The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how electrical systems stocks fared in Q3, starting with Allegion (NYSE: ALLE).

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

The 13 electrical systems stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 3.8% while next quarter’s revenue guidance was 1.2% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

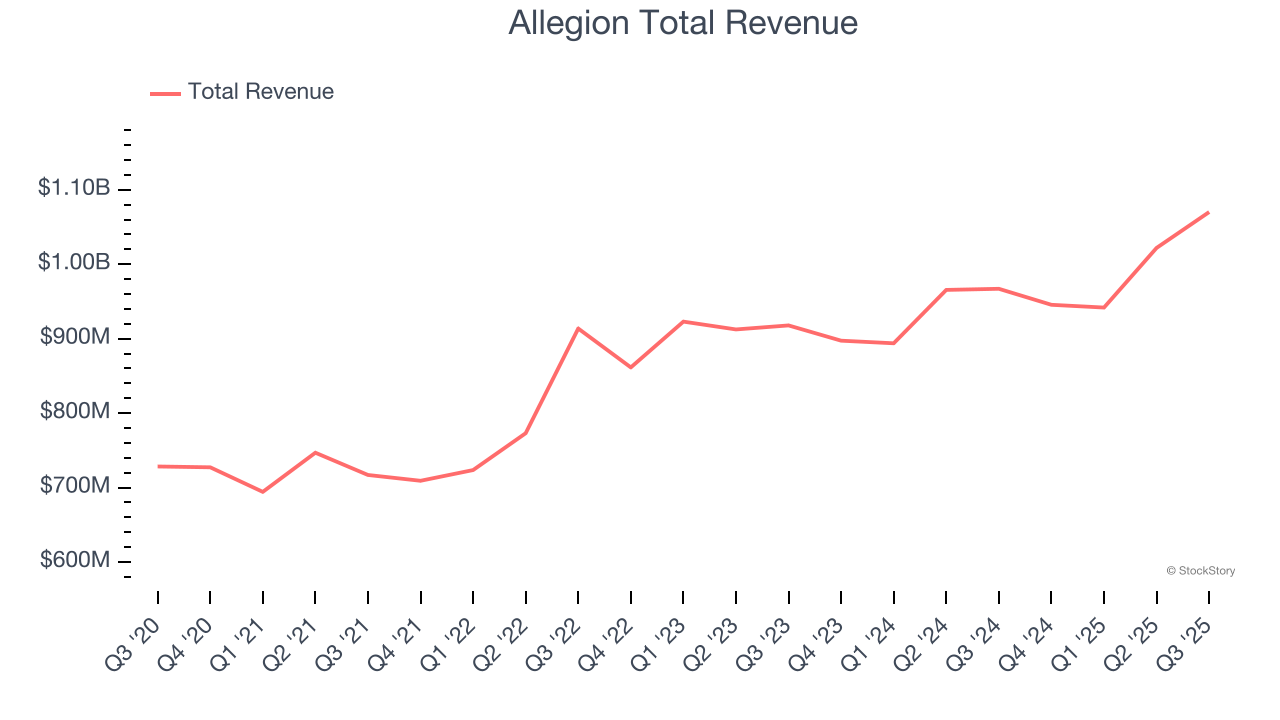

Allegion (NYSE: ALLE)

Allegion plc (NYSE: ALLE) is a provider of security products and solutions that keep people and assets safe and secure in various environments.

Allegion reported revenues of $1.07 billion, up 10.7% year on year. This print exceeded analysts’ expectations by 2.5%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ revenue estimates and a solid beat of analysts’ organic revenue estimates.

“Allegion’s third-quarter performance was defined by strong execution producing solid results,” Allegion President and CEO John H. Stone said.

The stock is down 7% since reporting and currently trades at $163.19.

Is now the time to buy Allegion? Access our full analysis of the earnings results here, it’s free for active Edge members.

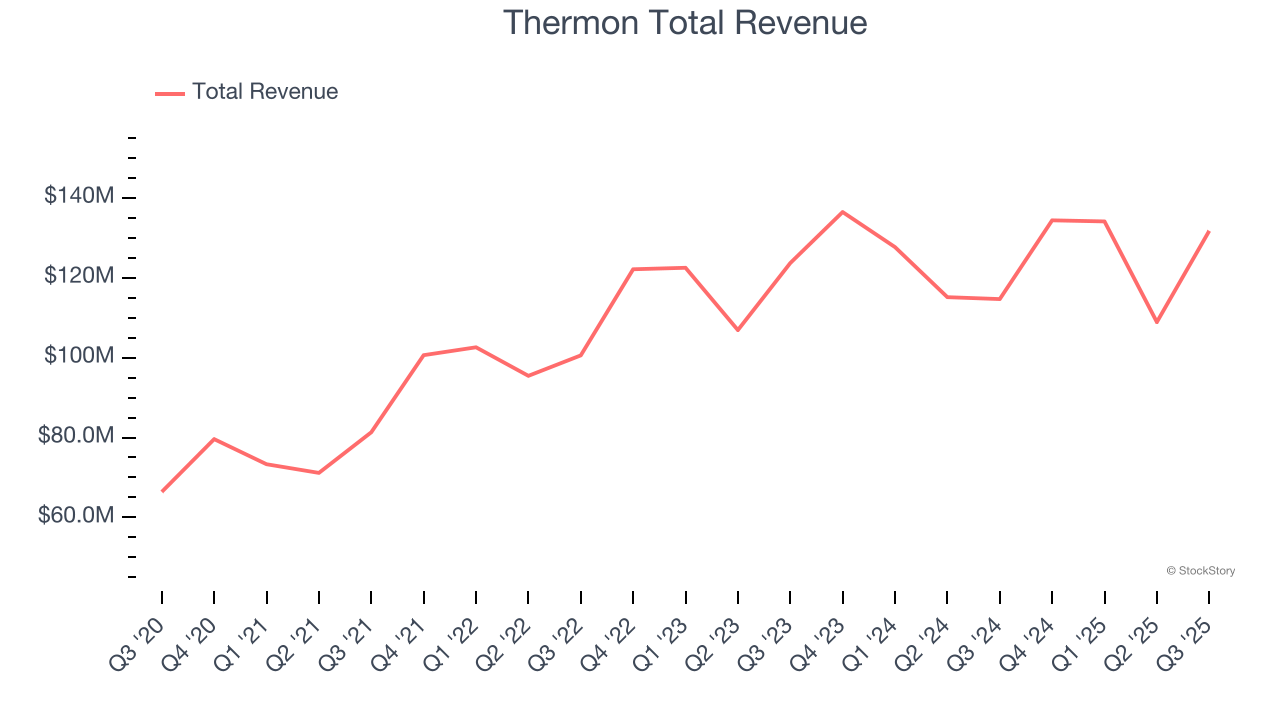

Best Q3: Thermon (NYSE: THR)

Creating the first packaged tracing systems, Thermon (NYSE: THR) is a leading provider of engineered industrial process heating solutions for process industries.

Thermon reported revenues of $131.7 million, up 14.9% year on year, outperforming analysts’ expectations by 10.3%. The business had a stunning quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Thermon scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 34.4% since reporting. It currently trades at $39.53.

Is now the time to buy Thermon? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Atkore (NYSE: ATKR)

Protecting the things that power our world, Atkore (NYSE: ATKR) designs and manufactures electrical safety products.

Atkore reported revenues of $752 million, down 4.6% year on year, exceeding analysts’ expectations by 2.5%. Still, it was a slower quarter as it posted a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EBITDA estimates.

As expected, the stock is down 2.9% since the results and currently trades at $64.59.

Read our full analysis of Atkore’s results here.

Verra Mobility (NASDAQ: VRRM)

Aiming to wrap technology and data around a historically manual and paper-based industry, Verra Mobility (NYSE: VRRM) is a leading provider of smart mobility technology to address tolls and violations, title and registration services, as well as safety and traffic enforcement.

Verra Mobility reported revenues of $261.9 million, up 16.1% year on year. This result topped analysts’ expectations by 9.8%. Overall, it was an exceptional quarter as it also recorded an impressive beat of analysts’ revenue estimates and full-year revenue guidance exceeding analysts’ expectations.

The stock is down 8.7% since reporting and currently trades at $21.76.

Read our full, actionable report on Verra Mobility here, it’s free for active Edge members.

LSI (NASDAQ: LYTS)

Enhancing commercial environments, LSI (NASDAQ: LYTS) provides lighting and display solutions for businesses and retailers.

LSI reported revenues of $157.2 million, up 13.9% year on year. This print surpassed analysts’ expectations by 5.2%. It was an exceptional quarter as it also produced an impressive beat of analysts’ revenue estimates and a solid beat of analysts’ EBITDA estimates.

The stock is down 15.4% since reporting and currently trades at $19.46.

Read our full, actionable report on LSI here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.