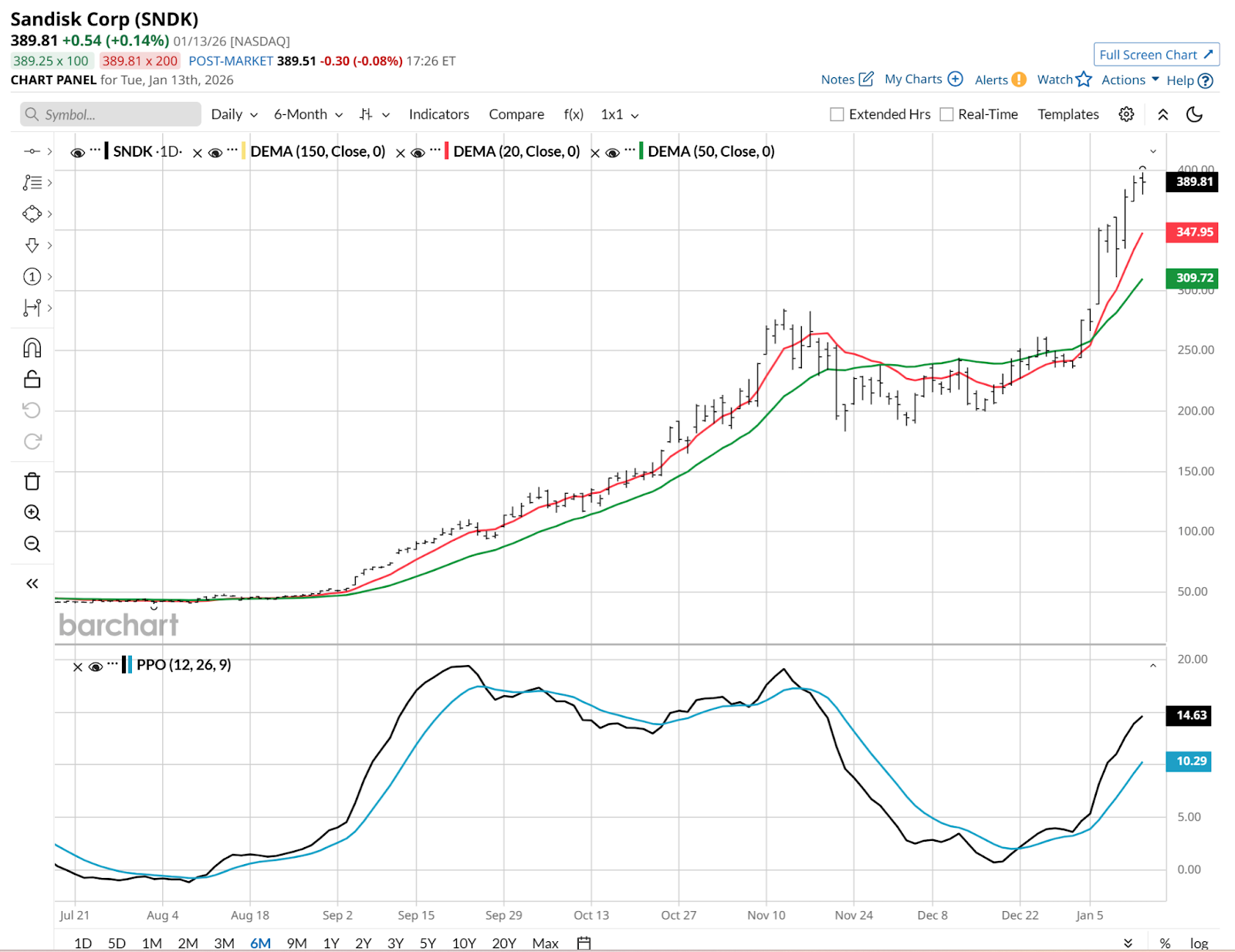

When a stock like Sandisk (SNDK) rallies 30% in a day as it did last week, tech lightweights like me think, “Wait, wasn’t that company around a long time ago — and then went away?” SNDK started in the late 1980s and gained a reputation as a leader in the flash memory business.

The company went public in 1995, but by 2016, it was plucked out of public company status by Western Digital (WDC). It returned to public markets with some fanfare, opening for trading on Feb. 14, 2025. And oh, how investors have fallen in love with it over the past 11 months! To the tune of almost 1,000%.

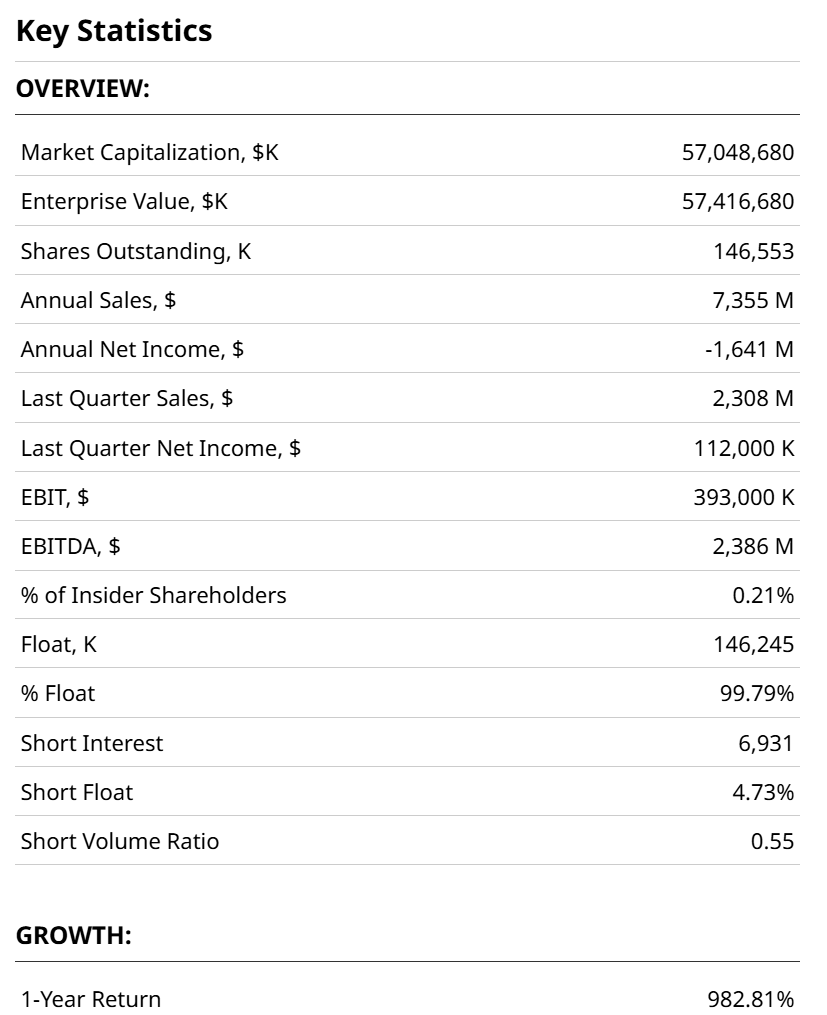

SNDK surged in value and was added to the S&P 500 ($SPX) last November. However, mandatory buying from broader index funds is still in its early innings following SNDK’s inclusion. All while it quietly climbs up the ladder. So, even with that outstanding run, its market capitalization means that it makes up just 0.09% of the index. Though at 7x trailing sales, it's not inexpensive. Nor should it be after a move like that and considering its position as the potential next darling of the artificial intelligence (AI) boom.

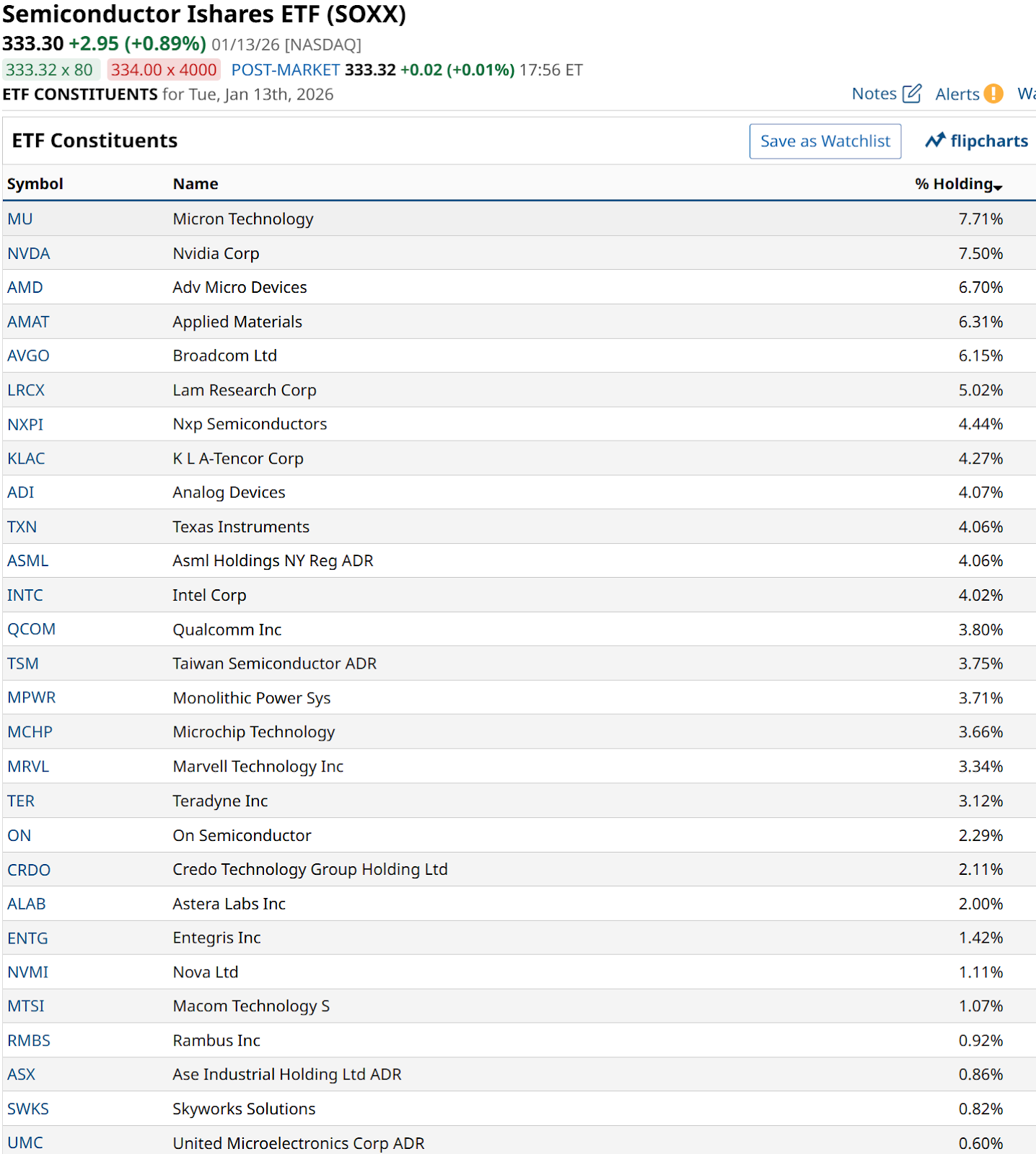

That highlights a major misperception about index exchange-traded funds (ETFs). Sure, you own “the whole market.” But most of the stocks barely fog the proverbial mirror. As such, if you spent 2025 chasing the "Magnificent Seven" or waiting for the next breakout, you likely missed the quietest mega-move in the market.

Since the spinoff, SNDK has evolved from a legacy storage brand to the S&P 500’s top-performing stock.

As AI enters the "Data Cycle," flash memory takes a starting role. SanDisk is the pure-play leader here. At the recent CES 2026, Nvidia (NVDA) CEO Jensen Huang called AI storage an "unserved market." SanDisk is filling that void. And the stock price reflects it.

The real story for ETF investors is the lack of institutional representation in the standard vehicles. If you own big semiconductor ETFs, like Semiconductor Ishares ETF (SOXX), you won’t find SNDK there.

Because of the timing of the spinoff and the lag in index rebalancing, ETFs are concentrated in a few niche players and the broad tech giants. From a tactical standpoint, this underrepresentation is a double-edged sword. On one hand, you’ve missed the initial 550% pop from the initial public offering (IPO).

However, my "ABL" (avoid big loss) rule applies here. With the stock trading in the high $300s and hitting record highs above $395, chasing the ticker today is a high-risk proposition.

Where To Find SNDK ‘In Size’

S&P Spin-Off Invesco ETF (CSD) is an intriguing alternative. The description is very informative:

The Invesco SP Spin-Off ETF seeks investment results that correspond generally to the performance, before the funds fees and expenses, of the SP U.S. Spin-Off Index. CSD offers exposure to U.S. domiciled companies that have been spun-off from a parent company within the last four years and have a float-adjusted market capitalization of at least $1 billion.

SNDK fits in here, at more than 7% of assets in this $90 million ETF. I am often heard complaining about how few ETFs offer true diversification. But this theme might.

The Takeaway

This is yet another example of what ETFs are — and aren’t. And why we always need to look under the hood to understand what we own. Sort of like that classic line from the movie “Ferris Bueller's Day Off”: "Life moves pretty fast. If you don't stop and look around once in a while, you could miss it."

Rob Isbitts is a semi-retired fund manager and advisor. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app. His new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cathie Wood Is Buying Up Roblox Stock. What Is the Bull Case for RBLX in 2026?

- Intel Stock Just Got a New Street-High Price Target. Should You Buy INTC Here?

- Unusual Options Activity: 3 Multi-Leg Trades to Watch — SHOP, SBUX, and PINS

- Don’t Trade the Venezuela Headlines. Why We’re Skipping Oil Majors to Zero In on These Energy Stocks Instead.