PARK RIDGE, Ill., Oct. 30, 2025 (GLOBE NEWSWIRE) -- Executive Summary

Introduction

The Great Wealth Transfer is widely expected to reshape the financial landscape in the coming years, with trillions of dollars anticipated to pass from the Silent Generation and Baby Boomers to younger generations. For many individuals and families, this historic shift raises important considerations around inheritance, preparedness, and the steps needed to ensure wealth is transferred smoothly and responsibly. To better understand consumer readiness for this shift and help advisors address the challenges and gaps that may influence the transfer of wealth, MDRT, The Premier Association of Financial Professionals®, conducted a survey of 2,000 U.S. consumers spanning four generations.

Discover the most important insights from the survey below, including crucial statistics on generational differences in estate planning preparedness, the obstacles consumers are facing in creating estate plans and their expectations for inheritance.

Wealth Transfer Expectations

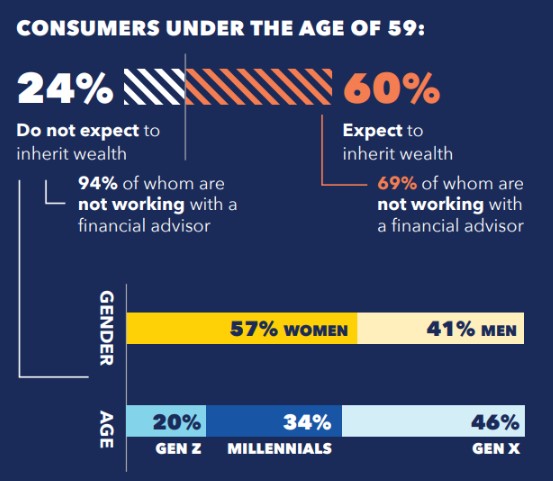

Younger consumers’ expectations of receiving an inheritance closely mirror the plans of older generations to pass down wealth. Most individuals who neither expect to inherit nor plan to give do not currently work with a financial advisor.

- 60% of consumers under 59 expect to inherit wealth in their lifetime.

- 64% of consumers over the age of 60 plan to pass wealth to family or heirs.

- 21% of consumers over the age of 60 do not plan to pass down wealth, with 94% not working with a financial advisor.

- 24% of consumers under 59 do not expect to inherit wealth, with 94% not working with a financial advisor.

Estate Planning Preparedness

Estate planning readiness varies across generations and genders. Generation X shows lower levels of estate planning preparedness than Millennials across nearly all areas, and men report higher levels of preparedness than women in several key aspects.

- 29% of consumers have created a will, 57% men and 43% women.

- 22% of consumers have discussed their estate plan with family or heirs.

- Men (54%) are more likely than women (45%) to have had these conversations.

- By generation, Baby Boomers lead at 31%, followed by Millennials at 30%, Gen X at 24% and Gen Z at only 14%.

- 18% of consumers have consulted a financial advisor about their estate plan.

- Men (61%) are more likely than women (40%) to have done so.

- Across generations, Millennials show the highest engagement with financial advisors at 35%, followed by Baby Boomers at 32%, Gen X at 22% and Gen Z at just 10%.

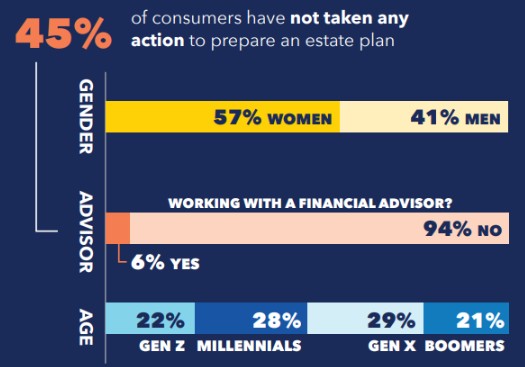

- Nearly half of all respondents (45%) have not taken any action to prepare an estate plan. Women (57%) are more likely than men (41%) to report taking no action.

Estate Planning Challenges

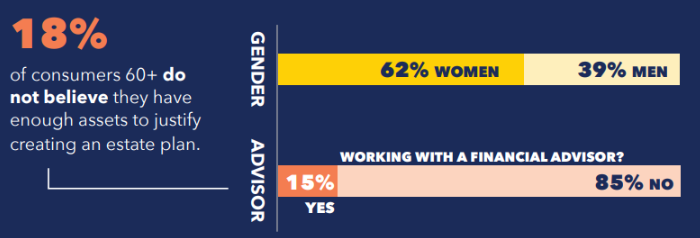

Some consumers report believing they do not have sufficient assets to justify creating an estate plan. Most respondents who shared this concern do not currently work with a financial advisor, and the same is true for the majority who report facing no major challenges in creating or updating their plan.

- 18% of consumers over the age of 60 do not believe they have enough assets to justify creating an estate plan.

- Women over the age of 60 are significantly more likely than men to feel they lack sufficient assets to justify creating an estate plan (62%).

- 85% of consumers who do not believe they have enough assets to justify creating an estate plan do not currently work with a financial advisor.

- 41% of consumers over the age of 60 say they have faced no major challenges in creating or updating their estate plan. Most of these consumers (69%) are not currently working with a financial advisor.

About MDRT

Founded in 1927, MDRT (Million Dollar Round Table), The Premier Association of Financial Professionals®, is a global, independent association of the world's leading life insurance and financial services professionals from more than 80 nations and territories and nearly 700 companies. MDRT members demonstrate exceptional professional knowledge, strict ethical conduct and outstanding client service. MDRT membership is recognized internationally as the standard of excellence in the life insurance and financial services business. For more information, please visit mdrt.org.

| Contact Information | |

| Carmen Wong Media Relations Specialist, MDRT cwong@mdrt.org +1 847.585.2388 | Ella Tobias G&S Business Communications etobias@gscommunications.com +1 317.726.6817 |

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/8ce68d71-e4f8-42fa-bbf5-69f096cb41d8

https://www.globenewswire.com/NewsRoom/AttachmentNg/635a99a2-f589-4ade-9c5a-3866add0c142

https://www.globenewswire.com/NewsRoom/AttachmentNg/2236869c-94b8-4611-9864-e97913e0bcc3