The sudden capture and extradition of Venezuelan President Nicolás Maduro over the weekend sent energy markets surging on Jan. 5. Investors interpreted the U.S. military’s move as a potential turning point for Venezuela’s oil sector, signaling opportunities for U.S. companies ready to step into a market long hampered by sanctions.

President Donald Trump amplified bullish sentiment, pledging U.S. oil firms a central role in reconstructing Venezuela’s energy infrastructure. Oil major Chevron (CVX) responded with a more than 5% jump on Jan. 5, reflecting investor anticipation that the firm could reclaim market share and revenues previously blocked under Maduro’s regime.

Chevron stands uniquely positioned as the only major U.S. oil producer with continuous operations in Venezuela. Analysts expect that a regime change could lift sanctions, unlock billions in past debts, and materially strengthen the company's balance sheet.

Expanded access to Venezuela’s vast reserves could also elevate production beyond the current 250,000 barrels per day, boosting future cash flows. Against this backdrop, let's discover what stance investors could adopt on CVX stock as geopolitical and operational catalysts begin to unfold.

About Chevron Stock

Headquartered in Houston, Texas, Chevron explores, produces, and markets crude oil, natural gas, and petroleum products, while manufacturing petrochemicals, lubricants, and renewable fuels. Carrying a market capitalization of $312 billion, the company spans upstream, midstream, and downstream operations.

CVX shares have delivered steady gains, rising 6% over the past year and 4% over the last six months. Momentum has strengthened more recently, with shares advancing 7% in the past month, reflecting improving investor confidence and renewed interest in the name.

From a valuation perspective, CVX stock trades at 22 times forward adjusted earnings and 1.5 times sales. Both of these metrics exceed industry averages, signaling a premium valuation.

Being a Dividend Aristocrat, Chevron has consistently raised its dividends for 38 consecutive years, currently paying $6.84 per share annually, yielding 4.37%. Its most recent dividend of $1.71 per share was scheduled for Dec. 10, for shareholders of record as of Nov. 18.

Chevron Surpasses Q3 Earnings

On Oct. 31, Chevron reported fiscal 2025 third-quarter results that exceeded Wall Street expectations. Revenue declined 1.9% year-over-year (YOY) to $49.73 billion but surpassed analyst forecasts of $49.01 billion. Adjusted EPS fell 26% to $1.85 from the prior year but beat the Street's $1.71 estimate.

Lower crude oil prices weighed on earnings, alongside severance expenses and transaction-related costs tied to the Hess acquisition. These headwinds were partially offset by stronger margins on refined product sales, reinforcing the benefit of Chevron’s diversified operating mix.

Although profitability declined 21% YOY to $3.6 billion, the quarter marked a production milestone. Chevron produced a record 4.1 million barrels of crude oil per day, a 21% increase from the same period last year. The company attributed the surge primarily to the Hess acquisition completed earlier in the year, which materially expanded its production base.

Downstream operations delivered a sharp improvement, with U.S. refining profits climbing more than 300% to $638 million from $146 million in Q3 2024, driven by higher product margins. At the same time, capital expenditures rose 7% to $4.4 billion as Chevron invested in legacy Hess assets, positioning the business for longer-term returns. Free cash flow strengthened 52% YOY to $7 billion, largely reflecting contributions from Hess.

Looking ahead, analysts expect near-term pressure to persist. Consensus forecasts call for Q4 fiscal 2025 EPS of $1.54, down 25% YOY. For the full year, earnings are projected to decline 27% to $7.34, followed by a further 4% drop in fiscal 2026 to $7.04.

What Do Analysts Expect for Chevron Stock?

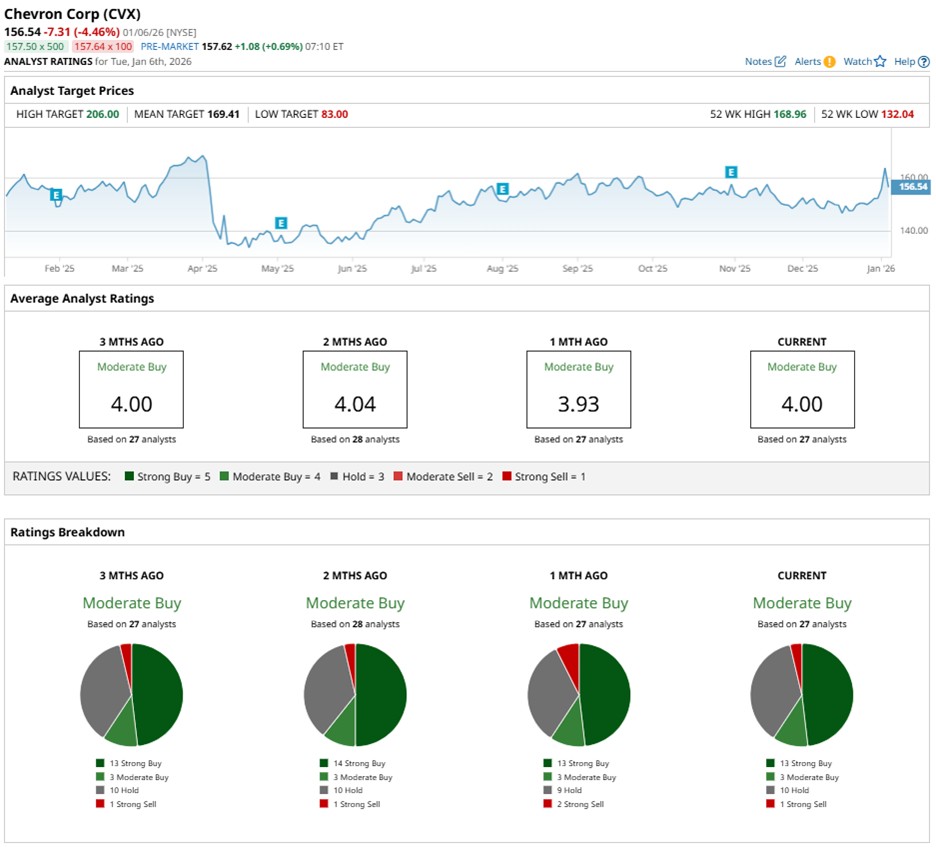

Wall Street maintains a cautiously optimistic stance on Chevron, assigning CVX stock an overall “Moderate Buy” rating that reflects balanced expectations amid commodity volatility and geopolitical shifts. Of the 27 analysts covering the stock, 13 rate it a “Strong Buy,” three recommend a “Moderate Buy,” nine advise “Hold,” and two have a “Strong Sell" rating.

CVX stock's mean price target of $169.26 implies upside potential of 6% from current levels, suggesting analysts still see room for appreciation despite its premium valuation. More notably, the Street-high target of $206 points to a possible upside of 29%, assuming that production growth, solid refining margins, and favorable geopolitical tailwinds materialize.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Trump Just Sent Blackstone Stock Plunging Below Key Support Levels. How Should You Play BX Here?

- Morgan Stanley Is Bullish on Nvidia After CES 2026. Should You Buy NVDA Stock Here?

- Evercore Analysts Love UnitedHealth Stock for 2026. Should You Buy UNH Here?

- Is Chevron Stock a Buy, Sell, or Hold for January 2026?