As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the advertising software industry, including LiveRamp (NYSE: RAMP) and its peers.

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

The 7 advertising software stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.8% while next quarter’s revenue guidance was 1.1% below.

Thankfully, share prices of the companies have been resilient as they are up 6.3% on average since the latest earnings results.

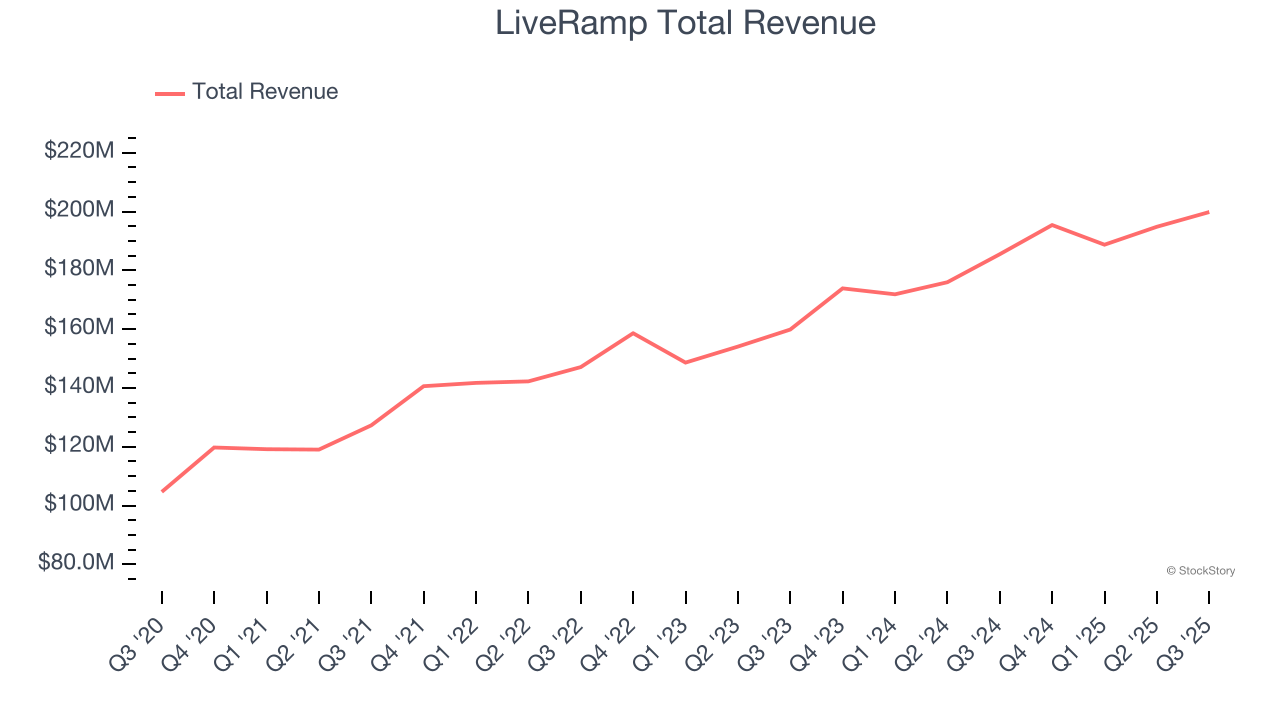

LiveRamp (NYSE: RAMP)

Serving as the digital middleman in an increasingly privacy-conscious world, LiveRamp (NYSE: RAMP) provides technology that helps companies securely share and connect their customer data with trusted partners while maintaining privacy compliance.

LiveRamp reported revenues of $199.8 million, up 7.7% year on year. This print exceeded analysts’ expectations by 1%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EBITDA estimates and a narrow beat of analysts’ annual recurring revenue estimates.

LiveRamp achieved the highest full-year guidance raise of the whole group. The company added 5 enterprise customers paying more than $1 million annually to reach a total of 132. Unsurprisingly, the stock is up 10.5% since reporting and currently trades at $30.30.

Is now the time to buy LiveRamp? Access our full analysis of the earnings results here, it’s free for active Edge members.

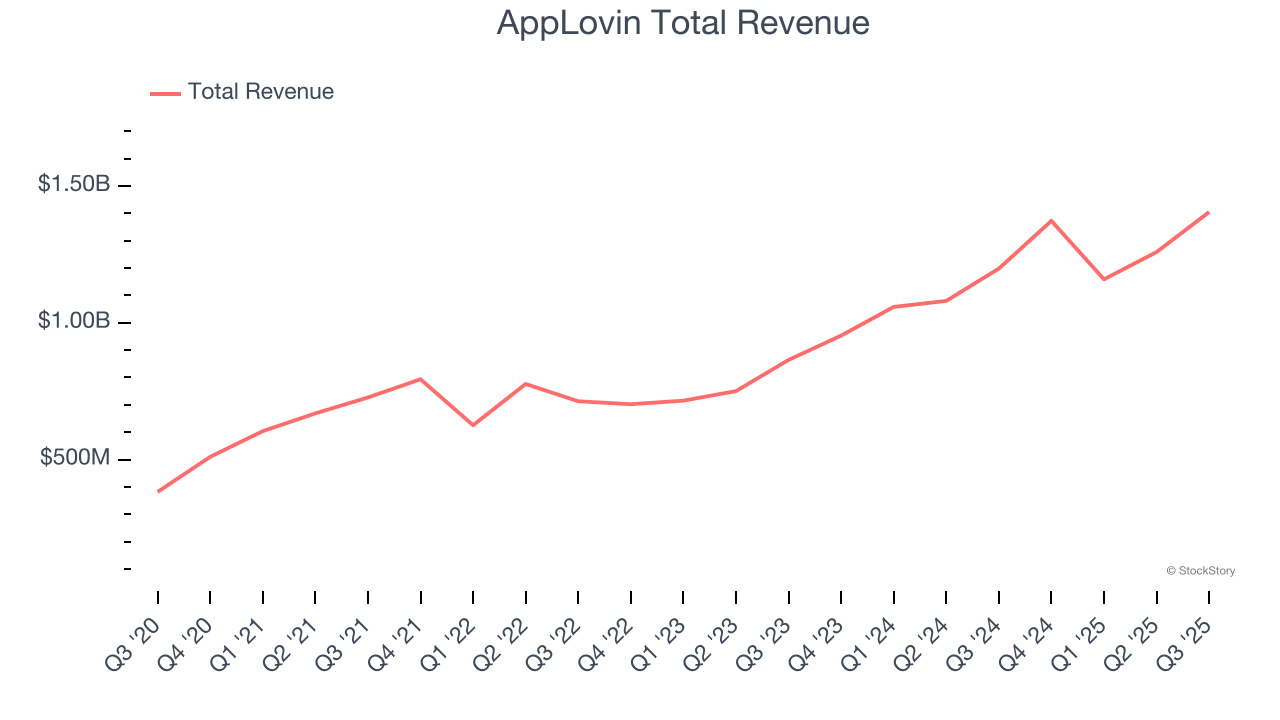

Best Q3: AppLovin (NASDAQ: APP)

Sitting at the crossroads of the mobile advertising ecosystem with over 200 free-to-play games in its portfolio, AppLovin (NASDAQ: APP) provides software solutions that help mobile app developers market, monetize, and grow their apps through AI-powered advertising and analytics tools.

AppLovin reported revenues of $1.41 billion, up 17.3% year on year, outperforming analysts’ expectations by 4.5%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ revenue estimates.

The market seems happy with the results as the stock is up 17% since reporting. It currently trades at $715.00.

Is now the time to buy AppLovin? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: DoubleVerify (NYSE: DV)

Using advanced analytics to evaluate over 17 billion digital ad transactions daily, DoubleVerify (NYSE: DV) provides AI-powered technology that verifies digital ads are viewable, fraud-free, brand-suitable, and displayed in the intended geographic location.

DoubleVerify reported revenues of $188.6 million, up 11.2% year on year, falling short of analysts’ expectations by 0.8%. It was a slower quarter as it posted revenue guidance for next quarter slightly missing analysts’ expectations and a slight miss of analysts’ revenue estimates.

DoubleVerify delivered the weakest performance against analyst estimates in the group. The stock is flat since the results and currently trades at $10.97.

Read our full analysis of DoubleVerify’s results here.

The Trade Desk (NASDAQ: TTD)

Built as an alternative to "walled garden" advertising ecosystems, The Trade Desk (NASDAQ: TTD) provides a cloud-based platform that helps advertisers and agencies plan, manage, and optimize digital advertising campaigns across multiple channels and devices.

The Trade Desk reported revenues of $739.4 million, up 17.7% year on year. This number beat analysts’ expectations by 2.8%. Overall, it was a very strong quarter as it also put up an impressive beat of analysts’ EBITDA estimates and EBITDA guidance for next quarter topping analysts’ expectations.

The stock is down 19.3% since reporting and currently trades at $37.13.

Read our full, actionable report on The Trade Desk here, it’s free for active Edge members.

Zeta Global (NYSE: ZETA)

Powered by an AI engine that processes over one trillion consumer signals monthly, Zeta Global (NYSE: ZETA) operates a data-driven cloud platform that helps companies target, connect, and engage with consumers through personalized marketing across channels like email, social media, and video.

Zeta Global reported revenues of $337.2 million, up 25.7% year on year. This print topped analysts’ expectations by 2.7%. It was a very strong quarter as it also logged an impressive beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

Zeta Global pulled off the fastest revenue growth but had the weakest full-year guidance update among its peers. The stock is up 16.4% since reporting and currently trades at $19.51.

Read our full, actionable report on Zeta Global here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.