Financial technology company Atlanticus Holdings (NASDAQ: ATLC) announced better-than-expected revenue in Q3 CY2025, with sales up 36.1% year on year to $419.8 million. Its non-GAAP profit of $1.21 per share was 24.1% below analysts’ consensus estimates.

Is now the time to buy Atlanticus Holdings? Find out by accessing our full research report, it’s free for active Edge members.

Atlanticus Holdings (ATLC) Q3 CY2025 Highlights:

- Volume: $4.93 billion vs analyst estimates of $4.39 billion (86.2% year-on-year growth, 12.5% beat)

- Revenue: $419.8 million vs analyst estimates of $417.6 million (36.1% year-on-year growth, 0.5% beat)

- Pre-tax Profit: $32.48 million (7.7% margin)

- Adjusted EPS: $1.21 vs analyst expectations of $1.60 (24.1% miss)

- Tangible Book Value per Share: $36.85 (18.7% year-on-year growth)

- Market Capitalization: $1.06 billion

Jeff Howard, President and Chief Executive Officer of Atlanticus stated, “This quarter, we produced significant organic growth and profitability, and completed a transformational acquisition. The acquisition of Mercury Financial substantially increases our scale, enhances our technology, adds to our origination capabilities, and brings on new team members to facilitate the continued growth of our business as we pursue our goal of Empowering Better Financial Outcomes for Everyday Americans.

Company Overview

Using data analytics to serve the millions of Americans with less-than-perfect credit scores, Atlanticus Holdings (NASDAQ: ATLC) provides technology and services that help lenders offer credit products to consumers often overlooked by traditional financing providers.

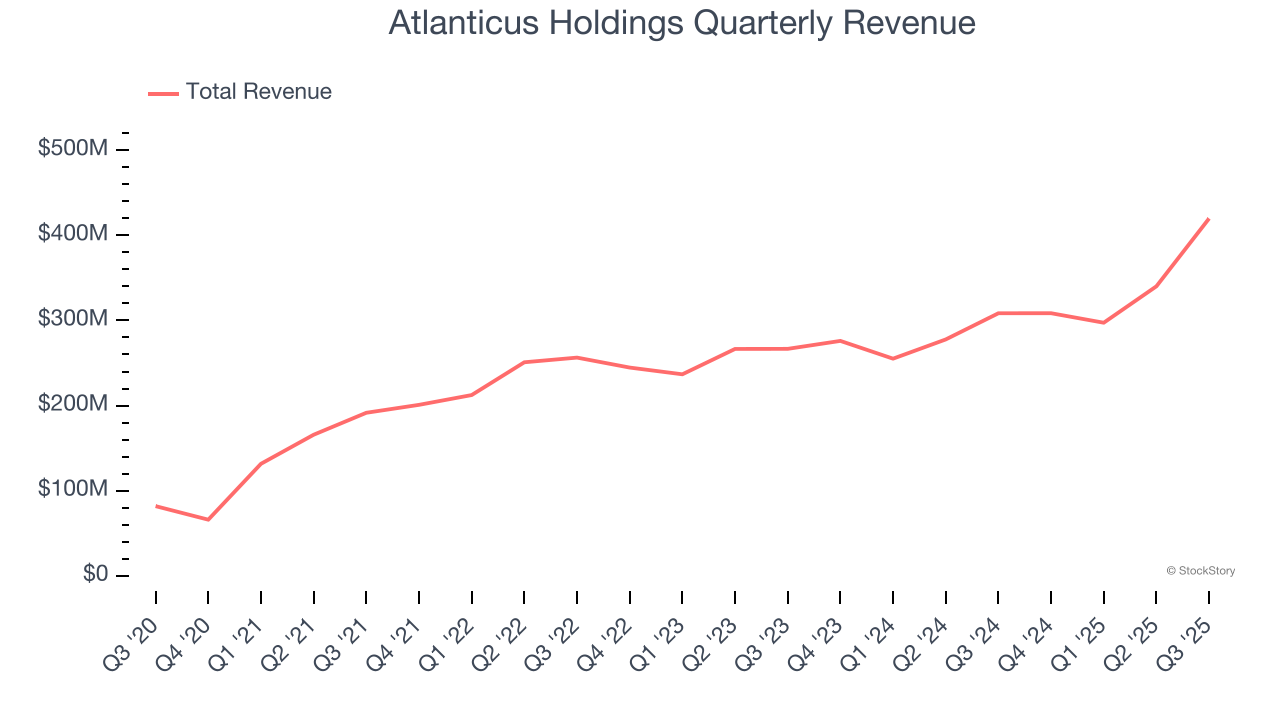

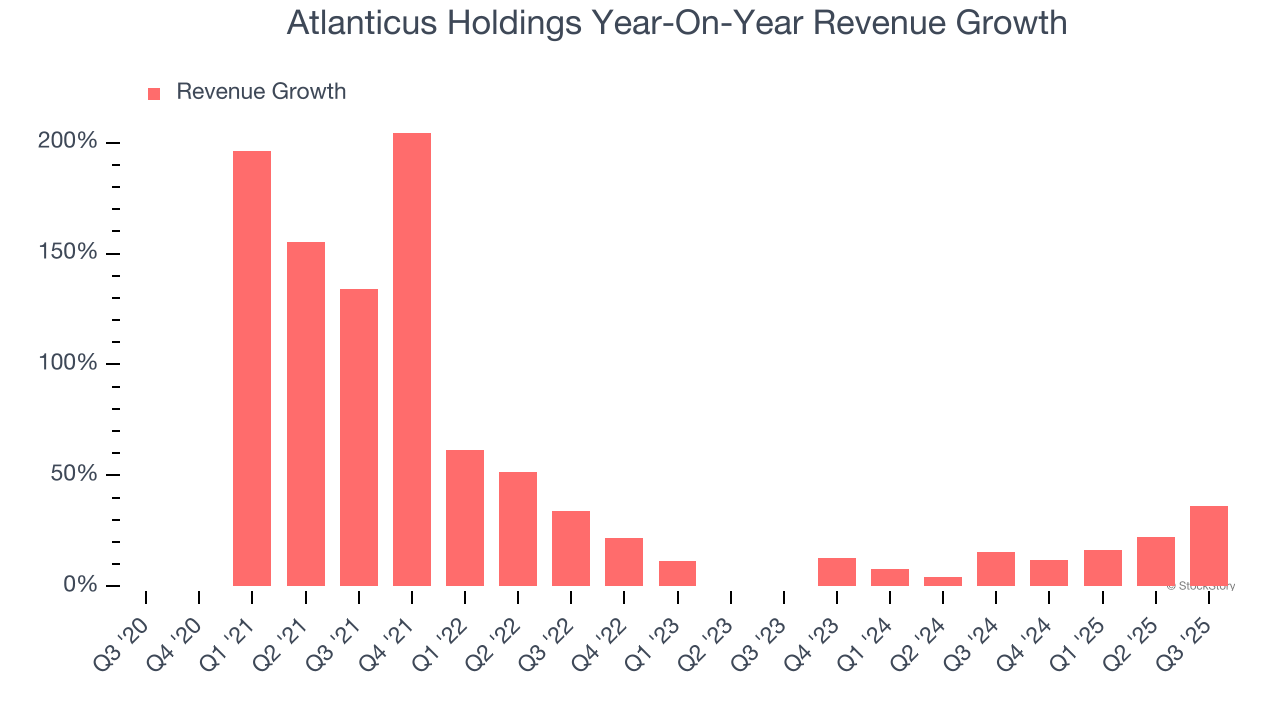

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Atlanticus Holdings grew its revenue at an incredible 40.8% compounded annual growth rate. Its growth beat the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Atlanticus Holdings’s annualized revenue growth of 16% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Atlanticus Holdings reported wonderful year-on-year revenue growth of 36.1%, and its $419.8 million of revenue exceeded Wall Street’s estimates by 0.5%.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

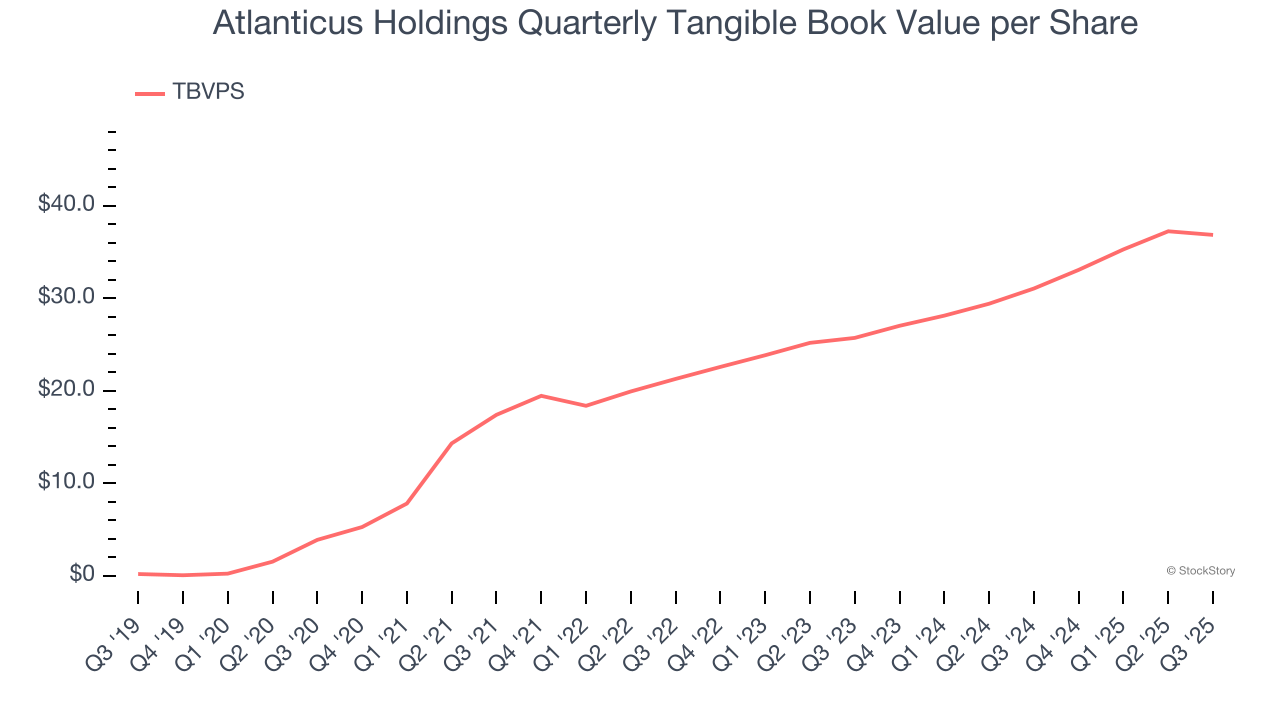

Tangible Book Value Per Share (TBVPS)

Financial institutions with multiple business lines manage complex balance sheets that span various financial activities. Market valuations reflect this operational complexity, prioritizing balance sheet strength and sustainable book value growth across all business segments.

When analyzing this sector, tangible book value per share (TBVPS) takes precedence over many other metrics. This measure isolates genuine per-share value and provides insight into the institution’s capital position across diverse operations. Traditional metrics like EPS are helpful but face distortion from the complexity of diversified operations, M&A activity, and various accounting rules that can obscure true performance across multiple business lines.

Atlanticus Holdings’s TBVPS grew at an incredible 56.8% annual clip over the last five years. TBVPS growth has recently decelerated to 19.7% annual growth over the last two years (from $25.72 to $36.85 per share).

Tangible Book Value Per Share (TBVPS)

Financial firms profit by providing a wide range of services, making them fundamentally balance sheet-driven enterprises with multiple intermediation roles. Market participants emphasize balance sheet quality and sustained book value growth when evaluating these multifaceted institutions.

This explains why tangible book value per share (TBVPS) is a premier metric for the sector. TBVPS provides concrete per-share net worth that investors can trust when evaluating companies with complex, multi-faceted business models. EPS can become murky due to the complexity of multiple revenue streams, acquisition impacts, or accounting flexibility across different financial services, and book value resists financial engineering manipulation.

Atlanticus Holdings’s TBVPS grew at an incredible 56.8% annual clip over the last five years. TBVPS growth has recently decelerated to 19.7% annual growth over the last two years (from $25.72 to $36.85 per share).

Key Takeaways from Atlanticus Holdings’s Q3 Results

We were impressed by how significantly Atlanticus Holdings blew past analysts’ transaction volumes expectations this quarter. On the other hand, its EPS missed. Overall, this quarter could have been better. The stock remained flat at $69.71 immediately following the results.

Atlanticus Holdings underperformed this quarter, but does that create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.