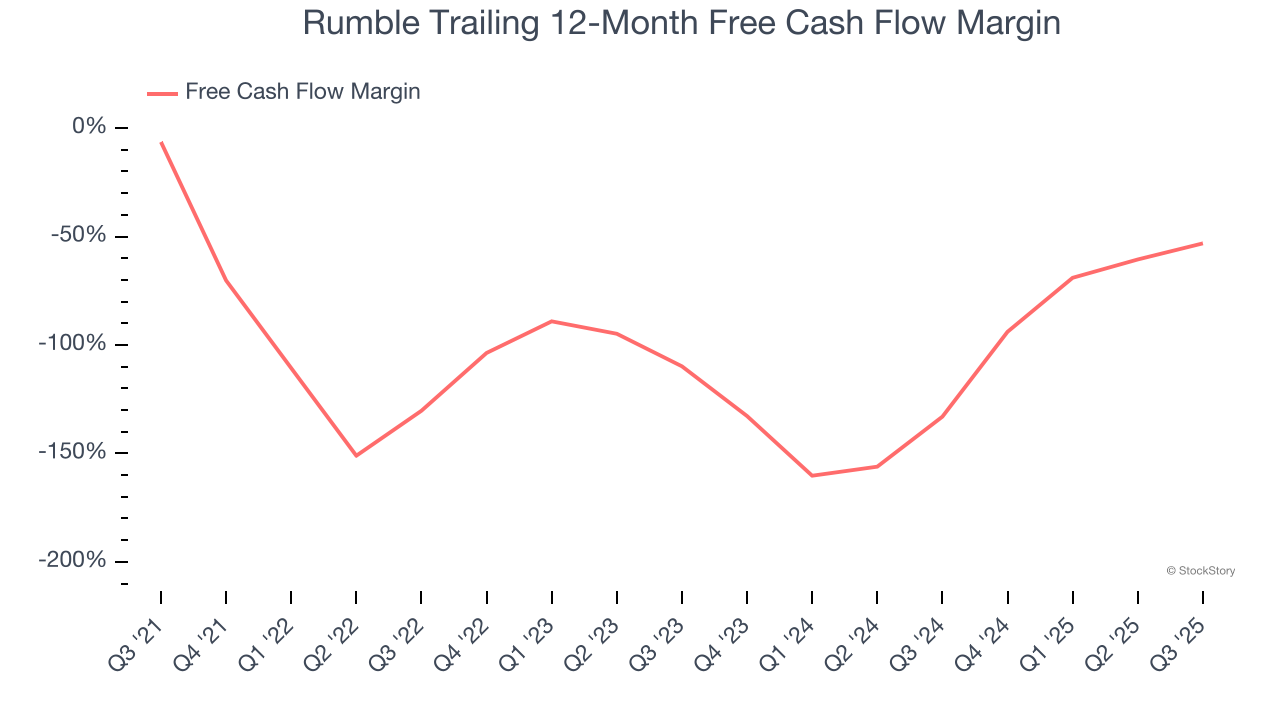

Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Rumble’s margin dropped by 46.7 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal it’s in the middle of a big investment cycle. Rumble’s free cash flow margin for the trailing 12 months was negative 53.1%.

Final Judgment

Rumble has huge potential even though it has some open questions. After the recent drawdown, the stock trades at 34.6× forward EV-to-EBITDA (or $6.54 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free for active Edge members.

Stocks We Like Even More Than Rumble

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.