With a market cap of $34.5 billion, PG&E Corporation (PCG) provides electricity and natural gas services to residential, commercial, industrial, and agricultural customers across northern and central California. It generates power from a diverse mix of sources, including nuclear, hydroelectric, fossil fuel, fuel cell, and photovoltaic energy, and operates extensive transmission, distribution, and storage infrastructure.

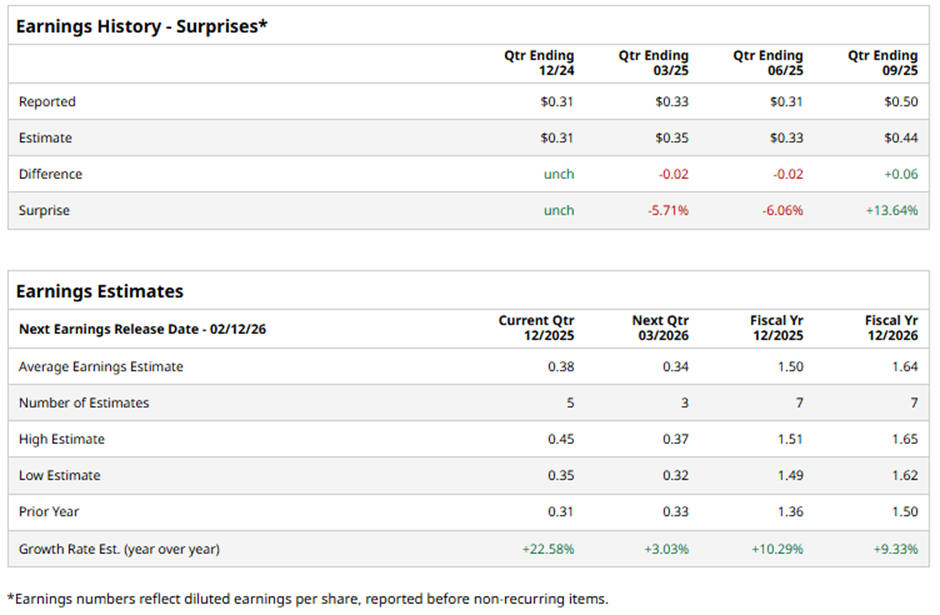

The Oakland, California-based company is set to unveil its fiscal Q4 2025 results soon. Ahead of this event, analysts predict PCG to report an adjusted EPS of $0.38, an increase of 22.6% from $0.31 in the year-ago quarter. It has surpassed or met Wall Street's bottom-line estimates in two of the past four quarters while missing on two other occasions.

For fiscal 2025, analysts expect the power company to report adjusted EPS of $1.50, up 10.3% from $1.36 in fiscal 2024.

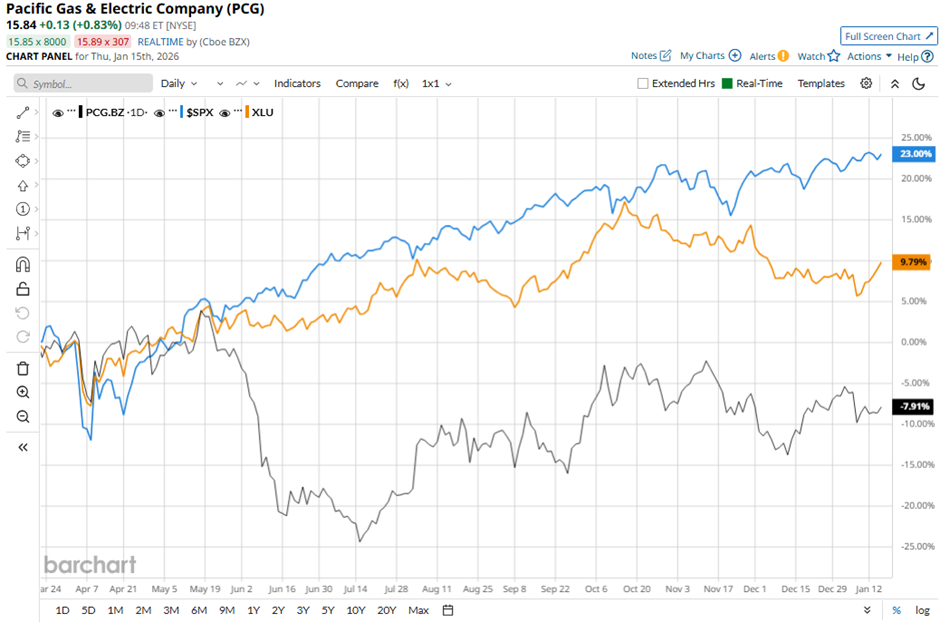

PCG stock has declined 6.6% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 17.1% gain and the State Street Utilities Select Sector SPDR ETF's (XLU) 12.3% increase over the same period.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $0.50, PG&E shares fell 1.7% on Oct. 23 after the company posted revenue of $6.25 billion, which missed Street forecasts. The stock was also pressured by higher wildfire-related claims, net of recoveries and Wildfire Fund expenses. In addition, PG&E narrowed 2025 adjusted core EPS guidance to $1.49 - $1.51 and initiated 2026 guidance of $1.62 - $1.66.

Analysts' consensus rating on PCG stock is bullish, with a "Strong Buy" rating overall. Out of 17 analysts covering the stock, opinions include 12 "Strong Buys” and five "Holds.” The average analyst price target for PG&E is $21.32, indicating a potential upside of 34.6% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Legendary Investor Michael Burry Is Betting Against Oracle Stock. What You Need to Know About the Bear Case for ORCL.

- 3 of the Best Stocks to Buy for 2026 If You Believe That AI Will Keep Revolutionizing the World

- As Trump Spats With Exxon CEO Darren Woods Over Venezuela, Should You Take a Risk and Buy XOM Stock?

- Is This Nvidia-Backed AI Stock a Buy Before It Soars 177%?