With a market cap of $7.3 billion, DaVita Inc. (DVA) is a leading provider of kidney dialysis services in the United States, operating a network of outpatient dialysis centers and clinical laboratories for patients with chronic kidney failure. It also offers hospital-based and home dialysis, integrated care programs, physician services, and comprehensive kidney care solutions.

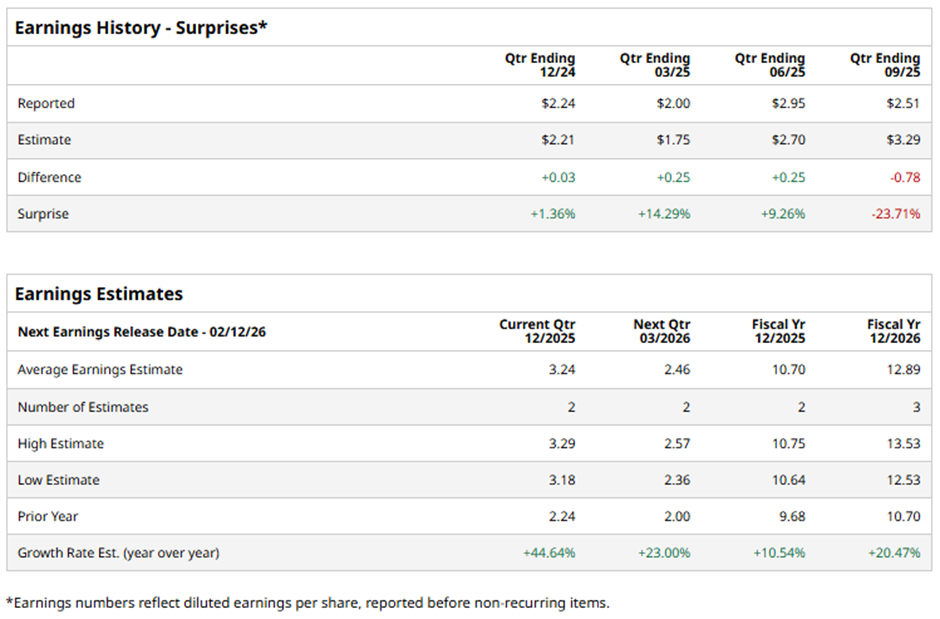

The Denver, Colorado-based is set to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts expect DVA to report an adjusted EPS of $3.24, a surge of 44.6% from $2.24 in the year-ago quarter. It has surpassed Wall Street's earnings estimates in three of the last four quarters while missing on another occasion.

For fiscal 2025, analysts predict the dialysis specialist to report adjusted EPS of $10.70, up 10.5% from $9.68 in fiscal 2024. Moreover, adjusted EPS is projected to grow 20.5% year-over-year to $12.89 in fiscal 2026.

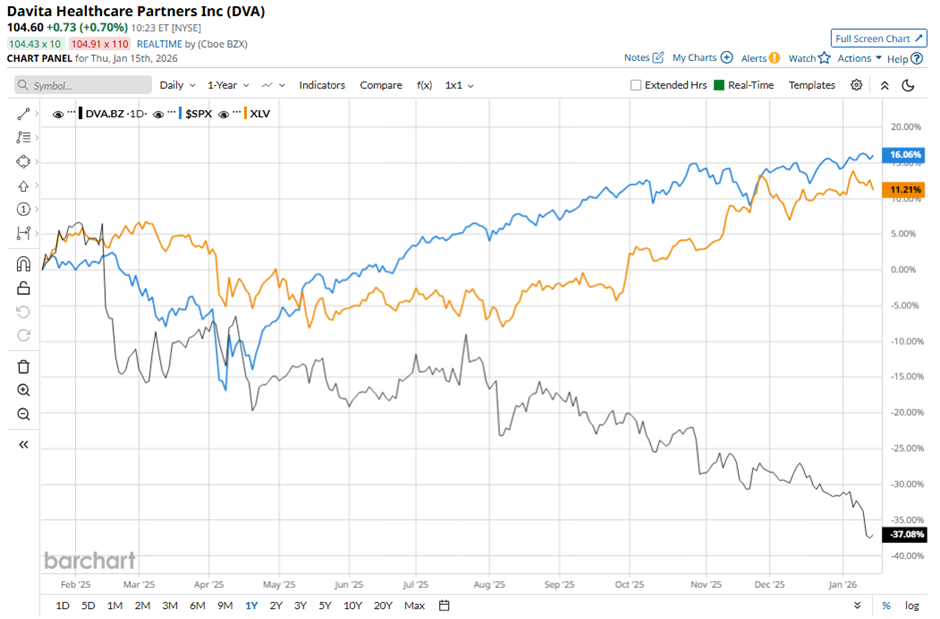

Shares of DaVita have decreased 36.1% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 17% rise and the State Street Health Care Select Sector SPDR ETF's (XLV) 11.3% gain over the same period.

Shares of DaVita tumbled 6.2% following its Q3 2025 results on Oct. 29. The company reported Q3 2025 adjusted EPS of $2.51, well below the analyst estimate. The decline was driven by higher patient care costs, which rose nearly 6% year-over-year to $271.23 per treatment, increased general and administrative expenses of $322 million, and lower dialysis volumes.

Investor sentiment was further pressured by the ongoing impact of an April ransomware attack, which cost the company $11.7 million during the quarter and disrupted operations.

Analysts' consensus view on DVA stock is cautious, with a "Hold" rating overall. Among eight analysts covering the stock, one recommends "Strong Buy," six suggest "Hold," and one indicates “Moderate Sell.” The average analyst price target for DaVita is $141, indicating a potential upside of 34.8% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- How to Play BABA Stock as Alibaba’s Growth Story Gets a Boost From the Chinese Government

- UnitedHealth Faces New Medicare Accusations. What Does That Mean for UNH Stock?

- This Little-Known Stock Is Entering the $1 Trillion Prediction Markets with Crypto.com. Should You Buy Shares Now?

- China May Be Blocking H200 Shipments After All. Should You Sell the News for Nvidia Stock?