There’s renewed investor focus on oil stocks this week following dramatic geopolitical developments: the United States recently captured Venezuelan President Nicolás Maduro. Following the news has been ensuing talk that U.S. oil companies may play a central role in rebuilding the country’s long-neglected energy infrastructure. A variety of U.S. energy names, including Exxon Mobil (XOM), have rallied sharply as markets price in the possibility of reopening access to Venezuela’s vast crude reserves after years of underinvestment and a sanctions-induced decline.

With evolving catalysts tied to Venezuela and broader industry dynamics in play, is XOM stock a buy now? Let's take a closer look.

About Exxon Mobil Stock

Exxon Mobil is one of the world’s largest integrated energy companies, engaged in the exploration, production, refining, and distribution of oil, natural gas, and petrochemicals across global markets. Headquartered in Spring, Texas, the firm operates through major business segments including upstream, downstream, and chemicals, along with growing investments in lower-emission technologies and energy solutions. Exxon Mobil’s market capitalization stands at $499 billion, reflecting its status as a mega-cap energy leader.

Exxon Mobil’s stock performance over the past year has reflected both cyclical energy market dynamics and recently intensified geopolitical catalysts. In the opening days of 2026, the market’s focus shifted sharply as U.S. forces captured Venezuelan President Nicolás Maduro, triggering a noticeable rally across the energy sector. Wall Street interpreted the dramatic geopolitical development as potentially reopening opportunities for U.S. oil majors, including Exxon.

In the sessions immediately following the news, XOM stock climbed significantly, even hitting a fresh 52-week high of $125.93 on Jan. 5. The stock has overall delivered a 15% return over the past year.

This Venezuela effect reflects a shift in investor sentiment toward energy stocks as strategic plays in a geopolitical narrative, even as crude oil prices themselves remain relatively subdued.

Venezuela currently produces less than 1% of global output, despite holding the world’s largest proven reserves at more than 300 billion barrels. Production has collapsed over decades due to mismanagement, underinvestment, and U.S. sanctions, leaving infrastructure severely degraded.

While some experts estimate it could take over $100 billion and a decade to meaningfully revive the sector, J.P. Morgan analysts believe output could rise to 1.3 million to 1.4 million barrels per day within two years following a political transition. U.S. majors such as Exxon Mobil are seen as potential participants, particularly given demand for Venezuela’s heavy crude.

XOM stock is currently trading at a premium to industry peers at 17 times forward earnings.

Exxon Mobil Q3 Earnings Beat

Exxon Mobil released its third-quarter 2025 earnings on Oct. 31, reporting adjusted EPS of $1.88, slightly above Wall Street’s consensus estimate but a decrease from the $1.92 reported in Q3 2024.

Total revenues for the quarter were about $85.3 billion, down from the prior year’s $90 billion, while net production year-to-date (YTD) rose to 4.7 million oil-equivalent barrels per day, highlighted by record output in the Permian Basin (nearly 1.7 million boepd) and Guyana (over 700,000 boepd).

Cash flow remained robust with $14.8 billion in operating cash flow and $6.3 billion in free cash flow, even as free cash flow lagged the prior year’s levels. Exxon returned $9.4 billion to shareholders through $4.2 billion in dividends and $5.1 billion in share repurchases, supporting its capital return strategy.

Further, Exxon reaffirmed expectations that full-year 2025 cash capital expenditures would be slightly below the lower end of its previously stated $27 billion to $29 billion range, reflecting disciplined spending, alongside structural cost savings projected to exceed $18 billion cumulatively by 2030.

Analysts tracking XOM project the company’s EPS to decline 11% year-over-year (YOY) to $6.92 in fiscal 2025, then grow 2% to $7.06 in fiscal 2026.

What Do Analysts Expect for Exxon Mobil Stock?

Last month, UBS reaffirmed its “Buy” rating and $145 price target after the company’s corporate plan update event. TD Cowen also raised its price target on Exxon Mobil to $135 from $128 while reiterating a “Buy” rating, citing stronger long-term earnings and cash-flow prospects.

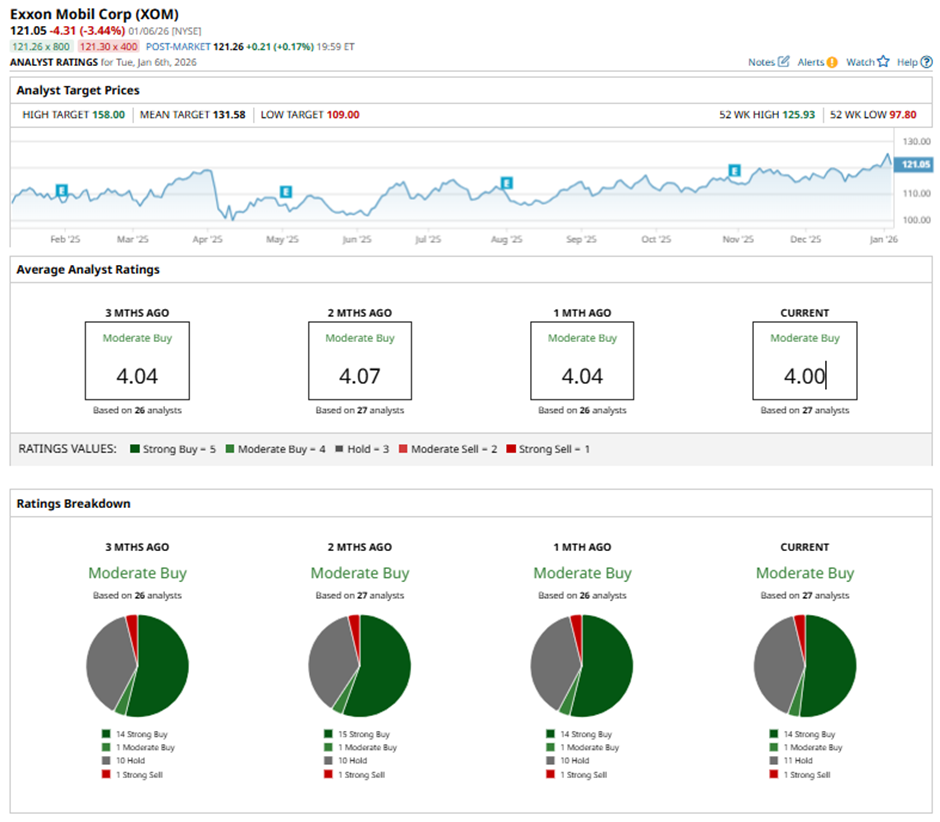

Overall, XOM has a consensus “Moderate Buy” rating. Of the 27 analysts covering the stock, 14 advise a “Strong Buy,” one suggests a “Moderate Buy,” 11 analysts are on the sidelines with a “Hold” rating, and one recommends a “Strong Sell" rating.

XOM’s average analyst price target of $131.35 indicates potential upside of 7%, while the Street-high target price of $158 suggests that the stock could rally as much as 28%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The 3 Best Dividend Aristocrats to Buy for 2026

- As the US Dollar Index Tests Critical Support, Here’s What a Dollar Breakdown Could Mean for Markets

- Trump Wants Lockheed Martin to Cut Its Dividend. Should You Still Buy LMT Stock or Stay Far Away?

- Palantir Is Pulling Back After a Post-Venezuela Run Higher. How Should You Play PLTR Stock Here?